Gold stocks have had a bitter 2021 but these four growing miners are shining bright

Pic: Clive Mason via Getty Images.

There is no shortage of gold-loving analysts, fund managers, miners and investment bankers ready to tell you the gold mining sector is undervalued.

While miners are reporting the same profits they were a year ago, the retreat of gold prices from all time highs in August last year has seen investors go cold on the big fellas.

While the ASX 200 is up 10.14% in the year to date, the VanEck Gold Miners ETF is a notable laggard, down 7.82% for 2021.

Some large cap gold miners have fared even worse. Northern Star Resources (ASX:NST) is a significantly larger company than it was this time last year, having absorbed Saracen Mineral Holdings to become the world’s eighth largest gold miner.

It reported an underlying profit of $372 million in 2020-21 but is down almost 27% year to date.

Evolution Mining (ASX:EVN) is down 26%, Newcrest (ASX:NCM) is off 8.66%, Ramelius Resources (ASX:RMS) has experienced a similar drop and Regis Resources (ASX:RRL), despite bulking up by buying IGO’s (ASX:IGO) 30% stake in the Tropicana gold mine, is down 38.34%.

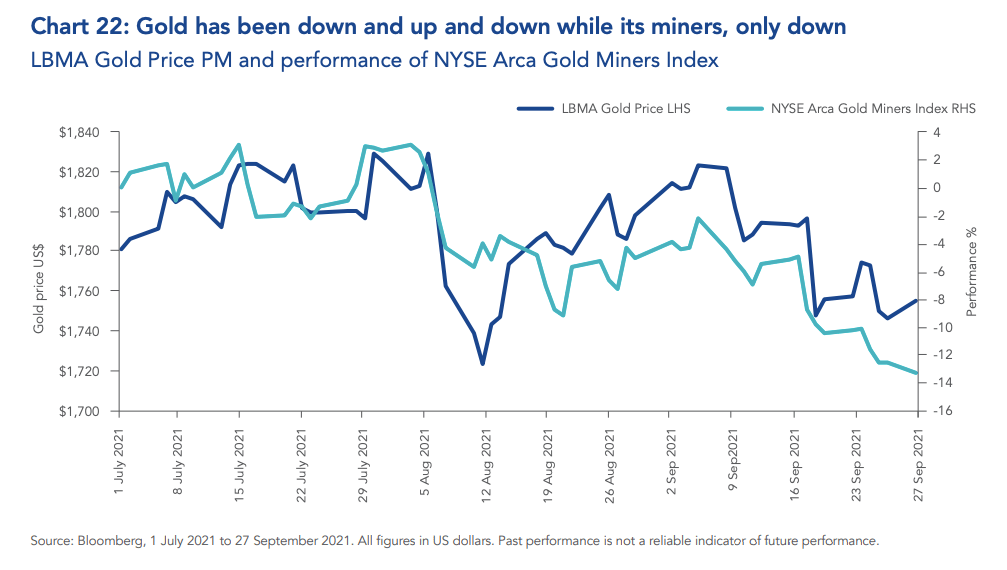

Gold equities have not just underperformed the market this year, but also physical gold itself.

But miners are as profitable as they were when share prices peaked a year ago, with VanEck saying this month it sees a ‘value opportunity’ in gold miners.

“When the gold price is declining or consolidating, gold equities tend to underperform. Even when gold rallies, gold stocks can sometimes lag during the early stages of the rally while markets digest the new outlook for the metal,” it said.

“Something similar is happening during this recent bounce back in gold prices.

“The revenues and earnings generated by the companies at the end of August is essentially the same it was a (year) ago, yet the stocks are trading at lower prices, creating a value opportunity.

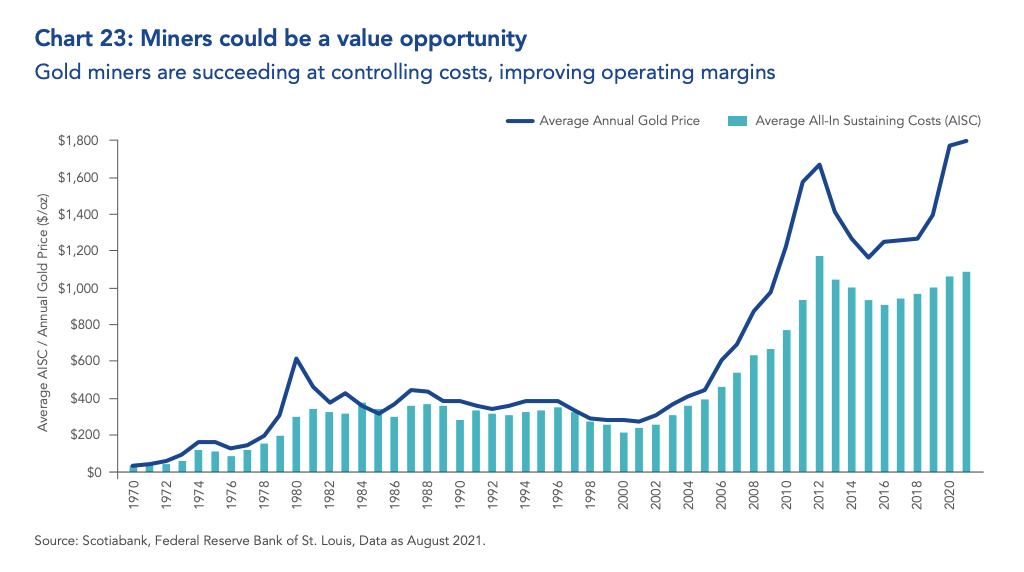

“We believe that, in recent years, gold companies have consistently demonstrated a disciplined capital allocation approach focused on delivering attractive return of capital.

