$12 lettuce? There’s a whole new ASX sector for that. And a few ETFs. Oh, and some stocks too

Here comes the boom. Via Getty

Well. I guess you’ve come across this by now:

Or these, which are pretty damn steep too:

The subtle discount on red capsicum has been removed.

Green is still the cheapest but not cheap though.

Sister site, photography by Daughter the Elder #CapsicumAsBitcoin pic.twitter.com/pk4yQU7dlW

— Fraser (@Fraser_inAu) May 24, 2022

The good news is – and it is a huge relief ahead of next week’s Game One of Mate against Mate – the lettuce pic is taken from a supermarket in Queensland, where the offending iceberg lettuce has gone viral, as so much does up there.

Anyway, so while that’s happening (above), this is happening (below) and it’s pretty timely.

And the vid is quite hypnotic.

I like cows.

Farm to index

Punters with an eye for a rip-off and something of the agri-bent can now get stuck into what one might want to describe as the absolutely booming local ag-sector.

The market is wide open through a new specialist index, which boasts a combined market capitalisation of nearly $30 billion.

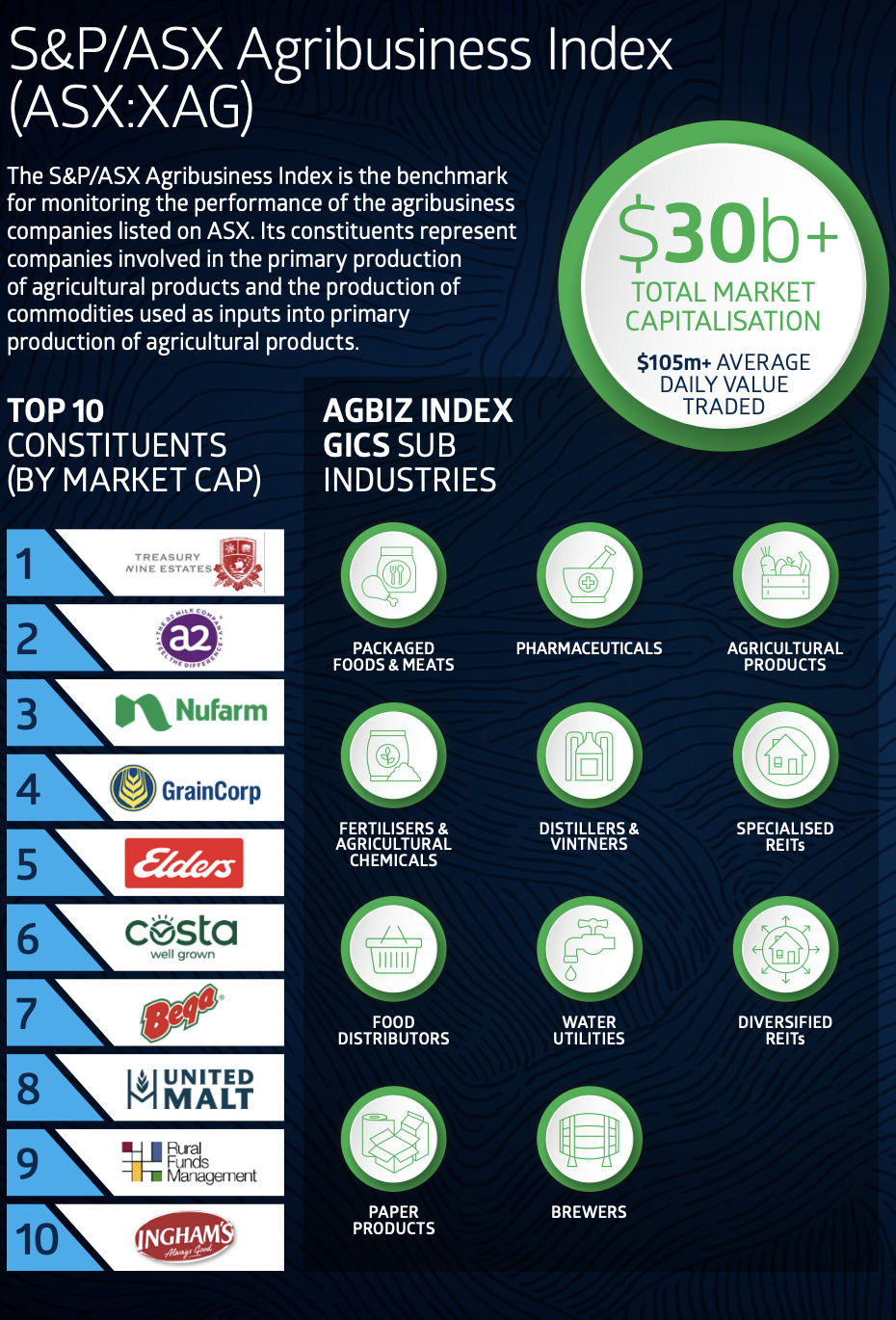

Wilkommen to the S&P/ASX Agribusiness Index (ASX: XAG):

The broad-based index includes companies whose main game is in the primary production of ag-products or the production of things used for making ag-products.

The AgBiz index will begin quotation as a real-time index on July 1 and fills a bit of a yawning chasm in the dysfunctional family of indices representing all the diverse sectors on ASX.

The whole point of the new XAG Index, the exchange reckons, is to provide a benchmark for everyone t0 clock the performance of primary production companies and the primary industry sector as a whole.

