Gold Digger: A dodgy guide to recovering palladium from your old catalytic convertor

Pic: BanksPhotos / iStock / Getty Images Plus via Getty Images

- Catalytic converters thefts are so high the NYPD is tweeting prevention tips

- 40,000 were stolen last year alone in the UK, with £16m worth stolen since 2019

- A legit recycler can recover $200k worth of palladium from 1t of catalytic converters

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

Three to seven grams of platinum group metals (PGMs) — mostly platinum, palladium and rhodium – go in every catalytic converter, which sit in your car exhaust to reduce polluting emissions.

Catalytic convertors account for as much as 80% of annual platinum and palladium production, respectively. In 2022, Metals Focus expects Total PGM demand to grow 11%, breaching 12.8Moz. That’s a record high.

It’s 1.2Moz more than 2021 and 200koz higher than pre-pandemic levels, driven by a 12.2% year-on-year growth in car production, and tighter emissions legislation in major markets – which mean more PGMs for your catalytic conversion pleasure.

Naturally, with platinum selling for $US1,023/oz, palladium around US$2,067.80and rhodium for a stunning $US15,200/oz – it’s no surprise that thefts of catalytic convertors have skyrocketed.

How do I get palladium from an old catalytic convertor?

Glad you asked.

First, this is what a catalytic convertor looks like:

You crack the outer casing open to get to the good part, filled with PGEs like platinum, palladium and rhodium:

And then just do what this guy does. Simple.

Is this Jason’s first successful #smelt of #catalyticconverters ? Watch the video to find out! https://t.co/VygE4WUwDb

— MBMMLLC (@MBMMLLC) May 28, 2020

Three to seven grams per convertor means you need a minimum of five catalytic convertors and a near-flawless extraction/recovery process to score one ounce of PGMs.

But that ounce – depending on the metal mix — could be worth a lot.

Thefts have gone through the roof

Just last month four men were arrested in New Jersey after police found them with seven allegedly stolen catalytic converters, collectively valued at approximately US$5,600.

Colorado’s Auto Theft Prevention authority says that in 2019, thieves stole 189 of them.

That number jumped to more than 1100 in 2020 and then last year, thieves stole 9,000 catalytic converters.

Thieves are even stealing them from church vehicles and straight off UPS trucks. In Austin last week, 11 were stolen off cars parked at the airport for the Memorial Day weekend.

The NYPD is even tweeting tips to prevent theft:

Some tips to help you avoid catalytic converter theft on your vehicle. Remember to always stay vigilant and if you see something say something, call 911 if you see suspicious behavior. pic.twitter.com/K6pWUXdhqE

— NYPD 105th Precinct (@NYPD105Pct) June 1, 2022

And it’s not just happening in America, in the UK there are reports that around 40,000 catalytic converters were stolen last year alone, with a combined value since 2019 of more than £16million.

Legit companies are recycling precious metals

And it’s not just dodgy folks recycling PGMs, companies are popping up all over the joint to take advantage of the recycling thematic.

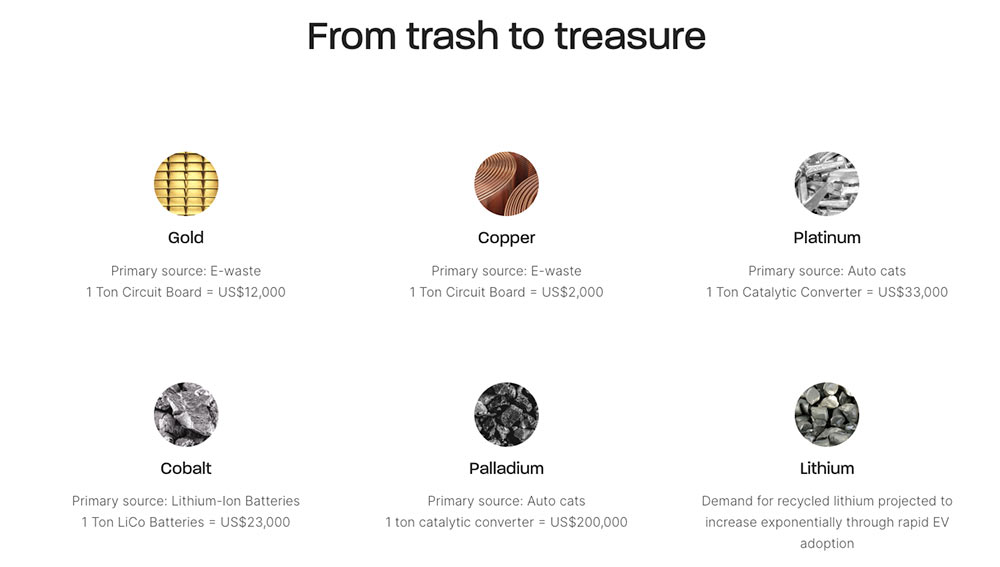

Mint Innovation reckons it can recover around $200k worth of palladium from 1t of catalytic converters.

