ASX August Winners: Everyone lost. August was rough.

Pic: Getty Images

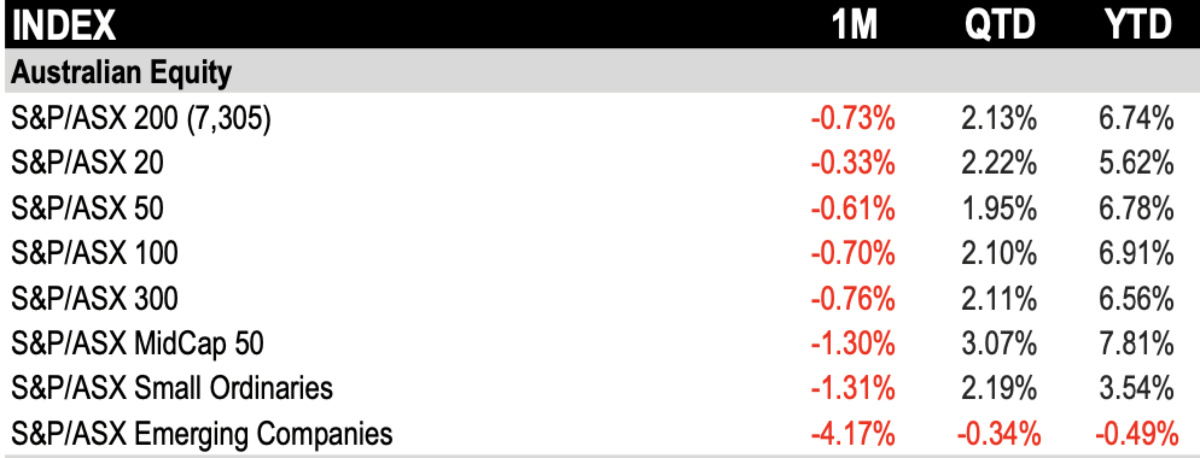

- The S&P ASX 200 was down 0.73% in August with mid caps and small caps down 1.3% for the month

- Eight of 11 sectors down in August with consumer discretionary leading winners and utilities the laggards

- Tech stock 4DS Memory rises more than 360% in August after announcing a major breakthrough

Australian markets fell in August. Australian large caps were down 0.7% for the month, reducing YTD gains. Mid- caps and small-caps lagged blue chips, with both the S&P/ASX MidCap 50 and the S&P/ASX Small Ordinaries down 1.3% in August.

While the S&P ASX MidCap 50 and the S&P ASX Small Ordinaries are up YTD, the S&P ASX Emerging Companies indices still has some catch-up to do with four months left for 2023, according to S&P Dow Jones Indices.

China slowdown fears prey on markets

Several headwinds faced global markets during August with the economic slowdown in China topping the list. Key economic data points coming out of China in August spooked markets with a rally that was expected in spending after prolonged Covid-19 lockdowns in the world’s second largest economy failing to eventuate.

A big slowdown in China’s property market, which accounts for ~25% of the economy, saw one of the country’s largest developers Country Garden posting a net loss between January and June of 48.9 billion yuan ($6.72 billion) and posing a default risk.

Furthermore, China’s second-largest property developer, heavily indebted Evergrande, filed for US bankruptcy protection in August as part of one of the largest debt restructurings.

There was mixed news coming out of the world’s largest economy in August as the US Federal Reserve continues to work towards a soft landing as it aims to bring inflation back to its 2% target.

The US unemployment rate increased to 3.8% in August, up from the previous 3.5% in July. Employers expanded their payrolls by 187,000 workers in the past month, which was above the 170,000 forecasted.

“Today’s report is consistent with an economy that is transitioning to steady and stable growth, an important and necessary deceleration that is helping to ease price pressures while maintaining a strong labor market,” The White House said.

