What the ETF? Palladium ETF rallies on supply concerns

Metallica performs in Las Vegas, Feb 2022. Pic: Ethan Miller, Getty Images

- Palladium ETF rallies on supply concerns

- Gold still a favourite in times of uncertainty

- Buy and hold strategy as investors seek long term gain

Commodity ETFs are proving popular among investors, particularly platinum group elements (PGMs) which are essential metals in the modern world, particularly so since the Russian invasion of Ukraine.

The group of six metals, especially the major three, platinum and palladium and rhodium, are prized for their catalytic qualities. They are key components for car manufacturing and semiconductors.

ETF Securities head of distribution Kanish Chugh told Stockhead palladium and platinum have been the major interest point for investors since Russia invaded Ukraine.

“While obscure, they are crucial for making cars and semiconductors — two politically sensitive industries which are big employers in the US and Germany,” he said.

“Russia accounts for 40% of global mined palladium and 10% of global platinum.

“The biggest palladium mining company is Nornickel, the chairman of which recently had his superyacht confiscated.”

Palladium hits all time high

Chugh said with Russia frozen out of global trade, and with Russian airspace closed, there were valid concerns that Russian palladium would be removed from global supply.

“This caused the price of palladium to shoot up to all time highs early this month at just under under US$3500/oz,” he said.

“However, the US and Europe recently allowed sanctions loopholes for Russian palladium, meaning it can be accepted to trade in London.

Russian palladium has been allowed out of the country which has helped bring prices back down to earth.

ETF Securities Physical Palladium ETF (ASX: ETPMPD) has been one of their star performers of the month.

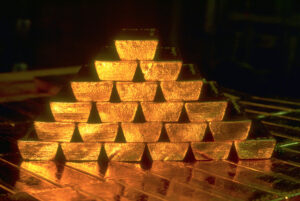

Gold remains timeless defensive asset

From Russia’s invasion of Ukraine to the US Fed lifting its cash rate by 0.25% for the first time in three years as US inflation peaks to it highest level in 40 years, investors and even so-called experts have been guessing how markets will play out.

There has been strong sharp daily falls and other days when markets have reached for the stars with uncertainty the only certainty.

Like the little black dress in the closet, gold remains the timeless classic to put on when you’re not sure what to wear to a function.

“When investors worry about the future, they naturally ditch assets whose value derives from it,” Chugh said.

“Gold is different, often thriving during periods of political or economic unrest with some recent examples of when gold outperformed shares and bonds include the 9/11 attacks in the United States, Brexit and the onset of COVID-19.”

For 30 years, Australian dollar gold has had a negative correlation of -0.36 to international equities like the S&P 500 and a negative correlation of -0.23 to domestic Australian equities like the All Ords.

He said when equities suffer drawdowns, gold historically has held its value more.

“There are good reasons why gold does this as it has a proven history as a safe haven asset,” he said.

“More fundamentally, gold has no cash flows, unlike shares, bonds or property, and cannot be valued based on future cash flows.

“When investors worry about the future, they naturally ditch assets whose value derives from it.”

Chugh said higher inflation has historically supported gold and according to the World Gold Council, gold performs best when inflation is above 3%.

“When inflation rises, the value of paper money declines,” he said.

“Gold is known for being unpredictable and for some investors, this is a strength, as it helps ensure gold is an effective diversifier.

“As we enter the new year, wearier, and with more dangers lurking, gold could continue providing an important source of diversification in investors’ portfolios.”

Chugh said since the ETFS Physical Gold (ASX Code: GOLD) was launched in 2003, it has returned an average of 8.1% a year and over the past five years an average of 9.3% a year.

“Asset allocation analysis suggests that adding 2% to 5% of gold to a portfolio can improve performance and boost risk-adjusted returns on a long-term basis,” he said.

His view is shared by BetaShares chief commercial officer IIan Israelstam who said their Gold Bullion ETF (ASX:QAU) was also a recent favourite among investors.

Buy and hold approach

Israelstam said there has been buy and hold activity taking place where investors are buying into all market conditions.

He said investors have been buying the big end of town with BetaShares A200 (ASX:A200), which tracks 200 of the largest companies by market cap, seeing $120 million of inflows already into March.

