The White House: Striking the balance of power in your energy portfolio

Via Getty

In this series, global equities portfolio manager James White ditches micro and macro and embraces “The Meta” perspective. A place where James can obsess over the detritus of where economies crash into equities.

Whitey’s house is Lessep IM, a Sydney-based global equities investment manager.

He said most of these things:

We invest in global equities.

We run a core portfolio of 40-50 stocks that capture the opportunities in productivity trends.

These trends reflect investments in the drivers of productivity and the beneficiaries of productivity.

We also aim to run a long-tail of stocks that have the potential to capture a greater share of new or existing markets.

I love trying to explain the world and equities offers the opportunity to do that in a meaningful way with a scoreboard attached.

I am a legend.

This is my pic. I’m good, but I’m no Edwards.

The energy sector is a challenging one for medium to long-term investors at this point in the cycle.

There’s a number of competing trends which make decision-making more difficult right now, particularly with volatility, demand and prices at all-time highs.

Arguments can be made, based on data, for why and when oil prices are falling or rising in the short and long-term. Let them rave, because most likely, companies will remain very profitable, and more focused on returning capital to investors.

Coupled with the importance of the sector remaining scrutinised by public markets, energy companies should be part of global equity portfolios.

Short-term

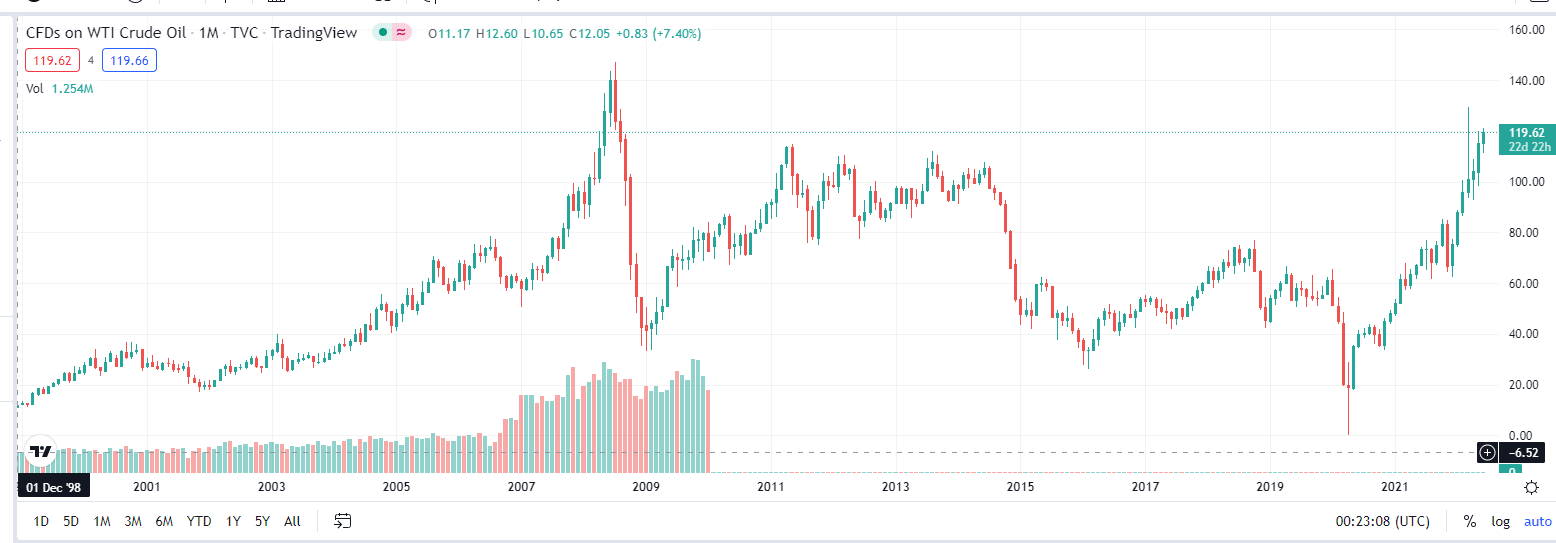

The oil price in the short-term looks strong.

It has cleared the prevailing price levels of the post-GFC era, and is approaching the all-time, nominal high of nearly $150 per barrel.

Historically, the cap on prices has been demand destruction. As prices reach a certain point, demand plummets, and, subsequently the price. At all-time, nominal highs the global economy may be at another such point.