At a key speech at the annual economic symposium hosted by the Federal Reserve Bank of Kansas City in Jackson Hole, Wyoming Fed Reserve chair Jerome Powell maintained a hawkish stand. The US consumer price index rose 3.2% from a year ago in July, slightly below expectations.

“Although inflation has moved down from its peak – a welcome development – it remains too high,” Powell said in his speech.

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

In Australia inflation slowed to a 17-month low, a signal that interest rate hikes might be coming to an end. Australian Bureau of Statistics data released in August showed the monthly consumer price index (CPI) rose 4.9% in the year to July, down from 5.4% in June and under market forecasts of 5.2%.

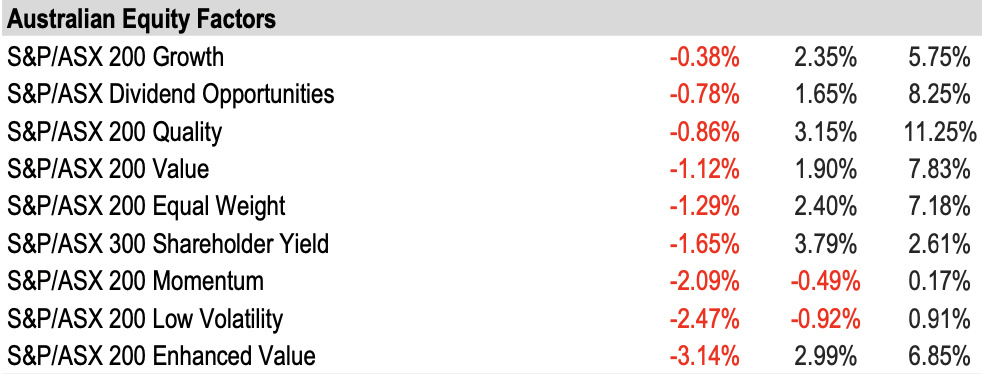

Equity factors in red, consumer discretionary & fixed income win out

All reported Australian equity factor indices closed in the red for August, with S&P reporting growth as the most successful in limiting its losses, down just 0.4%. At the other end of the spectrum, Enhanced Value lost 3.1%.

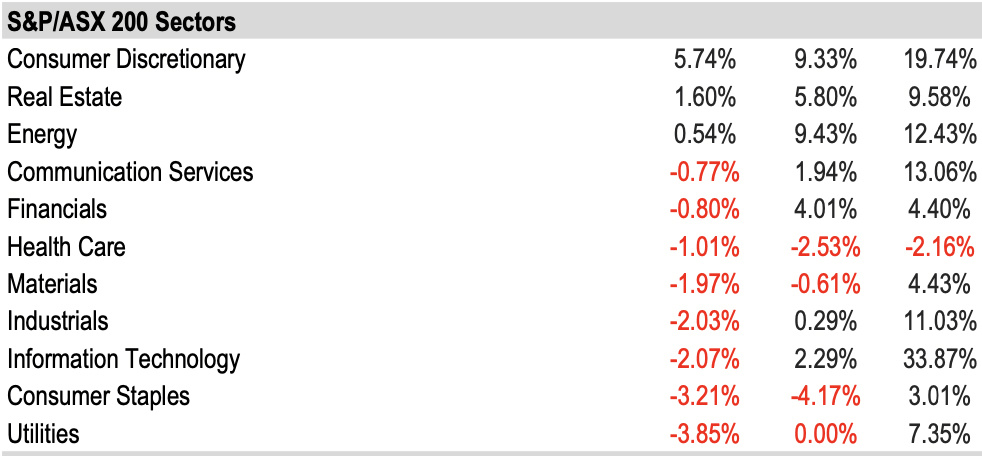

Eight of the 11 sectors finished in the red in August. The S&P/ASX 200 Consumer Discretionary was the best performing sector, up 5.74%, while Utilities lagged, down 3.85%.

