With food at record prices, here’s how ASX investors could play the growing global crisis

ASX agricultural stocks and ETFs. Picture Getty Image

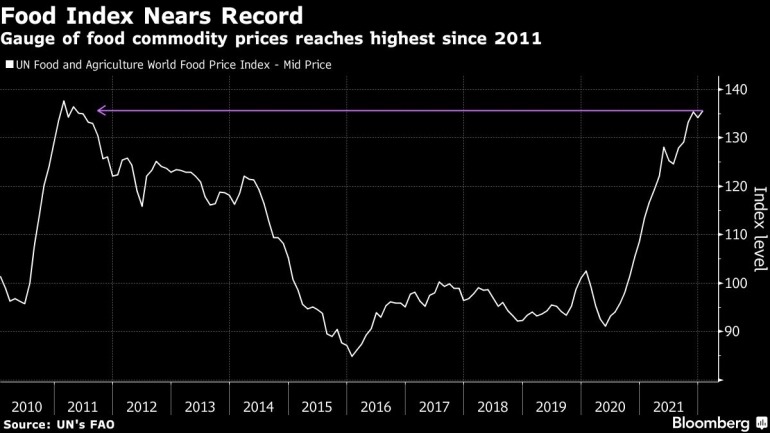

- The world’s food is in short supply and prices are surging

- A look at how investors could benefit from this by investing in ASX listed ETFs or stocks

- Stockhead speaks to Betashares’ assistant portfolio manager, Jessica Leung

The world is facing the biggest food crisis since World War II, with over 285 million people now in danger of starvation and billions facing surging food costs.

We were already in a food supply catastrophe even before the Ukraine-Russia crisis, but the conflict has pushed the problem over the edge.

To put things in perspective, the shortage itself has been observed as early as the turn of the century (around early 2000s), when a growth spurt in the world’s population caused food stocks to become depleted.

As supply dwindles, certain exporting countries sought ways to bolster their own food security by imposing export restrictions.

Then came the pandemic in 2020 and the Ukraine crisis in 2022 – creating a perfect storm of problems that could now potentially elevate food prices for years to come.

For ASX investors, there are many ways to play this mega trend, including buying into exchange traded funds (ETF) and agricultural stocks.

Fund manager Betashares for example, is about to launch its food-themed fund on the ASX called the BetaShares Future of Food ETF (IEAT).

Conflict drives short term, but bigger tailwinds ahead

Jessica Leung, assistant portfolio manager at BetaShares, told Stockhead the global food and agriculture industry will benefit from a number of significant tailwinds.

These tailwinds seem to be playing out on both sides of the equation, with over-demand and under-supply happening at the same time.

First of all, there is the population challenge.

“In the 70 years since 1950, UN data shows that the world has faced the challenge of having an extra 5.1 billion people to feed as the global population rose from 2.6 billion to 7.7 billion.

“According to the UN, this challenge will not get any easier, as the global population is expected to grow by around 2 billion by 2050 (to 9.7 billion), before potentially peaking at 11 billion by 2100,” she added.

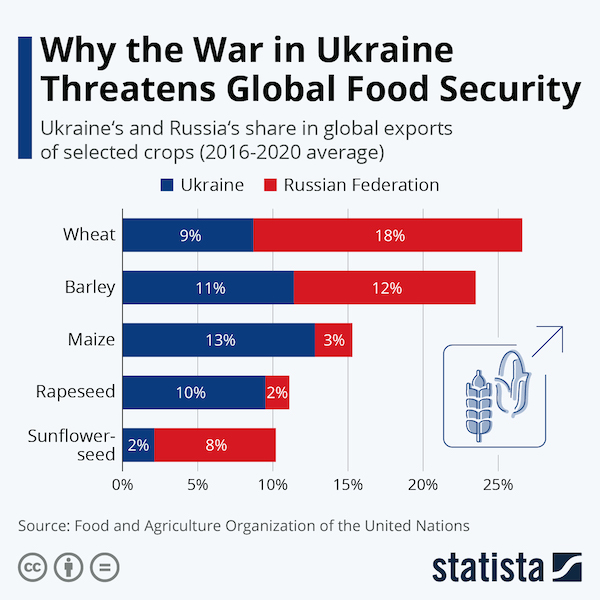

Over the shorter term however, it’s clear that Russia’s recent invasion of Ukraine has created a supply shock for the food, fertiliser and agriculture industry.

Russia and Ukraine are prominent players in the agriculture supply chain. In 2021, the combined wheat exports of both countries accounted for about 30% of the global market.

Fertilisers are also experiencing a parabolic price increase, with the US Department of Agriculture estimating a doubling in the fertiliser prices now compared to 2021.

“These tragic events have forced up the price of these products over the past few weeks,” said Leung.

“While these tragic events persist, it’s hard to see a return to normality for elevated prices in this sector.”

Agritech is the future

Meanwhile, structural changes within the food industry are happening.

