Is it time to invest in some unpopular sectors? This expert says yes

Pic: DKosig / iStock / Getty Images Plus via Getty Images

The principle behind building a diverse portfolio is simple — allocate investments across various markets, financial instruments, and industries to reduce risk.

In theory, long-term returns can be maximised by investing in different areas that react differently to the same event.

But what maximises long-term returns isn’t the diversification of the assets per se, as much as it is the successful diversification in underlying sentiment, writes Financial Insyghts president Peter Atwater.

“It is the ‘confidence diversification’ that matters,” he says.

“A well-diversified portfolio is made up of low and high demand assets reflecting a mix of falling confidence, rising confidence, euphoria, and hopelessness.

“Looking at valuations and investor behaviour today, what I observe is extreme confidence not only in stocks and bonds, but in real estate, private equity, and most of the other asset classes making up most ‘diversified’ portfolios.”

Right now, investor sentiment is high almost everywhere.

That means most portfolios are now comprised almost entirely of assets with extremely high sentiment, devoid of assets where there is low sentiment, let alone hopelessness.

“Put simply, when it comes to mood, every slice of the pie is now piping hot,” Atwater says.

“Portfolios that investors believe are well-diversified aren’t. They are highly concentrated in one mood: euphoria.”

What happens if the bubble pops?

Given the collective extreme in confidence, if sentiment drops, it is likely that all asset prices will fall sharply in unison, Atwater says.

“Investors won’t reap the benefits of diversification they believe they have in their portfolios,” he says.

“Rather than spending time focusing on whether there will be inflation or deflation ahead, I would encourage investors to think about the confidence diversification of their portfolios.

“Where, for example, is there a sense of hopelessness – in an asset, in a market, in an industry?”

Where are the low confidence sectors?

It’s been a very discouraging year thus far for gold, one of the poorest performers amongst the commodities cohort.

Gold is an uncorrelated asset – value not tied to larger fluctuations in the traditional markets – often used to hedge risk.

In a time of broader investor euphoria, boutique investment advisory firm head Frank Holmes says gold is the “ultimate contrarian investment”.

Contrarian investors purposefully go against prevailing market trends by selling when others are buying and buying when others are selling.

The theory is that markets are subject to “herding behaviour” amplified by fear and greed, making markets regularly over- and under-priced.

Right now, gold – and gold stocks, by extension — are under-priced, Holmes says.

Despite a good run-up towards end of last year on various regulatory tailwinds, marijuana stocks have significantly underperformed the broader equity market over the past year.

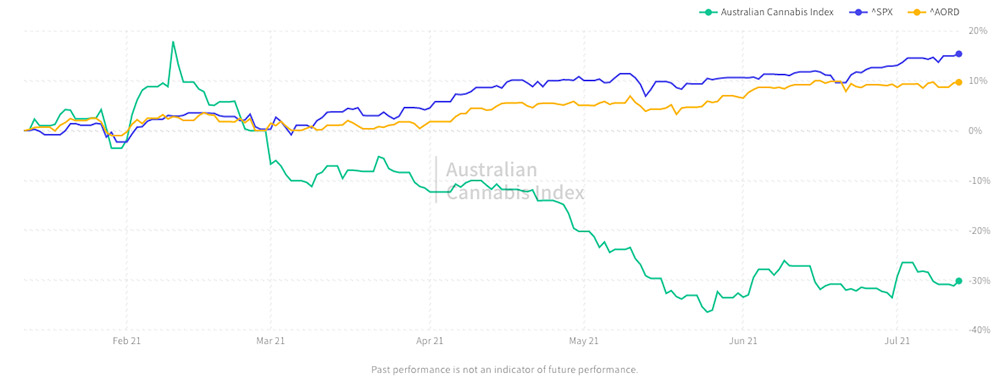

Just look how the Australian Cannabis Index – representing the overall publicly-traded market for the cannabis sector in Australia – has performed against the S&P 500 and the All Ords in 2021:

A chart that speaks louder than words.

It goes without saying that travel and tourism stocks have been hard hit by the COVID pandemic.

After a good start to 2021, the travel and tourism sector on the ASX crashed back to earth as jurisdictions – both local and international — struggle with new variants and their respective vaccine rollout.

ASX investors appear to have written off the sector, but there are plenty of believers out there.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.