A passage to India: How to invest in the world’s biggest growth story

Mugunthan Siva MD at India Avenue says fear is holding us back. Pic: MstudioImages

In this series on investing in India, Mugunthan Siva, managing director at India Avenue Investment Management, introduces equities across the one economy which is challenging China for innovation, opportunity and access.

Siva’s India Avenue IM is one of only a handful of firms driving Australian investment into the Indian equities market.

While Siva estimates firms with an India-only strategy have a modest ~$600 million in Funds Under Management (FUM) right now, this is at least more than double the ~$250 million in FUM five years ago. So the awareness is building, but has a long way to go.

India is the world’s largest democracy, one of the fastest growing major economies, a technology powerhouse and a major power.

According to DFAT, it was our seventh-largest trading partner and sixth-largest export market back in 2020, driven largely by coal and international education.

The former has since picked up following China’s petulant ban on Aussie coal, but while two-way trade with China has blossomed into a vast and protected national park, Indian investment is still at the backyard tomato patch stage in comparison.

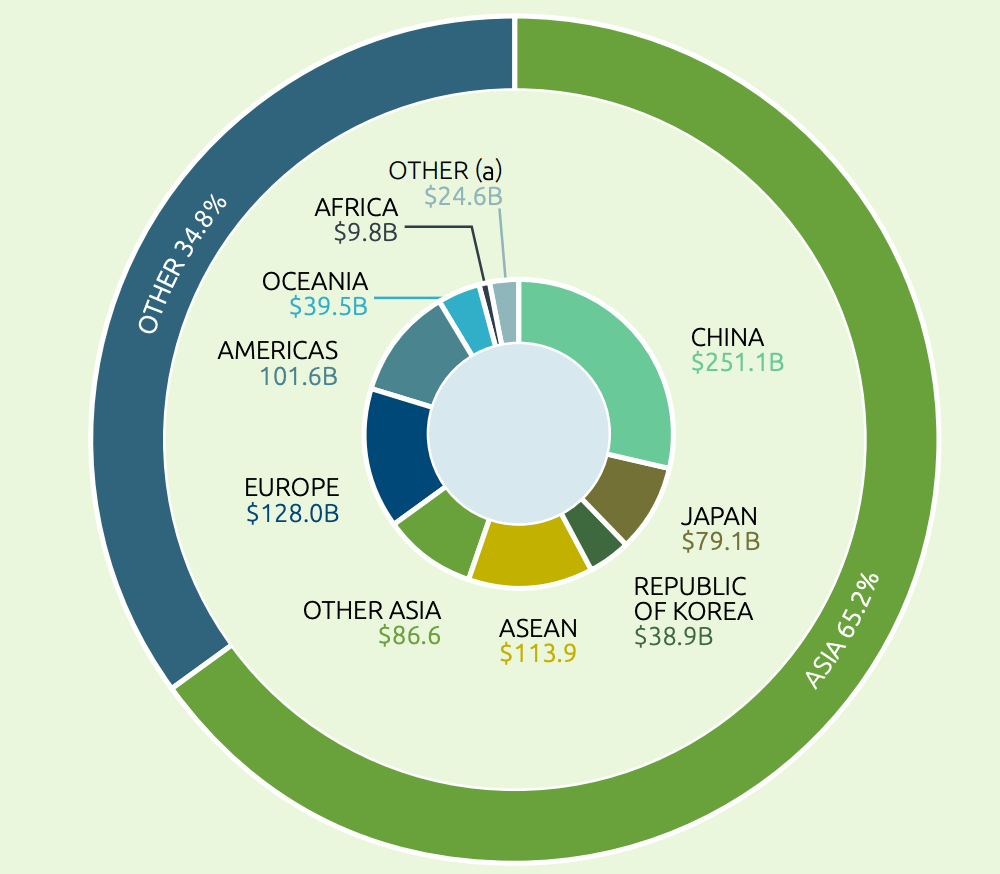

Australia’s Two-Way Trade by Region 2020-21… where is India?