“Our A100 fund NDQ has also been popular which has the case for March, January and February which shows investors are still using ETFs for a buy and hold core for their portfolio,” he said.

He said income has also been a theme primarily without interest rate risk. BetaShares Active Australian Hybrids Fund (ASX:HBRD) has had about $30m worth of flow into it this month.

“At the end of the day people still need income,” he said.

Perfect storm for FOOD

BetaShares Global Agriculture Companies ETF (ASX:FOOD), is benefiting from supply shortages globally.

“Certainly something that has been catalysed by fear of inflation and the Ukraine war has been our global agricultural companies ETF,” Israelstam said.

“It’s almost like a perfect storm for food both for our food products and our ETF called FOOD – inflation is causing prices to rise and we have significant shortage because of of Ukraine and Russia.”

He said the FOOD ETF is being driven by rising commodity prices and commodities companies.

Quality wins out

According to VanEck manager (investments) Cameron McCormack, analysis shows the quality factor is either top performing or second best in three out of four economic cycles, including recovery, expansion, slowdown and contraction.

“As we’ve seen since the start of the year, value companies have been outperforming, and this aligns with the analysis which shows value is the top performing factor during periods of recovery into expansion,” he said.

“Of course, markets are unpredictable, as is the length and magnitude of each wave of an economic cycle, but as the old adage says, it’s time in the market over timing the market.”

McCormack said it is challenging for investors to navigate economic conditions and prevailing markets.

He said value and quality focused ETFs are being used by savvy investors as tools, to either hold through the cycle, or blend, to help mitigate the troughs of the cycle.

The VanEck MSCI International Quality ETF (ASX:QUAL) has been their most popular ETF of the month. QUAL has seen inflows totalling $58.2 million for March so far.

“We have found that value and quality have a low correlation and blending these strategies can offer diversification benefits,” he said.

“We have simulated blending value and quality factors in international equities over 10- and 20-year periods.

“The results show blends of 50/50, 25% Value/75% Quality and 10% Value/90% Quality all outperform a portfolio that is 100% value or 100% quality over 20 years.”

McCormack’s view is shared by Israelstam, who said quality is valued among investors at the moment.

“Quality has been important with our Global Quality Leaders ETF (ASX:QLTY) has also seen good flow into it,” Israelstam said.

Investors have also been looking at property with VanEck Australian Property ETF (ASX:MVA) also seeing heavy inflows, along with the VanEck Australian Floating Rate ETF (FLOT).

The FLOT ETF invests in a diversified portfolio of Australian dollar denominated floating rate bonds with the aim of providing investment returns closely tracking returns of the index.

New launches

BetaShares Digital Health and Telemedicine ETF (ASX:EDOC) will launch by the end of March. The company believes COVID-19 has accelerated demand for digital health services as public health orders required patients to consult healthcare professionals remotely.

EDOC will provide investors with exposure of up to 50 leading global healthcare and telemedicine companies.

BetaShares Australian quality ETF (ASX:AQLT) is also due to launch later this month.

“There isn’t any fund in Australia at the moment that is driven on the quality factor, so this is our version,” Israelstam said.