CFDs on WTI Crude Oil – one month

But as the new White House Press Secretary explains, while no one is happy with the economy, people feel very good about their personal finances. Households can afford higher oil prices as a consequence of savings from the pandemic. But, how high?

DOOCY: “Why do you think it is that 83% of people polled say the economy is poor or not so good?”

PRESS SEC: “…People felt uncertain about the economy generally, but they actually felt as good about their personal financial situation as they ever have.” pic.twitter.com/fq5osPFJy3

— Breaking911 (@Breaking911) June 7, 2022

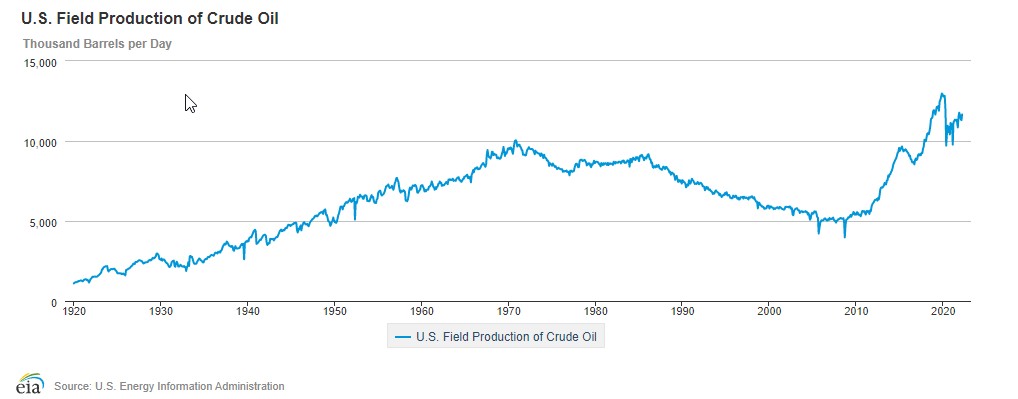

There is also the beginnings of a supply response. Oil production in the US was cut aggressively in 2020. Who remembers negatively priced oil? Today, oil production is 20% higher than the pandemic low, and rising.

Long-term

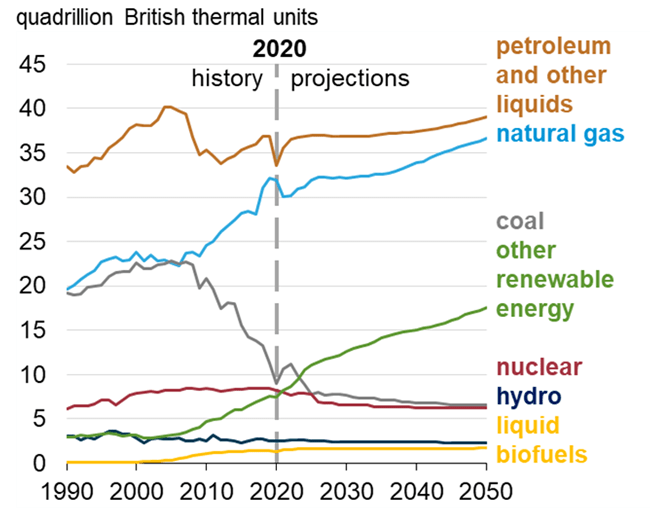

The US Energy Information Agency has provided long-term forecasts for energy consumption in the US. The chart shows petroleum demand will remain stable through the next decade, before accelerating a little from 2040.

It will remain, at 36%, a large part of US energy consumption.

Demand Destruction

An interesting historic note to make, using the data from this chart, is the demand destruction caused by $140 per barrel oil. Petroleum and Other Liquids demand fell 5 million units, or more than 15%, from 2007. It was replaced by natural gas, renewables, and a transition to much better fuel technology.

For instance, a Ford F150, the most popular consumer product in the world (by $), does 25 miles per gallon in 2022. In 1984, an F150 would do 10 miles per gallon.

On the supply side, the shift to de-carbonisation, often driven by taxes and administrative roadblocks, will make new oil production more expensive, and limit the supply response.

In a stable demand world, lower supply will most likely support prices.

