ASX November Winners: The 50 best stocks as ASX 200 reached record high

Pic: Getty Images

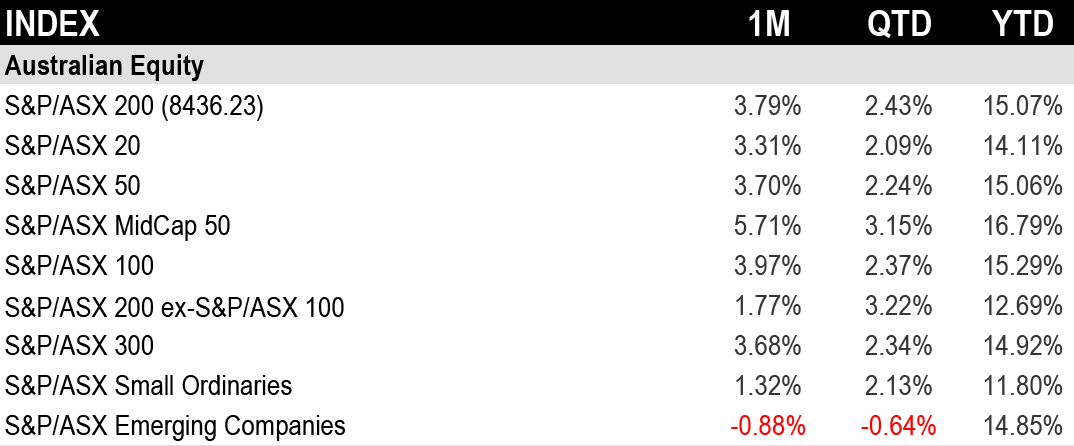

- The S&P/ASX 200 rose 4% in November to a new record high of 8436.23 points as volatility fell following US election

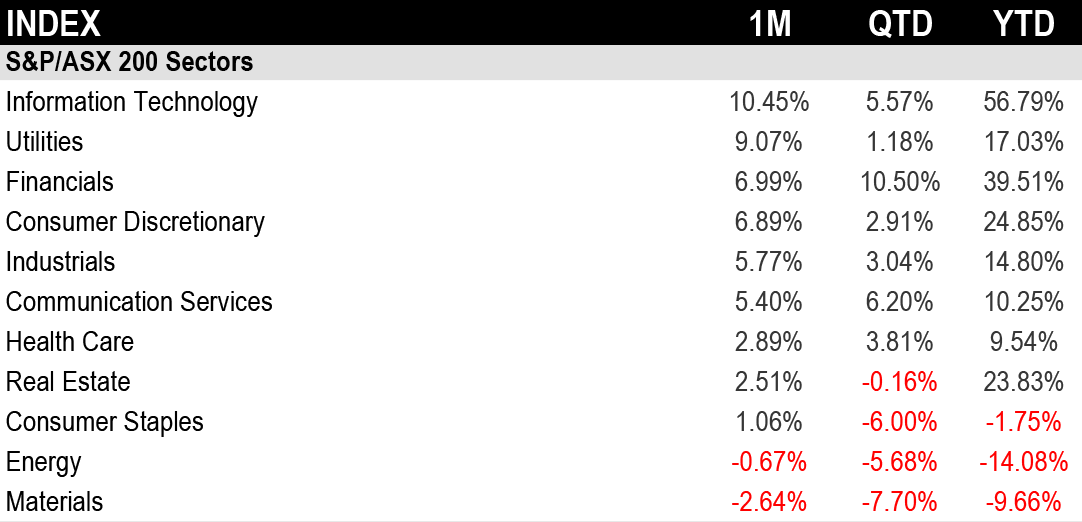

- Information Technology led the gainers rising 10% in November and remained top performer YTD, up 56.79%

- NoviqTech rose 423% in November after strategic placement to raise $1.05 million to accelerate its blockchain solutions

The S&P/ASX 200 rose 4% in November to a new record high with equity volatility coming off sharply after the US election, according to S&P Dow Jones Indices (S&P DJI).

The S&P/ASX 200 VIX dropped 3.3 vol points and closed at 10.5. The VIX is considered the fear gauge because when the index spikes, it suggests that investors are nervous about potential market downturns in the short term.

