‘Universally too cheap’: Rick Rule says these M&A focused gold miners are also prime takeover targets

Pic: DKosig / iStock / Getty Images Plus via Getty Images

In a recent chat with Stockhead’s Oriel Morrison, famous resources investor Rick Rule said Australian stocks were ripe targets for mounting merger and acquisition activity, especially in the gold space.

Most have enjoyed strong margins and profits this year despite a timid gold price, and potentially a flow of capital into cryptocurrencies, weighing on their share prices.

Gold miners now seem to be hungry for growth, looking to use their growing bank balances to fund capital investments, mergers and acquisitions.

“I think Australia is particularly ripe for mergers and acquisitions in two senses,” Rule says.

“One, the acquisition of non-Australian companies by Australian companies and increasingly — if the bigger and better Australian companies don’t begin to sell at premiums — the takeover of those companies by foreigners.

“And of course, the lateral and strategic mergers within the Australian Exchange. I think the next 18 months is going to surprise everyone positively with mergers and acquisitions.

“In the near term that benefits the acquiree, but in the long term if it is structured well, it will benefit the acquiror.”

Who are takeover targets in Australia?

Rule has a list of M&A targets he would prefer to keep proprietary, for obvious reasons.

But he does say to look for companies that are simply too cheap.

“Companies where the net present value of their cash flow, particularly where they have long life reserves, are substantially cheaper than their enterprise value,” he says.

“By my way of thinking, the plus $2bn to $10bn Australian gold mining industry – that market cap range – is universally too cheap.

“At current gold prices – not higher gold prices – these companies are all selling at prices that are as cheap as I have ever seen them in my career.

“I also believe that the gold price will go up, so I am attracted to both the numerator and denominator in that equation.”

From talking to industry execs worldwide, Rule knows that they are beginning to work up the courage to do M&A again.

The industry got pretty discouraged from doing that, for very good reason, in the decade 2000-2010, where so many aggressive acquisitions turned out to be disastrous for shareholders.

“But there is a circumstance now where the lack of investment, particularly in precious metals mining, for the last few years has meant that the surviving companies have to acquire, or they begin to shrink,” Rule says.

“They cannot explore and develop fast enough to maintain their current production. And the assets that they need to acquire are, in historical terms, extremely cheap.”

The $2bn-$10bn gold miners

Which companies fall into Rick Rule’s mid-cap takeover bracket? Only one, so we’re going to nudge it down to $1bn market cap.

These companies are also looking to add ounces themselves, increasingly by snapping up smaller mine developers on the ASX.

The price-to-earnings ratio (P/E ratio) mentioned below measures a stock’s current share price relative to its earnings per share. It is an imperfect, but still useful, guide to valuation particularly with reference to other stocks in its industry. Lower number = ostensibly cheaper.

EVOLUTION MINING (ASX:EVN)

Market Cap: $7.6 billion

Annual Production: 681,000oz (FY21)

Profit After Tax: $345.3 million (FY21)

P/E Ratio: 20.61

In terms of adding ounces, EVN recently paid Northern Star (ASX:NST) $400 million for the Mungari operations near Kalgoorlie in WA.

EVN is also progressing the $380 million development of the underground operation at Cowal.

The gold mine in the central west region of NSW is now permitted out to 2040, something which will enable a long-term shift to higher grade underground ore sources.

These will be blended with ore from the E42 pit to turn the mine — bought from gold giant Barrick during its Australian fire sale in 2015 — into one of Australia’s largest with a production profile of 350,000ozpa.

Together, these developments could help push annual production through 1 million ounces by 2024.

PERSEUS MINING (ASX:PRU)

Market Cap: $2.1 billion

Annual Production: 328,632oz (FY21)

Profit After Tax: $139.4 million (FY21)

P/E Ratio: 18.4

In 2021, PRU brought its third West African gold mine into production. It continues to track towards becoming a 500,000 ounce per year gold producer in FY22 “at a cash operating margin of not less than US$400 per ounce”.

This company is looking for growth organically, it says.

“With our three gold mines performing well, we are assessing options to continue our trend of growth, and that includes new mineral discoveries or upgrading existing Mineral Resources to add to our gold inventory,” chairman Sean Harvey says.

“Exploration programmes continued to generate encouraging results from prospects close to each of our three operating mines, demonstrating potential to organically grow these.

“We will continue to explore and drill our targets over the coming 12 months as we look to add life to each of our projects.”

In October, VP Capital portfolio manager John So said in comparison to its peers the stock was trading cheaply, partly because this part of the world (Africa) tends to trade at a discount compared to gold companies in North America or Australia.

SILVER LAKE RESOURCES (ASX:SLR)

Market Cap: $1.62 billion

Annual Production: 249,177oz (FY21)

Profit After Tax: $98.2 million (FY21)

P/E Ratio: 16.55

Silver Lake’s 2018 ‘merger of equals’ with Doray Minerals is an example of value-accretive M&A among the big miners, according to veteran resources analyst and Stockhead contributor Peter Strachan.

The miner now aims to produce 235,000-255,000oz in FY22, largely driven by the success of the Deflector operations, where the addition of the high-grade Rothsay gold mine is paying off.

Rothay was another savvy acquisition, completed via the takeover of small cap success story Egan Street Resources in 2019.

Silver Lake boasts a record company ore reserve of 1.36Moz, underpinning a planned expansion to 255,000-275,000ozpa over a three-year period. It had $359m of cash in hand at the end of September.