Movement at the station

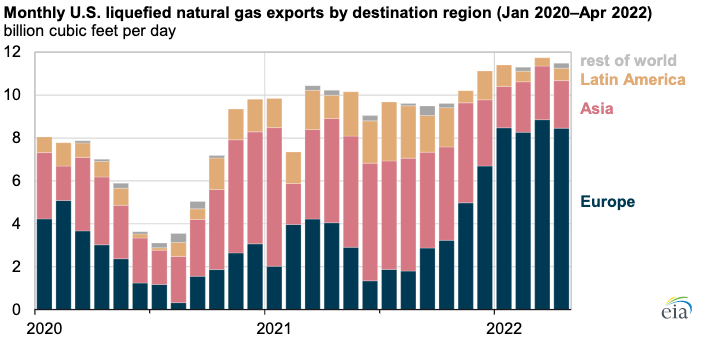

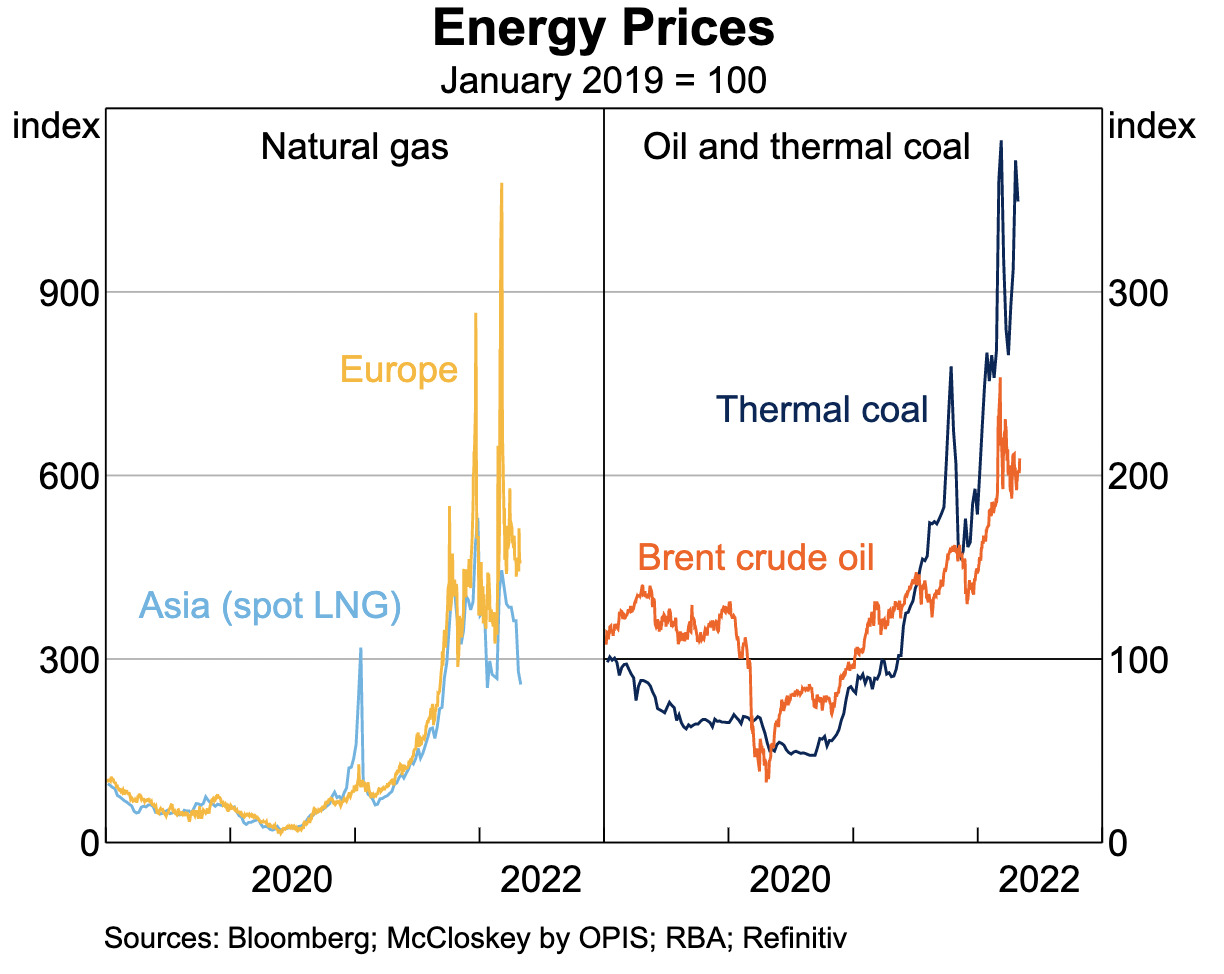

During the first four months of 2022, the United States exported 74% of its liquefied natural gas (LNG) to Europe, compared with an annual average of 34% last year, according to EIA estimates for April 2022.

