ASX March Rebalance: Lithium juniors storm the All Ords as resource plays dominate new benchmark entrants

Pic: Sturti/E+ via Getty Images

- BHP spin out South 32 has proven doubters wrong by joining its big brother on the S&P ASX 20

- Out of the benchmark S&P ASX 200 is gold miner Ramelius Resources hard hit by inflation pressure

- Resources stocks dominate additions to S&P ASX 300 while host of lithium juniors join All Ords

It may not quite feel like Autumn is in the air with a hot start to March for most of Australia, but leaves will soon be changing colour into the golden and copper tones, days will become cooler and footy season will be upon us.

Autumn also signals the ASX March rebalance of some key indices.

Responsibility for the great rebalancing act falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. You can see the full ASX March rebalance list here with indexes rebalanced in the latest quarterly review including:

- S&P ASX 20

- S&P ASX 100

- S&P ASX 200

- S&P ASX 300

- All Ordinaries

- S&P ASX All Technologies Index.

The ASX March rebalance come into effect before opening trade on Monday, March 20.

Of particular note are the S&P/ASX 200 and S&P/ASX 300 and are ones many fund managers or investors use as a cutoff for investments.

Entering the S&P/ASX 300 is a major milestone for a company, signifying they’ve made it to the big league.

Let’s dive deep into the performance of additions and removals to the indexes this March.

South 32 cracks ASX 20 but James Hardie out

Mockingly referred to as Crapco after BHP (ASX:BHP) spun its least fashionable businesses into a new firm in 2014, South32 (ASX:S32) has proved the doubters wrong by returning to rejoin its big brother in the ASX 20 for the first time since it was replaced in the landed gentry of Australian rock-lickers by Newcrest Mining (ASX:NCM) in December 2019.

And it is a shift echoed elsewhere among the latest S&P index rebalances, which have revealed the extent to which electric vehicles and investor demand for green resources stocks are changing the Australian equity landscape.

With a $20.5 billion market cap S32 is up 13.71% YTD and 40% over the past five years.

Building materials producer James Hardie Industries (ASX:JHX) has found itself out of the ASX 20 in the ASX March rebalance. JHX recently considerably lowered its FY23 guidance, blaming falling sales in the US and Australia on a downturn in the housing industry.

JHX is up more than 20% YTD but off ~26% over a one year period.

There were no changes to the S&P ASX 50.

The S32 & JHX share price today:

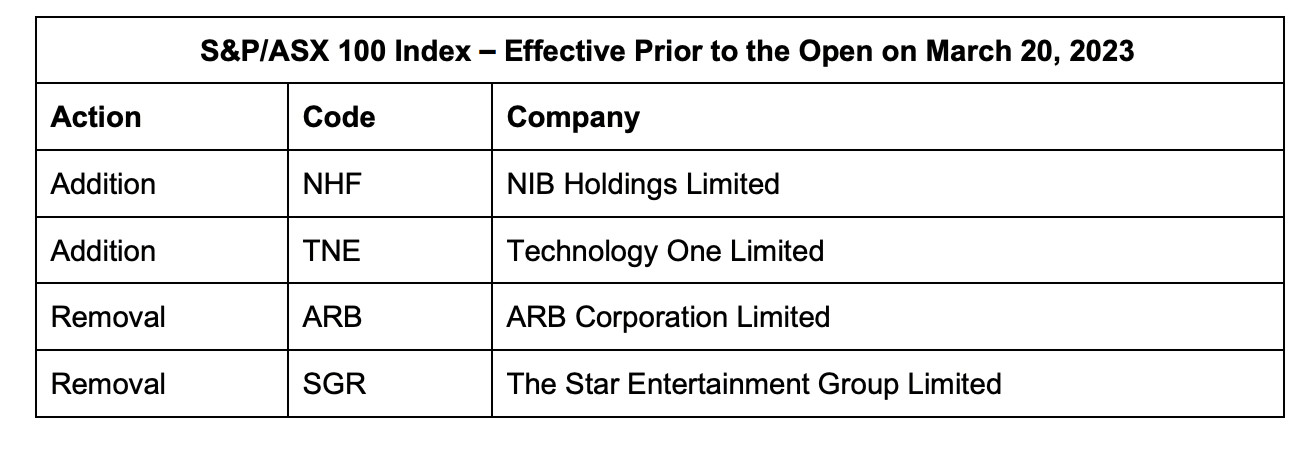

S&P ASX 100 – Star and ARB out, NIB and Technology One in

Health insurance fund NIB Holdings (ASX:NIB) has been elevated to the S&P ASX 100 list. NIB is a stock favourite of Datt Capital chief investment officer Emmanuel Datt in an environment of high inflation and rising costs.