| Code | Company | Last | Month % Change | Year % Change | Market Cap |

|---|---|---|---|---|---|

| FOOD | Beta Global Agri | 8.14 | 6.4% | 13.5% | $76,134,180 |

| GDX | VanEck Gold Miners | 50.77 | 5.8% | 15.2% | $546,824,413 |

| DRUG | Beta Global Health | 7.85 | 5.4% | 12.0% | $161,134,537 |

| MVR | VanEck Resources | 34.69 | 5.2% | 17.2% | $141,492,987 |

| HACK | Beta Global Cyber | 10.2 | 5.0% | 22.0% | $729,906,561 |

| FUEL | Beta Global Energy | 5.66 | 5.0% | 28.9% | $281,279,009 |

| MNRS | Beta Global Gold | 6.57 | 4.1% | 1.7% | $70,130,808 |

| IFRA | VanEck Infrastructure | 22.06 | 3.8% | 10.6% | $615,263,090 |

| MICH | Mag. Infra. Fund Ch | 3.02 | 3.4% | 10.2% | $886,786,848 |

| OZR | SPDR 200 Resources | 14.44 | 3.3% | 10.5% | $134,900,413 |

| QRE | Betashares Asx Res | 8.08 | 3.1% | 11.6% | $106,463,513 |

| INIF | InvestsmartAuIncFund | 3.11 | 3.0% | 14.8% | $77,711,522 |

| ATEC | BetaAusTechnologyETF | 19.49 | 3.0% | -10.0% | $171,328,720 |

| IIGF | InvestSMARTAUGthFund | 3.32 | 2.8% | 14.9% | $100,000,350 |

| REIT | VanEck Internat Reit | 20.52 | 2.7% | 11.5% | $202,438,210 |

| VLC | Vngd Aus Large | 76.21 | 2.6% | 8.5% | $149,494,584 |

| HQLT | BetaQualityLeadersch | 24.63 | 2.3% | 2.1% | $34,455,625 |

| E200 | StateStreetE200 | 24.87 | 2.3% | 6.7% | $38,170,897 |

| VHY | Vngd Aus High Yield | 68.11 | 2.3% | 9.3% | $2,183,273,029 |

| SFY | SPDR 50 Fund | 65.87 | 2.3% | 8.6% | $785,745,950 |

| SWTZ | Switzer Div Growth Fund (Managed Fund) | 2.69 | 2.3% | 8.5% | $72,151,060 |