“Gold companies’ operating margins have expanded significantly in recent years. Not only has the gold price reached record highs, but companies have also reduced and controlled costs, allowing margins to increase to record levels.”

Conditions to send gold over US$2000/oz brewing

VanEck says ‘tailrisk drivers’, especially the threat of inflation heading into 2022, have the potential to drive gold to US$2,000 per ounce and beyond.

“It nearly broke out a couple of times this year but failed and, in early August, dipped below its bull market trend bottom of US$1,760. Since the current trend began in 2019, gold has always bounced higher when testing the bottom of its range,” VanEck’s analysts said.

“We have been disappointed by the failure of gold to hold at such a critical support level and subsequently believe that, in the shorter term, it may spend longer than anticipated consolidating around the US$1,800-US$1,900 per ounce range.

“However, the upside is that gold was quick to rebound from this ‘flash crash’ and so a show of continued resilience should help reestablish the bull market trend and allow us to look back on this event as just an insignificant blip.”

Even as the market has dropped, a few gold producers have swam against the tide, most of them new gold miners or recent acquirers in the honeymoon stage of their operations.

Without further ado, here are four prominent ASX-listed gold miners who have bucked the trend so far this year.

CAPRICORN METALS (ASX:CMM)

Share Price: $2.69

Market Cap: $991m

YTD Share Price: +44.62%

How the fortunes of Regis Resources and Capricorn Metals have diverged since former Regis boss Mark Clark became the executive chairman of the junior gold miner he failed to takeover in 2018.

Capricorn owns the new Karlawinda gold project in the Pilbara, a bulk-tonnage, low-grade gold mine it opened at a cost of around $170 million in recent months.

Karlawinda is now in steady state operations having produced 24,329oz in its first quarter as an operating gold mine, and remains on track to produce 110,000-125,000oz in its first financial year.

Capricorn has the opportunity to make it 2 from 2 at the Mt Gibson gold mine, a 2.1Moz resource with similar qualities to Karlawinda the company secured opportunistically from a privateer for just $40 million in cash and shares.

Mt Gibson produced 868,000oz between 1986 and 1999.

Capricorn Metals share price today:

WEST AFRICAN RESOURCES (ASX:WAF)

Share Price: $1.44

Market Cap: $1.27b

YTD Share Price: +32.11%

West African Resources could not have picked a tenser time to open an overseas gold mine, having poured first gold at the Sanbrado mine in Burkina Faso in March 2020 as the coronavirus emerged outside China.

But it has barely skipped a beat, and is on track to beat the upper level of its first full calendar year guidance of 280,000oz after a record September Quarter.

West African’s output was up 29% to 81,960oz in the three months to September 30, at all in sustaining costs of US$690/oz, some of the lowest in the world without significant copper credits.

The company is now in a US$8m net cash position after reducing its notional debt by US$65m in the September Quarter, with $153m of cash and bullion on hand.

It has organic growth options as well, with resource definition and feasibility studies ongoing at the Toega deposit, where West African struck 79m at 2g/t of gold in recent drilling.

Sanbrado is expected to produce an average of 217,000oz over its first five years of life and 153,000ozpa over a decade.

West African Resources share price today:

AERIS RESOURCES (ASX:AIS)

Share Price: $0.18

Market Cap: $401m

YTD Share Price: +63.64%

Aeris is not strictly a gold producer, and it has to be said a lot of the value ascribed to it by investors is due to its copper interests.

It operates the small, low grade Tritton copper mine in New South Wales and expanded its profile by taking the Cracow gold mine in Queensland off Evolution Mining’s hands last year.

Run by Andre Labuschagne, famously the father of Australia test cricketer Marnus, Aeris is up more than 63% in 2021, largely driven by excitement around its Constellation copper discovery.

Along with near record copper prices, the high grade find is likely to significantly improve the economics of the Tritton project.

On the gold side, Cracow produced 73,685 ounces at a reasonable AISC of A$1,483/oz in FY21, helping Aeris to a 2600% increase in EBITDA to $159m and 259.7% jump in profit to $61.2m, and is forecast to produce 67,000-71,000oz at AISC of $1,550-1,600/oz in FY22.

Aeris Resources share price today:

FIREFINCH (ASX:FFX)

Share Price: $0.62

Market Cap: $579m

YTD Share Price: +228.95%

Firefinch paid just US$28.8 million to buy 80% of the Morila gold mine from AngloGold Ashanti and Barrick last year and has been on a tear since.

The Malian gold mine was once a million ounce producer known as Morila the Gorilla, but in recent years the highest grade material has been whittled down and the bulk of production has come from low grade tailings.

But the majors left plenty of meat on the bone, and Firefinch has turned that around by opening satellite mines to introduce higher grade ore delivering stronger recoveries to the Morila plant.

Having produced a company record 12,555oz in the June quarter its attention is now on turning Morila back into a 200,000ozpa producer over time by reviving the Morila Super Pit, the source of most of its 7.4Moz of historic production.

Like Aeris it should be noted Firefinch is also valued for its giant Goulamina lithium project in Mali, which is being spun out into new float Leo Lithium to be developed alongside JV partner Ganfeng, China’s largest lithium producer.

Firefinch share price today:

At Stockhead, we tell it like it is. While Firefinch is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.