The company also reckons it can recycle around $US12,000 worth of gold from one tonne of old circuit boards – not bad considering the price of gold is currently around $US1,871.50/oz.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

> Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Year | % Six Month | % Month | % Week | Market Cap |

|---|---|---|---|---|---|---|---|

| OKU | Oklo Resources Ltd | 0.155 | 24% | 11% | 76% | 104% | $73,151,989.46 |

| BBX | BBX Minerals Ltd | 0.165 | -37% | 0% | 43% | 43% | $75,903,543.38 |

| SPQ | Superior Resources | 0.045 | 309% | 150% | 13% | 29% | $73,152,477.97 |

| OAU | Ora Gold Limited | 0.014 | -33% | -7% | -18% | 27% | $13,754,237.97 |

| MEI | Meteoric Resources | 0.0165 | -70% | -3% | 10% | 27% | $21,368,163.19 |

| M24 | Mamba Exploration | 0.125 | -54% | -39% | -11% | 25% | $5,271,875.38 |

| TAR | Taruga Minerals | 0.024 | -74% | -40% | 33% | 20% | $13,295,109.52 |

| GSR | Greenstone Resources | 0.061 | 190% | 126% | 91% | 20% | $57,750,128.72 |

| MEK | Meeka Gold Limited | 0.068 | -9% | 48% | 48% | 19% | $60,745,427.49 |

| OKR | Okapi Resources | 0.265 | 15% | -35% | -5% | 18% | $30,456,184.98 |

| CY5 | Cygnus Gold Limited | 0.17 | 13% | -6% | 10% | 17% | $20,057,503.55 |

| MM8 | Medallion Metals. | 0.275 | -8% | 41% | 12% | 17% | $29,160,905.40 |

| AL8 | Alderan Resource Ltd | 0.021 | -63% | -38% | -13% | 17% | $8,085,755.52 |

| ANX | Anax Metals Ltd | 0.105 | 8% | 31% | 11% | 17% | $38,040,675.20 |

| WWI | West Wits Mining Ltd | 0.028 | -69% | -10% | -7% | 17% | $53,424,741.37 |

| VRC | Volt Resources Ltd | 0.022 | -31% | -21% | 10% | 16% | $67,338,889.32 |

| HMX | Hammer Metals Ltd | 0.061 | -42% | 49% | -39% | 15% | $49,739,072.00 |

| REZ | Resourc & En Grp Ltd | 0.035 | 25% | -27% | -26% | 13% | $17,493,202.62 |

| EM2 | Eagle Mountain | 0.445 | -56% | -14% | 31% | 13% | $111,026,252.69 |

| AVW | Avira Resources Ltd | 0.0045 | -25% | -10% | -25% | 13% | $9,534,555.00 |

| BNR | Bulletin Res Ltd | 0.18 | 170% | 120% | -5% | 13% | $47,865,031.50 |

| KCN | Kingsgate Consolid. | 1.71 | 90% | 13% | 25% | 12% | $362,965,542.92 |

| AXE | Archer Materials | 0.795 | 7% | -33% | -6% | 11% | $191,319,749.39 |

| LEX | Lefroy Exploration | 0.3 | -76% | -17% | -2% | 11% | $43,762,400.40 |

| NAG | Nagambie Resources | 0.053 | -25% | -24% | 4% | 10% | $25,657,307.90 |

| ARL | Ardea Resources Ltd | 1.265 | 171% | 153% | -16% | 10% | $206,231,392.98 |