| ILC | iShares S&P/ASX 20 | 28.84 | 2.3% | 8.1% | $453,898,162 |

| QOZ | Betasharesrafiaus | 15.32 | 2.2% | 8.5% | $403,806,507 |

| MVOL | ISHARES EDGE AU MVOL | 30.81 | 2.2% | 10.7% | $28,370,009 |

| YMAX | Betasharesyieldmax | 7.94 | 2.1% | 2.2% | $346,441,764 |

| A200 | Betaaustralia200ETF | 125.14 | 2.0% | 9.4% | $2,236,362,692 |

| STW | SPDR 200 Fund | 68.25 | 2.0% | 8.0% | $4,746,175,571 |

| VAS | Vngd Aus Shares | 94.29 | 1.9% | 8.3% | $10,390,253,300 |

| IOZ | iShares S&P/ASX 200. | 30.21 | 1.8% | 8.2% | $4,666,751,272 |

| OZF | SPDR 200 Financials | 21.75 | 1.7% | 9.7% | $151,329,954 |

| QHAL | VanEck Qual Hedged | 38.88 | 1.6% | 10.2% | $404,967,444 |

| IXJ | Ishs Glob Health Etf | 116.5 | 1.6% | 20.0% | $1,072,409,860 |

| MVB | VanEck Banks | 31.55 | 1.6% | 11.2% | $205,001,200 |

| VBLD | Vngd Glb Infra | 62.57 | 1.6% | 17.6% | $296,811,030 |

| GGUS | Beta Geared US EQ | 33.65 | 1.5% | 17.7% | $120,694,000 |

| QFN | Betashares Asx Fin | 12.21 | 1.5% | 10.2% | $55,229,046 |

| MVW | VanEck Equal Weight | 33.62 | 1.3% | 8.8% | $1,737,434,283 |

| EX20 | Betaausex20 | 20.4 | 1.2% | 8.3% | $230,712,647 |

| MVE | VanEck Midcap | 36.74 | 1.2% | 11.8% | $176,602,161 |

| VETH | VanEthicConAustShETF | 59.17 | 1.2% | 8.8% | $347,698,779 |

| AUST | BETA MANAGED RISK AU | 17.19 | 1.2% | 4.2% | $24,658,919 |

| IHD | iShares S&P Div Opp | 13.79 | 1.2% | 5.0% | $293,843,249 |

| EIGA | Einvest Income | 3.94 | 1.0% | 7.4% | $31,657,427 |

| IHVV | iShs S&P500AUDHedged | 435.94 | 1.0% | -7.7% | $590,055,707 |

| VSO | Vngd Aus Small | 69.93 | 0.9% | 6.5% | $688,073,391 |

| RARI | RUSSAUSTRESPINVETF | 25.96 | 0.9% | 9.3% | $279,749,255 |

| VMIN | Vngd Min Vol Atv ETF | 53.47 | 0.8% | -5.4% | $16,797,904 |

| RINC | Beta LM Real Income | 9.34 | 0.8% | 15.7% | $66,241,936 |

| GRNV | VanEck ESG Australia | 27.44 | 0.7% | 7.6% | $101,339,741 |

| RDV | Russell High Div ETF | 30.51 | 0.7% | 9.1% | $269,676,338 |

| FAIR | Betaausustainability | 18.87 | 0.6% | 6.2% | $1,251,129,245 |

| SELF | SLFWLTH SMSF LEADRS | 47.38 | 0.6% | 1.9% | $4,371,705 |

| HVST | BETA DIVHARVESTER | 13.31 | 0.5% | 0.2% | $174,335,277 |

| HNDQ | BetaNasdaq100CH | 31.7 | 0.4% | 3.8% | $102,053,380 |

| SSO | SPDR Small Ords | 16.89 | 0.3% | -3.3% | $30,720,379 |

| INES | Investsmart SHS fund | 3.56 | 0.3% | 7.2% | $64,438,737 |

| HLTH | VanEck Glbl Hlth Ldr | 10.89 | 0.3% | 10.9% | $75,464,107 |

| EINC | Beta LM Equity Income | 8.72 | 0.2% | 4.8% | $27,227,990 |

| EINC | Beta LM Equity Income | 8.72 | 0.2% | 4.8% | $27,227,990 |

| VGAD | VNGD INTL SHARES H | 86.36 | 0.1% | 1.2% | $1,735,739,633 |

| IHWL | Ishares Core Wld Aud | 42.69 | 0.0% | -1.1% | $249,542,804 |

| WXHG | SPDR World Ex Oz Hdg | 28.37 | -0.1% | 4.1% | $138,701,172 |

| ISO | iShares Small Ords | 5.35 | -0.2% | -3.4% | $174,980,036 |

| AASF | Airlie Aus Fund | 3.48 | -0.3% | 15.2% | $305,494,808 |

| GIVE | Perpetual Eth Sri | 3.35 | -0.3% | 0.0% | $2,129,715 |

| IHOO | iShs Global100AUDHedged | 139.32 | -0.7% | -3.6% | $147,876,228 |

| UMAX | BETA S&P500 YIELDMAX | 20.95 | -0.7% | 9.8% | $126,336,201 |