First, Leung said that consumers are increasingly seeking out plant and cell-based alternatives to meat and dairy products.

In fact, a recent estimate predicted that the plant-based alternatives market could swell to $162 billion in the next decade, up from $29.4 billion in 2020.

Secondly, investors and the community at large are increasingly conscious of the need to efficiently produce enough food that is nutritious and affordable – all while reducing greenhouse emissions and environmental impact.

“This combined with technological advancements within the sector are key factors driving the food and agricultural industry to become more sustainable,” Leung added.

The current energy crisis, along with recent climate change disasters like droughts and flooding, will accelerate the transition into more developed farming technologies.

It’s the kind of mega trend that could benefit funds like the IEAT.

“At a broader level, these tragic events have forced a rethink about how the world can efficiently produce enough food to feed the world,” Leung said.

“As a result, more traditional agricultural practices will increasingly be augmented by the production of alternative food sources, as well as smart farming practices.”

Food ETFs listed on the ASX

Investing in companies or funds positioned at the forefront of this technological change or supply chain could potentially be a wise move for the long-term investor.

For the more diversified exposure, investors could look into one of two food thematic ETFs on the ASX that Betashares provides.

The new BetaShares Future of Food ETF (ASX:IEAT) provides exposure to companies that are at the forefront of the tech revolution changing the way that food is produced, distributed, and consumed.

“This includes plant based and cell cultured foods, smart farming, natural and alternative ingredients, natural and organic foods, sustainable packaging as well as food supply chain,” explained Leung.

The IEAT portfolio currently includes some of the well known food companies in the US such as Beyond Meat, Tattooed Chef, and Danone.

“To qualify for inclusion in the fund, companies must be involved in these industries and pass a number of screens related to market cap and liquidity,” Leung explained.

“This way, investors can be confident they are gaining exposure to a portfolio of global leaders in this growing industry.”

Meanwhile, the other Betashares’ food themed fund is the BetaShares Global Agriculture ETF (ASX:FOOD).

FOOD invests in global agricultural companies located outside of Australia, and is largely weighted to the sectors of packaged foods and meats, fertilisers and agricultural chemicals, and farm machinery.

“The current events are more relevant to our FOOD ETF rather than our IEAT ETF, although some of the underlying holdings may be impacted by these ongoing circumstances,” said Leung.

What about food stocks on the ASX

For blue chips exposure, one could invest in well known companies like GrainCorp (ASX:GNC), and Bega Cheese (ASX:BGA), A2 Milk (ASX:A2M), or even retailers like Coles (ASX:COL) and Woolworths (ASX:WOW).

But there are also smaller caps at the other end of town, and here’s a few of them:

The infant milk company could well benefit from the opening up of economies around the world post-pandemic, especially that of China.

The company has struggled during the pandemic, especially with the absence of the ‘daigous’ – highly organised shoppers who buy from Australia’s retail stores and sell them to China.

The company has now bounced back, with the latest quarter showing a 49% increase of revenue on pcp to $17.6m. Its total China sales (including daigous) were up 8% on the previous quarter.

Bubs has also recently released the the Bubs Supreme product, an infant milk that combines ‘super premium’ formulation with A2 beta-casein protein milk.

Australian Dairy Group (ASX:AHF)

Victorian-based Australian Dairy is also an aspirant to serve Asian markets, and it is at a later stage of construction for its plant.

The company is hoping for first production soon, and has already sold some dairy products in Australia under the Camperdown Dairy brand.

Its Gradulac infant formula range is also now sold in Chemist Warehouse stores nationally.

The company says it is anticipating record farm milk prices for FY23, with early indications from processors at over $8.30 per kg milk solids for conventional milk.

Wide Open Agriculture (ASX:WOA)

The WA-based agri company says it has a first mover advantage to develop a proprietary, lupin-based protein suitable for numerous food and drink categories with forecast market size US$100 billion+.

Lupin is one of the highest sources of plant proteins available (40%) combined with a high source of dietary fibre (37%).

In Australia, the current market value of raw lupins is around $200m, with 96% consumed by livestock and 60% of global supply produced in WA.

This multi-range food company sells anything from healthy organic snacks to baby food.

Brands include Blue Dinosaur, Funch, and SensoryMil.

In the last quarter, FFF delivered $1.75m, up 67% on pcp. This was a record quarter where the company surpassed $1 million in gross revenue in a single calendar month of March.

The company continues to invest in its digital strategy, with online sales in the quarter generating $226k in revenue, up 525% on pcp.

The plant-based food and nutraceutical company has continued on its US momentum, with its “13 Seeds” product range recently available on Walmart.com in the US.

Other products currently offered on the Walmart platform include TheraJoint+ with TheraNight+.

The company is also reformulating its premium hemp-based skincare range, and pre-production run on four skincare products is now underway, with a further nine products currently in development.

Share prices today:

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.