A passage through India: These motorcycle stocks won’t stop climbing

Via Getty

In this series on investing in India, Mugunthan Siva and Ramanesh Mahendran from India Avenue Investment Management, introduce equities across the economy which is challenging China for innovation, opportunity and access.

India’s overtaken China on the demographic super highway, easing into place as the world’s largest country by population this year.

With circa 1.4 billion people and a mere 81 million registered cars (China by comparison has 320 million registered motor vehicles), India’s armada of two-wheelers is a point of difference a savvy investor with or without a penchant for leather might want to investigate.

India has approximately 220m two-wheelers on the road, making motorbikes and their offspring around 75% of India’s traffic right across the country. This compares to China’s 81m motorbikes, making India the largest two-wheeler market in the world by some degrees. Yet the space to grow is almost unlimited.

Mugunthan says there’s approximately 700 million two-wheelers in the world, ‘placing India at over 30% of the global market.’

“India is also the largest producer of two-wheelers in the world at the moment, producing almost 16 million units by the financial year ending March 2023,” he adds.

Meet India’s motorcycle market

Mugunthan and Ramanesh say the two-wheeler market can be split into four distinct segments; Scooters, Mopeds, Motorcycles and Electric Two-Wheelers.

“The popularity of two-wheelers among Indians is of no surprise at all, with their fuel efficiency, low maintenance costs and slim profile allowing them to navigate through traffic easily,” Mugunthan says.

“Among these two-wheelers, the engine capacity is the main distinguishing feature between the different price points. In fact, the engine capacity is one of the main factors which separate the low, budget-end models to the high luxury models. These range anywhere from 100cc to 800cc.”

In terms of price points, two-wheelers can hold any range.

“Some of the cheapest bikes can go for US$600 while the more popular bikes can range up to US$2000,” says Ramanesh.

And speaking of cycles, the domestic two-wheeler industry posted year-on-year double-digit growth in 2022-23 after three consecutive years of decline, but, incredibly the segment is still at a nine-year low, with sales somewhere around 2014 levels at 16 million units. So the cycle is ready to swing back into gear.

Indian sales hit almost 15.9 million units in the fiscal year to March 2023, up 17% from 13.57mn.

Rushlane’s Two-Wheeler Retail Sales volumes for FY 2021/22

Players in the Indian market

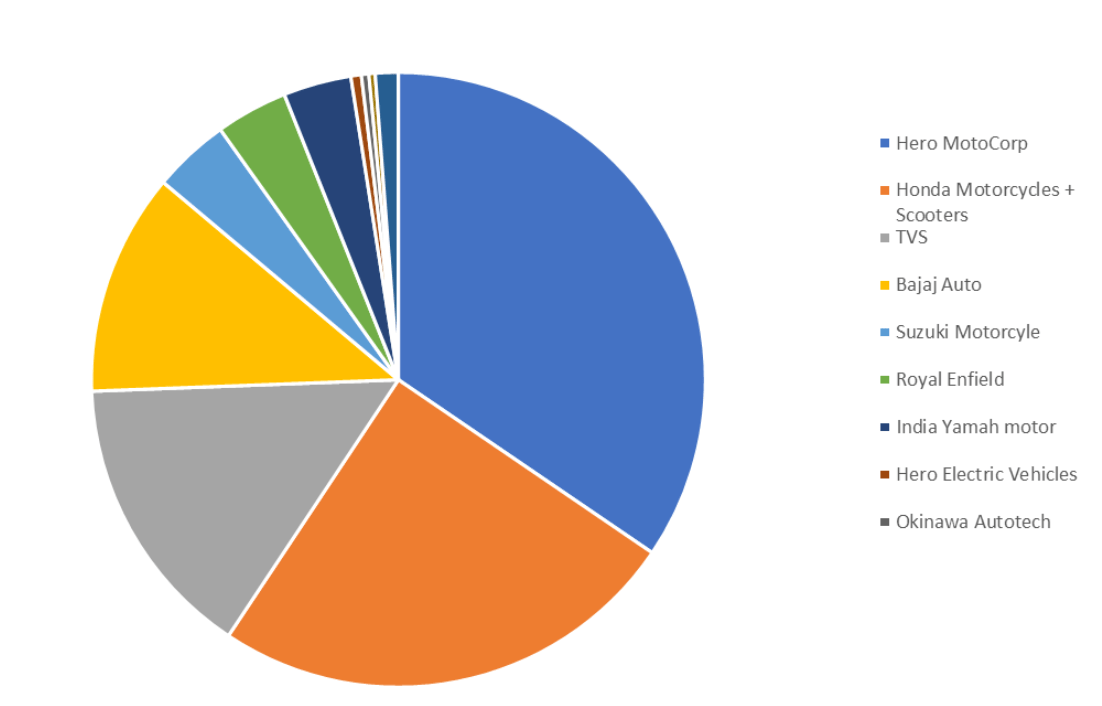

There are currently 10 distinct manufacturers in the two-wheelers market in India, according to Ramanesh.

