ASX June Winners: The best 50 stocks as inflation spikes

Pic: Getty Images

- S&P/ASX 200 rose 1% in June with large caps leading gains with mid, small and emerging companies lagging

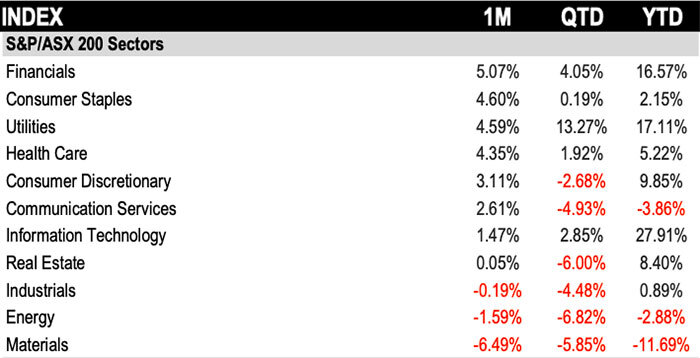

- S&P/ASX 200 financials and consumer staples were the top performers in June with materials the biggest laggard

- Urea fertiliser company NeuRizer and heavy mineral sands explorer MRG Metals were the biggest winners for June

Australia’s S&P/ASX 200 edged higher and closed the last month of FY24 up 1%. Large-cap companies continued to lead, with the YTD return differential between the S&P/ASX 50 and the S&P/ASX Small Ordinaries widening to 2%, according to S&P Dow Jones Indices (S&P DJI).

Looking at key economic data coming out in June and the Australian CPI climbed to its highest level in 2024, further reducing chances that the Reserve Bank of Australia (RBA) will cut interest rates any time soon.

According to new data from the Australian Bureau of Statistics (ABS), inflation is marching upward again with the monthly CPI indicator hitting 4% for May, much higher than April’s 3.6%, and above the 3.8% the market had forecast.

The RBA’s preferred measure of inflation – trimmed mean – rose to 4.4% in May from 4.1% in April.

The monthly inflation data is less comprehensive compared to the quarterly figures, which are scheduled for release on July 31. The quarterly inflation rate is forecast to rise to 3.8% for the April-June period, up from 3.6% in the March quarter.

IG Markets senior analyst Tony Sycamore says May’s rise in trimmed mean inflation puts pressure on the RBA to lift rates again. Several economists have warned the RBA may lift rates at its next June meeting.

“This means it will likely take a significant and unlikely downside surprise in June inflation data to prevent the RBA from delivering a fourteenth-rate hike to 4.60% before year-end,” Sycamore says.

Financials fronted up in June

Three of the 11 sectors finished in the red in June. The S&P/ASX 200 Financials and Consumer Staples were among the best performing sectors with 5.07% and 4.6% gains in June. The S&P/ASX 200 Financials has extended its YTD gains to 16.57%, while Consumer Staples having been in the red YTD is now in the black with a 2.15% gain.

The S&P/ASX 200 Information Tech sector remains the top performer for 2024, up ~28% YTD.

The S&P/ASX 200 Materials sector had the biggest fall of 6.49% in June and is the worst-performing sector YTD, down 11.69%.

Read Josh Chiat’s > Up, Up, Down, Down: Metals stink up the joint in a tough June

Among factor/thematic indices, the S&P/ASX 300 Shareholder Yield and the S&P/ASX 300 Net Zero 2050 Paris-Aligned ESG were among the best performers in June, extending their YTD excess returns versus the S&P/ASX 300 to 3% and 5%, respectively.

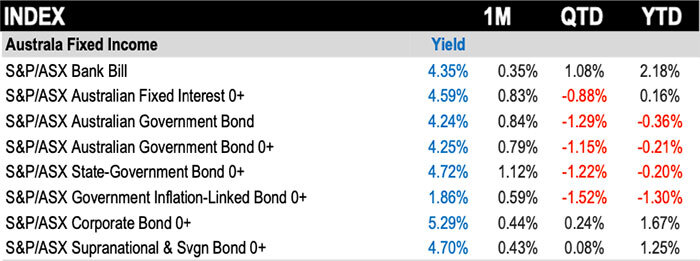

Fixed income volatile

S&P Global says Australian fixed income indices had volatile sessions in June as inflation accelerated faster than expected for three consecutive months, increasing uncertainties with the RBA’s upcoming policy rate decision in August.