In 2020 and 2021, Asia had been the main destination for US LNG exports, accounting for almost half of the total exports.

US LNG exports averaged 11.5 billion cubic feet per day (Bcf/d) during the first four months of 2022, an 18% increase compared with the 2021 annual average. The increase in American LNG exports was driven by additional export capacity and by high LNG demand, particularly in Europe.

Since December 2021, the European Union (EU) and the United Kingdom (whingers) have been importing record amounts of LNG, primarily because of low natural gas storage inventories. Sounds familar.

Research by the EIA shows the high spot natural gas prices at the European trading hubs incentivised global LNG market participants with destination flexibility in their contracts to deliver more LNG supplies to Europe. Additional LNG imports in Europe and a mild winter offset lower natural gas pipeline imports from Russia.

The United States became the largest LNG supplier to the EU and United Kingdom in 2021, accounting for 26% of total imports.

In the first four months of 2022, LNG imports from the States into the EU and the United Kingdom have more than tripled while during the first four months of 2022, American LNG exports to Asia have more than halved.

As we Man from Snowy River fans often say, usually when a little bent – ‘there’s movement at the station’.

Investment

There are two reasons to be long oil and gas stocks, regardless of short-term price fluctuations (although, those are becoming more important).

First, part of equity’s importance in a multi-asset portfolio is to give investors protection against inflation. Fixed income can’t do this. Companies provide inflation protection through their pricing power.

Second, it’s important that oil and gas assets, assets that are strategic to the global economy and the environment, remain in public markets. The governance of public markets is superior to private markets. It is easier to manage environmental risks and potential supply problems if investors have the information and incentive to do so.

The Lessep portfolio’s exposure to the oil and gas industry, with a productivity focus, has been limited to the high productivity shale oil players in both the Permian and Vaca Muerta basins. These companies, such as Pioneer, Laredo, Coterra, and Vista have all enjoyed strong performance in 2022.

But the pool of available names has shrunk through mergers. Anadarko, Cimarex, Parsley, and Concho have disappeared. Allworth looking up from a historical standpoint.

It seems as though it might be a useful time to think about broadening the exposure into the majors. In particular, with pressure to limit supply expansion, the likelihood of capital return to shareholders is increasing. This more capital efficient industry will likely support higher returns, and, coincidentally (?), a higher oil price.

Here at home

Before Christmas, Metgasco CEO officer Ken Aitken told Stockhead’s Bevis Yeo a domestic gas crisis was coming for the eastern coast.

“Prices were climbing across the east coast as a lot of coal seam gas was sold off as LNG and there hasn’t been a lot of exploration of late,” he said.

“During COVID-19, a lot of that gas that wasn’t needed by Asia but now that more gas is going to LNG to meet the contracts there, because these countries are coming out of the pandemic, the gas price in East Coast is rising, whereas in the West Coast there’s a lot of onshore gas being found and the gas price hasn’t really moved.”

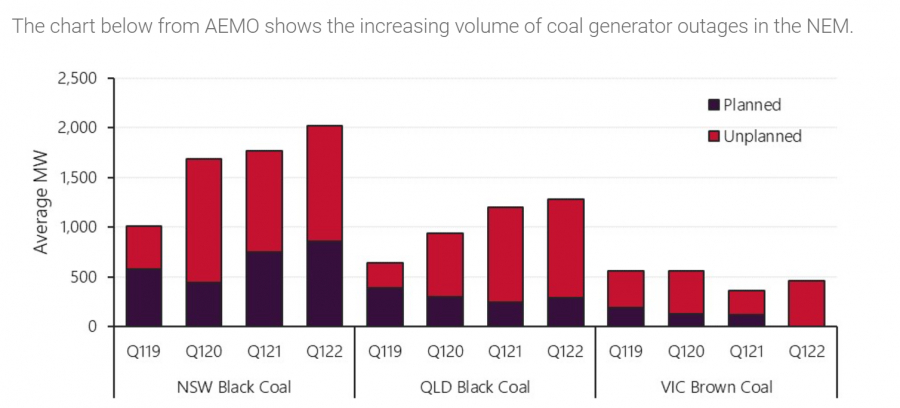

Australia’s new Labor-led government is in high alert amid acute power shortages on the East Coast, but observers at the consultancy EnergyQuest say the “current crisis is rather an electricity crisis than a gas crisis”.