| GML | Gateway Mining | 0.011 | -50% | -31% | -8% | 10% | $24,861,170.04 |

| PRS | Prospech Limited | 0.046 | -74% | -38% | -16% | 10% | $2,998,326.23 |

| AZS | Azure Minerals | 0.295 | 9% | -6% | -11% | 9% | $88,559,680.49 |

| VMC | Venus Metals Cor Ltd | 0.18 | -14% | -5% | -8% | 9% | $27,949,556.36 |

| AWJ | Auric Mining | 0.098 | -37% | -15% | 14% | 9% | $5,494,796.99 |

| NMR | Native Mineral Res | 0.185 | -30% | -31% | -8% | 9% | $8,163,761.40 |

| CHZ | Chesser Resources | 0.1 | -31% | -26% | 0% | 9% | $56,459,818.56 |

| CXU | Cauldron Energy Ltd | 0.014 | -67% | -44% | 0% | 8% | $7,495,757.88 |

| KRM | Kingsrose Mining Ltd | 0.07 | 19% | -8% | -1% | 8% | $52,676,856.33 |

| KSN | Kingston Resources | 0.145 | -36% | -22% | -12% | 7% | $55,723,874.27 |

| PNR | Pantoro Limited | 0.29 | 26% | -8% | 7% | 7% | $441,006,086.36 |

| BMO | Bastion Minerals | 0.15 | -23% | -35% | -23% | 7% | $11,389,389.00 |

| VAN | Vango Mining Ltd | 0.046 | -30% | -21% | -6% | 7% | $60,477,006.34 |

| MGV | Musgrave Minerals | 0.315 | -27% | -7% | -3% | 7% | $163,837,749.45 |

| G88 | Golden Mile Res Ltd | 0.05 | -18% | -9% | -22% | 6% | $10,186,630.70 |

| GTR | Gti Energy Ltd | 0.017 | -20% | -35% | -15% | 6% | $21,915,813.94 |

| SKY | SKY Metals Ltd | 0.085 | -47% | -9% | -10% | 6% | $32,026,594.95 |

| AAU | Antilles Gold Ltd | 0.071 | 15% | -5% | 8% | 6% | $24,738,347.27 |

| BC8 | Black Cat Syndicate | 0.45 | -38% | -18% | -13% | 6% | $77,845,796.16 |

| SMI | Santana Minerals Ltd | 0.91 | 658% | 184% | -7% | 6% | $118,047,186.32 |

| AAJ | Aruma Resources Ltd | 0.074 | 17% | 3% | -21% | 6% | $11,615,151.22 |

| ADT | Adriatic Metals | 2.47 | 0% | -8% | 0% | 6% | $499,598,868.00 |

| GED | Golden Deeps | 0.019 | 58% | 36% | 6% | 6% | $21,948,027.57 |

| WAF | West African Res Ltd | 1.34 | 23% | 5% | 0% | 6% | $1,317,128,368.47 |

| PGO | Pacgold | 0.63 | 0% | 20% | -11% | 5% | $34,625,943.45 |

| SSR | SSR Mining Inc. | 29.34 | 21% | 15% | -5% | 5% | $533,091,723.57 |

| MRZ | Mont Royal Resources | 0.34 | 1% | -3% | 0% | 5% | $22,792,223.34 |

| AQI | Alicanto Min Ltd | 0.074 | -47% | -43% | -24% | 4% | $28,394,807.66 |

| BNZ | Benzmining | 0.62 | -32% | -9% | -18% | 4% | $32,157,436.46 |

| PNM | Pacific Nickel Mines | 0.075 | 50% | -1% | -18% | 4% | $20,345,689.20 |

| NVA | Nova Minerals Ltd | 0.66 | -51% | -48% | -13% | 4% | $116,230,473.83 |

| SFR | Sandfire Resources | 5.64 | -16% | -4% | 1% | 4% | $2,246,700,773.64 |

| SLR | Silver Lake Resource | 1.595 | -16% | 0% | -10% | 4% | $1,427,809,339.79 |

| LCL | Los Cerros Limited | 0.061 | -65% | -53% | -32% | 3% | $39,038,931.30 |

| OGC | OceanaGold Corp. | 3.36 | 25% | 38% | -3% | 3% | $231,319,659.83 |

| MXR | Maximus Resources | 0.068 | -14% | 13% | -22% | 3% | $20,981,780.69 |

| OZM | Ozaurum Resources | 0.185 | 12% | 32% | 32% | 3% | $10,584,960.00 |

| PRU | Perseus Mining Ltd | 1.9575 | 40% | 30% | 0% | 3% | $2,589,555,488.27 |

| GSN | Great Southern | 0.041 | -22% | -35% | -29% | 3% | $21,294,683.44 |

| WCN | White Cliff Min Ltd | 0.0205 | 14% | 28% | -21% | 3% | $13,072,067.24 |

| EMR | Emerald Res NL | 1.24 | 14% | 16% | 9% | 2% | $743,463,879.99 |

| DEG | De Grey Mining | 1.095 | -31% | -5% | -6% | 2% | $1,465,197,266.00 |

| TRM | Truscott Mining Corp | 0.049 | 48% | 63% | -4% | 2% | $7,445,135.66 |

| NST | Northern Star | 8.97 | -22% | -1% | -7% | 2% | $10,101,644,344.74 |

| RED | Red 5 Limited | 0.4075 | 140% | 57% | 3% | 2% | $918,980,654.28 |

| IVR | Investigator Res Ltd | 0.055 | -48% | -29% | -5% | 2% | $71,944,937.48 |

| TIE | Tietto Minerals | 0.4275 | 17% | -1% | -14% | 2% | $397,982,179.66 |

| AUC | Ausgold Limited | 0.058 | 14% | 29% | -9% | 2% | $117,709,523.38 |

| WGX | Westgold Resources. | 1.4275 | -37% | -22% | -11% | 2% | $653,424,709.08 |

| BRV | Big River Gold Ltd | 0.335 | -11% | 52% | -3% | 2% | $73,822,447.53 |

| AAR | Astral Resources NL | 0.088 | -2% | -4% | -2% | 1% | $52,463,773.03 |

| EVN | Evolution Mining Ltd | 3.8 | -28% | -1% | -4% | 1% | $6,727,138,196.61 |

| GBZ | GBM Rsources Ltd | 0.095 | -30% | -17% | -17% | 1% | $48,109,418.87 |

| NCM | Newcrest Mining | 24.885 | -12% | 8% | -7% | 1% | $21,702,894,902.10 |

| CMM | Capricorn Metals | 3.705 | 85% | 31% | -9% | 1% | $1,319,110,537.15 |

| BGL | Bellevue Gold Ltd | 0.87 | 0% | 14% | -6% | 1% | $861,245,574.71 |

| ALK | Alkane Resources Ltd | 1.05 | 8% | 38% | 0% | 0% | $607,495,088.40 |

| SBM | St Barbara Limited | 1.225 | -35% | -5% | -8% | 0% | $962,567,026.24 |

| GOR | Gold Road Res Ltd | 1.335 | -12% | -1% | -11% | 0% | $1,122,313,626.59 |

| A1G | African Gold Ltd. | 0.14 | -43% | -22% | -13% | 0% | $15,523,342.64 |

| ADV | Ardiden Ltd | 0.011 | 0% | -8% | -24% | 0% | $29,351,688.92 |

| AGC | AGC Ltd | 0.089 | -44% | -10% | -7% | 0% | $6,027,728.28 |

| AGC | AGC Ltd | 0.089 | -44% | -10% | -7% | 0% | $6,027,728.28 |

| AGS | Alliance Resources | 0.175 | 19% | 5% | 0% | 0% | $40,953,448.03 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | 50% | -25% | 0% | $34,940,161.69 |

