Southern Palladium is listing today and looks set to nab a sweet slice of the PGM pie

Pic: Lucy Lambriex / Moment via Getty Images

- Southern Palladium is listing today after a $19m IPO at $0.50

- The Bengwenyama project has an inferred resource of 18.80 million oz

- Bridge Street Capital says the company is “very inexpensive against its peers”

Platinum group minerals (PGM) explorer and developer Southern Palladium (ASX:SPD) will hit the bourse today after a $19m IPO at $0.50 – and a market cap of around $45m.

The company will acquire a 70% interest in private company Miracle Upon Miracle Investments on listing – which holds the Bengwenyama PGM project in South Africa.

It’s a project that currently has a JORC 2012 Inferred Resource of 18.80 million oz (3 PGE + gold) and CEO Johan Odendaal says that after the company’s second phase drilling, they could virtually double that resource.

“The first phase drilling will cover 25,000m and 63 boreholes on the shallower area of the project to bring some of the inferred resources and exploration target up to indicated,” he said.

“Phase two will consist of around 14,000m for 12 boreholes, and within a matter of 18 months, we can double our resource to easily 40 million ounces.

“And what sets our project apart is that we don’t have to go and explore for platinum – we know it’s there.”

Phase one drilling is likely to start within the next four weeks to upgrade these resources and allow the start of a feasibility study.

Last economically shallow orebody in Bushveld

Bengwenyama sits on the Eastern Limb of the Bushveld Complex, the largest source of platinum and palladium ore in the world.

It’s a location and shallow orebody that Odendaal says sets the company apart from other PGM players, with the potential for at least the first 20 years of production to be mined within 500m from surface.

“If you look at our peers, they’re mining at depths of 1,500-2,000m, so very deep and vertical shafts that are very capital intensive,” he said.

“Whereas with in terms of access for our project, it’s the last shallow project on the Bushveld complex, and we will focus on a decline which is less capital intensive.”

Plus, the deposit is nestled among some of the world’s top PGM deposits close to smelters owned by the industry’s two majors Impala Platinum or Implats and Anglo American Platinum and has all the infrastructure in place to develop the project.

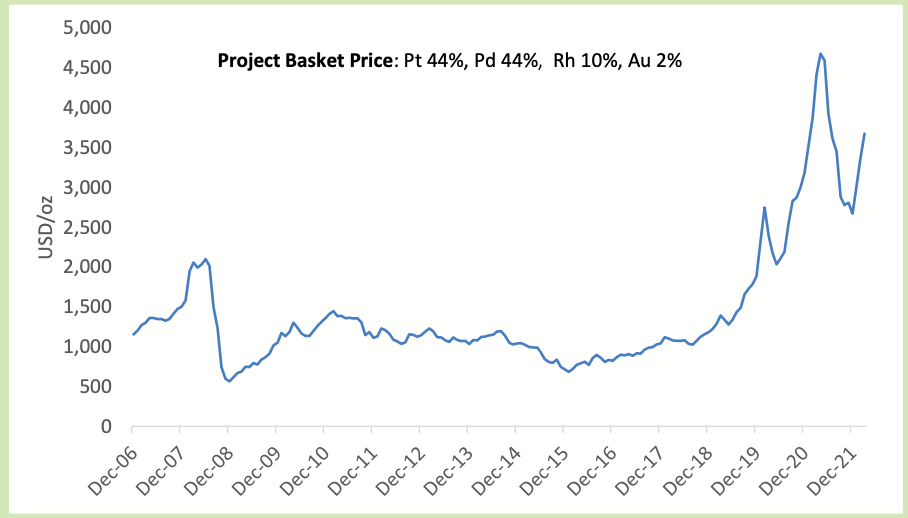

PGM price rise off the back of geopolitical tension

Russia produces about 40% of global supplies of palladium and 10% of platinum, and it’s likely consumers will veer towards more ethical/non-conflict supplies of PGMs

As sanctions and boycotts against Russia have expanded since its invasion of Ukraine on February 24, palladium prices have risen to all-time highs on supply fears.

Even before the Russian invasion of Ukraine, he said the market was looking at supply shortages from 2023 onwards.

And South Africa is the only country that challenges Russia in its palladium output, which puts SPD in a very interesting position – considering that the proportions of palladium and platinum at the project are relatively even at ~44% each, the company has optionality as conditions for palladium and platinum shift.

Palladium is paying US$2010/oz yesterday, platinum was fetching US$1007/oz.

“We’re currently sitting on a basket price of around $3000/oz at current prices, which is fantastic,” Odendaal said.

The project’s conventional metallurgy means it has the ability to sell concentrate to local smelters on commercial terms, something that could potentially be an Achilles heel of the new WA projects.

SPD could be PGM ‘value play’

Bridge Street Capital’s Dr Chris Baker says more than two-thirds of the companies in their PGM universe are up 50% or more since September 2020 – when the acquisition terms for the Bengwenyama project were negotiated and SPD was established.

“This highlights very strong share price performances in the sector, especially Galileo (ASX:GAL) which now has a market cap of around A$300m, with results from just six drill holes and, as yet, no resources – remarkable,” he said.

“SPD with its 18.8Moz in inferred resources, and priced at under A$2/oz (equity basis) is very low for the sector – Chalice is capped at over A$200/oz.

“This is a real value play, with significant upside as the company demonstrates with the drill rig that the resources are real.

“Not only do we think SPD is very inexpensive against its peers, it’s fair to say that it’s quite difficult to find an equivalent project of such quality.”

Dr Baker also flagged that the vendors, the local Bengwenyama community, will own 30% of the project directly and 12.3% of SPD, “so the success case from the local landowners is very real as well – a win-win outcome in our judgement,” he said.

A future for PGMs in hybrid and hydrogen vehicles

The metals are used largely in catalytic converters, devices in cars and bikes which moderate their emissions.

But with the EU banning new ICE car sales by 2035, there’ll be a new role for platinum in the hydrogen sector via the the proton exchange membrane (PEM) electrolyser, which requires a compound of iridium on its anode and platinum on its cathode.

And Odendaal sees a bright future for PGMs, especially in hybrid vehicles and PEM electrolysers.

“Firstly, there’s stricter legislation coming through in terms of emsissions, so that will support PGM demand,” he said.

“Secondly, we will see more hybrid vehicles coming through – so those will still use platinum; and finally, there’s hydrogen production and the PEM electrolyser.

“Longer term for haulage – in particular trucks, trains, ships and even planes – there’s a demand for fuel cell use in those transport applications.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.