VanEck Asia Pacific CEO and managing director Arian Neiron told Stockhead November was positive for Australian equities investors, particularly those with international exposure.

“Investors with international broad-based equities exposure had much to cheer about, with the MSCI World ex Australia seeing a sharp increase post-US election and ending the month up 5.18% to a new all-time high,” he said.

“The outperformance of global small caps relative to large caps post US federal election is consistent with historical trends and suggests ‘the size effect’ is back in play.”

The US equities-focused Russell 2000 was up 11.54%, and MSCI World ex Australia Small Cap up 7.21%.

Tech sector led gains, up 30% YTD

Nine out of the 11 S&P/ASX 200 sectors had gains in November, led by technology, which rose 10% and remains the top performing sector YTD, up 56.79%.

Neiron said the financial (ex-property) sector continued to be a strong performer with the Commonwealth Bank (ASX:CBA) a major contributor to ASX gains, despite announcing flat year-on-year profits.

“CBA’s price was up 11.09% for the month, and it now represents more than 10% of the S&P/ASX 200 index,” he said.

However, the materials and energy sectors remained in the red for November, firming their lowest ranks YTD.

Bonds rose, gold took a breather on Trump re-election

Neiron said Donald Trump’s election win has made its mark.

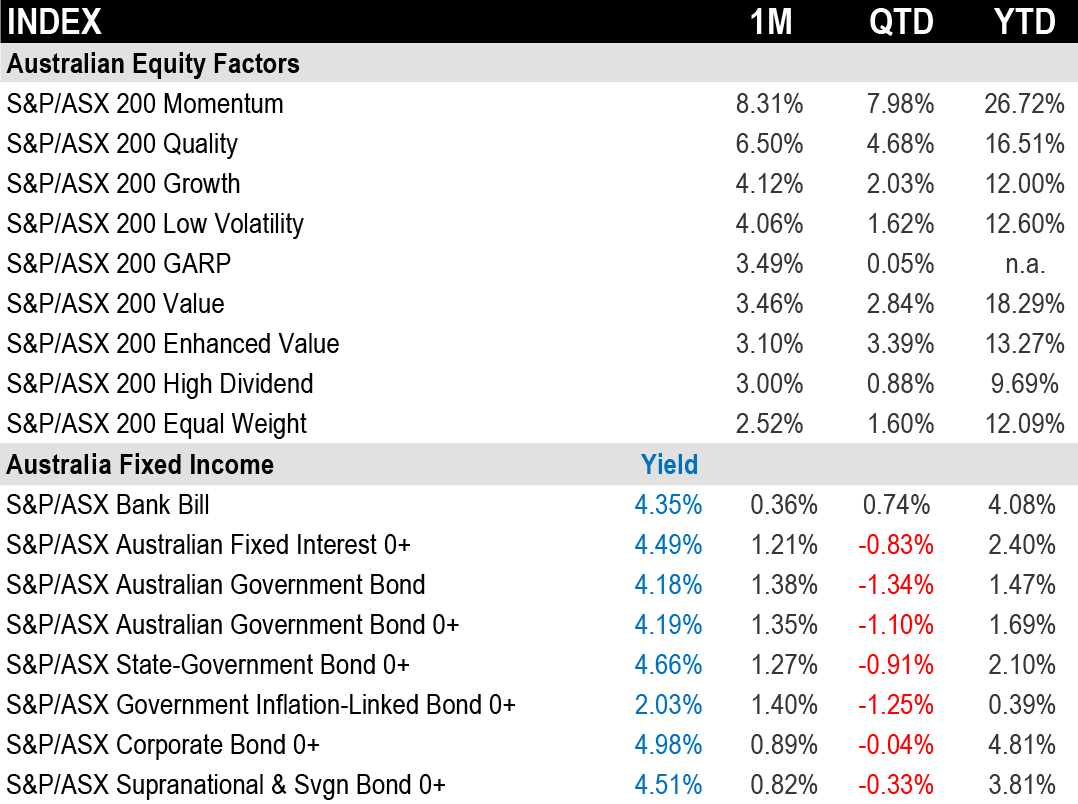

“Global bonds have stabilised since last months’ decline, with Australian and global bonds up 1.14% and 1.16% up respectively as 10-year yields have declined,” he said.

“This reversal is primarily attributed to Donald Trump’s selection of Scott Bessent as his Treasury Secretary.