| AQX | Alice Queen Ltd | 0.005 | -67% | -55% | -17% | 0% | $10,197,088.06 |

| ASR | Asra Minerals Ltd | 0.038 | 12% | 65% | 31% | 0% | $50,919,081.16 |

| AYM | Australia United Min | 0.006 | -14% | -25% | -14% | 0% | $11,055,464.91 |

| BYH | Bryah Resources Ltd | 0.047 | -41% | -10% | -10% | 0% | $10,179,322.88 |

| CGN | Crater Gold Min Ltd | 0.017 | -11% | 0% | 0% | 0% | $21,063,473.65 |

| CWX | Carawine Resources | 0.15 | -40% | -23% | -29% | 0% | $20,675,152.05 |

| DCX | Discovex Res Ltd | 0.007 | 8% | 75% | -13% | 0% | $17,980,648.53 |

| DDD | 3D Resources Limited | 0.003 | -50% | -25% | -14% | 0% | $12,545,616.28 |

| DLC | Delecta Limited | 0.011 | 83% | -8% | 0% | 0% | $13,253,995.76 |

| DTM | Dart Mining NL | 0.07 | -56% | -15% | -4% | 0% | $9,468,211.20 |

| ENR | Encounter Resources | 0.135 | -15% | -4% | -10% | 0% | $41,238,187.38 |

| FAU | First Au Ltd | 0.013 | -28% | 30% | 8% | 0% | $10,645,842.34 |

| G50 | Gold50Limited | 0.21 | 0% | -25% | -9% | 0% | $11,763,780.21 |

| GNM | Great Northern | 0.005 | -69% | -29% | -17% | 0% | $8,545,254.88 |

| GRL | Godolphin Resources | 0.115 | -28% | -21% | -12% | 0% | $9,674,376.96 |

| HAW | Hawthorn Resources | 0.115 | 109% | 15% | -32% | 0% | $38,354,295.50 |

| HXG | Hexagon Energy | 0.027 | -69% | -66% | -27% | 0% | $13,848,729.33 |

| ICL | Iceni Gold | 0.12 | -42% | -37% | -31% | 0% | $16,665,535.64 |

| KGM | Kalnorth Gold Ltd | 0.013 | 0% | 0% | 0% | 0% | $11,625,120.78 |

| KNB | Koonenberrygold | 0.09 | 0% | -40% | -10% | 0% | $6,728,317.92 |

| KTA | Krakatoa Resources | 0.077 | 43% | 48% | -27% | 0% | $25,853,243.78 |

| KZR | Kalamazoo Resources | 0.34 | -24% | 0% | -15% | 0% | $48,640,115.29 |

| LNY | Laneway Res Ltd | 0.005 | 4% | 4% | 0% | 0% | $31,510,082.05 |

| LYN | Lycaonresources | 0.44 | 0% | 7% | 14% | 0% | $12,985,500.00 |

| MBK | Metal Bank Ltd | 0.005 | -42% | -38% | -17% | 0% | $11,735,181.72 |

| MDI | Middle Island Res | 0.135 | 23% | 38% | 4% | 0% | $16,526,459.97 |

| MKR | Manuka Resources. | 0.21 | -48% | -36% | -25% | 0% | $24,813,123.72 |

| MTH | Mithril Resources | 0.007 | -58% | -58% | -13% | 0% | $17,521,398.25 |

| NAE | New Age Exploration | 0.01 | -41% | -9% | -23% | 0% | $14,358,989.10 |

| NES | Nelson Resources. | 0.019 | -67% | -37% | -10% | 0% | $5,591,646.12 |

| NPM | Newpeak Metals | 0.001 | -50% | -33% | 0% | 0% | $8,853,750.03 |

| NSM | Northstaw | 0.22 | -28% | -27% | -21% | 0% | $8,827,940.00 |

| PAK | 0.011 | 0% | 0% | 0% | 0% | $0.00 | |

| PAKDB | 0 | 0% | 0% | 0% | 0% | $0.00 | |

| PF1 | Pathfinder Resources | 0.5 | 67% | 69% | 0% | 0% | $26,560,505.00 |

| PNX | PNX Metals Limited | 0.005 | -48% | -20% | 0% | 0% | $22,220,289.04 |

| POL | Polymetals Resources | 0.13 | 0% | -10% | -7% | 0% | $5,207,353.58 |

| RDN | Raiden Resources Ltd | 0.011 | -58% | -54% | -15% | 0% | $14,174,421.32 |