| HETH | BetaSustainabilityCH | 12.55 | -0.7% | 2.1% | $165,295,228 |

| DJRE | SPDR DJ GLOBAL REIT | 23.38 | -0.8% | 17.0% | $460,586,066 |

| MHG | Magellan Gbl Eq Fund | 3.54 | -0.8% | -4.3% | $273,039,215 |

| MVA | VanEck Property | 24.26 | -0.9% | 14.0% | $628,824,904 |

| WVOL | ISHARES EDGEWLD MVOL | 35 | -0.9% | 12.4% | $219,402,493 |

| VDCO | Vngd Div Conserv | 51.57 | -1.0% | -5.9% | $255,096,252 |

| SMLL | BetaSmallCompanies | 4.02 | -1.0% | 0.0% | $72,901,812 |

| VAP | Vngd Aus Prop Sec | 91.59 | -1.0% | 15.5% | $2,455,511,973 |

| MVS | VanEck Small Masters | 21.46 | -1.0% | 5.2% | $46,674,687 |

| SYI | Spdrmsciauselecthdy | 30.75 | -1.1% | 7.6% | $282,315,819 |

| VDHG | Vngd Div High Growth | 59.03 | -1.2% | 0.9% | $1,624,535,338 |

| VDBA | Vngd Div Balance | 53.45 | -1.2% | -4.7% | $616,195,319 |

| VDGR | Vngd Div Growth | 56.15 | -1.2% | -1.7% | $604,867,180 |

| SLF | SPDR S&P/ASX Prop Fu | 13.32 | -1.3% | 12.9% | $644,922,013 |

| ZYUS | ETFS S&P500 Yield | 13.18 | -1.3% | 12.8% | $68,504,806 |

| ZYAU | ETFS Asx300 Yield | 9.8 | -1.4% | 5.5% | $86,830,185 |

| IMPQ | EINVEST FISCF | 5.56 | -1.4% | 4.9% | $34,454,280 |

| IJH | iShares Mid-Cap ETF | 364.13 | -1.4% | 6.7% | $220,769,506 |

| IJR | iShares Small-Cap | 147.49 | -1.4% | 1.5% | $449,902,423 |

| HJPN | Betashares Wt Japan | 14.99 | -1.5% | -7.1% | $97,592,279 |

| QUAL | Vaneck Wld Xau Qual | 38.8 | -1.5% | 15.3% | $2,576,120,713 |

| IVV | iShares S&P 500 ETF | 602.6 | -1.7% | 18.3% | $5,010,766,528 |

| MOAT | Vaneck Us Wide Moat | 99.62 | -1.7% | 12.7% | $416,572,289 |

| MSTR | MSTR INT SHR ACT ETF | 8.93 | -1.8% | -17.6% | $139,334,271 |

| QUS | Beta SP500 Equal ETF | 41.99 | -1.9% | 14.3% | $189,994,180 |

| ERTH | BetaERTHOppETF | 11.39 | -1.9% | -11.0% | $176,984,496 |

| QLTY | Beta Quality Leaders | 21.91 | -2.0% | 5.5% | $273,809,888 |

| BEAR | Betashares Aust Bear | 8.81 | -2.1% | -13.5% | $58,742,675 |

| NDQ | Betasharesnasdaq100 | 30.96 | -2.1% | 10.9% | $2,370,497,278 |

| IPAY | Beta Future Pay ETF | 10.5 | -2.1% | 0.0% | $6,042,000 |

| CURE | ETFS S&P Biotech | 42.63 | -2.3% | -40.2% | $46,011,491 |

| QMIX | SPDR MSCI WORLD QMIX | 24.61 | -2.5% | 10.7% | $28,542,203 |

| WDMF | ISHARES EDGE WLD MF | 38.59 | -2.5% | 6.6% | $166,939,735 |

| VGMF | VanguardMultiFactor | 61.85 | -2.5% | 10.6% | $44,145,517 |

| CRYP | BetaCryptoInnovETF | 5.83 | -2.8% | 0.0% | $108,672,000 |

| IWLD | Ishares Core Wld | 41.28 | -2.9% | 0.7% | $362,394,297 |

| WRLD | BETA MANAGED RISK GL | 15.3 | -3.0% | 11.6% | $37,233,193 |

| CLDD | BetaCloudCompETF | 11.6 | -3.1% | -15.4% | $52,697,437 |

| VGS | Vngd Intl Shares | 97.03 | -3.2% | 11.3% | $4,425,270,341 |

| VISM | Vngd Intl Small Cap | 59.04 | -3.3% | -4.6% | $178,335,876 |

| RBTZ | Beta Robotics & AI | 12.07 | -3.3% | -11.0% | $173,574,913 |

| IIND | BetaShares India. | 9.88 | -3.3% | 7.4% | $70,772,787 |

| VVLU | Vngd Globvlu Atv ETF | 60.35 | -3.4% | 14.1% | $392,025,109 |

| VESG | VNGD ETHI INTL SHS | 69.66 | -3.5% | 10.3% | $604,510,369 |

| WXOZ | SPDR World Ex Oz | 40.81 | -3.6% | 9.6% | $268,025,075 |

| ETHI | Betasustainability | 11.88 | -3.8% | 7.0% | $2,007,894,307 |