The Australian Energy Market Operator (AEMO) already dedicated firm volumes of domestic gas to power generators as thermal coal is in short supply.

ASX oil and gas stocks to watch: a selection of Bev’s finest

Here’s Bev’s selection of oil and gas companies with established oil and gas reserves or with existing production or plans to become producers in the near-term.

Market Cap: $452.6m

Cooper Energy is a veteran oil and gas company with production of 2.63 million barrels of oil equivalent during the 2021 financial year.

However, the company is certainly not resting on its laurels with completion of its Athena gas plant project at 90% completion at the end of the September.

The plant will replace the Iona plant, offering higher production, lower operating cost and the ability to support the Otway Phase 3 development.

Market Cap: $30.6m

While ADX Energy is looking increasingly at renewable energy, the company has also been growing its Austrian oil and gas production.

In the June quarter, it produced oil and gas at a rate of 348 barrels of oil equivalent (boe) per day, up from 261boe/d in the March quarter.

The company has 0.9 million barrels of proved and probable reserves along with a significant number of leads and prospects to further grow reserves and production.

Market Cap: $93.2m

Blue Energy recently raised $10m through a placement of shares to fund a reserve building program at its ATP 814 permit in the North Bowen Basin, Queensland.

This is aimed at increasing the company’s proved and probable reserves, which currently stand at 71 petajoules, to underpin gas supply agreements with EnergyAustralia, Origin Energy and Queensland Pacific Metals.

Notably, the Origin and EnergyAustralia gas agreements are expected to underpin new gas pipeline construction.

Market Cap: $116.1m

Comet Ridge recently executed a binding agreement to acquire APLNG’s 30% interest in the Mahalo gas project in Queensland, taking its stake up to 70%, though this might be reduced to 50% under the equity alignment agreement with Santos.

The company has just spudded the Mahalo North-1 vertical well that is aimed at certifying reserves at the Mahalo North block, which will in turn support a large Mahalo Hub development.

Market Cap: $20.5m

Metgasco participated in the recent successful drilling of the Vali and Odin gas wells in the Cooper Basin, which achieved a 100% success rate.

A final investment decision to commercialise the Vali field is expected in the current quarter with production at a gross rate of about 12 million standard cubic feet of gas targeted to begin in the middle of 2022.

This is perfectly timed and placed to meet gas demand in Australia’s East Coast and could be increased by tying-in the nearby Odin gas field.

The company is also participating in the upcoming Cervantes-1 oil exploration well in the Perth Basin.

Market Cap: $38.1m

While Pilot Energy has been blazing a trail on the renewables front, the company also has a stake in the operating Cliff Head oil field in the Perth Basin where operator Triangle Energy has flagged the potential to boost production.

This will be achieved through a three-well program that is aimed at increasing production up to 3,000 barrels per day while extending field life beyond 2030.

Market Cap: $44.9m

Red Sky recently confirmed that the wellbore at its Killanoola SE-1 well in South Australia’s Penola Trough is clear, paving the way for the installation of a wellhead, wireline perforation works and well testing.

Should the wireline perforation of the 16m of potential pay at SE-1 work, it is expected to increase oil production rates significantly.

Prior to the discovery of potential pay at SE-1, the Killanoola-1 well had flowed oil at a rate of up to 300 barrels per day.

Market Cap: $354.1m

Strike has just delivered a 300 petajoule resource for the West Erregulla gas field in the Perth Basin that was the subject of a successful appraisal drilling program.

Notably, this resource is hosted within the primary target Kingia Sandstone and the company believes that up to 128 petajoules could be present in other formations such as the High Cliff and Wagina/Dongara sandstones.

Construction of the upstream and midstream processing facilities is expected to commence in the second half of 2022 once final investment decisions are made and regulatory approvals are received.

Strike is also poised to drill the Walyering-5 well with Talon.

Market Cap: $65m

As noted above, Talon is participating in the promising Walyering-5 gas well that targets up to 38.7 billion cubic feet of gas and 0.98 million barrels of condensate.

The oil and gas company has also acquired the Condor prospect that could have the potential to host up to 10 times the gas resources at Walyering and the right of refusal over the Ocean Hill gas discoveries.

Market Cap: $63.6m

Vintage is the operator of the Vali and Odin gas fields as well as the Cervantes-1 exploration well that Metgasco has interests in.

The latter targets a gross prospective resource of about 15.3 million barrels of oil.

At Stockhead we tell it like it is. While ADX Energy and Metgasco are Stockhead advertisers, they did not sponsor this article.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.