| RDS | Redstone Resources | 0.007 | -59% | -46% | -30% | 0% | $5,157,826.77 |

| RML | Resolution Minerals | 0.01 | -58% | -44% | -38% | 0% | $8,242,832.47 |

| RXL | Rox Resources | 0.325 | -25% | -13% | -14% | 0% | $54,905,807.78 |

| S2R | S2 Resources | 0.185 | 16% | -3% | 28% | 0% | $64,147,473.90 |

| SBR | Sabre Resources | 0.005 | 0% | 0% | 0% | 0% | $13,945,824.27 |

| SFM | Santa Fe Minerals | 0.1 | 0% | -5% | -13% | 0% | $7,281,878.90 |

| SMS | Starmineralslimited | 0.21 | 0% | 17% | 2% | 0% | $5,512,500.00 |

| SVL | Silver Mines Limited | 0.19 | -41% | -5% | -14% | 0% | $245,448,107.17 |

| TCG | Turaco Gold Limited | 0.087 | -28% | -24% | -11% | 0% | $37,211,350.20 |

| THR | Thor Mining PLC | 0.013 | -19% | -7% | -7% | 0% | $13,874,912.65 |

| TMX | Terrain Minerals | 0.01 | 0% | 18% | 0% | 0% | $7,607,610.09 |

| TMZ | Thomson Res Ltd | 0.028 | -80% | -57% | -20% | 0% | $17,812,482.56 |

| TRY | Troy Resources Ltd | 0.037 | -20% | 0% | 0% | 0% | $31,631,563.33 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -40% | -25% | -14% | 0% | $7,982,441.72 |

| VKA | Viking Mines Ltd | 0.008 | -76% | -56% | -27% | 0% | $7,176,809.02 |

| WMC | Wiluna Mining Corp | 0.48251 | -45% | -45% | -20% | 0% | $101,961,574.11 |

| YRL | Yandal Resources | 0.21 | -64% | -46% | -16% | 0% | $24,379,226.13 |

| GMD | Genesis Minerals | 1.47 | 120% | 5% | 8% | -1% | $368,252,640.56 |

| AGG | AngloGold Ashanti | 4.91 | -22% | -16% | -15% | -1% | $438,010,126.15 |

| DGO | DGO Gold Limited | 2.93 | -17% | 2% | -10% | -1% | $234,060,708.33 |

| MI6 | Minerals260Limited | 0.435 | 0% | -21% | -5% | -1% | $96,800,000.00 |

| TTM | Titan Minerals | 0.078 | -32% | -18% | -15% | -1% | $109,958,201.57 |

| X64 | Ten Sixty Four Ltd | 0.75 | -14% | 1% | -9% | -1% | $167,547,881.24 |

| MAU | Magnetic Resources | 1.375 | -8% | -12% | -4% | -1% | $308,471,376.13 |

| AMI | Aurelia Metals Ltd | 0.335 | -22% | -19% | -22% | -1% | $395,858,066.24 |

| TBR | Tribune Res Ltd | 3.98 | -22% | -17% | -12% | -1% | $208,822,946.46 |

| SVY | Stavely Minerals Ltd | 0.32 | -42% | -36% | -20% | -2% | $79,593,242.86 |

| HAV | Havilah Resources | 0.27 | 8% | 54% | 46% | -2% | $82,098,790.61 |

| MRR | Minrex Resources Ltd | 0.052 | 108% | 27% | -20% | -2% | $52,453,206.47 |

| TAM | Tanami Gold NL | 0.052 | -29% | -20% | -12% | -2% | $61,105,046.39 |

| HCH | Hot Chili Ltd | 1.22 | -36% | -40% | -22% | -2% | $131,439,233.04 |

| KAL | Kalgoorliegoldmining | 0.115 | 0% | -23% | -23% | -2% | $8,329,979.00 |

| AM7 | Arcadia Minerals | 0.225 | 0% | 13% | -15% | -2% | $7,873,312.50 |

| BRB | Breaker Res NL | 0.22 | 19% | -24% | -10% | -2% | $68,426,595.09 |

| NWM | Norwest Minerals | 0.042 | -51% | -47% | -24% | -2% | $7,585,510.25 |

| ADN | Andromeda Metals Ltd | 0.1025 | -49% | -36% | 4% | -2% | $307,665,774.80 |

| MKG | Mako Gold | 0.082 | -13% | -25% | 1% | -2% | $31,343,811.36 |

| CHN | Chalice Mining Ltd | 6 | -31% | -34% | -15% | -2% | $2,182,114,627.67 |

| RRL | Regis Resources | 1.96 | -24% | 14% | -3% | -2% | $1,426,527,203.22 |

| CLA | Celsius Resource Ltd | 0.0195 | -54% | -15% | -7% | -3% | $23,818,582.48 |

| PDI | Predictive Disc Ltd | 0.195 | 77% | -11% | -13% | -3% | $261,224,981.56 |

| RSG | Resolute Mining | 0.2825 | -53% | -18% | -19% | -3% | $303,581,168.00 |

| CDT | Castle Minerals | 0.035 | 119% | 40% | -27% | -3% | $33,982,761.46 |

| HRN | Horizon Gold Ltd | 0.35 | -30% | -13% | -8% | -3% | $37,342,205.60 |

| OBM | Ora Banda Mining Ltd | 0.035 | -82% | -46% | -8% | -3% | $46,715,568.30 |

| CST | Castile Resources | 0.17 | -32% | -13% | -3% | -3% | $32,952,169.97 |

| GMR | Golden Rim Resources | 0.063 | -62% | -32% | -10% | -3% | $19,776,543.95 |