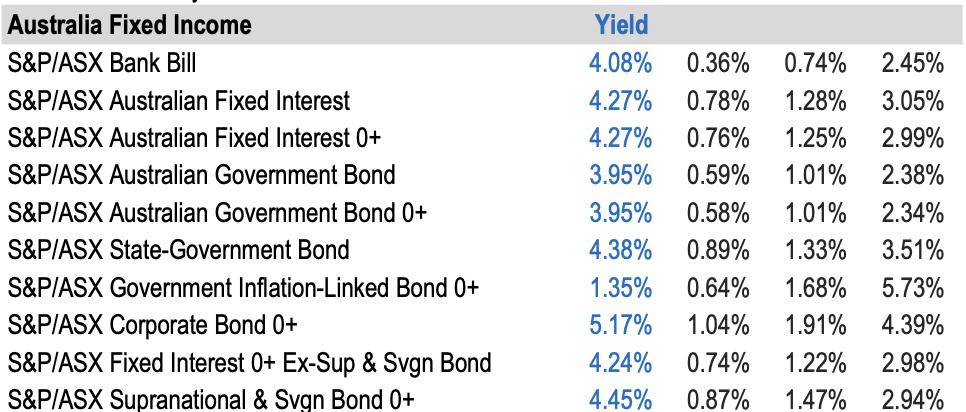

Fixed income was one of the big winners in August, extending gains for the quarter and YTD.

Here are the 50 best performing ASX stocks for August:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | AUGUST RETURN % | MARKET CAP |