But why?

The oddity is obvious – people-to-people and culture-to-culture links are super tight – we’ve a hell of a lot in common and this closeness already underpins the relationship.

We share a slice of the Evil English Empire, we worship together at the altar of Shane and Sachin, while our Aussie-Indian diaspora continues growing on the back of rich and resilient contributions to Australia’s economy and its multicultural landscape.

Stockhead: So Mugunthan, explain why haven’t Aussie investors jumped at the obvious opportunity India looks like?

Mugunthan: Okay. Firstly, we know that India’s GDP growth is likely to be above other developed or developing countries due to its fundamentals of a youthful and large population (over 1.4 billion, average age 29). Additionally, its reformist, pro-business Government has played its cards right by putting in place incentives to make India more self-reliant at a time when China was adopting a zero-tolerance policy for dealing with COVID-19 and therefore absent to some degree in global supply chains.

We also know that equity market returns from India have been strong since its fragile five days in 2012 where the country experienced high inflation and weak economic growth during the taper tantrum brought on by US rate rises… The Narendra Modi-led BJP Government of India has been at the helm whilst equity investors have enjoyed some remarkable – stellar – returns from 2014 onwards.

Yeah, it seems an ideal moment, so…

So, with a US recession looming, interest rates likely to plateau soon and India likely to benefit from incremental gains in global GDP market share, it sets up the ideal ecosystem for a capex boom as India’s corporates benefit from operating leverage of fulfilling not only local demand and supply but also benefit from being more integrated into global supply chains and demand.

With corporate India having deleveraged over the past decade, it now positions the economy in a much healthier macro and micro position that India has witnessed in its past.

Okay, but despite all this, which seems pretty welcoming – especially compared to the China story – Aussie investors have largely been absent from investing in India.

Speaking frankly, a fear of the unknown when it comes to investing in developing economies has usually led to procrastination. Today, India is the fifth largest economy in the world with over 3% of global GDP and is forecast to grow the fastest among developed and developing countries over the next five years, according to the IMF.

Over the next 20 years, a growing India is going to be putting its hand up for a whole range of Australia’s goods and services, everything from agriculture, education and skills training, healthcare, biotech mining and energy.

Over the longer-term, India’s strong fundamentals – its youthful demographics, burgeoning consumer class, steady urbanisation, unmet infrastructure investment demand, and digitalisation and formalisation of the economy – are expected to drive sustained growth. Yet Australians in general invest significantly in two markets – ASX 200 and S&P 500 – a case of home bias and the economy where most well known success stories have emerged from which are household names today – IBM, Walmart, Coca-Cola, McDonalds, Amazon, Costco etc.