Software-as-a-service (SaaS) Technology One (ASX:TNE) has also been lifted into the S&P ASX 100 after seeing its share price rise 14.61% YTD.

Removed is ARB Corporation (ASX:ARB) , which recently announced its profit before tax for H1 FY23 would fall within the range of $64 million to $64 million, a decline of 29.7% vs the pcp.

The company said the profit decline reflects lower sales and the inflationary impact on the company’s cost base.

Beleaguered casino operator Star Entertainment Group (ASX:SGR) has also been removed from the S&P ASX 100 list.

The NHF, TNE, ARB & SGR share price today:

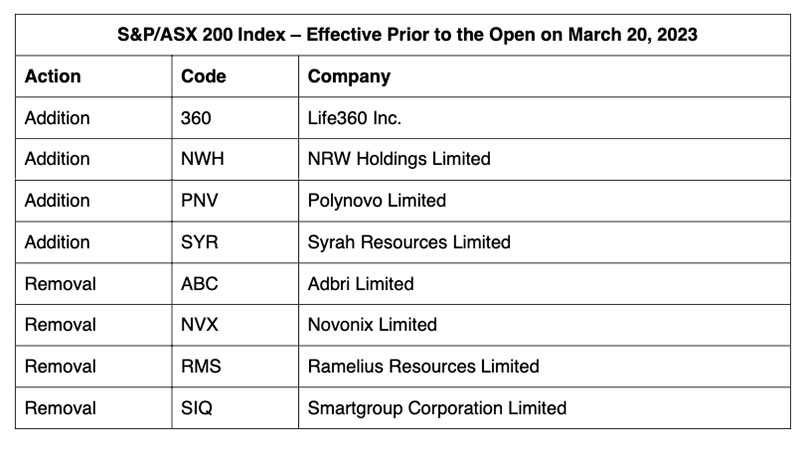

S&P ASX 200 – Legacy gold miner falls foul of inflationary pressure

Out of the benchmark S&P ASX 200 for the first time in forever (well since mid-2020) is Ramelius Resources (ASX:RMS). Winner of the Digger of the Year award at Diggers and Dealers in 2020, the past year has been hard.

RMS is down 41% over the past 12 months with COVID-19, inflation, a shortage of truck drivers and a decision to postpone an expansion of its Edna May gold mine due to likely cost overruns adding to its woes.

Graphite battery stock Novonix (ASX:NVX) also exited Australia’s benchmark index, but was replaced by a similar player in Syrah Resources (ASX:SYR), one of the past year’s top performing resources stocks thanks to its plan to supply Tesla with active anode material from a new plant in Louisiana.

Mining services giant NRW Holdings (ASX:NWH) also capped a good year for it and the contracting sector with inclusion in the ASX 200.

Location technology company Life 360 (ASX:360) is among four companies to join the benchmark S&P ASX 200, and has been a beneficiary of a resurgence in tech stocks this year.

The Life360 app has more than 40 million active users and offers families features such as communications, driver safety, and location sharing.

The 360 share price is up 12.05% YTD.

Wound care company Polynovo (ASX:PNV) has also been elevated back to the S&P ASX 200 after being removed in the June 2022 quarterly rebalance.

Petra Capital healthcare analyst Tanushree Jain told Stockhead PNV has been an Aussie healthcare success story with US FDA approval, marketing, good revenues and a market cap now well and truly more than $1 billion.

“It’s an example of how important the US market is for Australian healthcare stocks and once you open that door whether through an FDA approval or starting to generate sales and grow your profile in the US that’s the time when the real transition and re-rating of that stock happens,” she said.

