Can ASX cannabis stocks keep running with the bulls in 2021?

ASX cannabis stocks are up and about. We asked investor Mark Bernberg whether he thinks the current rally has legs. (Pic: Getty)

ASX cannabis stocks have gone running with the bulls to close out the year.

Like many things cannabis-related, recent momentum has been supported in part by new regulatory developments.

Investors now have to make a judgment call — does this mark the dawn of a new era, or do ASX pot stocks still have more work to do to prove out their business models?

For Mark Bernberg – cannabis investor and CEO of news and research site The Green Fund – it’s still more of the latter.

Speaking with Stockhead earlier this week, Bernberg provided some insights that help put the recent rally into context.

Follow the leader

Compared to the US and Canada, Bernberg observed the ASX is still a “relatively nascent market”.

In turn, local stocks often follow their lead which can be both good (see: the Q4 rally) and bad (see: the 2019 ‘cannabis winter’).

But for Bernberg, it also means the mini bull-run for ASX pot stocks can’t really be attributed to a change in business fundamentals.

“I think you’re seeing a lot of hype, and it’s largely driven by what’s going on in the international markets,” he said.

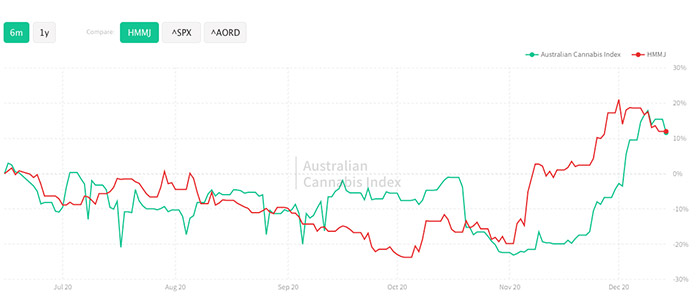

For evidence, he cited the Green Fund’s Australian Cannabis Index – a benchmarking tool comprised of 16 ASX pot stocks which meet key criteria around market cap and daily trading volume.

On a six-month basis, here’s how the ACI has tracked the Horizons MLS ETF (the world’s first marijuana ETF which trades on the TSX):

“If you look at global activity, there’s now a legitimate conversation around cannabis legalisation in the US at the federal level, and I do think the UN reclassification has helped open the door for that,” Bernberg says.

The US House of Representatives has voted in favour of a bill to decriminalise pot (although its passage through the Senate will be difficult).

But while only five (of 163) Republican lawmakers approved the bill, a Morning Consult-Politico survey earlier this month showed 51 per cent of Republican voters were in support of it.

“My portfolio is heavily weighted towards the US,” Bernberg says.

“It’s the biggest possible cannabis market in the world that’s on the precipice of opening up, and when it does the hype will drive big gains on some stocks.”

“Some Australian stocks will come riding with that, but I don’t think it will be the case that fundamentals have changed — enthusiasm has changed.”

Barriers to entry

Back on the ASX, cannabidiol (CBD) is still the order of the day. Federal cannabis legalisation is still a long way off on these shores.

Yesterday, the TGA confirmed that it will down-schedule low-dose CBD products for distribution through pharmacies.

After delaying its November decision, the final ruling included an expanded daily dose maximum in packaging rules of 150mg/day (up from 60mg).

However, Bernberg said the onus will still be on ASX cannabis stocks to prove they have a differentiated product.

“You need to look at where the precedents have played out with major CBD producers overseas – Charlotte’s Web, CB Sciences, even Elixinol at one point were all really big,” he says.

“And they’ve been hammered because CBD is very easy to come by.”

“If you and I wanted to start a CBD company, we could go straight to Mile High Labs in Colorado and ask for a supply of concentrate. All we have to do is come up with packaging and a name.”

“So there’s low barriers, and no serious clinical studies to be able to prove something and create brand recognition.”

“Everyone in Canada and the US has a different CBD product. Everyone in Australia does too, so tell me — how do you create brand awareness when there’s no proprietary formulations?”

Pot capital of the world

Looking at the market in that global context, Bernberg said that ties in with his preference for the US over ASX cannabis stocks right now.

And he’s more bullish about the prospects for THC products amid renewed momentum for cannabis legalisation, as opposed to CBD products.

“If you look at the US market from a macro perspective and try to highlight the growth areas, I think they will be in recreational cannabis,” he said.

“Then it’s a process of asking — who are the dominant multi-state operators that have a larger share of the big markets?”

On that front, Bernberg highlighted four companies — Cresco Labs, Curaleaf, Green Thumb Industries, and Trulieve Cannabis.

All four have operations in the US and are listed on the Canadian Securities Exchange.

What separates those stocks from the pack? “Two things,” Bernberg says.

“The first is amount of cash in the bank. They are well cashed up, with a share price moving in right direction so when they do raise capital, it’s at a higher price,” he said.

He also cited positive trends around operating margins – an important metric for cannabis companies which have a tendency to burn through cash.

“While they’re still not profitable yet they’re getting very close. That tells me they’re creating operational efficiencies, their companies are well run and they’ve finally worked out how to create economies of scale across multiple states.”

Bernberg said that at a broader level, US cannabis legalisation will be the main game for investors over the next 12-18 months.

“What excites me in the US with the recreational opportunity is 1. the market itself is so big, and 2. the rising tide from legalisation will help drive share prices higher anyway.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.