| STN | Saturn Metals | 0.3875 | -19% | -14% | 2% | -3% | $50,011,183.15 |

| RGL | Riversgold | 0.042 | 13% | 144% | -37% | -3% | $28,742,287.96 |

| XAM | Xanadu Mines Ltd | 0.028 | -39% | 4% | -15% | -3% | $36,718,765.59 |

| GCY | Gascoyne Res Ltd | 0.275 | -48% | -11% | 2% | -4% | $114,999,493.50 |

| GCY | Gascoyne Res Ltd | 0.275 | -48% | -11% | 2% | -4% | $114,999,493.50 |

| AME | Alto Metals Limited | 0.08 | -13% | -24% | -4% | -4% | $42,243,000.96 |

| GIB | Gibb River Diamonds | 0.053 | -31% | -41% | -12% | -4% | $11,210,000.59 |

| HMG | Hamelingoldlimited | 0.13 | 0% | -13% | -16% | -4% | $14,300,000.00 |

| HMG | Hamelingoldlimited | 0.13 | 0% | -13% | -16% | -4% | $14,300,000.00 |

| MEG | Megado | 0.13 | -10% | 37% | -13% | -4% | $5,596,343.74 |

| NXM | Nexus Minerals Ltd | 0.26 | 217% | -49% | -15% | -4% | $75,315,638.06 |

| AUT | Auteco Minerals | 0.051 | -45% | -29% | -28% | -4% | $105,432,410.57 |

| MAT | Matsa Resources | 0.051 | -39% | -6% | -22% | -4% | $18,306,685.62 |

| RMS | Ramelius Resources | 1.265 | -35% | -16% | -15% | -4% | $1,049,535,981.89 |

| A8G | Australasian Metals | 0.375 | 121% | -14% | -17% | -4% | $15,027,230.31 |

| HRZ | Horizon | 0.125 | -7% | -4% | -7% | -4% | $73,836,776.00 |

| ZNC | Zenith Minerals Ltd | 0.37 | 48% | 51% | -11% | -4% | $128,964,058.13 |

| ERM | Emmerson Resources | 0.093 | 13% | 22% | -15% | -4% | $50,658,010.28 |

| BTR | Brightstar Resources | 0.023 | -34% | -52% | -18% | -4% | $14,877,799.99 |

| PNT | Panthermetalsltd | 0.215 | 0% | 0% | -7% | -4% | $6,235,000.00 |

| ARN | Aldoro Resources | 0.21 | -32% | -51% | -26% | -5% | $20,834,853.69 |

| DTR | Dateline Resources | 0.105 | 31% | 33% | -9% | -5% | $46,521,342.00 |

| MHC | Manhattan Corp Ltd | 0.0105 | -25% | 5% | -13% | -5% | $16,025,926.28 |

| GSM | Golden State Mining | 0.062 | -65% | -32% | -17% | -5% | $7,218,121.78 |

| DRE | Dreadnought Resources Ltd | 0.041 | 71% | -11% | -7% | -5% | $113,547,342.04 |

| ICG | Inca Minerals Ltd | 0.077 | -49% | -13% | -18% | -5% | $37,080,114.38 |

| KAU | Kaiser Reef | 0.185 | -38% | -5% | -5% | -5% | $23,952,082.09 |

| CYL | Catalyst Metals | 1.47 | -27% | -33% | -11% | -5% | $144,730,464.06 |

| DCN | Dacian Gold Ltd | 0.18 | -38% | -12% | -22% | -5% | $189,888,486.03 |

| IDA | Indiana Resources | 0.054 | -32% | -11% | -16% | -5% | $25,057,816.80 |

| RVR | Red River Resources | 0.18 | -22% | 0% | -12% | -5% | $92,027,446.62 |

| RND | Rand Mining Ltd | 1.42 | 4% | -5% | -5% | -5% | $80,763,864.62 |

| STK | Strickland Metals | 0.07 | 133% | 6% | 1% | -5% | $89,676,265.00 |

| PKO | Peako Limited | 0.017 | -51% | -23% | -6% | -6% | $5,243,719.72 |

| FEG | Far East Gold | 0.33 | 0% | 0% | -8% | -6% | $40,272,279.30 |

| TLM | Talisman Mining | 0.165 | -25% | 6% | -6% | -6% | $30,977,017.01 |

| BAT | Battery Minerals Ltd | 0.008 | -62% | -43% | -11% | -6% | $18,779,716.57 |

| E2M | E2 Metals | 0.16 | -50% | -43% | -27% | -6% | $31,861,171.68 |

| BCN | Beacon Minerals | 0.031 | -14% | 0% | -11% | -6% | $116,520,795.55 |

| GBR | Greatbould Resources | 0.091 | -13% | -30% | -8% | -6% | $37,968,495.57 |

