ASX December Winners: Santa didn’t rally but at least these 50 stocks went okay

Sadly it was largely a case of "bah, humbug" in December on the ASX. Pic via Getty Images

- The S&P/ASX 200 fell 3% in December as Santa rally failed to eventuate yet again

- Consumer staples led the S&P/ASX 200 sectors in December with tech leading overall in 2024

- Niobium and rare earths explorer Aldoro Resources led the winners chart in December, up 332%

Australia’s S&P/ASX 200 dropped 3.15% in December to 8.159.1, the worst monthly return of 2024. The fall effectively erased November’s 3.79% gains as the much anticipated “Santa rally” – which traditionally sees a rise in equity markets in the last month of the year – failed to eventuate, according to S&P Dow Jones Indices (S&P DJI).

The S&P/ASX 200 rose 11.44% in 2024. The S&P/ASX Emerging Companies was the only Australian Equity Index to remain in the black in December, up 0.74% to be the top performer for the year up 15.70%.

“Four of the last seven Decembers have now ended lower for the S&P/ASX200, raising serious questions about the Santa Claus rally’s reliability, which has long been an integral and reliable part of the trader’s manual,” IG market analyst Tony Sycamore said.

“Interestingly, in recent years, after falling in December, the ASX200 has historically rebounded strongly the following January, providing hope for a positive start to 2025.”

VanEck Asia Pacific CEO and managing director Arian Neiron told Stockhead the pullback was part of a global sell-off after the US Federal Reserve signalled it would make fewer rate cuts in 2025, with the central bank dot plot showing two 25bps rate cuts.

The Australian dollar was also down 4.98% relative to the US dollar, and below 50c/British pound for the first time since April 2020.

“Australia’s currency weakness can partially be attributed to the relative strength of the US dollar, but it has also been impacted by China, whose economic woes have dragged down Australian commodity prices,” Neiron said.

Consumer staples lead gainers, tech tops 2024 up ~50%

Just four of the 11 S&P/ASX 200 sectors rose in December with consumer staples leading the gainers with a 0.64% rise, utilities up 0.38%, industrials rising 0.28% and energy putting on 0.25%.

“2024 witnessed a large divergence among the S&P/ASX 200 sectors,” S&P DJI said.

“Information technology led with an impressive 50% return, followed by financials which gained 34% and contributed 84% of the index return.”

Energy and materials lagged, both with ~14% declines in 2024.