Here were the 50 best performing ASX stocks for June:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JUNE RETURN % | MARKET CAP |

|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.013 | 550% | $24,731,598 |

| MRQ | MRG Metals Limited | 0.004 | 300% | $10,100,475 |

| SCL | Schrole Group Ltd | 0.46 | 156% | $16,539,322 |

| ACW | Actinogen Medical | 0.062 | 148% | $123,420,268 |

| CE1 | Calima Energy | 0.008 | 131% | $5,067,488 |

| OIL | Optiscan Imaging | 0.235 | 124% | $183,774,977 |

| 8VI | 8Vi Holdings Limited | 0.135 | 121% | $6,286,713 |

| VN8 | Vonex Limited. | 0.035 | 119% | $12,664,002 |

| COV | Cleo Diagnostics | 0.34 | 100% | $28,152,000 |

| ENR | Encounter Resources | 0.74 | 100% | $286,275,814 |

| TTM | Titan Minerals | 0.048 | 92% | $79,977,935 |

| DXN | DXN Limited | 0.064 | 88% | $12,942,255 |

| EZZ | EZZ Life Science | 1.845 | 86% | $70,616,988 |

| K2F | K2Fly Ltd | 0.185 | 85% | $33,646,894 |

| BIO | Biome Australia Ltd | 0.58 | 81% | $111,847,269 |

| DRO | Droneshield Limited | 1.72 | 79% | $1,250,582,640 |

| T88 | Taiton Resources | 0.145 | 79% | $7,797,309 |

| FRS | Forrestania Resources | 0.034 | 79% | $5,177,144 |

| SUM | Summit Minerals | 0.34 | 70% | $23,028,808 |

| AHF | Aust Dairy Limited | 0.022 | 69% | $14,866,436 |

| GCM | Green Critical Minerals | 0.005 | 67% | $4,546,340 |

| LTP | LTR Pharma Limited | 0.78 | 63% | $53,860,198 |

| SIX | Sprintex Ltd | 0.05 | 61% | $26,049,615 |

| LPM | Lithium Plus | 0.16 | 60% | $21,174,400 |

| NIM | Nimy Resources | 0.064 | 60% | $9,452,535 |

| TM1 | Terra Metals Limited | 0.072 | 60% | $23,070,738 |

| AL3 | AML3D | 0.095 | 58% | $32,430,517 |

| FAL | Falcon Metals | 0.25 | 56% | $44,250,000 |

| FTL | Firetail Resources | 0.072 | 54% | $13,943,067 |

| AXI | Axiom Properties | 0.07 | 52% | $28,559,101 |

| AKM | Aspire Mining Ltd | 0.33 | 50% | $177,672,945 |

| 1MC | Morella Corporation | 0.003 | 50% | $18,536,398 |

| ADG | Adelong Gold Limited | 0.006 | 50% | $6,707,934 |

| AYM | Australia United Mining | 0.003 | 50% | $5,527,732 |

| OAU | Ora Gold Limited | 0.006 | 50% | $35,705,798 |

| SIT | Site Group Int Ltd | 0.003 | 50% | $7,807,471 |

| VPR | Volt Group | 0.0015 | 50% | $16,074,312 |

| WEL | Winchester Energy | 0.003 | 50% | $4,081,688 |

| XRG | Xreality Group Ltd | 0.055 | 49% | $29,316,385 |

| WWG | Wiseway Group | 0.11 | 47% | $18,402,326 |

| TVN | Tivan Limited | 0.073 | 46% | $123,446,177 |

| CCO | The Calmer Co International | 0.008 | 45% | $9,669,200 |

| M2M | Mt Malcolm Mines NL | 0.026 | 44% | $4,052,964 |

| JAT | Jatcorp Limited | 0.66 | 43% | $49,127,186 |

| RCL | Readcloud | 0.083 | 43% | $11,842,565 |

| SGQ | St George Mining | 0.0255 | 42% | $23,724,970 |

| FND | Findi Limited | 4.7 | 42% | $232,293,812 |

| ZGL | Zicom Group Limited | 0.066 | 40% | $16,950,241 |

| SEG | Sports Entertainment Group | 0.28 | 40% | $74,787,225 |

| CLA | Celsius Resource Ltd | 0.014 | 40% | $36,418,691 |

Urea fertiliser company NeuRizer (ASX:NRZ) was the biggest winner for June with a 550% gain, despite spending much of the month not trading.

NEU announced a trading halt on June 14 and said on June 18 it would be suspended from quotation “pending an announcement regarding an ASX price query letter and response, along with an announcement in relation to a material acquisition”.

Come end of the month and NEU was still in a voluntary suspension, telling the market “the voluntary suspension will continue until the company is in a position to make the relevant announcement.”

MRG Metals (ASX:MRQ) also had a strong June (+300%) after inking a joint venture with Sinowin Lithium to develop its Mozambique Corridor Sands projects (Corridor Central and Corridor South) and its other Mozambique Heavy Mineral Sands projects.

Actinogen Medical’s (ASX:ACW) rose 148% after announcing positive results of its Phase 2a biomarker trial for Alzheimer’s Disease candidate Xanamem were published in the peer-reviewed Journal of Alzheimer’s Disease.

“This new peer-reviewed publication reports that Xanamem 10mg potentially slows AD progression in patients with high plasma pTau181,” ACW chief medical officer Dr Dana Hilt says in an announcement.

