Innovation never sleeps: Franklin Templeton says watch these 5 big tech shifts this quarter

Picture: Getty Images

- Franklin Templeton says innovation accelerates despite recessions, pandemic, wars

- Expect advancements in sectors like gene therapy and augmented reality in healthcare

- New ways to grab our attention are reinventing the media industry

Franklin Equity Group portfolio manager Matthew Moberg says that innovation continues to accelerate, despite recessions, war, pandemics and inflation.

“Each advancement supports our belief that our ability to manipulate data, material and organisms (byte, atom, and gene) at their basic forms will create profound advancements in the economy,” he said.

“Innovation can fall out of favour with investors, but the underlying progress continues relentlessly.”

In fact, Moberg has listed five advancements for this quarter to check out.

1. Gene therapy approvals accelerating

On August 17, 2022, the US Food and Drug Administration (FDA) unanimously approved its third gene therapy drug, and eight days later on August 25, the European Union (EU) approved its fourth.

The therapy approved by the FDA treats Beta-thalassemia, an inherited blood disease that leads to insufficient oxygen in the body and consists of just a single curative dose for patients.

“The results of the drug are stunning; in some studies, up to 91% of patients became blood transfusion independent,” Moberg said.

Also on the blood disease spectrum, the EU approved a separate gene therapy treatment for hemophilia, a condition that prevents blood from clotting.

“This is the second gene therapy the EU approved this year,” Moberg says.

“The US and EU approvals should advance the adoption of genomic therapeutics and may help spur funding for research and manufacturing in the space.”

ASX gene therapy players

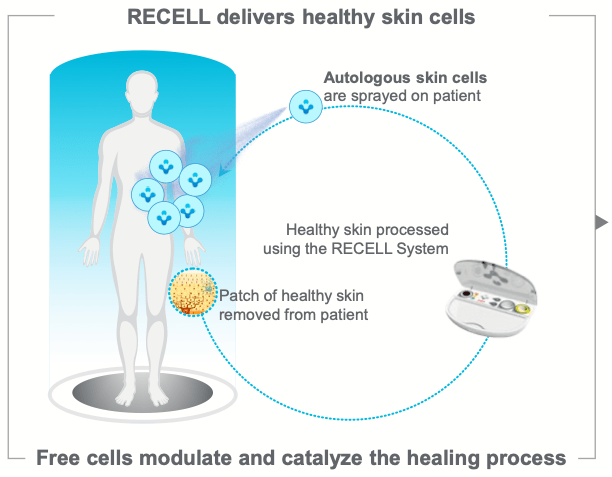

On the ASX, biotechs that have gene therapy programs include Avita Medical (ASX:AVH), which just last month announced its partner, COSMOTEC, also an M3 Group company, received insurance coverage in Japan for Avita’s RECELL System for the treatment of acute burns.

The RECELL System is used to prepare a spray-on using a small amount of a patient’s own skin to treat severe burn. COSMOTEC will now launch and promote RECELL in the Japanese market.

This comes after results from pivotal trial evaluating the safety and effectiveness of Avita’s RECELL System in patients with soft-tissue injuries in August showed healing with RECELL were the same or just slightly better than control.

Regarless the company is moving forward with its plan for a PMA (pre-market approval) submission with the FDA later this year.

Here’s how the RECELL therapy works:

Another Aussie company in the space is Osteopore (ASX:OSX), which – as the name suggests – is focused on bones.

Last month the company received US$360,000 in non-dilutive grant funding from the Government of Chile’s Scientific and Technological Development Support Fund (FONDEF) which provided US$225k, and the University of Chile which provided US$135k toward developing a novel 3D-printable implant that accelerates bone regeneration.

If successful, it would be a world-first breakthrough and would be incorporated into Osteopore’s implants to stimulate cell and tissue growth.

And if you’re in need of soft tissue regeneration, Aroa Biosurgery (ASX:ARX) has you covered.

It’s proprietary extracellular matrix (ECM) biomaterial is manufactured from the ovine (sheep) forestomach tissue, sourced exclusively from New Zealand pasture-raised animals, and basically provides a scaffold for tissue regeneration.

ECM also contains residual vascular channels that facilitate the rapid establishment of a dense capillary network by supporting migrating endothelial cells to establish new vasculature and a robust blood supply to help build new tissue.

2. Augmented reality used during surgery

Moberg also flagged augmented reality (AR) as high on his list in the medical sphere.

Johns Hopkins University performed its first augmented reality surgery in live patients this year, with the surgeons wearing headsets that allowed them to superimpose medical scans on their patients to perform spinal surgery.

“When using augmented reality in the operating room, it’s like having a GPS navigator in front of your eyes in a natural way so you don’t have to look at a separate screen to see your patient’s CT scan,” Johns Hopkins Neurosurgery Spinal Fusion Laboratory director, Johns Hopkins University School of Medicine professor and the doctor who performed the surgery Dr Timothy Witham said.