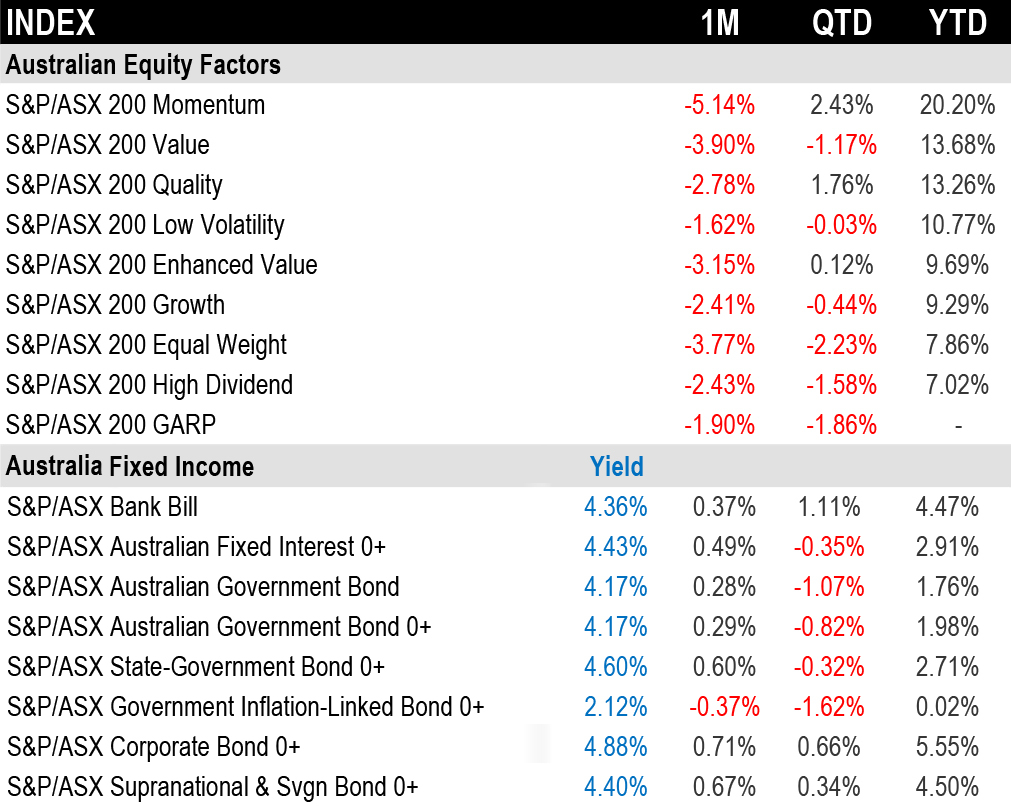

Momentum tops equity factors in 2024, bonds positive

Australian equity factors all fell in December. Momentum was the best-performing factor in 2024, returning 20% for the year, which S&P DJI said combined with the outperformance of larger companies, led to a 4% underperformance in Equal Weight relative to the market cap-weighted index with High Dividend also lagging.

Bonds also mostly posted positive returns in December and were positive across the board in 2024, which S&P DJI said was driven by moderating inflation and spread tightening.

The Reserve Bank of Australia (RBA) remained a global outlier and maintained a hawkish bias with no lowering of interest rates in 2024, which S&P DJI said capped the return of the S&P/ASX Australian Fixed Interest 0+ at 3%.

“Bonds were the one bright spot in December, with short-dated government bond yields edging lower and credit spreads tightening after RBA Governor Bullock opened the door to a potential rate cut in February,” Neiron said.

The 50 best performing ASX stocks in December

| CODE | COMPANY | LAST SHARE PRICE | DECEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| ARN | Aldoro Resources | 0.38 | 332% | $51,157,022 |