| SI6 | SI6 Metals Limited | 0.0075 | -38% | -25% | -25% | -6% | $9,997,007.90 |

| SLZ | Sultan Resources Ltd | 0.145 | -50% | -9% | -3% | -6% | $12,076,236.41 |

| CDR | Codrus Minerals Ltd | 0.084 | 0% | -42% | -7% | -7% | $3,360,000.00 |

| TG1 | Techgen Metals Ltd | 0.14 | -38% | -20% | -18% | -7% | $6,095,903.24 |

| TBA | Tombola Gold Ltd | 0.055 | 20% | 72% | -4% | -7% | $50,628,232.72 |

| MTC | Metalstech Ltd | 0.405 | 138% | 16% | 62% | -7% | $67,499,158.95 |

| ASO | Aston Minerals Ltd | 0.13 | -40% | -13% | -13% | -7% | $136,820,677.25 |

| FG1 | Flynngold | 0.13 | 0% | -24% | -10% | -7% | $8,327,936.50 |

| KWR | Kingwest Resources | 0.13 | 43% | -37% | -33% | -7% | $32,801,358.38 |

| SAU | Southern Gold | 0.038 | -49% | -36% | -21% | -7% | $8,106,492.73 |

| ALY | Alchemy Resource Ltd | 0.025 | 50% | 108% | -14% | -7% | $22,873,777.37 |

| KAI | Kairos Minerals Ltd | 0.025 | -32% | -7% | -17% | -7% | $49,052,337.28 |

| SNG | Siren Gold | 0.37 | 6% | 21% | -11% | -8% | $29,553,973.05 |

| CAZ | Cazaly Resources | 0.036 | -42% | -18% | -8% | -8% | $13,349,584.55 |

| WRM | White Rock Min Ltd | 0.12 | -80% | -61% | -40% | -8% | $20,840,297.28 |

| GWR | GWR Group Ltd | 0.115 | -52% | 10% | -15% | -8% | $40,152,081.88 |

| TSO | Tesoro Gold Ltd | 0.069 | -58% | -8% | 0% | -8% | $46,122,068.54 |

| FML | Focus Minerals Ltd | 0.17 | -43% | -40% | -28% | -8% | $48,714,969.65 |

| GUL | Gullewa Limited | 0.068 | -22% | -15% | -16% | -8% | $12,945,370.80 |

| BGD | Bartongoldholdings | 0.22 | 0% | 7% | -1% | -8% | $18,884,799.12 |

| LCY | Legacy Iron Ore | 0.022 | 38% | 5% | -15% | -8% | $140,950,176.38 |

| ZAG | Zuleika Gold Ltd | 0.033 | -13% | 74% | 3% | -8% | $17,211,170.63 |

| LRL | Labyrinth Resources | 0.027 | -48% | -23% | -31% | -8% | $22,707,535.63 |

| CAI | Calidus Resources | 0.82 | 71% | 40% | -13% | -9% | $322,242,926.40 |

| BMR | Ballymore Resources | 0.2 | 0% | -9% | -23% | -9% | $14,695,616.20 |

| PGD | Peregrine Gold | 0.45 | 23% | 17% | -5% | -9% | $17,229,001.05 |

| PUR | Pursuit Minerals | 0.02 | -74% | -38% | -23% | -9% | $18,910,983.88 |

| CEL | Challenger Exp Ltd | 0.245 | -16% | -17% | -18% | -9% | $230,935,901.74 |

| LM8 | Lunnonmetalslimited | 0.84 | 0% | 147% | -19% | -10% | $92,295,946.68 |

| MVL | Marvel Gold Limited | 0.037 | -26% | -48% | -23% | -10% | $26,059,816.69 |

| MEU | Marmota Limited | 0.063 | 40% | 47% | 5% | -10% | $61,745,122.91 |

| QML | Qmines Limited | 0.225 | -45% | -41% | -20% | -10% | $14,967,377.78 |

| MLS | Metals Australia | 0.08 | 100% | 100% | -43% | -10% | $32,625,183.45 |

| SRN | Surefire Rescs NL | 0.034 | 55% | 183% | -28% | -11% | $47,626,567.91 |

| CBY | Canterbury Resources | 0.05 | -47% | -44% | -17% | -11% | $6,159,926.50 |

