Farmers took a battering this year, but 2024 outlook is good for these agri stocks

Crops for 2023 were underwhelming, but things could turn around in 2024. Picture Getty

- Crops for 2023 were underwhelming, but things could turn around in 2024

- Select Harvests is expecting good output in 2024

- Cobram and Costa Group are also expecting a better year

The global almond market is expected to grow at a CAGR of between 5% to 8%, to reach a total market size of around US$12 billion by 2027.

Australia was the third biggest exporter of almonds last year, shipping around US$580 million overseas. The other top exporters are the US, Spain, Turkey and the Netherlands.

Almond consumption meanwhile has increased steadily over the years, with top consumers being Japan, US, India and Germany.

On the ASX, the $500m market-capped Select Harvests (ASX:SHV) is the main player in this market. The company is also one of the world’s largest almond companies.

On Tuesday, Select presented a market update to investors at the Bell Porter Conference.

Select announced a 2023 crop volume of 19,500 metric tonnes (MT), which was higher than its previous forecast of 17,500MT. This was however lower than 29,000MT achieved in 2022, and 28,250MT in 2021.

Just like other farms, Select grappled with adverse climate conditions which included cold and wet weather during the growing season, as well as major flooding events pre-harvest.

Select said the 2023 crop had less in-shell and a higher than average mix of manufacturing grade material due predominantly to insect damage on a smaller crop. However the quality profile does not contain the mould and staining issues of last year’s crop.

Approximately 80% of this year’s crop has already been committed for sale, said the company.

Select Harvests’ almond orchards

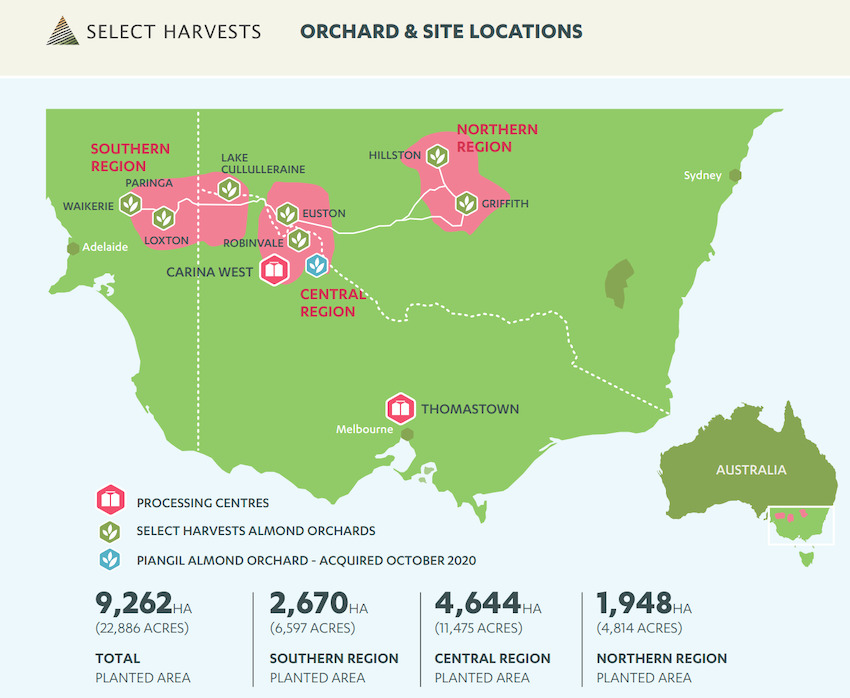

Select owns a portfolio of farmland across the southeastern part of the country – which includes 9,262ha of company owned, leased and joint venture almond orchards.

These orchards, plus other independent orchards, supply the company’s state-of-the-art primary processing facility at Carina West in northwest Victoria.

The facility has the capacity to process 22,000MT of almonds in the peak season, capable of meeting the increasing demand for both in-shell and kernel product.

Select explained that almond trees grow best in warm, dry summers and mild, wet winters and the tree buds have a chilling requirement of 300 to 600 hours below 7.2°C to break dormancy.

Almond trees are dormant over the colder winter period, around May to July in Australia.

Blossom usually occurs from late July to early September. At the start of blossom in almond orchards, you will often see alternate rows in bloom. This is because almonds are not self fertile, so there are always 2-3 varieties interplanted in an orchard. Bees are used to cross-pollinate the blossom.

Following petal fall, the leaves, new shoots and fuzzy greyish-green fruit begin to grow rapidly – from around September to December. Once the fruit has finished growing, the hull begins to split during summer, from early January.

Harvest then occurs between February and April, when the nut is at an acceptable moisture level.

The first step in processing almonds is to remove the hull and shell or hull only. Some almonds are value-add processed and supplied as slivered, sliced, diced, split, left whole or ground for almond meal/flour.

Farming outlook for 2024

Meanwhile, Select says the farming outlook for 2024 is positive.

Currently, tree health looks great and good bud health is observed across the orchard portfolio. The forecast shift to El Nino weather pattern later this year will also be a tailwind for almond growth.

Select also confirmed that the recent Varroa mite outbreaks in NSW won’t impact its 2024 crop.

“We currently have one farm under investigation for Varroa mite, and even if confirmed positive, this will not affect pollination for this year,” said Select.