Ken Chapman, head of strategic delivery, capital markets at the ASX, told Stockhead right now the agribusiness sector is flying under the radar when compared to the headline sectors like mining, energy, banking, property, healthcare or tech.

“The combination of accelerating climate risks, booming consumer demand, increasing complexity in geopolitical relations and supply chains, and exponential advances in technology is driving demand for capital in all stages in the value chain.”

And, with war in Europe chocking off key suppliers and key supply chains, and following an incredibly plentiful La Nina summer here at home, the critical function of the agriculture sector has been thrown into stark relief.

Aussie wheat farmers for example, collectively emerged this year as the world’s second largest bunch of exporters.

They’ve just about wrapped up planting the next harvest across 14.5 million hectares, which is in fact an all-time high.

Super-toppy global prices and ideal growing conditions are proving strong tailwinds, according to forecasts from the brokerage IKON Commodities.

The disruption to wheat exports from Ukraine and to some extent Russia has meant continued solid export demand from Austalia. We will likely end up exporting 28-29 million mt of wheat – this is even more than what USDA think at the moment. pic.twitter.com/JWWKHpFPjW

— IKON Commodities (@IKONcommodities) March 20, 2022

Already Aussie grain farmers have pulled in an historic crop, harvesting circa 62 million tonnes, a record harvest in itself – and just as two of the world’s biggest grain producers downed tools and went to war – escalating already stiff global prices.

WA canola is going for well over $1,280 a tonne — a 75% improvement on this time last year – while the trade in live moo cows (light steers) into Indonesia at circa $6.00 a keg are worth way more than double.