Optiscan Imaging (ASX: OIL) soared 124% in June after unveiling its innovative new medical imaging device, InVue, which has been designed to revolutionise precision surgery by granting surgeons immediate access to real-time digital pathology.

OIL in May announced it had entered a collaboration through a know-how agreement with the world-renowned Mayo Clinic to develop an endomicroscopic imaging system for use in robotic surgery.

Here were the 50 worst performing ASX stocks for June:

| CODE | COMPANY | LAST SHARE PRICE | JUNE RETURN % | MARKET CAP |

|---|---|---|---|---|

| ME1 | Melodiol Global Health | 0.003 | -95% | $582,276 |

| CLZ | Classic Minerals | 0.001 | -80% | $1,511,096 |

| SNX | Sierra Nevada Gold | 0.035 | -71% | $3,531,851 |

| 1TT | Thrive Tribe Tech | 0.004 | -69% | $1,882,486 |

| IMI | Infinity Mining | 0.015 | -67% | $1,543,794 |

| NSM | Northstaw | 0.011 | -66% | $1,678,509 |

| FTC | Fintech Chain Ltd | 0.006 | -63% | $3,904,618 |

| MMM | Marley Spoon Se | 0.014 | -61% | $2,119,039 |

| ICU | Investor Centre Ltd | 0.004 | -60% | $1,218,045 |

| MSG | MCS Services Limited | 0.002 | -60% | $594,299 |

| GRV | Greenvale Energy Ltd | 0.036 | -59% | $17,890,427 |

| DY6 | DY6 Metals | 0.07 | -58% | $3,175,882 |

| AAU | Antilles Gold Ltd | 0.003 | -57% | $3,986,140 |

| SVG | Savannah Goldfields | 0.013 | -57% | $4,216,274 |

| NNL | Nordic Nickel | 0.048 | -56% | $7,273,495 |

| CTT | Cettire | 1.17 | -55% | $421,268,233 |

| CAN | Cann Group Ltd | 0.028 | -55% | $12,476,132 |

| EOF | Ecofibre Limited | 0.03 | -55% | $12,123,965 |

| AVG | Aust Vintage Ltd | 0.155 | -50% | $50,779,648 |

| ADS | Adslot Ltd. | 0.001 | -50% | $3,749,672 |

| EEL | Enrg Elements Ltd | 0.002 | -50% | $3,029,895 |

| FGL | Frugl Group Limited | 0.05 | -50% | $5,759,397 |

| HCT | Holista CollTech Ltd | 0.005 | -50% | $1,394,000 |

| IEC | Intra Energy Corp | 0.0015 | -50% | $1,690,782 |

| MOM | Moab Minerals Ltd | 0.003 | -50% | $2,135,889 |

| PNT | Panther Metals | 0.024 | -50% | $2,091,988 |

| PUR | Pursuit Minerals | 0.002 | -50% | $10,906,200 |

| QXR | Qx Resources Limited | 0.006 | -50% | $7,215,506 |

| WNR | Wingara Ag Ltd | 0.008 | -50% | $1,579,883 |

| CCX | City Chic Collective | 0.125 | -48% | $30,149,611 |

| ANX | Anax Metals Ltd | 0.023 | -48% | $15,900,293 |

| ASO | Aston Minerals Ltd | 0.009 | -47% | $11,655,578 |

| EV1 | Evolution Energy | 0.034 | -47% | $10,044,632 |

| PLC | Premier1 Lithium Ltd | 0.016 | -47% | $2,793,186 |

| JLL | Jindalee Lithium Ltd | 0.31 | -47% | $18,751,936 |

| ENL | Enlitic Inc | 0.14 | -46% | $10,626,475 |

| AML | Aeon Metals Ltd. | 0.006 | -45% | $7,674,804 |

| SM1 | Synlait Milk Ltd | 0.235 | -45% | $44,809,241 |

| ZMM | Zimi Ltd | 0.011 | -45% | $1,356,829 |

| CZN | Corazon Ltd | 0.005 | -44% | $3,005,575 |

| HXG | Hexagon Energy | 0.01 | -44% | $5,642,075 |

| CY5 | Cygnus Metals Ltd | 0.042 | -44% | $13,201,161 |

| CLU | Cluey Ltd | 0.037 | -43% | $6,451,634 |

| AM7 | Arcadia Minerals | 0.041 | -43% | $4,330,854 |

| VBS | Vectus Biosystems | 0.077 | -43% | $4,097,210 |

| AAJ | Aruma Resources Ltd | 0.012 | -43% | $2,362,698 |

| ASR | Asra Minerals Ltd | 0.004 | -43% | $8,144,317 |

| ENV | Enova Mining Limited | 0.012 | -43% | $10,537,223 |

| FAU | First Au Ltd | 0.002 | -43% | $4,154,983 |

| MCL | Mighty Craft Ltd | 0.004 | -43% | $1,475,637 |

At Stockhead, we tell it like it is. While Optiscan is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.