“Investors are optimistic that Bessent, known for his fiscal conservatism, will work to reduce budget deficits.

“The US dollar has also strengthened, putting downward pressure on gold bullion, which was down 2.51% for the month after an exceptionally strong October.”

The Australian dollar dipped slightly relative to US dollar, but ended the month largely flat at 0.65.

Among factor indices, Momentum and Quality performed the best while Equal Weight and High Dividend lagged, according to S&P DJI.

Bitcoin surged on Trump victory

Trump’s pro-Bitcoin position saw the cryptocurrency surge by 38% for the month, bringing it within arm’s reach of the US$100k mark.

“With Trump as the president-elect, regulatory headwinds are turning into tailwinds for the first time,” Neiron said.

“Trump has already started appointing pro-crypto figures across the executive branch, while the Republican party now holds a unified government, increasing the likelihood of supportive legislation.”

Neiron said such legislation included proposals, many of which were announced at a Bitcoin conference in Nashville in July, like creating a national Bitcoin reserve and rewriting crypto market structure and stablecoin draft legislation.

“With Gary Gensler’s resignation effective on January 20, 2025, we anticipate Trump will follow through on his promise to replace the SEC chairman, favouring more crypto-friendly candidates and ending the agency’s notorious ‘regulation by enforcement’ era,” he said.

“Now in uncharted territory with no technical price resistance, we believe the next phase of the bull market is just beginning.

“This pattern mirrors what happened four years ago, when Bitcoin’s price doubled between the 2020 election and year-end, followed by an additional ~137% gain in 2021.”

Here were the 50 best performing ASX stocks in November

| CODE | COMPANY | LAST SHARE PRICE | NOVEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| NVQ | Noviqtech Limited | 0.115 | 423% | $26,932,481 |