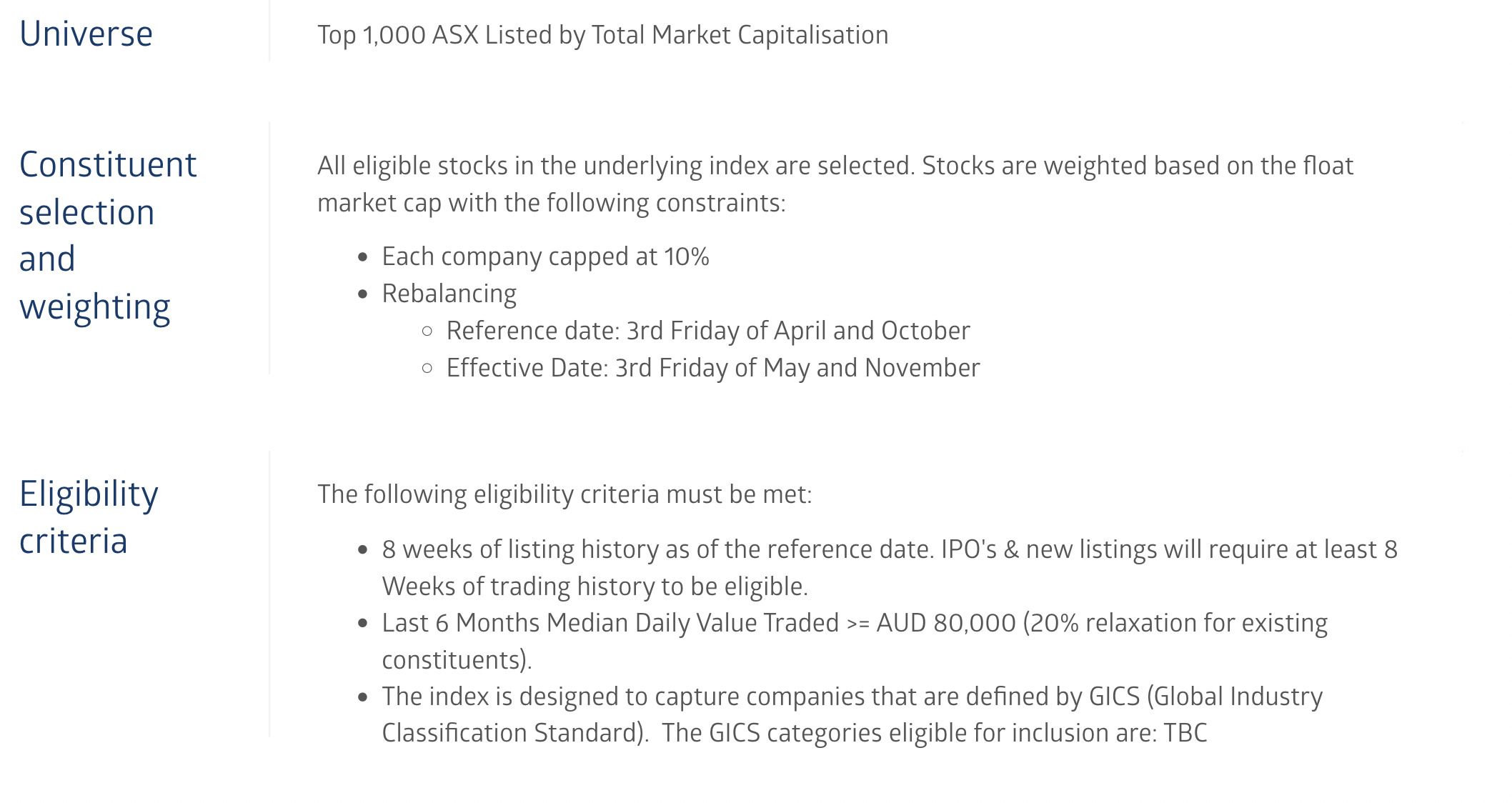

All ASX-listed companies which fit the bill meet the eligibility criteria at a rebalance date are included in the index. The index is rebalanced every six months with the ASX using the 3rd Friday of April and October as likely reference dates.

The exchange says to ensure the investability of the index its set capitalisation and liquidity standards, capping participation by any one company at 10%.

According to the ASX, criteria for inclusion are:

The mega-trends

Ken Chapman says it’s past time to lift the sector’s profile within the investment community.

“There are tailwinds, if you like, that are expected to create tremendous demand for investment capital.

“These tailwinds include mega-trends such as accelerating planetary climate risk, booming consumer growth and demand especially in Asia, increasing complexity in geopolitical relations and supply chains, and exponential advances in technology,” he told Stockhead.

“All these mega-trends are expected to drive ongoing demand for capital in all stages in the value chain. So the timing for the index is very opportune.”

Marc Whittaker at Invesrtors Mutual told Stockhead last week of agriculture’s intense viability in the economic climate as an investible sector.

“The more exposure and diversity you can get to the sector the better, particular given the sector’s appeal during times of inflation and volatility.”

Shadow boursing on the XAG

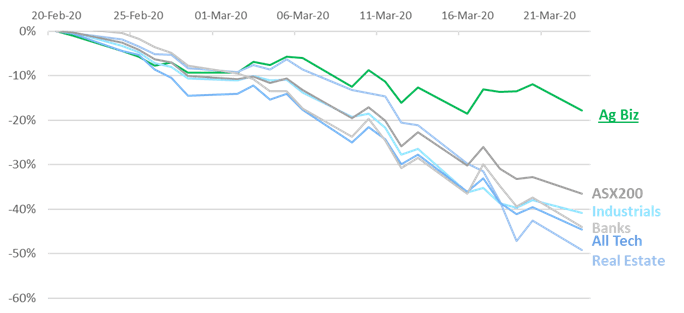

These charts below from the ASX show the theoretical trajectory of the XAG against the exchanges’s key sectors:

Between Jan 2017 and May 2022, the ASX200 gained ~23%

In the same period, the AgBiz Index would’ve gained ~40%.