| MTM | MTM Critical Metals | 0.26 | 217% | $105,718,282 |

| GCM | Green Critical Minerals | 0.014 | 180% | $26,705,746 |

| BGE | Bridge SaaS | 0.05 | 150% | $9,992,960 |

| ION | Iondrive Limited | 0.03 | 150% | $26,389,010 |

| BDG | Black Dragon Gold | 0.069 | 116% | $20,829,908 |

| CLE | Cyclone Metals | 0.056 | 115% | $59,625,607 |

| SHG | Singular Health | 0.225 | 105% | $55,623,344 |

| 88E | 88 Energy Ltd | 0.002 | 100% | $57,867,624 |

| AHF | Aust Dairy Nutritionals | 0.076 | 100% | $56,492,458 |

| ATH | Alterity Therapeutics | 0.008 | 100% | $42,562,689 |

| AYM | Australia United Mining | 0.004 | 100% | $7,370,310 |

| NRZ | Neurizer Ltd | 0.002 | 100% | $5,929,721 |

| VPR | Volt Group | 0.002 | 100% | $21,432,416 |

| LM1 | Leeuwin Metals Ltd | 0.14 | 92% | $6,559,234 |

| IVX | Invion Ltd | 0.28 | 87% | $19,394,881 |

| AXE | Archer Materials | 0.58 | 84% | $147,811,268 |

| BXN | Bioxyne Ltd | 0.027 | 80% | $55,329,176 |

| AHN | Athena Resources | 0.005 | 79% | $7,971,402 |

| TVN | Tivan Limited | 0.1 | 75% | $190,996,314 |

| CMD | Cassius Mining Ltd | 0.012 | 71% | $6,504,054 |

| MME | Moneyme Limited | 0.205 | 67% | $164,016,088 |

| OCC | Orthocell Limited | 1.355 | 67% | $324,797,392 |

| CRB | Carbine Resources | 0.005 | 67% | $2,758,689 |

| EPM | Eclipse Metals | 0.006 | 67% | $13,727,133 |

| 5EA | 5Eadvanced | 0.13 | 65% | $43,799,744 |

| IGN | Ignite Ltd | 0.655 | 62% | $10,688,648 |

| DUB | Dubber Corp Ltd | 0.032 | 60% | $83,185,629 |

| MEM | Memphasys Ltd | 0.008 | 60% | $14,168,118 |

| ETM | Energy Transition | 0.039 | 56% | $54,939,638 |

| TFL | Tasfoods Ltd | 0.017 | 55% | $7,430,624 |

| BRN | Brainchip Ltd | 0.39 | 53% | $769,262,511 |

| MX1 | Micro-X Limited | 0.084 | 53% | $48,984,331 |

| PTR | Petratherm Ltd | 0.305 | 53% | $94,304,960 |

| NVA | Nova Minerals Ltd | 0.37 | 51% | $103,209,122 |

| M4M | Macro Metals Limited | 0.012 | 50% | $44,807,325 |

| AUH | Austchina Holdings | 0.0015 | 50% | $3,600,575 |

| ERG | Eneco Refresh Ltd | 0.021 | 50% | $5,719,525 |

| GMN | Gold Mountain Ltd | 0.003 | 50% | $11,902,420 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | $9,296,169 |

| NFM | New Frontier | 0.018 | 50% | $26,167,236 |

| OD6 | OD6 Metals | 0.048 | 50% | $6,177,128 |

| TX3 | Trinex Minerals Ltd | 0.0015 | 50% | $2,742,978 |

| ERA | Energy Resources | 0.003 | 50% | $1,216,188,722 |

| A11 | Atlantic Lithium | 0.335 | 49% | $232,204,350 |

| PMT | Patriot Battery Metals | 0.405 | 47% | $234,314,743 |

| BVS | Bravura Solution Ltd | 2.25 | 46% | $1,008,796,505 |

| AI1 | Adisyn Ltd | 0.086 | 46% | $26,426,720 |

| JAT | Jatcorp Limited | 0.5 | 45% | $41,633,331 |

| ART | Airtasker Limited | 0.465 | 43% | $210,831,625 |

Niobium and rare earths explorer Aldoro Resources (ASX:ARN) led the winners chart in December, up 332%.

Surface sampling at the company’s Kameelburg project in Namibia confirmed extensive niobium mineralisation, with Line 4 fully mineralised at 0.52% niobium oxide and Line 3 showing 220m of 388m mineralised at 0.7%. Diamond drilling is underway, targeting carbonatite zones.

MTM Critical Metals (ASX:MTM) was the second best performer in December, up 217% with progress being made on its Flash Joule Heating technology – a metal recovery and mineral processing method that efficiently extracts metals like lithium from spodumene, gallium from scrap and gold from e-waste.

Regenerative medicine company Orthocell (ASX:OCC) was also on the winners’ table in December with positive news flow boosting its share price 67%.

Orthocell announced it had submitted a 510(k) application with the US FDA to commercially distribute its peripheral nerve-repair device Remplir into the US$1.6bn US market.

Filing of the application followed news that the US FDA 510(k) regulatory study of its peripheral nerve-repair product Remplir had met all endpoints.

Non-bank lender MONEYME (ASX:MME) also rose 67% in December after announcing it had secured a new funding partnership with alternative asset investment platforms iPartners.

MoneyMe said the partnership involved securing a new $125 million corporate funding facility, which will be used to replace the company’s existing facility, driving funding efficiencies through substantially better terms.

The 50 worst performing ASX stocks in December

| CODE | COMPANY | LAST SHARE PRICE | DECEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| PER | Percheron | 0.007 | -91% | $7,612,063 |

