Guy on Rocks: What is battered lithium play Vulcan really worth?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Red rage continues

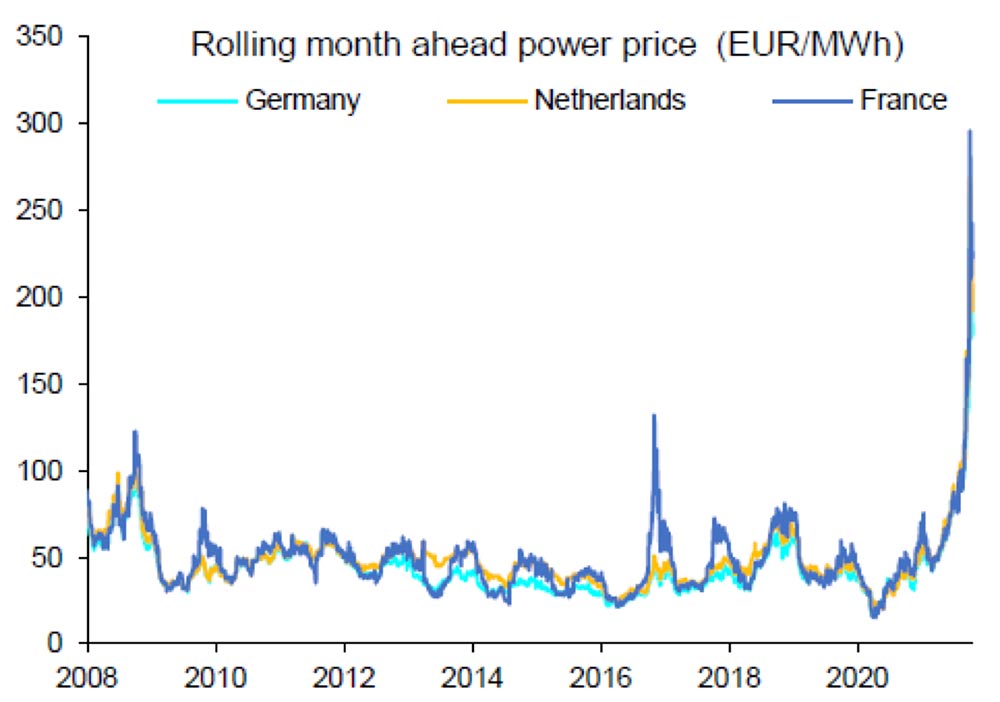

Soaring energy and freight prices in Europe and China (figures 1 and 2) and have the very real potential of supercharging metal prices as smelting costs spiral upwards.

Citi (Citi Research, 29 October 2021) believe that costs for aluminium producers have increased by around $3,000/t since January while zinc smelters are facing cost increases of $890/t and copper smelters/refiners $415/t.

Copper smelters/refiners margins are only just entering negative territory.

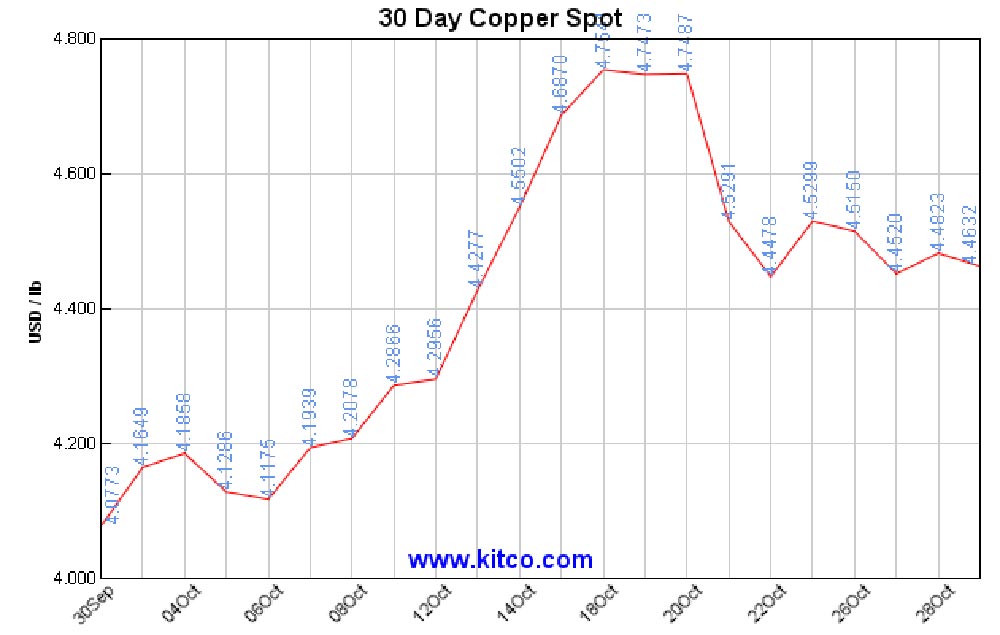

The wild ride for the red metal continued last week with copper setting (figure 3) an intra-day all time high of US$4.74/lb as the short squeeze continues.

