RooLife ready to ride the wave of booming Chinese consumer demand

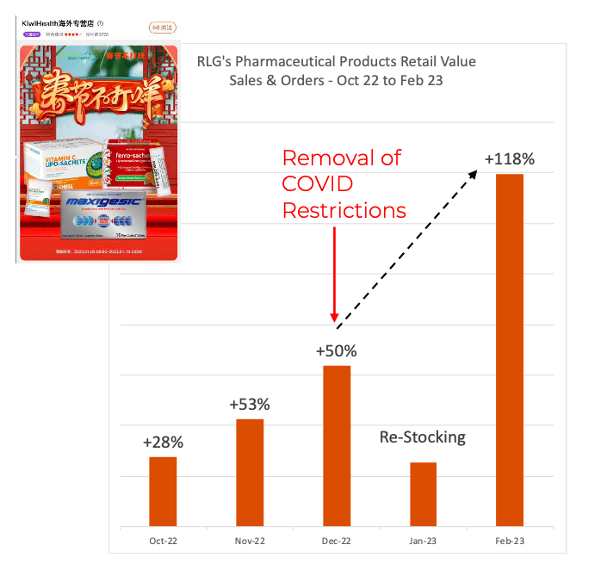

Just look at how much pharmaceutical sales boomed once COVID19 restrictions were removed in China. Pic: Supplied (RLG)

RooLife has had its eye on Chinese consumers for some time, with the platform identifying trends in demand and securing distribution rights for international products that fit consumer needs and provides the technology and sales infrastructure necessary for brands to sell at scale in China.

And CEO Bryan Carr says the timing has never been better to gain exposure to the Chinese market, with booming consumer demand as the country re-opens after prolonged COVID19 restrictions.

“Over the last three years, there’s certainly been an apprehension and concern from Australian investors about China exposure and yet, if you look at fundamentals during that period of time, our food and general exports to China grew,” he said.

“And that happened during the darkest hours.

“There’s pent up demand, consumers have been sitting at home saving their money, and now they’re out consuming.

“Now is the greatest opportunity to reach out and grow your business in China.”

Health and wellness conscious consumers

Earlier this month, RooLife Group (ASX:RLG) secured a stocking and distribution deal for Remedy Drinks – an Aussie Kombucha brand – into Alibaba’s 300 high-tech Freshippo supermarkets and stores (and official app) in China.

For context, Alibaba is a massive Chinese physical and online ecommerce company who are very selective in which products they sell, so the deal gives RLG a big credibility boost for Chinese consumers.

Carr says the pandemic has really heightened the importance of health and wellness for consumers, leading the company to launch its own VORA health brand including vegetable protein products to service high-demand and high growth markets in China and South East Asia.

And it’s paying off so far, with 73% of RLG’s revenue was derived from the food, health, and wellbeing sectors in FY22.

“Over the last few years with COVID, people have developed a much greater awareness of their health and well-being and the products and the foods that they consume,” he said.

“I think China is following that ethos, which has caused us to refine and focus our positioning to be very much in that health well-being and healthy foods space.”

High growth in middle class expected

RLG offers its customers diversified access to high growth markets in high growth sectors – and growth in China is certainly expected to grow, with Morgan Stanley estimating real consumption growth could hit 9% this year – that’s up from 0% in 2022.

“If you look at China, the size of the Chinese middle class is equivalent to the whole population of the US, and their spending capability is increasing,” Carr said.

“We would forecast it continues for a long time to come.

“The other aspect is, China is an importer of food and products, and will be for a very long time, so if you want exposure to a high growth consumption market, that’s got a long growth in front of it, certainly, we provide that ability and diversification.”

This article was developed in collaboration with RooLife Group Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.