| MKL | Mighty Kingdom Ltd | 0.009 | -80% | $1,944,571 |

| AFA | ASF Group Limited | 0.005 | -75% | $3,961,988 |

| MRD | Mount Ridley Mines | 0.003 | -70% | $2,335,467 |

| 8VI | 8Vi Holdings Limited | 0.016 | -69% | $670,583 |

| PGY | Pilot Energy Ltd | 0.005 | -67% | $8,272,858 |

| LYN | Lycaon Resources | 0.09 | -60% | $4,768,634 |

| MHC | Manhattan Corp Ltd | 0.019 | -53% | $4,463,079 |

| LOM | Lucapa Diamond Ltd | 0.02 | -52% | $6,672,806 |

| VTI | Vision Tech Inc | 0.058 | -52% | $3,192,115 |

| CR9 | Corellares | 0.003 | -50% | $1,403,230 |

| JAY | Jayride Group | 0.003 | -50% | $715,737 |

| RBR | RBR Group Ltd | 0.001 | -50% | $2,580,285 |

| RIE | Riedel Resources Ltd | 0.031 | -48% | $1,723,478 |

| APC | APC Minerals | 0.0135 | -48% | $1,379,337 |

| IVR | Investigator Resources | 0.02 | -47% | $31,777,591 |

| VAR | Variscan Mines Ltd | 0.007 | -46% | $5,480,004 |

| ALV | Alvo Minerals | 0.05 | -44% | $5,857,944 |

| C29 | C29 Metals | 0.053 | -43% | $9,231,977 |

| GLL | Galilee Energy Ltd | 0.007 | -42% | $3,900,350 |

| CSS | Clean Seas Ltd | 0.089 | -41% | $17,916,882 |

| 4DS | 4DS Memory Limited | 0.05 | -40% | $88,171,746 |

| BUY | Bounty Oil & Gas NL | 0.003 | -40% | $4,495,503 |

| REC | Recharge Metals | 0.018 | -40% | $4,616,819 |

| LAT | Latitude 66 Limited | 0.038 | -40% | $5,449,227 |

| IBX | Imagion Biosys Ltd | 0.023 | -39% | $4,630,853 |

| SPG | SPC Global Holdings | 1.1 | -39% | $212,280,070 |

| CMB | Cambium Bio Limited | 0.4 | -38% | $5,312,156 |

| RLF | RLF AgTech | 0.028 | -38% | $7,521,156 |

| CAE | Cannindah Resources | 0.039 | -38% | $28,395,118 |

| AHK | Ark Mines Limited | 0.14 | -38% | $7,762,498 |

| AVE | Avecho Biotech Ltd | 0.0025 | -38% | $7,923,243 |

| CR3 | Core Energy Minerals | 0.025 | -38% | $4,184,178 |

| ENV | Enova Mining Limited | 0.005 | -38% | $4,924,647 |

| RGT | Argent Biopharma Ltd | 0.17 | -37% | $9,226,286 |

| VMT | Vmoto Limited | 0.073 | -37% | $30,567,452 |

| AXI | Axiom Properties | 0.039 | -36% | $16,875,833 |

| LTP | LTR Pharma Limited | 0.81 | -36% | $90,690,001 |

| PPG | Pro-Pac Packaging | 0.027 | -36% | $4,905,568 |

| IFG | Infocus Group | 0.02 | -35% | $3,138,187 |

| PNT | Panther Metals | 0.011 | -35% | $2,729,878 |

| CU6 | Clarity Pharma | 4.17 | -35% | $1,337,781,299 |

| IR1 | Iris Metals | 0.235 | -35% | $40,163,705 |

| EMN | Euro Manganese | 0.029 | -34% | $6,114,157 |

| SBM | St Barbara Limited | 0.225 | -34% | $243,640,427 |

| 14D | 1414 Degrees Limited | 0.026 | -33% | $7,345,032 |

| AMS | Atomos | 0.01 | -33% | $12,150,185 |

| BMO | Bastion Minerals | 0.004 | -33% | $3,378,899 |

| EM2 | Eagle Mountain | 0.011 | -33% | $4,407,236 |

| GCR | Golden Cross | 0.002 | -33% | $2,194,512 |

Percheron Therapeutics (ASX:PER) fell 91% in December after failure of its phase 2b trial of lead candidate avicursen (ATL-1102) into non-ambulant (unable to walk unassisted) boys with Duchenne muscular dystrophy (DMD).

Percheron announced the trial failed to achieve its primary endpoint, which measured upper limb function at week 25 of treatment, compared with placebo.

“This has understandably come as an enormous disappointment for all our shareholders, as indeed it has to all those of us who work in the company on your behalf,” the Percheron board noted in a letter to shareholders.

At Stockhead we tell it like it is. While Orthocell and MoneyMe were Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.