“Silver Lake’s financial position enables us to continue to approach future capital deployment from a position of strength, as we seek to refresh opportunities, both internally and externally, building on the success and momentum generated over multiple years,” the company says.

REGIS RESOURCES (ASX:RRL)

Market Cap: $1.62 billion

Annual Production: 372,870oz (FY21)

Profit After Tax: $146 million (FY21)

P/E Ratio: 8.44

Earlier this year, Regis announced a game changing acquisition — a 30% interest in the Tropicana gold mine for $903m.

Tropicana is a tier-one asset with a production outlook of 380,000oz to 430,000oz in FY21. It has a current 10-year life with additional upside.

The immediate impact is clear: Regis solidifies its position as a top 5 Aussie gold miner with annual, low-cost production of ~500,000oz per year from FY22 onwards.

On the development front Regis could decide on a second underground mine at its Garden Well orebody at Duketon this quarter, while it continues to wait impatiently on government approvals for the 2.02Moz McPhillamy’s project in regional NSW.

RAMELIUS RESOURCES (ASX:RMS)

Market Cap: $1.41 billion

Annual Production: 272,109oz (FY21)

Profit After Tax: $127 million (FY21)

P/E Ratio: 11.16

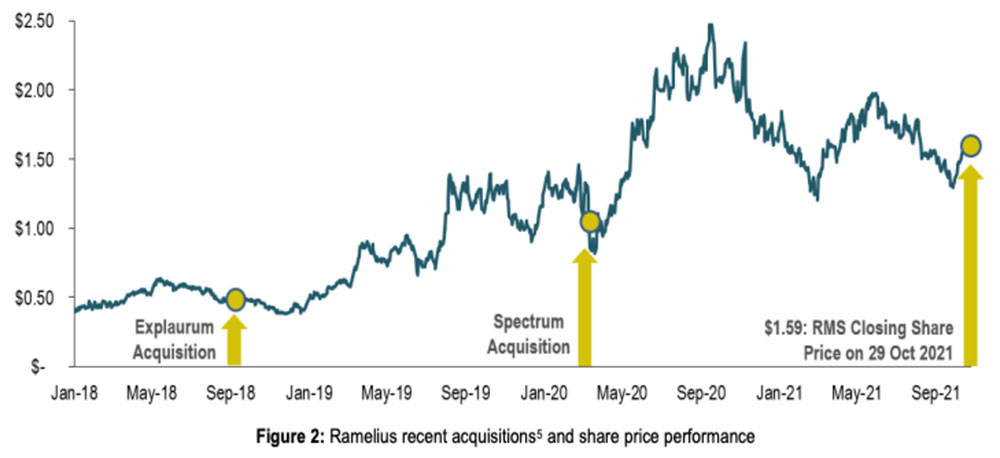

Ramelius has proven a successful acquirer of assets in recent years under managing director Mark Zeptner.

Ramelius has undertaken the acquisitions of Explaurum and Spectrum Metals in recent years (each via takeover offer), providing a mix of cash and shares to target shareholders in each case.

The latest is a successful $181m bid for Apollo Consolidated (ASX:AOP) and its undeveloped 1.1Moz Rebecca gold project.

“As demonstrated in Figure 2, the returns realised by target shareholders who received Ramelius shares and have retained those shares, in each case, have been outstanding, with all Ramelius shareholders benefiting from the value creation achieved by the company since undertaking those acquisitions,” the company says.

Ramelius forecasts 260,000 – 300,000 ounces of gold production in FY22.

WEST AFRICAN RESOURCES (ASX:WAF)

Market Cap: $1.36 billion

Annual Production: 136,476oz (CY20)*

Profit After Tax: $100 million (CY20)*

P/E Ratio: 8.95

This small cap success story is one of the top performing gold miners on the ASX this year, bucking the downward trend seen across most major goldies.

West African has hit its straps at the new Sanbrado mine in Burkina Faso, hitting record production levels in the September Quarter and announcing it is likely to exceed full year guidance of ~280,000oz in 2021.

That has given WAF the ability to raise $126.4 million in equity to buy the nearby 6.8Moz Kiaka project from B2Gold and GAMS for a combined US$100m.

This new mine, due to open by 2025, will make WAF a 400,000ozpa producer.

*First gold was poured March 18, 2020

GOLD ROAD RESOURCES (ASX:GOR)

Market Cap: $1.36 billion

Annual Production: 126,434oz (CY20)

Profit After Tax: $81 million (CY20)

P/E Ratio: 17.81

GOR’s only operation is the 8.8Moz Gruyere project, a 50:50 joint venture with Gold Fields.

In February 2021, Gold Road released a three-year production outlook that shows a 35% to 50% increase in annual production to a sustainable circa 350,000 ounces per annum by 2023 (100% basis). The operation is expected to produce between 250,000oz and 300,000oz this year.

GOR is also on the hunt for assets, having failed so far to replicate its exploration success at Gruyere. It recently fell short in its bid for Apollo to Ramelius Resources.

“The Offer aligns with Gold Road’s strategy to grow and diversify its growth pipeline with high quality, low risk opportunities in tier one jurisdictions”, GOR said at the time, which means it is probably on the lookout for similar opportunities.

The company had cash and equivalents of $123.5 million, with no drawn debt, by the end of September.

Watch the rest of Oriel’s chat with Rick Rule here:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.