Since then, doctors utilised the same system in over 2,000 surgeries, demonstrating the high accuracy of augmented reality assistance to place screws in vertebrae while reducing spinal damage.

“Augmented reality and virtual reality have applications far beyond video games and the metaverse,” Moberg says.

“This particular medical application can reduce time, increase accuracy and improve outcomes in multiple surgical scenarios.”

Slim pickings for AR stocks on the ASX

There’s really only one player in this space on the ASX and that’s Vection Technologies (ASX:VR1).

In May last year, VR1 completed the first milestone as part of its public hospital trial to integrate XR-technology integration within the Italian public healthcare sector with the Luiss Business School.

The solution has enabled surgeons to visualise in their field of view (hand-free), in AR, all the data necessary for the surgery, including diagnostic images, surgery checklist, endoscopic video-feed, and more.

The company also has an established healthcare and pharma division – Vection Health – and confident it has first mover advantage in the sector.

AVH, OSX, ARX and VR1 share prices today:

3. Genetic engineering to enhance crop yields

Moberg is also excited by genetic engineering in Agriculture, specifically pointing to scientists in Indiana who have modified the genetics of plant leaves to optimise photosynthesis, increasing soybean yields by 24.5% on average.

“This technology could be applied to other multilayered plants like rice, wheat and corn,” he said.

“This new research defies previous expectations that improving soil nutrient uptake is the only way to raise crop yields.

“This advancement illustrates how crops can improve beyond pest and drought tolerance. “Novel genetically engineered seeds can represent a key solution to feeding a larger global population with less environmental impact and less water usage.”

Plus, with hectic flooding events around the world and in our eastern states, optimising agricultural production is front of mind at the moment – especially when you add in consumers already feeling the rising cost of living at the supermarket.

Aussie players in the agritech sector

While we don’t have any genetic crop engineers on the ASX, we have a few companies that help on the plant nutrition side like freshly listed RLF Agtech (ASX:RLF) with a Plant Proton Delivery (PPD) technology that aims to solve some of the world’s biggest agricultural, environmental, and human challenges and enables farmers to grow higher yielding, better quality, and more nutritious produce, while massively reducing atmospheric carbon.

The company has also released a Veridium Seed Priming Technology which it says is primed to increase sales by increasing farm yields and ROI.

Essentially the tech delivers plant-available nutrition directly to the seed, improving soil moisture and fertiliser uptake.

And the company says trials have shown large gains in wheat, maize (corn) and rice over and above existing technology.

There’s also Roots Sustainable Agricultural Technologies’ (ASX:ROO) HEPS (heat exchange probes) that cool the root zone temperature of plants and keep them at optimal range year-round.

RLF and ROO share prices today:

4. US Inflation Reduction Act a boost for green energy

Another innovation accelerator is a good old-fashioned shock, Franklin Templeton reckons.

“This summer in Europe, energy prices in some regions increased more than 5–6 times versus the previous year, and energy prices in the United States have also increased,” Moberg notes.

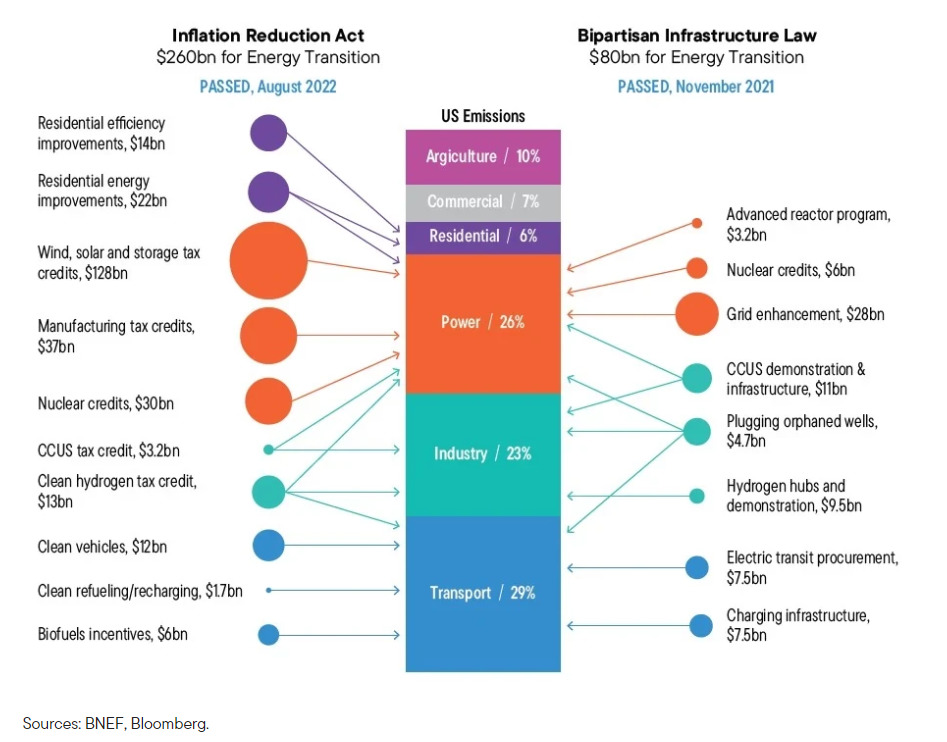

“In the United States, the IRA, signed into law in August, injects US$369 billion into green energy, on top of the US$80 billion already approved in November 2021.

