‘Ultra-high net worths’ backing explorer Moneghetti want a Julimar-type payday

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Gold explorer Moneghetti Minerals has a mandate go for big, company-making discoveries right from the start.

The tremendously experienced all-woman team at Moneghetti just completed its pre-IPO seed round and hopes to list next year.

Interest is strong. The explorer raised $478,850 at 8.5c a share – twice the original offer — within 24 hours.

That cash primarily came from “offshore ultra-high net worth investors, existing shareholders and some initial offshore institutions that are also interested in subscribing for IPO shares to strengthen their positions”.

Veteran investment banker and Moneghetti executive director Anna Nahajski-Staples founded the explorer after recognising an unfulfilled appetite from these rich investors to extend their portfolios to cover early stage (greenfields) gold exploration.

But not just any exploration. They’re not interested in some crappy ~100,000oz toll-treated open cut.

It’s the high risk, very high reward type stuff these guys want — think Julimar, DeGrussa, Nova or Hemi.

“There is a huge appetite to back earlier stage exploration; to back higher risk, higher reward projects with well-run junior companies,” Nahajski-Staples says.

“And these particular investors are very interested in scalability. If they are taking a punt on greenfields exploration they want the potential prize to be huge.

“I could see an opportunity. Then it was a matter of defining where I thought the best projects were.”

Elephant Country

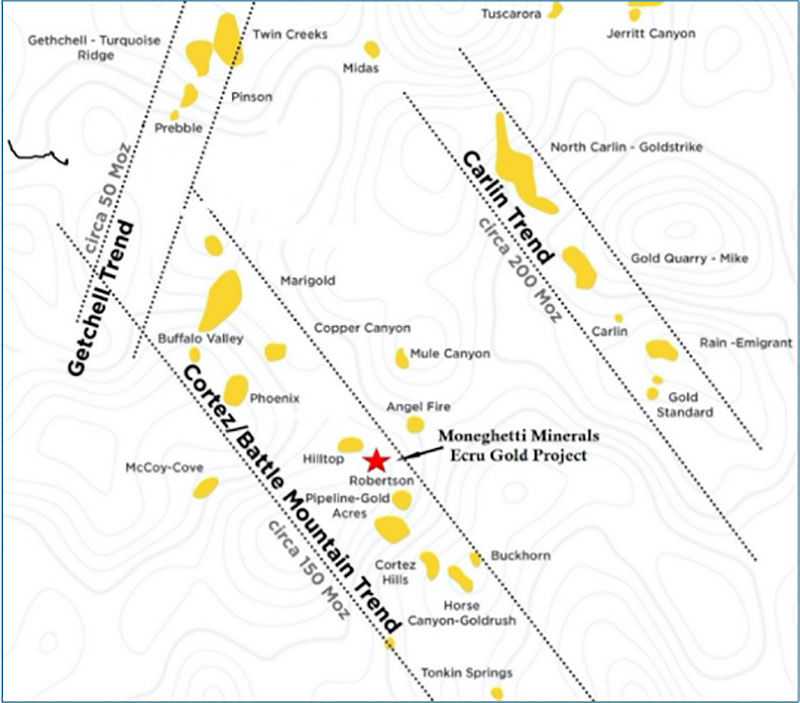

Moneghetti plans to list in 2021 with three gold projects; two in Nevada and one in WA.

Nevada is one place that certainly fits the ‘elephant country’ criteria.

One of the projects in question is Ecru, which is surrounded on three sides by major miner Barrick and by Newmont on the fourth.

Barrick’s three mines have an incredible 50 million ounces of gold between them.

And Ecru is sandwiched in the middle, in an area where hardly any drilling has been done:

In a twist of fate, Moneghetti is acquiring a project from one of the most legendary exploration teams in recent memory: S2 Resources (ASX:S2R).

In 2012, the S2 team – then micro-cap explorer Sirius Resources — made an entirely new type of nickel discovery called Nova in the Fraser Range of WA.

Within two months the Sirius share price was up 4000 per cent, from 5c to over $2.50. And when it was finally acquired by major miner Independence Group in 2015, the former penny stock was valued at $4.38 per share, or $1.8 billion.

That’s the kind of success Moneghetti wants to emulate.

S2 managing director Mark Bennett previously told Stockhead that the explorer went to Nevada “to find those giant gold deposits”.

“If we get to depth and hit the right target — as they have around us – you can find some pretty spectacular things,” he said of Ecru.

S2 walked away from this project at the height of COVID for non-project related reasons, Nahajski-Staples says.

“They decided to exit the US in general,” she says.

“The fact they were operating in the US, Europe and Australia meant it just wasn’t tenable at the time.”

But Bennett and his team really like this project, she says.

“We picked their brain. Their exploration team is globally highly regarded for their success and their knowledge.

“They are one of the top exploration teams in the world and they liked the project. We saw this as a huge opportunity.

“S2 had also done a lot of the legwork on this, so we are able to pick up where they left off. That puts us in a really strong position moving forward.”

There is now a strong investor appetite to fund bigger, deeper drill programs, Nahajski-Staples says. It’s an exciting time.

“Even just a few years ago the name of the game was de-risking as much as you possibly could. You had to de-risk everything,” she says.

“Explorers had to meet all these criteria from investors who were like ‘we want near term production stories, or very brownfields plays – we are not interested in greenfields’.”

That dynamic has now been turned on its head, she says.

“People want to get behind a strong team – people they can trust – who are looking for the big opportunities, like Julimar.

“Companies that make bold moves, take educated risks.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.