|---|---|---|---|---|

| 4DS | 4Ds Memory Limited | 0.1475 | 361% | $276,605,306 |

| RDN | Raiden Resources Ltd | 0.03 | 300% | $49,326,454 |

| ECG | Ecargo Holdings | 0.038 | 171% | $28,301,500 |

| VMM | Viridis Mining | 0.6 | 140% | $16,250,346 |

| LLI | Loyal Lithium Ltd | 0.735 | 130% | $52,527,205 |

| WC8 | Wildcat Resources | 0.375 | 127% | $242,946,907 |

| IGN | Ignite Ltd | 0.08 | 90% | $7,166,574 |

| NMR | Native Mineral Resources | 0.056 | 87% | $7,406,459 |

| BRX | Belararox | 0.485 | 87% | $24,329,089 |

| RLG | Roolife Group Ltd | 0.013 | 86% | $8,646,698 |

| INP | Incentiapay Ltd | 0.011 | 83% | $13,915,700 |

| BEX | Bikeexchange Ltd | 0.009 | 80% | $9,513,201 |

| IEC | Intra Energy Corp | 0.007 | 75% | $9,724,690 |

| RHK | Red Hawk Mining Ltd | 0.785 | 74% | $126,636,433 |

| OKJ | Oakajee Corp Ltd | 0.026 | 73% | $2,194,705 |

| HLA | Healthia Limited | 1.7425 | 72% | $136,687,178 |

| STP | Step One Limited | 0.58 | 66% | $101,937,160 |

| FRE | Firebrick Pharma | 0.32 | 64% | $35,189,402 |

| KNB | Koonenberry Gold | 0.054 | 64% | $4,090,848 |

| OAR | OAR Resources Ltd | 0.0065 | 63% | $15,678,814 |

| ACM | Australian Critical Minerals | 0.3225 | 61% | $8,473,406 |

| AW1 | American West Metals | 0.295 | 59% | $104,554,313 |

| LDX | Lumos Diagnostics | 0.1 | 59% | $48,778,719 |

| ARV | Artemis Resources | 0.028 | 56% | $45,527,633 |

| GCX | GCX Metals Limited | 0.043 | 54% | $8,360,041 |

| RTH | Ras Tech | 0.76 | 54% | $37,276,040 |

| VEE | Veem Ltd | 0.65 | 53% | $88,217,644 |

| AD8 | Audinate Group Ltd | 13.95 | 53% | $1,081,842,397 |

| FTL | Firetail Resources | 0.125 | 52% | $12,031,250 |

| OAK | Oakridge | 0.12 | 52% | $2,063,481 |

| EML | EML Payments Ltd | 1.145 | 51% | $402,032,939 |

| KKO | Kinetiko Energy Ltd | 0.12 | 50% | $89,764,805 |

| MPG | Many Peaks Gold | 0.3 | 50% | $11,276,090 |

| ROC | RocketBoots | 0.12 | 50% | $3,579,235 |

| BVS | Bravura Solution Ltd | 0.76 | 49% | $345,232,582 |

| EL8 | Elevate Uranium Ltd | 0.445 | 48% | $122,260,221 |

| NGY | Nuenergy Gas Ltd | 0.04 | 48% | $57,757,264 |

| PPG | Pro-Pac Packaging | 0.31 | 48% | $56,323,190 |

| LU7 | Lithium Universe Ltd | 0.044 | 47% | $18,260,529 |

| IMR | Imricor Med Sys | 0.645 | 47% | $98,842,890 |

| BOT | Botanix Pharma Ltd | 0.19 | 46% | $284,239,363 |

| ERG | Eneco Refresh Ltd | 0.019 | 46% | $5,174,809 |

| MIL | Millennium Grp Ltd | 0.365 | 46% | $16,978,773 |

| BIO | Biome Australia Ltd | 0.14 | 46% | $21,118,890 |

| FME | Future Metals NL | 0.048 | 45% | $19,007,386 |

| 3DA | Amaero International | 0.195 | 44% | $81,284,817 |

| MBK | Metal Bank Ltd | 0.049 | 44% | $13,547,790 |

| AGE | Alligator Energy | 0.046 | 44% | $148,766,352 |

| BDX | Bcal Diagnostics | 0.1 | 43% | $21,323,269 |

| AEE | Aura Energy | 0.275 | 41% | $158,163,006 |

4DS Memory (ASX:4DS) topped the winners list in August, up more than 360% after announcing a breakthrough, where it it had successfully incorporated its ReRAM memory cells into the imec megabit array.

The company has validated that 4DS Interface Switching ReRAM technology is transferable from fab to fab, and demonstrated a fully functional megabit array with 4DS Interface Switching ReRAM memory cells.

“The results obtained are significantly better than the Board and management team at 4DS were expecting,” 4DS said in its announcement.

Also up more than 300% in August was Raiden Resources (ASX:RDN), which last week announced it’s managed to secure firm commitments to raise another $6 million in funding via a share placement to professional, sophisticated, and institutional investors.

The lithium hunter says it will use the funds chiefly to progress exploration work and drilling at its portfolio of lithium projects located in the Pilbara region of Western Australia. That, and to potentially upgrade its 85% interest in lithium-gold acreage held by Arrow Minerals (ASX:AMD) to 100% interest.

Here are the 50 worst performing ASX stocks for August:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | AUGUST RETURN % | MARKET CAP |