This was followed by a breakdown at LME monthly contracts which settle the third week of the month (last Tuesday) with a number of short sellers struggling to deliver to exit and cover bad positions.

Available copper is almost non-existent with 14,500 tonnes under warrant in the LME warehouses versus cancelled warrants sold and scheduled to move out of warehouses totalling 181,000 tonnes.

The big players in this space, who will remain nameless, are allegedly moving the copper out to customers (or hoarding it perhaps?).

Furthermore, refined copper imports were down 27% in China this year with China releasing stockpiles in an attempt to ease the recent price spikes in copper.

With only five new mines scheduled to come on-line next year (one in the DRC, one in Peru, two in Chile and one in Russia) I am not confident the supply side is going to improve.

Note these jurisdictions have been making headlines in this column over 2021 for all the wrong reasons.

The copper development pipeline (after de-risking >250 projects) through to 2030 looks abysmal.

Lobo Tiggre of The Independent Speculator considers it is ”one of the most solid bull cases. And even if the commodity super cycle does roll over, I could see copper keep on going,”.

He further pointed out that “It takes 10 years for [mines] to come online. And even once you line up the financing, the permits, and all that other stuff … it still takes five years for these big copper mines to come online.”

I think he is right on the money and the Stockhead faithful will also be interested in his views on gold.

“At some point, they will wake up and smell the financial napalm. I don’t think that can be very far off in the future. Gold has been responding more to the dollar. I think we go back to seeing it respond more directly to interest rates and CPI”.

As Micky Fulp (Mercenary Geologist on Kitco News) pointed out, the reason the CPI was “sanitised” in the US (i.e. many items were removed) was an attempt to hide real inflation, which he considers is closer to 15%, however the Biden dollars (i.e. welfare) in the US are linked to CPI so having a lower (misleading) number appears to suit the US administration.

Last week, the US third-quarter employment cost index report showed a rise of 1.3%, (consensus was 0.9%), with CPI up 4.4%, year-on-year.

The Euro zone also reported its October consumer price index at up 4.1%, year-on-year (highest since 2008), compared to a 3.4% in the September report.

Another metal feeling the pinch is magnesium (recently posting all-time highs of 71,250 Yuan or USD$11,400/t-figure 5) whose lightweight and strengthening properties make it essential for aluminium alloys (e.g. sheet used in autos, beverage cans).

It is also used for diecasting auto parts, as a desulphurising agent in steel, to make ductile iron, in chemicals and other applications.

Chinese smelters are currently at 40% utilisation rates and with China accounting for 87% of world supply, this will have significant flow on effects autos, aerospace, iron/steel, chemicals, beverage cans and consumer goods.

Company News

A rough week for aspiring lithium producer Vulcan Energy Resources (ASX:VUL) (figure 6) that saw its share price belted from over $16 to close at $10.81 following a report from research house J Capital.

VUL is claiming to be the world-first lithium hydroxide monohydrate chemical product with zero carbon footprint, from their geothermal lithium brine project in the Upper Rhine Valley, Germany.

J Capital have arrived like a low flying bomber and are having a swing at a number of key assumptions (such as flow rates) with VUL responses being somewhat inconclusive if you believe the market reaction.

The project boasts some impressive financial metrics such as a post-tax NPV of $3.4 billion, however I think one needs to be a little cautious about companies trading at enormous valuations ($1.4 billion market capitalisation) that are unfunded through to production and, more importantly, are yet to complete a definitive feasibility study (DFS).

This is when we get a much better idea as to what the real costs and associated risks are likely to be.

As a rule of thumb, I think it is possible to assign a value of 20% of the unrisked post-tax net present value of a project which sits in the medium risk range (as far as technical and market risk is concerned).

I would place this in the higher risk category but, applying this approach, a market capitalisation in the range of say $700 million or could be justified.

Assuming this is correct I would estimate a possible value around $5-6/share which leaves plenty of downside.

Given the hefty CAPEX figures of €226m for the geothermal wells and plant, and €474m for Direct Lithium Extraction (DLE) plants and Central Lithium Plant (CLP), I am being a little generous on applying a 20% discount to NPV.

As we have seen in the past (e.g. Quintis), once the sell recommendations start coming over the hill it can be hard to stop the momentum. This is particularly so when the research is correct, or even correct for the wrong reasons.