“As countries strive for energy security, rising prices of legacy fossil fuels coupled with government incentives for renewables should accelerate the buildout of many new energy sources and lead to new investments in grid infrastructure and transportation.”

He also said that high prices, high economic need and significant government support “create positive backdrops for innovation.”

Check out the green energy injection:

Hydrogen and uranium plays on the ASX

Ok there’s a tonne of companies in this space, but to name a few, consider Frontier Energy Ltd (ASX:FHE), developing the Bristol Springs Green Hydrogen Project, located in southwest Western Australia.

A Pre-Feasibility Study has already found that Stage One could power a 36.6MW electrolyser to produce 4.4 million kilograms of green hydrogen per annum at just $2.83/kg – well within reach of the $2/kg price point where the green fuel is considered to be competitive with fossil fuels.

The preliminary front-end engineering and design study (Pre-FEED) for the project is due to be released during the fourth quarter of this calendar year.

There’s also mining giant Fortescue Metals Group (ASX:FMG) which in recent years has kicked off its Fortescue Future Industries (FFI) division.

Here’s that it’s-me-your-best-mate-bajillionaire-Twiggy-chatting-climate-change-over-breakfast-in-my-mansion advert if you need a reminder:

Thank you fossil fuel execs, but the party is over. ♂️ #GreenHydrogen is the zero-carbon fuel of the future. There’s a fortune to be made, and we’re in. Are you? #COP26 #ThePowerOfNow pic.twitter.com/gJ7LhvLRj8

— Fortescue Future Industries (@FortescueFuture) November 10, 2021

Anyway, earlier this month FFI announced a global strategic collaboration with energy infrastructure developer Tree Energy Solutions (TES) which aims to accelerate the development of a green hydrogen and green energy import facility in Germany.

The investment of €130 million (US$127 million) will be funded by FFI’s un-utilised capital commitment and provides FFI with a pathway for access to critical infrastructure to execute its strategy.

The first phase of this partnership is to jointly develop and invest in the supply of 300,000t of green hydrogen with final locations being currently agreed, and a financial investment decision targeted in 2023.

The first delivery of green hydrogen into TES’ terminal in Wilhelmshaven, Germany is anticipated to take place in 2026 and initial collaboration projects will be focused on Australia, Europe, the Middle East and Africa.

There are too many uranium plays to list but a few with recent news include A-Cap Energy (ASX:ACB) which is revitalising the Letlhakane Project in Botswana, host to one of the world’s largest undeveloped uranium deposits.

The company plans to kick off a 3,000m diamond drilling program (PQ) in November.

And another fresh listee Basin Energy (ASX:BSN) has recently identified four high priority uranium targets at its Geikie project in Canada’s Athabasca Basin just a little more than a week after listing on the ASX.

Drill testing of the highest priority targets is expected to commence in the first quarter of 2023.

FHE, FMG, ACB and BSN share prices today:

5. Streaming platforms and TikTok growth

In his final innovation to keep an eye on, Moberg has flagged media – specifically streaming and apps.

US streaming has surpassed cable in viewership for the first time. Platforms like Netflix, Disney, and HBO garnered 34.8% of total viewing hours, cable earned 34.4%, while broadcast television earned 21.6%.

This happened gradually, compared to how quickly TikTok impacted media, Moberg says.

“On average, a streaming subscriber takes 18 minutes to decide what to watch, but a new TikTok starts immediately,” he said.

“This helped TikTok hit one billion active users in half the time of Facebook or YouTube.

“New ways to grab our attention are reinventing the media industry, an industry often on the leading edge of change.”

Not many Aussie streamers and app developers

On the streaming side, there’s News Corp (ASX:NWS) and Telstra (ASX:TLS), share ownership of Foxtel, and Nine Entertainment (ASX:NEC), who owns streaming service Stan.

Looking at ASX players on the app side, there’s Crowd Media (ASX:CM8) – a mobile entertainment and digital media company creates digital platforms, builds mobile products, and works with digital influencers across social media channels.

NWS, TLS, NEC and CM8 share prices today:

At Stockhead we tell it like it is. While Roots Sustainable Agricultural Technologies, Frontier Energy, A-Cap Energy and Basin Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.