As Eddy revealed a few weeks ago the universe has a bit of a crisis on its hands with whole Ukraine-Russia thing, pushing the global food chain right over the edge. He says it’s the worst set-up since WWII and there’s near 300 mill people out there who were already in trouble before a shot was fired.

“As supply dwindles, certain exporting countries sought ways to bolster their own food security by imposing export restrictions,” Eddy says.

Eddy’s agricultural angle

At the big end (like, the welcome to the XAG index end) of town, Eddy tracks GrainCorp (ASX:GNC), and Bega Cheese (ASX:BGA), A2 Milk (ASX:A2M), and even retailers like Coles (ASX:COL) and Woolworths (ASX:WOW).

But there are also smaller caps at the other end of town, and here are a few of them:

Yeah Bubs has been all over the news like a nappy rash this week, after US President and baby-hugging leader of the free world Joe Biden tweeted about what a bunch of life savers they are.

The infant milk company’s stock price sprouted like a child gnawing through packets of products by another small cap feeder – Nutritional Growth Solutions (ASX:NGS).

Eddy says BUB could well benefit from the Shanghai’s (hopefully) imminent post-lockdown stimmy.

“The company has struggled during the pandemic, especially with the absence of the ‘daigous’ – highly organised shoppers who buy from Australia’s retail stores and sell them into China.

BUB has certainly bounced back, with the latest quarter showing a 49% increase of revenue on pcp to $17.6m. Its total China sales (including daigous) were up 8% on the previous quarter.

Australian Dairy Group (ASX:AHF)

Victorian-based Australian Dairy is also an aspirant to serve Asian markets, and it is at a later stage of construction for its plant.

The company is hoping for first production soon, and has already sold some dairy products in Australia under the Camperdown Dairy brand.

Its Gradulac infant formula range is also now sold in Chemist Warehouse stores nationally.

The company says it is anticipating record farm milk prices for FY23, with early indications from processors at over $8.30 per kg milk solids for conventional milk.

Wide Open Agriculture (ASX:WOA)

The WA-based agri company says it has a first mover advantage to develop a proprietary, lupin-based protein suitable for numerous food and drink categories with forecast market size US$100 billion+.

Lupin is one of the highest sources of plant proteins available (40%) combined with a high source of dietary fibre (37%).

In Australia, the current market value of raw lupins is around $200m, with 96% consumed by livestock and 60% of global supply produced in WA.

This multi-range food company sells anything from healthy organic snacks to baby food.

Brands include Blue Dinosaur, Funch, and SensoryMil.

In the last quarter, FFF delivered $1.75m, up 67% on pcp. This was a record quarter where the company surpassed $1 million in gross revenue in a single calendar month of March.

The company continues to invest in its digital strategy, with online sales in the quarter generating $226k in revenue, up 525% on pcp.

The plant-based food and nutraceutical company has continued on its US momentum, with its “13 Seeds” product range recently available on Walmart.com in the US.

Other products currently offered on the Walmart platform include TheraJoint+ with TheraNight+.

The company is also reformulating its premium hemp-based skincare range, and pre-production run on four skincare products is now underway, with a further nine products currently in development.

Food ETFs listed on the ASX

To close it out, here’s a few other options for a more diversified exposure.

Voila: two food thematic ETFs on the ASX that Betashares provides.

The new BetaShares Future of Food ETF (ASX:IEAT) provides exposure to companies that are at the forefront of the tech revolution changing the way that food is produced, distributed, and consumed.

The IEAT portfolio currently includes some of the well known food companies in the US such as Beyond Meat, Tattooed Chef, and Danone.

The other Betashares’ food themed fund is the BetaShares Global Agriculture ETF (ASX:FOOD).

FOOD invests in global agricultural companies located outside of Australia, and is largely weighted to the sectors of packaged foods and meats, fertilisers and agricultural chemicals, and farm machinery.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.