What’s more of a concern however is the 2023 Californian crop, as Hurricane Hillary on the 19-21 August impacted the start of harvest operations there.

As a result, Californian harvest has quality issues and almond prices will remain muted until evidence on Californian crop size and quality concerns have been addressed.

It’s understood that traders are now desperately trying to offload their almond inventory, leading to price declines in the market.

Farming outlook from other agri stocks on the ASX

| Code | Name | Price | Mth % Change | 6-Mth % Change | 12-Mth % Change | Market Cap |

|---|---|---|---|---|---|---|

| FSF | Fonterra Share Fund | 3.03 | -3.85 | 25.43 | 23.87 | $322,232,952 |

| CGC | Costa Group Holdings | 2.89 | -14.90 | 19.21 | 10.96 | $1,315,128,714 |

| RIC | Ridley Corporation | 2.28 | 14.32 | 6.31 | 3.41 | $704,306,950 |

| RGI | Roto-Gro Intl Ltd | 0.22 | 0.00 | 0.00 | 0.00 | $4,333,920 |

| NUF | Nufarm Limited | 5.07 | -2.69 | -9.30 | -6.28 | $1,955,928,070 |

| RLF | Rlfagtechltd | 0.13 | -21.88 | -35.90 | -10.71 | $11,916,696 |

| SHV | Select Harvests | 4.31 | -5.27 | 7.21 | -13.63 | $487,866,416 |

| BGT | Bio-Gene Technology | 0.09 | -10.00 | 0.00 | -14.29 | $17,554,589 |

| GNC | GrainCorp Limited | 7.11 | -12.33 | -5.33 | -16.65 | $1,608,496,268 |

| AAP | Australian Agri Ltd | 0.02 | 42.86 | 25.00 | -20.00 | $6,101,990 |

| A2M | The A2 Milk Company | 4.41 | -10.55 | -33.48 | -20.68 | $3,144,766,415 |

| DBF | Duxton Farms Ltd | 1.42 | -2.07 | -5.33 | -21.11 | $59,183,388 |

| NAM | Namoi Cotton Ltd | 0.40 | -9.09 | 0.00 | -25.61 | $85,116,649 |

| AAC | Australian Agricult. | 1.29 | -13.26 | -19.22 | -31.97 | $789,624,439 |

| LGP | Little Green Pharma | 0.17 | -15.00 | -5.56 | -40.35 | $50,181,047 |

| WOA | Wide Open Agricultur | 0.33 | 0.00 | 109.68 | -40.91 | $46,566,576 |

| WNR | Wingara Ag Ltd | 0.03 | -22.50 | -47.84 | -43.49 | $5,441,818 |

| WLD | Wellard Limited | 0.04 | -18.75 | -35.00 | -48.00 | $23,375,014 |

| ELD | Elders Limited | 6.32 | -16.18 | -29.15 | -48.53 | $981,108,119 |

| 1AG | Alterra Limited | 0.01 | -22.22 | -41.67 | -50.00 | $4,875,868 |

| AHF | Aust Dairy Limited | 0.02 | -25.00 | -45.45 | -72.31 | $11,805,602 |

| AHF | Aust Dairy Limited | 0.02 | -25.00 | -45.45 | -72.31 | $11,805,602 |

| ROO | Roots Sustainable | 0.00 | 0.00 | -66.67 | -91.67 | $554,889 |

Cobram Estate Olives (ASX:CBO)

Cobram is Australia’s largest olive oil producer with over 2.4 million olive trees on its Australian groves. It also owns olive farm and milling operations in the US.

Its brands include the Cobram Estate and Red Island.

Cobram said the 2023 season was challenging for horticultural crops in southern Australia.

Higher-than-average spring rainfall and cooler spring/autumn temperatures led to a 10-day delay in flowering and shortened growing season. This resulted in smaller olives, lower oil accumulation, and ultimately lower olive oil yields.

CBO production from its own groves totalled 12.5m litres, down 24.5% on original projections but up 32% compared to FY22.

However heading into 2024 crop year, good growing conditions during summer and above average annual rainfall have resulted in pleasing levels of vegetative growth and productive potential across the groves.

CBO says it will have sufficient oil for its FY24 packaged goods sales.

In the US, crop is expected to be significantly higher in FY24 (harvested in October/November 2023), resulting in increased olive oil availability for the company’s American operations.

Costa Group (ASX:CGC)

Costa is Australia’s leading horticulture company and is the fresh produce supplier to domestic food retailers.

The company said its citrus season was around three weeks behind starting, meaning virtually all the citrus harvest earnings will fall in H2 of this year.

Despite early citrus season fruit being well received in export markets, there has been a disappointing deterioration in outlook for later season fruit quality affected by CY22 weather impacts. La Nina overhang is also contributing to fruit size being below expectations.

Elsewhere, tomato sales volume was positive to forecast, while avocado saw a recovery from prior year.

In the second half, Costa is expecting more stable weather and positive pricing over the early part of the main berry season. Together with an expected solid Arana crop, this points to strong second half berry earnings, says Costa.

Mushroom demand meanwhile has steadily improved, consistent with cooler winter months, with demand over coming period expected to level off.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.