| PTR | Petratherm Ltd | 0.2 | 292% | $50,074,580 |

| FGH | Foresta Group | 0.011 | 175% | $24,731,480 |

| PAR | Paradigm Biopharmaceuticals | 0.515 | 151% | $158,932,420 |

| HTG | Harvest Tech Group | 0.029 | 107% | $23,489,016 |

| IFG | Infocus Group Holdings | 0.031 | 107% | $5,648,737 |

| PHO | Phosco Ltd | 0.084 | 105% | $19,722,372 |

| SWF | Selfwealth | 0.245 | 104% | $57,682,927 |

| 1TT | Thrive Tribe Tech | 0.002 | 100% | $1,406,723 |

| AXP | AXP Energy Ltd | 0.002 | 100% | $11,649,361 |

| BP8 | BPH Global Ltd | 0.004 | 100% | $1,586,566 |

| FAU | First Au Ltd | 0.002 | 100% | $4,143,987 |

| GCM | Green Critical Minerals | 0.005 | 100% | $11,445,320 |

| HIQ | Hitiq Limited | 0.041 | 95% | $15,569,179 |

| TYP | Tryptamine Ltd | 0.044 | 91% | $52,741,589 |

| AVJ | AVJennings Limited | 0.62 | 91% | $346,127,931 |

| KRR | King River Resources | 0.015 | 88% | $27,507,974 |

| MHK | Metal Hawk | 0.31 | 82% | $32,732,301 |

| AHF | Aust ralian Dairy Nutritionals | 0.038 | 81% | $23,042,976 |

| DAF | Discovery Alaska Ltd | 0.018 | 80% | $4,216,225 |

| MXO | Motio Ltd | 0.039 | 77% | $11,688,533 |

| PHL | Propell Holdings Ltd | 0.021 | 75% | $5,845,100 |

| PHX | Pharmx Technologies | 0.071 | 69% | $41,895,475 |

| PAB | Patrys Limited | 0.005 | 67% | $10,287,237 |

| PPL | Pureprofile Ltd | 0.04 | 67% | $38,259,364 |

| IMR | Imricor Med Systems | 1.16 | 63% | $297,193,343 |

| ILA | Island Pharma | 0.195 | 63% | $30,427,938 |

| 1AI | Algorae Pharma | 0.008 | 60% | $11,811,763 |

| AVE | Avecho Biotech Ltd | 0.004 | 60% | $9,507,891 |

| OPL | Opyl Limited | 0.027 | 59% | $4,609,295 |

| QHL | Quickstep Holdings | 0.395 | 58% | $28,690,486 |

| SLH | Silk Logistics | 2.08 | 58% | $168,803,528 |

| CAE | Cannindah Resources | 0.063 | 58% | $35,153,998 |

| ROG | Red Sky Energy | 0.011 | 57% | $54,222,272 |

| SP8 | Streamplay Studio | 0.011 | 57% | $13,807,485 |

| EML | EML Payments Ltd | 1.01 | 54% | $372,640,758 |

| ORD | Ordell Minerals Ltd | 0.35 | 52% | $10,925,914 |

| CLE | Cyclone Metals | 0.026 | 50% | $18,066,763 |

| KNI | Kunikol | 0.225 | 50% | $18,221,546 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | $9,296,169 |

| TKL | Traka Resources | 0.0015 | 50% | $2,918,488 |

| TMK | TMK Energy Limited | 0.003 | 50% | $23,313,913 |

| VRX | VRX Silica Ltd | 0.057 | 50% | $33,925,806 |

| CAT | Catapult Group International | 3.68 | 50% | $960,841,406 |

| CDD | Cardno Limited | 0.23 | 48% | $8,593,346 |

| MWY | Midway Ltd | 1.245 | 47% | $108,733,596 |

| GTIDD | Gratifii | 0.11 | 47% | $30,037,304 |

| PBH | Pointsbet Holdings | 1.04 | 46% | $341,278,856 |

| TGN | Tungsten Mining | 0.079 | 46% | $62,913,142 |

| GTK | Gentrack Group Ltd | 13.01 | 46% | $1,292,861,336 |

The NoviqTech (ASX:NVQ) share price surged 423% in November with the company securing a strategic placement to raise $1.05 million to accelerate its blockchain solutions with funding backed by prominent investors, including Antanas Guoga – aka Tony G – a renowned blockchain innovator, whose endorsement bolstered investor confidence.

NoviqTech also announced it was in advanced discussions to list its shares on the OTC market in the US, an established trading platform, operated by OTC Markets Group in New York, providing live market trading in companies which hold primary listings in other markets.

Petratherm (ASX:PTR) was up 292% in November after announcing metallurgical testing of samples from its Muckanippie heavy mineral (HM) project in South Australia identified high titanium mineral content, with results showing approximately 65% titanium oxide.

Titanium – valued for its applications in electric vehicles, battery storage, wind technology, pigments, and as an alloy in steel and superalloys – is classified as a critical mineral by Australia, the US and the European Union.

Paradigm Biopharmaceuticals (ASX:PAR) rose 151% in November after the US FDA successfully concluded a 30-day review period for the biotech’s phase III pivotal clinical trial protocol of repurposed pentosan polysulfate sodium (Zilosul) to treat knee osteoarthritis (OA), clearing the way for a start date in Q1 CY25.

Provider of tech solutions that overcome challenges associated with remote video and data streaming, Harvest Technology Group (ASX:HTG) rose 107% in November after several positive announcements, including that it had established the subsidiary Harvest Technology Europe Ltd (HTE) in Ireland to relaunch its Nodestream product range across the UK and European markets.

Harvest Tech also inked a reseller agreement with Pulsar Beyond via their Pulsar Solution Inc entity and announced an additional $1m funding from a major investor and receipt of its R&D Rebate for FY24 of $1.59m.

Here were the 50 worst performing ASX stocks in November

| CODE | COMPANY | LAST SHARE PRICE | OCTOBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| NML | Navarre Minerals Ltd | 0.105 | -99% | $10,141,055 |