The RMS, NVX, SYR, NRW & PNV share price today:

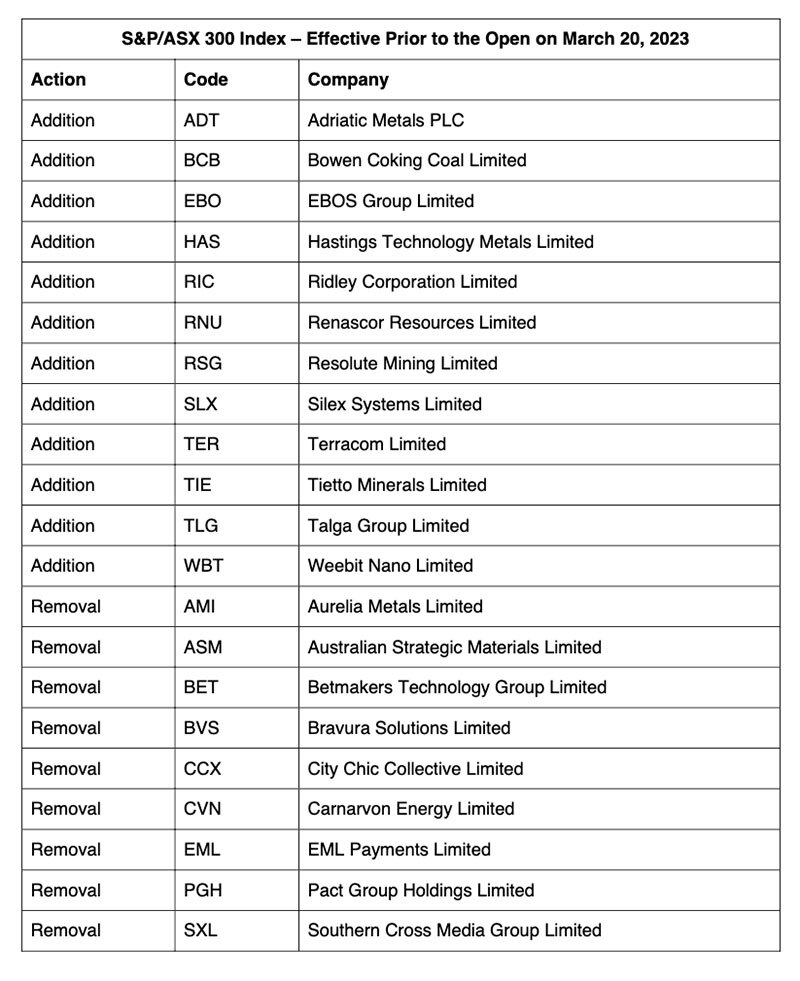

Resources stocks dominate additions to S&P ASX 300

Heading all the way into the ASX 300 with a Spartan energy were coal miners Bowen Coal (ASX:BCB) and Terracom (ASX:TER), the latter of which delivered an outrageous 23% dividend yield as of its February half-year results on the back of record thermal coal prices.

Graphite, a key material in the anode of a lithium ion battery and benefactor of the EV boom, is also picking up some steam, with project developers Renascor Resources (ASX:RNU) and Talga Group (ASX:TLG) entering the 300.

Sprinkle in some solar panel-supplying silver with Bosnian mine developer Adriatic Minerals (ASX:ADT) and rare earths in the form of Andrew Forrest-backed Hastings Technology Metals (ASX:HAS) and that EV metal flavour is stronger than a schmaltzy chicken soup in the pot of a Yiddisher bubbe.

Gold makes an appearance as well, with African miners Tietto (ASX:TIE) and Resolute (ASX:RSG) movin’ on up like Curtis Mayfield.

Underperformers Aurelia Metals (ASX:AMI) and Australian Strategic Materials (ASX:ASM) dropped out.

Lithium juniors storm the all ordinaries

The emphasis in the major indices on battery metals stocks is only getting stronger. Among the 57 additions to the All Ordinaries Index, which is the oldest index of shares on the ASX and made up of the share prices for 500 of the largest listed companies, are a host of lithium, rare earths and base metals stocks.