| HEUR | Betashares Wt Europe | 12.59 | -3.9% | -1.7% | $50,509,358 |

| IOO | Ishs Global 100 Etf | 99.96 | -3.9% | 17.7% | $2,528,047,071 |

| INCM | Beta Income Leaders | 14.59 | -4.0% | 9.4% | $22,139,435 |

| NDIA | ETFS India Nifty 50 | 60 | -4.0% | 15.5% | $32,621,944 |

| TECH | ETFSglobaltech | 90.35 | -4.1% | -10.3% | $334,483,087 |

| WDIV | SPDR GLOBAL DIVIDEND | 18.19 | -4.2% | 5.5% | $355,001,993 |

| WCMQ | WCMQualityGlobalGrow | 7.28 | -4.5% | -1.4% | $299,948,980 |

| MOGL | MOGL (Managed Fund) | 3.33 | -4.6% | -1.2% | $68,581,256 |

| ESGI | Vaneck Esg Internatl | 27.97 | -4.6% | 8.0% | $120,343,139 |

| BBOZ | Beta Aust Str Bear | 4.09 | -4.7% | -28.7% | $269,370,000 |

| LPGD | Loftus Peak | 2.91 | -4.9% | 1.7% | $199,001,934 |

| FANG | ETFs Fang+ | 14.93 | -5.3% | -12.4% | $222,306,912 |

| ROBO | ETFS ROBO Glb Robo Auto | 75.9 | -5.3% | -12.4% | $244,129,841 |

| IXI | iShs Global Cons ETF | 83.1 | -5.5% | 13.8% | $143,214,324 |

| IJP | Ishs MSCI Japan ETF | 83.89 | -5.7% | -6.9% | $393,741,565 |

| IKO | iShares MSCI Sk ETF | 97.65 | -6.8% | -15.7% | $75,218,177 |

| BNKS | Beta Global Banks | 6.76 | -6.9% | 4.0% | $124,431,795 |

| IVE | Ishs MSCI EAFE Etf | 98.67 | -6.9% | 0.2% | $402,767,949 |

| BBUS | Beta Us Str Bear | 9.07 | -7.1% | -31.8% | $214,411,400 |

| F100 | BetaShares FTSE 100 | 10.04 | -7.5% | 8.5% | $444,272,577 |

| AGX1 | Antpds Globl Shrs | 5.47 | -7.8% | -10.8% | $419,482,802 |

| IEU | Ishs Europe Etf | 67.42 | -7.9% | 3.8% | $888,863,611 |

| ESPO | VanEck Video Gaming | 9.81 | -8.0% | -9.1% | $88,702,325 |

| VEQ | Vgd Ftse Eur Shares | 59.68 | -8.3% | 2.3% | $295,467,521 |

| CNEW | VanEck China New | 8.14 | -9.1% | -0.5% | $130,376,624 |

| ACDC | ETFS Batt Tech Lith | 83.2 | -9.1% | -7.6% | $466,690,354 |

| PIXX | Platinum Int Fund | 4.86 | -9.8% | -6.5% | $331,067,783 |

| EMKT | Vaneck Emerging Mkt | 20.34 | -10.0% | -4.7% | $48,826,927 |

| WEMG | SPDR EMERGING MKTS | 22.27 | -10.3% | -10.3% | $19,970,877 |

| VAE | Vgd Ftse Asia Ex Jpn | 69.05 | -10.8% | -13.8% | $360,114,335 |

| ESTX | ETFSeurostoxx50 | 67.37 | -10.8% | -2.4% | $59,948,426 |

| VGE | Vngd Emerging Mkts | 68.74 | -11.4% | -9.1% | $596,950,666 |

| CETF | VanEck China A50 | 57.7 | -11.8% | -16.7% | $17,721,292 |

| DRIV | Beta Electric V ETF | 9.32 | -12.1% | 0.0% | $9,999,000 |

| IEM | Ishs MSCI Emg Mktetf | 60 | -12.5% | -14.3% | $879,924,204 |

| FEMX | Fidelity Gem | 6.11 | -12.7% | -6.9% | $198,571,250 |

| EMMG | Beta LM EM Fund | 5.8 | -13.9% | -17.1% | $90,721,534 |

| IAA | Ishs Asia 50 ETF | 92.91 | -14.0% | -23.3% | $694,918,105 |

| PAXX | Platinum Asia Fund | 4.21 | -14.4% | -29.1% | $118,494,214 |

| ASIA | Beta AsiaTech Tigers | 7.66 | -15.7% | -37.2% | $491,878,832 |

| IZZ | Ishs China Etf | 42.68 | -19.3% | -31.2% | $189,971,359 |

| CORE | ETFS Glb Core Infra | 0 | -100.0% | -100.0% | $16,076,540 |

| GLIN | Ampcap Global Infra | 0 | -100.0% | -100.0% | $22,126,914 |

| MGE | Mag Global Equities | 0 | -100.0% | -100.0% | $1,748,497,889 |

| RENT | Ampcap Global Prop | 0 | -100.0% | -100.0% | $18,516,220 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.