New Ideas

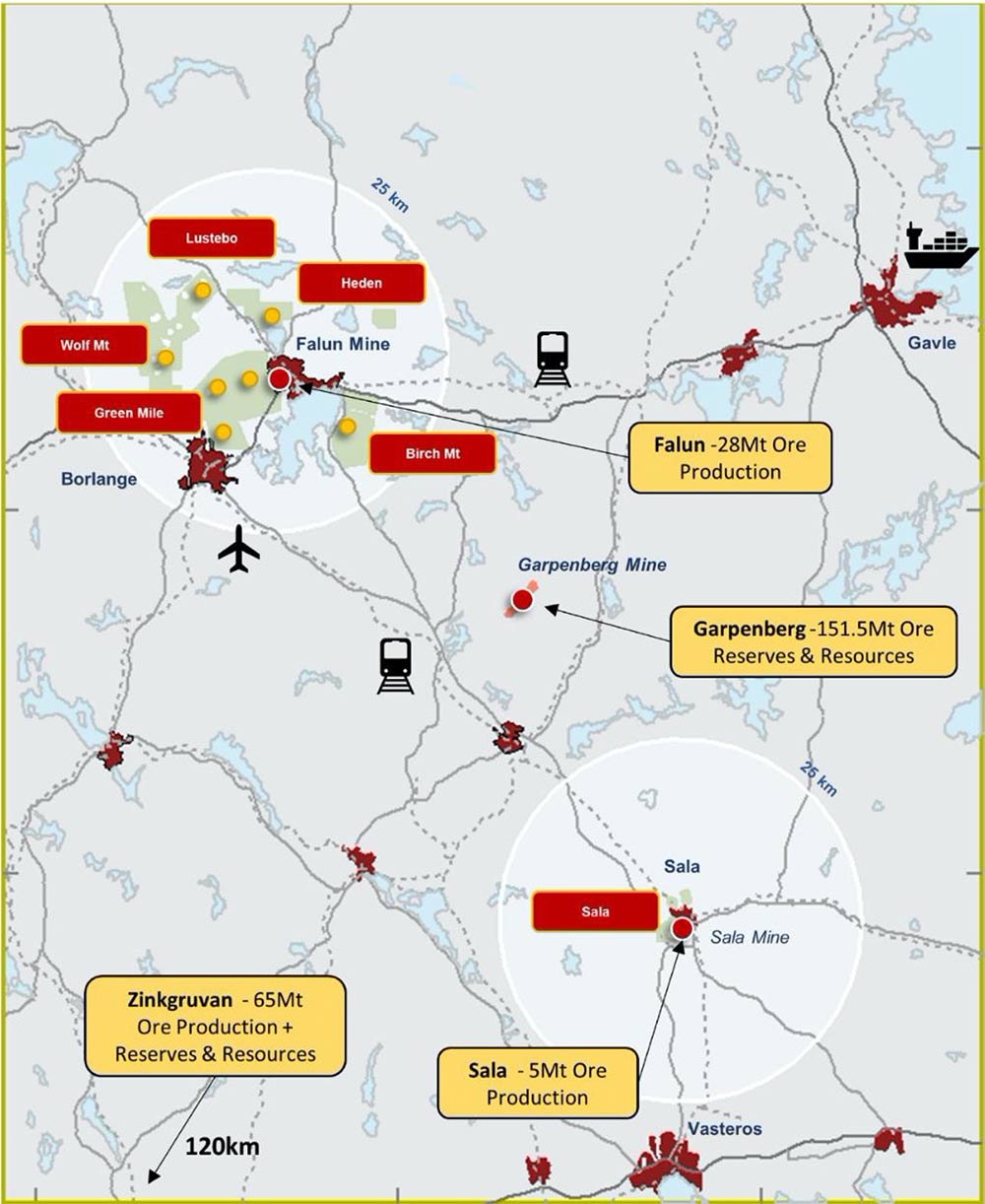

I first covered Alicanto Minerals (ASX:AQI) (figure 7) in June last year when the stock was trading around 5-6 cents.

Their September Quarterly was considered by the company to be “transformational” and who could blame them?