While a handful like Poseidon Nickel (ASX:POS), Rumble Resources (ASX:RTR), Sierra Rutile (ASX:SRX) and New Century Resources (ASX:NCZ) have slipped from index inclusion entirely, far more battery or critical metals stocks have moved up the list including:

- Sovereign Metals (ASX:SVM)

- Red Dirt Metals (ASX:RDT)

- Peninsula Energy (ASX:PEN)

- Lithium Power International (ASX:LPI)

- Latin Resources (ASX:LRS)

- Northern Minerals (ASX:NTU)

- Sunrise Energy Metals (ASX:SRL)

- Lindian Resources (ASX:LIN)

- Global Lithium (ASX:GL1)

- Anson Resources (ASX:ASN)

- AIC Mines (ASX:A1M)

- Cobalt Blue (ASX:COB)

- Dreadnought Resources (ASX:DRE)

- Galileo Mining (ASX:GLL)

- Atlantic Lithium (ASX:A11), which sank 32% in London on Wednesday after a short seller’s report hit the Ghanaian explorer and lithium offtake partner Piedmont (ASX:PLL).

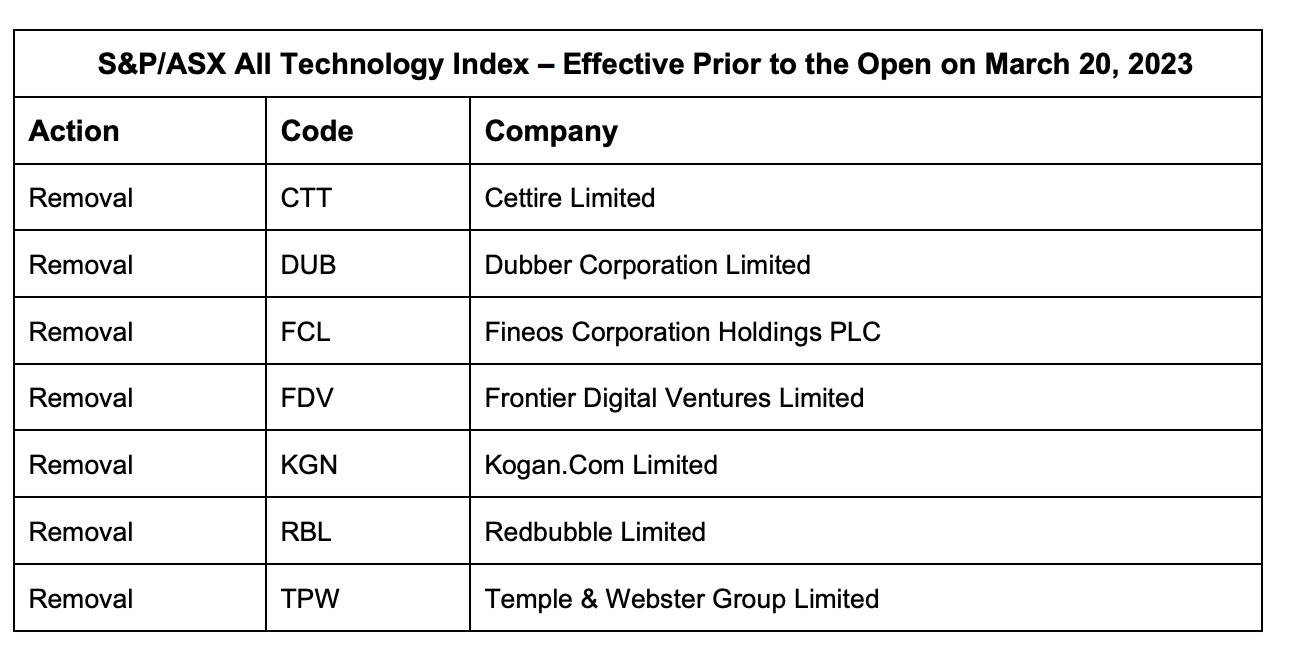

Removals and no additions to S&P ASX All Tech Index

It’s been a case of removing and not adding to the S&P All Technology Index in the ASX March rebalance. Discretionary ecommerce stocks with exposure to rising costs and consumer spending pressures are among those to be removed including luxury brand online retailer Cettire (ASX:CTT) and heavily shorted Kogan (ASX:KGN), Redbubble (ASX:RBL) and Temple & Webster (ASX:TPW).

While CTT is up ~28% YTD most of the stocks removed are down and have fallen over a one-year period. TPW is down ~47% for one year, while cloud-based call recording company Dubber Corporation (ASX:DUB) has fallen 82% for the same period.

The CTT, KGN, RBL, TPW & DUB share price today:

And finally….breathe… That’s a mighty and massive rebalancing of the order of things, with tech, biomed and retail stocks largely flopping out and resources rising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.