It must be the apocalypse if agstocks are finally a buy: check out these 5

Pic: d3sign / Moment via Getty Images

We’re seeing death and pestilence, and now one stockbroker is betting on famine as the pick to get investors through a pandemic.

Pac Partners is not taking a gamble on hand sanitiser nor on manufacturers of medical suppliers, but on farmers (among others).

Resident agriculture analyst Paul Jensz said in a note yesterday that as agfood makes up less than 5 per cent of the ASX300 it tends to be overlooked by the the general public during times of market strife.

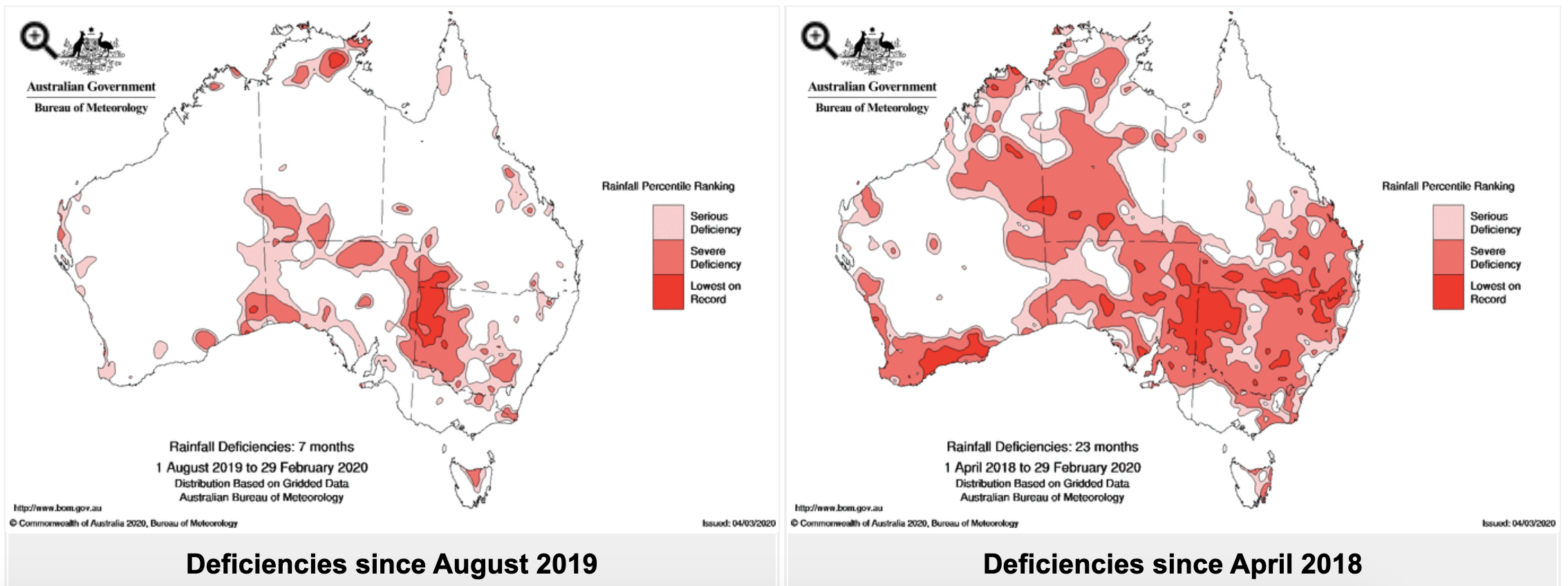

Throw in the fact that average rainfall is up and has eased droughts everywhere but the worst hit area around western NSW, and companies like Elders (ASX:ELD) might actually be a buy.

Jensz prefers branded consumer products and low-cost producers with Australian dollar sales into off-shore markets right now — his top picks are Select Harvests (ASX:SHV) and Bubs (ASX:BUB).

Elders is also one of his picks. He says it has the strongest diversified exposure of the primary producers accounting for about 40 per cent of livestock sales nationally, about 20 per cent of sales of “farm inputs” — a term describing the seeds, equipment and chemicals needed to grow crops and animals, and about 10 per cent of finance/insurance places.

The company said in January none of its properties were directly affected by the bushfires, and Jensz says it has a 15 per cent return on investment which is the highest of the sector.

The pandemic may offer almond grower Select Harvests more opportunities to buy other companies, Jensz says.

Select Harvest controls 2 per cent of global almond supply. While the prices the company is fetching for its 2020 crop are down 4 per cent on average, Indian and Middle Eastern buyers quickly snapped up two thirds of it.

Jensz speculates that this is because the Californian crop was sold so quickly and China is suffering a protein shortage as African Swine Flu has caused the destruction of 40 per cent of the country’s pigs.

He says Select Harvest has a strong cash balance (at the time of the last full year report it had $8m in cash) and is trading on low multiples.

Goat milk maker Bubs is expected to shine and not just because of coronavirus.

“We expect Dec half 2020 will delivers positive cash flow show, and demonstrate that BUB has sustainably broken away from middling infant formula peers,” Jensz wrote.

“We are confident of BUB maintaining the sales growth at around 80 per cent per annum for FY’21F and FY’22F because of its product differentiation and reliable supply chain.”

The company controls 70 per cent of Australia’s goat milk supply, and 78 per cent of sales are in Australia via Chemist Warehouse and Woolworths. It does have a China sales strategy, but it has the cash to ride out a slowdown in that country.

Chicken musher Ridley Corp (ASX:RIC) is “emerging from a complex past” and Bega Cheese (ASX:BGA) has strong brands like Vegemite and Bega peanut butter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.