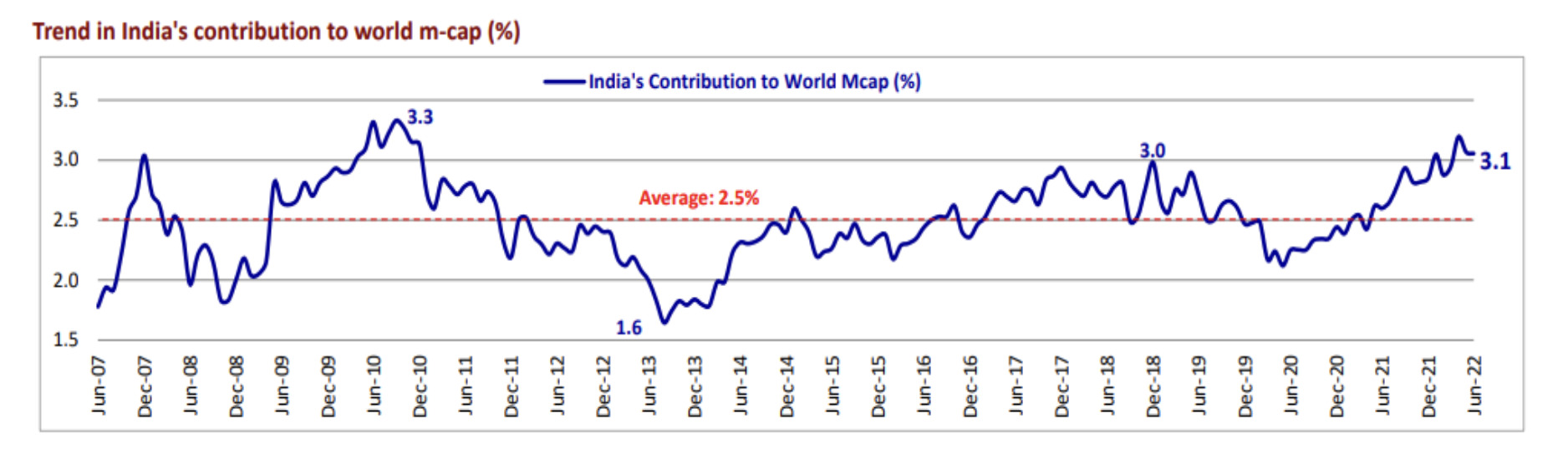

However, India’s equity market cap is now over 3.2% of global market cap and it is moving up the ranks to being the fourth largest equity market behind the US, China and Japan (at approximately US$3.1 trillion in size).

Several of India’s unicorns (second largest location for unicorns in the world) are listing on the stock market and there is increasing privatisation of Government assets which will lead to a significant boom in India’s equity market size as well.

Source: Motilal Oswal – Bulls & Bears July 2022

So why the procrastination 0n our part then?

Well, as I said there’s some fear… perhaps a lack of imagination and India hasn’t nearly attracted the headlines that China’s emergence has. And then as well, there haven’t really been many investment options available in Australia to easily invest directly into India’s listed companies.

Foreign investors need a Foreign Portfolio Investors License to invest in Indian listed stocks and the process is cumbersome in terms of administration, tax and structure for a retail investor.

Therefore the best way to play the India growth story is through an actively managed fund or an ETF which invests only in India. This will allow for investment not only in large, well-known companies, but also into companies which may become the market leaders of tomorrow – part of the “discovery” and “price appreciation” which growth investors seek when investing for the long-term.

Whereas Emerging Markets and Asia focused funds tend to focus on a pool of large, liquid stocks across multiple economies and markets, usually without having the “deeper knowledge” of the local ecosystem that a single country investment firm can have.

Given the hesitation which resides in the unknown about India, it may be prudent to invest via an actively managed India Fund. An actively managed investment has the potential to avoid some of the pitfalls of investing in developing country equity markets.

Alrighty, so is there some sort of a checklist investors should tick off ahead of taking the plunge?

Yes and it’s pretty straightforward I reckon. Of course there’s several specifically India-centric notions that you’ll need to consider when selecting stocks fundamentally:

- Indian listed companies are on average more than 40% owned by founders of the business. An innate understanding of local founder culture is required to invest successfully

- Government changes to regulation, taxes, subsidies can play a role in microeconomics for a business and the industry it operates in, therefore impacting its share price

- Cultural differences to developed economies are likely to lead to different demographic trends which may be hard to identify

These are some of the reasons why stock picking from a fundamental perspective can add value to a long-term investor, seeking to benefit from India’s growth story.

Additionally, some of the thing’s investors should consider is that India is likely to be the third largest economy in the world by the end of the decade and its stock market, fuelled by its growth and largely privatised economy will grow to well over US$5 trillion only preceeded by the US and China who it’s entirely possible might be busy blowing each other up by then.

Oh – and remember both of those two economies, as well as Australia, are likely to have ageing/aged populations by then. All the latest data is suggesting that India may’ve already overtaken China as the world’s most populous country – and even that extraordinary bit of news appears to be travelling under the radar.

Thanks mate, shall we get into some company names next time?

Hell, yes.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.