PETER STRACHAN: Gas prices outperformed oil in the December slump – can it flow into ’24?

Picture: Getty Images

Australian domestic gas prices have risen over the past decade.

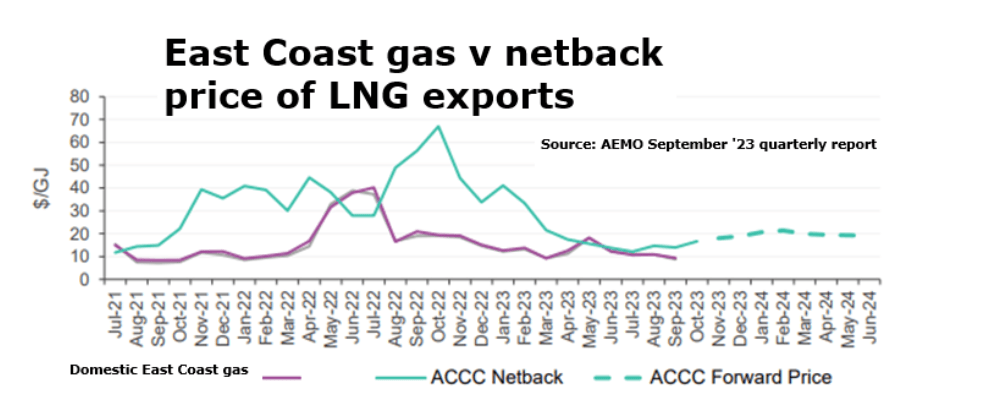

While $4/GJ was common in 2012, the East Coast price lifted to an average of $17/GJ in 2022/23 and wholesale gas prices have since declined from record levels a year ago to average $10.41 per gigajoule (GJ) for the September ’23 quarter of 2023.

Forward pricing indicates local gas prices will stay in a $10 to $20/GJ range on the East Coast and a similar pattern can be seen in Western Australia where the spot gas price has lifted from around $4 to over $10/GJ over the past four years.

International gas prices are largely driven by the spot trade of liquefied natural gas (LNG) while long term contracts are linked to the price of a barrel of crude oil.

In recent times, the LNG trade has been driven by regional events, including natural and manmade disasters. Gas prices lifted during the Covid pandemic and spiked after Russia’s invasion of Ukraine.

Asian LNG presently trades around A$25/GJ while European wholesale LNG pricing is ~A$21/GJ.

Given restrictions on the sale of Russian gas, wars in the Middle East and Ukraine as well as underinvestment in new gas supply, the outlook for gas pricing over the medium to long term remains very supportive of new project development.

Gas is not only used for power generation. It is used in making nitrogen-based fertilisers, plastics, and many other furnace, kiln and boiler uses along with industrial applications as well as for heating and cooking.

ASX listed gas producers and project developers

Perth based, European gas and oil producer ADX Energy (ASX:ADX) has embarked on a fully funded, four-well oil and gas development and exploration programme on projects in Austria, set to unfold through 2024.

The first of two development and appraisal wells at its Anshof oilfield appears to have progressed as planned.

While many wells can get stuck or face other drilling difficulties when completing a tricky high angled well, the Anshof-2 well has so far met with technical success. The target reservoir zone was intersected at a shallower depth than expected, suggesting that the sandstone reservoir may hold more oil than the 5.2 million barrels that had been estimated if everything else falls into place.

In addition, there does not appear to be any water found so far and unexpected gas readings while drilling through the underlying structure could also provide support for production from the 50-60% held project, which aims to lift oil production to over 1,000 BOPD by late 2024.

The market is waiting for the drill rig to move from Anshof onto its Welchau gas exploration project in January 2024. This well will target a Best Prospective Resource of over 800 BCFe of gas and condensate in which ADX will retain an 80% working interest.

In the light of high European gas prices and recent trade in undeveloped gas in the Perth Basin at A$2/GJ, discovery here would be a gamechanger for a company with a market capitalisation of $41 million.

A third development well drilled will be added at the Anshof oilfield mid-year ’24, followed by drilling a Greenfields gas target, adjacent to an analogue producing field, where 39 BCF of gas has been estimated.

ADX has attracted a farm-in partner who will effectively cover the cost of drilling for this final well to earn a 50% interest. Plenty of market moving action.

Botswana focused, Botala Energy (ASX:BTE) is busy establishing a five-well pilot gas development at its 70% held, Serowe coal seam gas field in Botswana, where a net 222 BCF of Contingent gas Resource has been estimated and a Prospective net Resource of 5.6 Tcfg of gas is yet to be established.

Gas flow rate testing during 2024 aims to confirm commercial viability, leading to commercial power production for local requirements and a potential 20MW hybrid, solar/gas power plant linked into Botswana’s national power grid.

In August 2023, Queensland Pacific Metals (ASX:QPM) added to its plans to develop a nickel-cobalt sulphate/energy metals project near Townsville, with the synergistic Moranbah coalbed methane project.

Moranbah is presently turning around 27TJ/day of gas into power at the Townsville Power Station, but QPM may have other uses for that gas if its $2.1 billion TECH project makes headway and can use the gas.

The company aims to drain methane from third party coal mines to capture waste gas and improve environmental credentials and safety for miners.

QPM was paid $35 million by the project’s vendors as compensation for acquiring associated obligations to deliver gas from the 240 PJ Moranbah project.

QPM is rehabilitating wells and working with nearby coal miners to capture waste gas, which is currently being flared, while planning for more wells and looking for opportunity to apply its gas to other value adding opportunities around Townsville.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.