Why more small caps are breaking into South American cannabis

Health & Biotech

South America is notorious for being home to some of the biggest illegal drug cartels in the world.

I mean, who hasn’t heard of big time Colombian drug lord Pablo Escobar? (He’s even got his own Netflix series).

Some of the reasons South America is a favoured location for illegal drug production, like great growing conditions and low cost of labour, may help it dominate the medical and recreational cannabis markets.

ASX-listed oil and gas investor BPH Energy (ASX:BPH) has just agreed to take a stake in private medical cannabis company Patagonia Genetics.

BPH is taking an initial 10 per cent stake in Patagonia and has the option to increase that to 49 per cent.

This investment makes BPH one of very few ASX-listed players with exposure to the South American cannabis market.

Other ASX-listed juniors with exposure to the region include AusCann (ASX:AC8) — which has operations in Argentina, Mexico and Colombia — and Creso (ASX:CPH), which is in the process of being acquired by PharmaCielo, which has operations in Colombia.

BPH chairman David Breeze told Stockhead that Latin America had characteristics that could make it a global leader in cannabis production.

The Green Fund says the region is known for its “almost perfect growing conditions”.

And that, “coupled with large amounts of available farming land, very low costs of labour, sunshine that can drive up to two harvests per annum, and the booming home grow culture” means Latin America is “primed to potentially become the global leaders in low-cost cannabis production”.

Patagonia Genetics managing director Matthew Critchley told Stockhead that Chile, for example, gets 12 to 14 hours of sun a day.

“The big thing over there is the low cost of the labour, the sunshine and the climate,” he said.

“They can get between two and three harvests per year. The climate is essentially perfect for cannabis.”

Because of the perfect outdoor growing conditions, there is no need for big speccy greenhouses that cost an arm and a leg.

According to Critchley, it costs just 10c per gram to produce in South America versus about $1 to $1.50 per gram in Canada.

The recreational market in Chile is also huge, with around 500 million users.

The law allows recreational users to grow up to six plants for home use, which means medicinal cannabis players can capitalise on that by selling the seeds.

That is exactly what Patagonia plans to do.

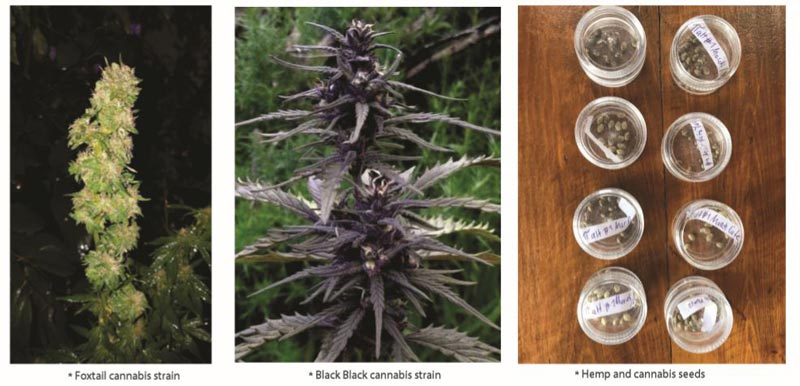

Patagonia has 260 unique cannabis and hemp strains.

“A large proportion of these are unhybridized landraces not seen in domestic markets in over 30 years, hence their genetic value,” BPH’s Breeze said.

These include the highly sought after original Colombian F1 Red and Black Black strains.

“As far as I know none of the major [licenced producers] — like Cannapi, Aphria and Tilray — have the original F1 or the Black Black,” Patagonia’s Critchley told Stockhead.

“That will have huge appeal to those guys that want to buy those seeds in seed shops and grow them themselves. So we still can target that market.”

Patagonia applied for licences in December last year and expects to be cultivating in Chile by mid-2020.

But the company is assessing other options to potentially fast track it into operation.

“At the moment we are also in talks with guys in Colombia and Israel to joint venture, where essentially we can bypass waiting for our Chilean licences, export our seeds there and have them pretty much planted in the next season,” Critchley said.

The cash injection Patagonia is getting from BPH’s initial investment is expected to fully cover the costs of outdoor cultivation.

“It will all be very low capex, tractor laid, outdoor field grown,” Critchley said.

“We plan to do initially between half a hectare to a hectare of seeds and between 5 hectares and 10 hectares of outdoor CBD [cannabidiol].

“We’re still doing the modelling for that, but we should be able to get all that done with BPH’s initial $700,000 investment.”

Patagonia has signed land use agreements on two properties for a total 20 hectares of land in Patagonia, near the major shipping port of Puerto Montt, Chile.

The company has also applied for a licence to export its seeds.

This would allow the company to sell them domestically in South America, as well as export to markets like Canada, the US and Europe.

Besides its 26 per cent stake in oil and gas explorer Advent Energy, BPH also has investments in biotechs Cortical Dynamics and Molecular Discovery Systems – a subsidiary of BPH.

BPH’s Breeze said medical cannabis was an “excellent fit” with the company’s biotech focus.

“It is a significant global growth industry,” he said.

“Medical cannabis is the largest market segment in the sector and is expected to be valued at over $US100 billion ($148.4 billion) by 2025.

“There is a growing body of evidence that suggests medicinal cannabis can provide benefits for certain patients including those with terminal cancer, chronic pain, AIDS/HIV, and children with intractable forms of epilepsy.”

BPH and Patagonia originally discussed the idea of a reverse takeover, eventually deciding to go down the path of a minority stake to start.

But an ASX listing is not completely off the table.

“We may either vend the 51 per cent into BPH, depending on how their oil assets go in the next year, or we may list the 51 per cent of Patagonia on the exchange itself,” Critchley said.