While there are some significant players who hold large market shares, the different selling nature of each company makes them difficult to compare.

“For example, at the moment Hero Motocorp is the leading two-wheeler manufacturer in India, holding over 46% market share as of 2021. They hold a significant role in the first purchaser’s market, allowing the majority of Indians to enjoy their models for budget-friendly prices.

“Other main competitors include Honda, Bajaj Auto and TVS, which combine for almost 50% of the total market share,” he adds.

Hero MotoCorp

As of 2023, Hero MotoCorp is the leading two-wheel manufacturer throughout India, and has maintained this position for the last 18 years. With over 48.3% market share as of 2022, Hero MotorCorp’s budget friendly models and innovative technology has allowed millions of Indians to purchase and enjoy their product.

“Of their dominant market share in motorcycles, Hero MotoCorp also holds a 62.10% market share in entry-level motorcycles and 58.50% market share in deluxe motorcycles, compared to a measly 3.70% market share in premium motorcycles.

“What this shows is that Hero Motocorp holds a significant market share in the lower-end and budget friendly market, while also holding a significant portion in the middle-class market. However, their share on the premium end is incredibly lacklustre, and doesn’t seem to have a significant hold,” says Ramanesh.

“As of 2018, Hero MotoCorp holds the production output ability of over 7.6 million units a year. Along with a market capitalisation of US$7.5 billion and revenue of US$4.3 billion, it’s clear that Hero MotorCorp holds a very dominant position in the two-wheeler market.

“One of their more popular products comes in the form of their 100cc to 150cc motorbikes, their cheapest product due to the lack of engine capacity. Their dominance over this first purchaser’s market has allowed them to reach annual profit growth levels of 31.7% as of March 2023.”

Eicher Motors

Ramanesh tells me that Eicher’s market lies on the other side of the two-wheeler market, towards the premium end.

After all, this is the holding company for Royal Enfield, a globally recognised brand considered to produce luxury, upper-class models. It is also the only Indian brand to provide products in North America and Europe.

It’s a motorbike. Via Royal Enfield

“Royal Enfield currently holds a 6.83% market share in the entire sector of two-wheelers. However, they hold a significant position in the premium level of this market.

“As of 2018, Royal Enfield holds an annual production output of 850,000 units, with Eicher Motors holding a market capitalisation of $12.34 billion. Their product line allows them to appeal towards a higher-income customer base, which has led to their most recent quarter reporting annual profit growth levels of 48.43%.”

Outlook including EVs

India is currently one of the frontrunners in the EV industry, says Mugunthan Siva, with consistent government investment and electric vehicle adoption allowing for a very healthy outlook for the sector within India.

“The EV infrastructure in India has developed to a point where it is now a significant and viable option for individuals and families. As of 2023, approximately 400,000 of the total 7 million bikes that have been sold this year have been electric.

“Although this is only 5.7% of the total, it’s an impressive statistic granted that only half of the year has gone by. Furthermore, India’s FY23 only saw around 850,000 units sold, a remarkable increase from the FY22 figure of 330,000.”

“We believe that the two-wheeler industry will act as one of the key drivers in EV adoption in India, and is expected to achieve 40-45% penetration by 2030. (Ed: Thats according to Bain and Company).

“A few years ago, and only a few years – like before the pandemic in 2018-19 – sales of electric two-wheeler models here were negligible,” Mugunthan says.

According to data from India’s Society of Manufacturers of Electric Vehicles (SMEV), the industry sold 7,26,976 high-speed electric two wheelers (speed > 25km/h) in 2022-23.

Easy Riders

After three consecutive periods of decline, FY23 finally saw a double-digit growth in sales to reach 15.67 million units sold, up 17% from FY22. However, despite these being impressive figures, the industry still stands at a nine-year low and a reported negative CAGR of 6.97%.

But Mugunthan is quick to remind me how this more agile India operates. It is full of surprises.

“Looking at the financials following FY18, specifically in regards to Eicher Motors and Hero MotoCorp, it’s clear that the sales volume, EBITDA margin and operating profit have experienced an upward trend following their recovery after the COVID-19 period,” Mugunthan says.

“And as we said, don’t forget Eicher Motor holds a significant market share within premium motorcycles while Hero MotoCorp maintains dominance of not only entry and deluxe vehicles,” (Ed: this is Ramanesh, butting in) “but for the industry in general, these two stocks control a significant portion of the market.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.