| SCP | Scalare Partners | 0.21 | -81% | $5,930,076 |

| NRZ | Neurizer Ltd | 0.001 | -75% | $5,635,721 |

| FCG | Freedom Care Group | 0.037 | -72% | $883,705 |

| CZN | Corazon Ltd | 0.002 | -67% | $1,535,811 |

| EM2 | Eagle Mountain | 0.0165 | -66% | $6,678,874 |

| AS2 | Askari Metals | 0.012 | -60% | $1,643,364 |

| PNT | Panther Metals | 0.017 | -54% | $4,000,927 |

| ADX | ADX Energy Ltd | 0.046 | -54% | $25,205,367 |

| WIN | WIN Metals | 0.02 | -52% | $11,506,222 |

| RDN | Raiden Resources Ltd | 0.015 | -52% | $55,455,103 |

| 88E | 88 Energy Ltd | 0.001 | -50% | $57,867,624 |

| AUH | Austchina Holdings | 0.001 | -50% | $2,400,384 |

| BCC | Beam Communications | 0.075 | -50% | $7,173,019 |

| GGE | Grand Gulf Energy | 0.002 | -50% | $6,125,968 |

| IEC | Intra Energy Corp | 0.001 | -50% | $1,908,782 |

| RNE | Renu Energy Ltd | 0.001 | -50% | $1,727,328 |

| SBW | Shekel Brainweigh | 0.022 | -50% | $4,789,286 |

| WTM | Waratah Minerals Ltd | 0.175 | -50% | $35,879,406 |

| RSG | Resolute Mining | 0.435 | -49% | $883,555,755 |

| AMS | Atomos | 0.015 | -48% | $20,655,314 |

| FL1 | First Lithium Ltd | 0.088 | -48% | $7,009,517 |

| SNG | Siren Gold | 0.06 | -48% | $12,813,260 |

| G88 | Golden Mile Res Ltd | 0.01 | -47% | $4,728,229 |

| SER | Strategic Energy | 0.009 | -47% | $6,039,300 |

| PEN | Peninsula Energy Ltd | 0.985 | -47% | $154,570,364 |

| HCT | Holista CollTech Ltd | 0.012 | -45% | $3,429,201 |

| IMI | Infinity Mining | 0.014 | -44% | $4,802,102 |

| BSN | BasinEnergy | 0.018 | -44% | $2,086,992 |

| CTT | Cettire | 1.205 | -44% | $459,392,055 |

| LU7 | Lithium Universe Ltd | 0.009 | -43% | $6,045,642 |

| BGE | Bridge SaaS | 0.02 | -43% | $3,997,184 |

| AON | Apollo Minerals Ltd | 0.014 | -42% | $9,052,458 |

| C1X | Cosmos Exploration | 0.028 | -42% | $2,337,065 |

| EMS | Eastern Metals | 0.013 | -41% | $1,477,791 |

| EEL | Enrg Elements Ltd | 0.001 | -40% | $3,253,048 |

| AHN | Athena Resources | 0.003 | -40% | $3,211,403 |

| TRE | Toubani Res Ltd | 0.18 | -39% | $37,778,393 |

| CVW | Clearview Wealth Ltd | 0.325 | -38% | $213,756,623 |

| CYM | Cyprium Metals Ltd | 0.018 | -38% | $27,467,322 |

| IBX | Imagion Biosys Ltd | 0.038 | -38% | $1,678,508 |

| ILT | Iltani Resources Lim | 0.15 | -38% | $6,821,628 |

| MEM | Memphasys Ltd | 0.005 | -38% | $8,815,407 |

| MKR | Manuka Resources. | 0.035 | -38% | $27,291,868 |

| JAT | Jatcorp Limited | 0.345 | -37% | $29,975,998 |

| LAT | Latitude 66 Limited | 0.063 | -37% | $10,038,049 |

| USL | Unico Silver Limited | 0.205 | -37% | $81,019,595 |

| RCR | Rincon | 0.012 | -37% | $3,218,187 |

| ARD | Argent Minerals | 0.019 | -37% | $24,575,888 |

| NOU | Noumi Limited | 0.165 | -37% | $47,108,584 |

Victorian-focused gold explorer Navarre Minerals (ASX:NML) fell 99% in November after its relisting on the ASX with a recapitalisation and refreshed management team following its suspension in June 2023.

Navarre is targeting high-grade discoveries in one of Australia’s most prolific gold regions with plans to immediately start a 7000m exploration drilling campaign at its flagship Stawell Corridor Gold Project in central western Victoria.

A recent capital raise hit its $6m target, with total bids reaching $9m. The company’s name change to Aureka was approved at its recent AGM and is expected to take place in the coming weeks.

Worth a read Barry FitzGerald: Navarre goes back to the future in return to Victorian gold strategy.

At Stockhead, we tell it like it is. While Paradigm Biopharmaceuticals and Harvest Technology Group are Stockhead advertisers, the companies did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.