| EMU | EMU NL | 0.016 | -61% | -27% | -11% | -11% | $8,797,031.74 |

| RMX | Red Mount Min Ltd | 0.008 | -16% | -20% | -16% | -11% | $13,138,910.86 |

| M2R | Miramar | 0.115 | -45% | -44% | -36% | -12% | $7,347,642.68 |

| RDT | Red Dirt Metals Ltd | 0.51 | 252% | -25% | 6% | -12% | $151,627,213.00 |

| MZZ | Matador Mining Ltd | 0.17 | -66% | -48% | -29% | -13% | $36,978,315.85 |

| IPT | Impact Minerals | 0.01 | -36% | -24% | -17% | -13% | $21,904,615.86 |

| PUA | Peak Minerals Ltd | 0.013 | -30% | -9% | -19% | -13% | $12,496,449.01 |

| CPM | Coopermetalslimited | 0.44 | 0% | 138% | 4% | -14% | $12,159,000.00 |

| KCC | Kincora Copper | 0.086 | -71% | -31% | -18% | -14% | $6,298,263.23 |

| AWV | Anova Metals Ltd | 0.012 | -48% | -40% | -8% | -14% | $17,977,130.40 |

| CTO | Citigold Corp Ltd | 0.006 | -45% | -40% | -25% | -14% | $17,001,954.55 |

| GMN | Gold Mountain Ltd | 0.006 | -84% | -66% | -14% | -14% | $7,158,895.02 |

| DEX | Duke Exploration | 0.11 | -74% | -44% | -21% | -15% | $9,923,226.72 |

| XTC | Xantippe Res Ltd | 0.01 | 400% | 150% | -23% | -17% | $69,147,512.09 |

| BEZ | Besragoldinc | 0.072 | 0% | -37% | 31% | -17% | $12,373,197.12 |

| PRX | Prodigy Gold NL | 0.019 | -67% | -49% | -5% | -17% | $11,069,924.51 |

| ARV | Artemis Resources | 0.032 | -47% | -60% | -43% | -18% | $45,814,922.47 |

| MOH | Moho Resources | 0.032 | -59% | -48% | -29% | -18% | $4,424,375.60 |

| MCT | Metalicity Limited | 0.004 | -65% | -54% | -41% | -20% | $13,829,533.02 |

| NML | Navarre Minerals Ltd | 0.062 | -41% | -13% | -33% | -23% | $91,433,034.18 |

| SIH | Sihayo Gold Limited | 0.003 | -75% | -63% | 0% | -25% | $12,754,158.48 |

| FFX | Firefinch Ltd | 0.3975 | 6% | -51% | -64% | -63% | $1,122,181,059.95 |

| AOP | Apollo Consolidated | 0 | -100% | -100% | -100% | -100% | $177,888,559.90 |

| BDC | Bardoc Gold Ltd | 0 | -100% | -100% | -100% | -100% | $154,075,451.40 |

| KLA | Kirkland Lake Gold | 0 | -100% | -100% | -100% | -100% | $52,690,000.00 |

| TRN | Torrens Mining | 0 | -100% | -100% | -100% | -100% | $9,218,941.94 |

SMALL CAP STANDOUTS

The Brazil focused gold explorer pulled up thin but high-grade palladium and platinum in drilling at the flagship ‘Três Estados’ project.

The results from TED 001, drilled in the 2021 drilling programme at the Tabocal prospect, included 2m @ 0.98g/t gold, 4.43g/t palladium and 10.82g/t platinum from 37m.

The mineralisation at BBX’s projects is weird. An ongoing test work program has been designed to fine-tune a preferred extraction technique.

It is early days, but BBX is excited, CEO Andre J Douchane says.

“This is only the second hole of 82 that need to be analysed. There will be many more assays in the coming days – almost exclusively from Três Estados,” he says.

“The Tres Estados prospect, which has 44 drill holes in it, was chosen by the technical team as potentially having the best area to quickly develop a JORC resource on.

“The next 20 or so drill holes analysed will either prove that assumption correct or not.”

The resurgent $78m market cap explorer is up 10% in 2022. It had $1.1m in the bank at the end of March, plus a financing facility worth $9.95m.

The explorer bounced back from recent lows after entering a deal to acquire a rare earths and gold project called ‘The Don’ in the Kimberley region of WA.

It’s a good neighbourhood, with rare earths players PVW Resources (ASX:PVW)to the south and Northern Minerals (ASX:NTU) to the north of the project area.

“The company is always on the lookout for additional projects to enhance the value of our existing portfolio and ‘The Don’ certainly does that,” M24 managing director Mike Dunbar says.

“Given the success that PVW Resources to the south and Northern Minerals to the north have had exploring the same sedimentary formations and aged rocks for REEs and gold, it was surprising that this Project had not been secured by the other active explorers in the area.”

Dunbar is a proven mine finder and builder.

He was involved in the discovery and development of the +2moz Thunderbox gold mine, the delineation and development of the +1Moz Dalgaranga gold mine, and the discovery and delineation of the +1Moz Glenburgh gold deposit.

$6m market cap M24 is down 31% year-to-date. It had $3.7m in the bank at the end of March.

GREENSTONE RESOURCES (ASX:GSR)

GSR has raised $4.9m to fund PGE exploration right next door to Galileo’s (ASX:GAL) recent company changing discovery.

GSR and its ‘Mt Thirsty’ nickel-copper JV partner Conico (ASX:CNJ) have both been urging on nearology fervour since GAL hit palladium paydirt last month.

“… Prospective horizons from GAL appear to trend on to ground held by the Mt Thirsty Joint Venture,” director and shareholder of CNJ Guy Le Page says.

“It appears around 1.5km of this layered intrusion (Mission Sill) appear to strike on to the JV ground (figure below) and remain largely untested.”

Maiden drilling targeting extensions to Callisto will kick off within next 6-8 weeks, GSR says.

The cash will also be used to drill the ‘Burbanks’ and ‘Phillips Find’ gold projects.

“Greenstone is at transformational point, simultaneously growing the high-grade inventory at our flagship Burbanks Gold Project, while also maintaining aggressive exploration activities at both Mt Thirsty and Phillips Find,” GSR boss Chris Hansen says.

“With recent drilling over the past months at Burbanks North having returned multiple bonanza grade intercepts we have subsequently defined a new zone of mineralisation with a strike extent of over 1.5km and a depth of 450m, which still remains open in all directions.

“While exploration will continue to remain the core focus at both Burbanks and Phillips Find as we seek to expand the known mineralised horizon, we will shortly pursue a brief infill drill program at Burbanks North to support future resource estimates in this area.”

$48m market cap GSR is up 80% year-to-date.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.