|---|---|---|---|---|

| ELE | Elmore Ltd | 0.003 | -63% | $4,198,151 |

| CLA | Celsius Resource Ltd | 0.01 | -58% | $24,706,568 |

| BAT | Battery Minerals Ltd | 0.056 | -57% | $7,654,688 |

| MSB | Mesoblast Limited | 0.515 | -55% | $370,463,195 |

| SIX | Sprintex Ltd | 0.019 | -55% | $6,792,383 |

| 3DP | Pointerra Limited | 0.093 | -55% | $67,621,057 |

| SPL | Starpharma Holdings | 0.1475 | -55% | $57,469,031 |

| 8VI | 8Vi Holdings Limited | 0.105 | -54% | $5,029,371 |

| ANO | Advance Zinctek Ltd | 0.815 | -52% | $68,674,891 |

| ICG | Inca Minerals Ltd | 0.02 | -51% | $9,215,190 |

| CGO | CPT Global Limited | 0.13 | -51% | $9,007,933 |

| AVW | Avira Resources Ltd | 0.001 | -50% | $3,200,685 |

| GGX | Gas2Grid Limited | 0.001 | -50% | $4,077,102 |

| KEY | KEY Petroleum | 0.001 | -50% | $2,951,892 |

| SPT | Splitit | 0.038 | -47% | $23,237,929 |

| VTM | Victory Metals Ltd | 0.21 | -47% | $16,584,429 |

| GCM | Green Critical Min | 0.008 | -47% | $8,957,429 |

| NSM | Northstaw | 0.048 | -47% | $7,207,620 |

| NWF | Newfield Resources | 0.15 | -46% | $115,330,631 |

| NYR | Nyrada Inc. | 0.027 | -46% | $4,056,226 |

| AMM | Armada Metals | 0.022 | -42% | $1,508,497 |

| BET | Betmakers Tech Group | 0.105 | -42% | $103,789,576 |

| ME1 | Melodiol Glb Health | 0.007 | -42% | $20,256,243 |

| GBE | Globe Metals & Mining | 0.038 | -41% | $19,763,979 |

| TRE | Toubani Resources | 0.115 | -41% | $13,285,870 |

| FRS | Forrestania Resources | 0.062 | -41% | $5,773,589 |

| BIR | BIR Financial Ltd | 0.044 | -41% | $13,212,989 |

| CXO | Core Lithium | 0.395 | -40% | $843,406,718 |

| CHN | Chalice Mining Ltd | 3.57 | -40% | $1,461,712,611 |

| CXM | Centrex Limited | 0.075 | -40% | $47,321,993 |

| KNO | Knosys Limited | 0.036 | -40% | $8,645,548 |

| MTB | Mount Burgess Mining | 0.003 | -40% | $3,046,940 |

| PKD | Parkd Ltd | 0.018 | -40% | $2,036,367 |

| RCR | Rincon | 0.033 | -40% | $2,221,804 |

| TG1 | Techgen Metals Ltd | 0.036 | -40% | $3,009,563 |

| BC8 | Black Cat Syndicate | 0.23 | -39% | $60,047,202 |

| RAC | Race Oncology Ltd | 0.8 | -39% | $132,901,056 |

| RVS | Revasum | 0.135 | -39% | $14,828,332 |

| KCC | Kincora Copper | 0.041 | -39% | $6,600,437 |

| PNR | Pantoro Limited | 0.049 | -39% | $265,405,556 |

| GLE | GLG Corp Ltd | 0.135 | -39% | $10,003,500 |

| OMX | Orange Minerals | 0.032 | -38% | $1,589,356 |

| KNG | Kingsland Minerals | 0.185 | -38% | $7,602,366 |

| SKF | Skyfii Ltd | 0.042 | -38% | $18,466,279 |

| AIS | Aeris Resources Ltd | 0.235 | -38% | $162,372,215 |

| ZLD | Zelira Therapeutics | 1.07 | -38% | $12,481,871 |

| CY5 | Cygnus Metals Ltd | 0.2 | -38% | $52,487,819 |

| EEL | Enrg Elements Ltd | 0.005 | -38% | $6,059,790 |

| IRE | IRESS Limited | 6.46 | -37% | $1,217,867,370 |

| ABE | Australian Bond Exchange | 0.11 | -37% | $3,720,298 |

| ALV | Alvomin | 0.17 | -37% | $13,004,340 |

| POD | Podium Minerals | 0.041 | -37% | $14,573,464 |

| TMB | Tambourah Metals | 0.215 | -37% | $17,417,474 |

On the losers list in August was biotech Mesoblast (ASX:MSB) which tanked more than 50% on August 4 after failing to receive US FDA approval for its stem cell treatment, remestemcel-L.

MSB announced the US FDA had provided a complete response to its Biologics License Application (BLA) resubmission for remestemcel-L for the treatment of paediatric steroid-refractory acute graft versus host disease (SR-aGVHD) and will require more data to support marketing approval.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.