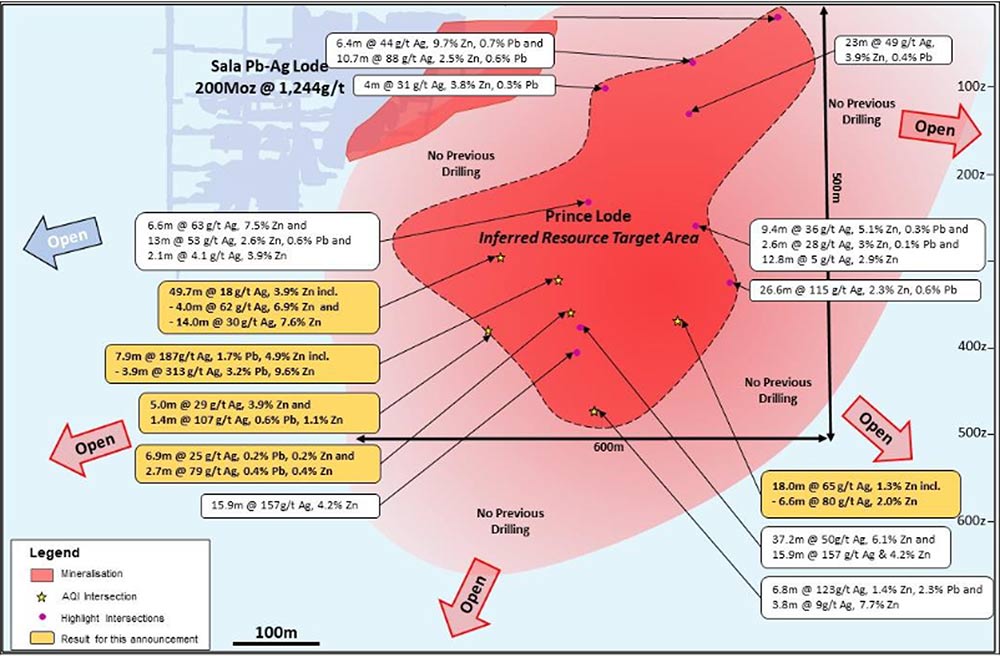

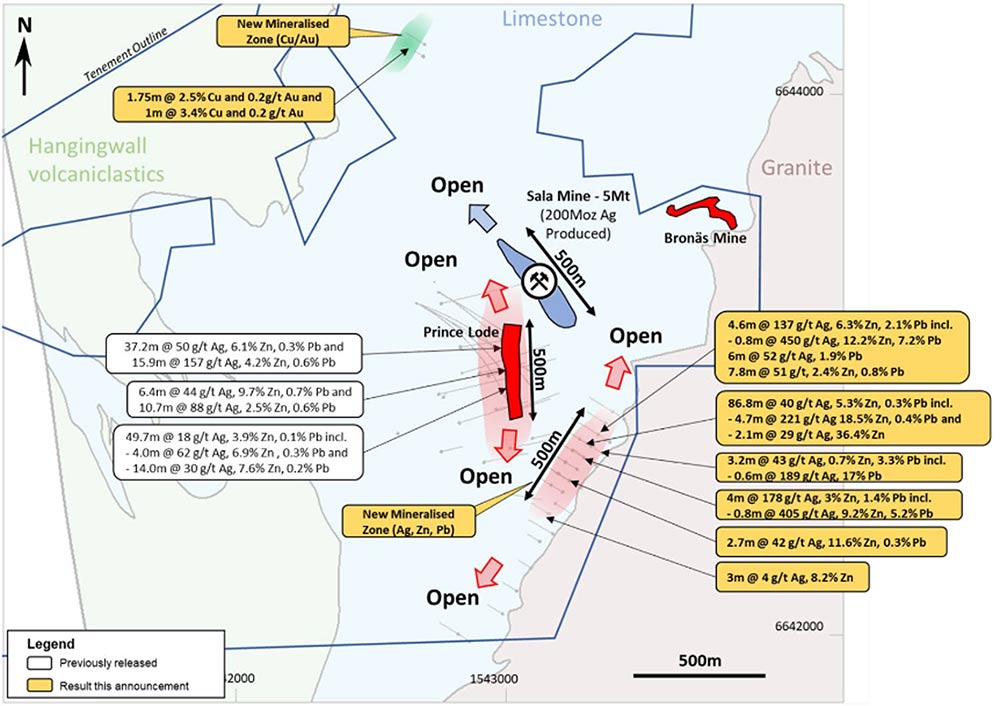

The drilling at the Sala silver-zinc-lead project in Sweden (previous production of 200Moz of silver to 290m depth – figure 8, 9) has turned up numerous high-grade intersections in this skarn deposit with a maiden JORC resource due in 1Q 2021. A 14,000m diamond program is ongoing.

Better results from the Prince Lode (figure 8) included:

SAL2101

- 8m @ 7.7% Zn and 9g/t Ag from 572.75m downhole

- 8m @ 123 g/t Ag, 2.3% Pb and 1.4% Zn from 589.75m downhole

SAL2102

- 9m @ 25 g/t Ag, 0.2% Pb and 1.8% Zn from 499.8m downhole

- 7m @ 79 g/t Ag, 0.4% Pb and 0.4% Zn from 645.1m.

SAL2103

- 0m @ 187g/t Ag, 1.7% Pb and 4.9% Zn from 486.downhole

The company has compared these high-grades (in-particular zinc) to other world class deposits such as Boliden’s nearby Garpenberg mine, only 50km from Sala.

The team is led by Stephen Parsons who has enjoyed recent success with ASX listed Bellevue Gold Ltd (ASX:BGL) along with fellow BGL faithful Ray Shorrocks and Michael Naylor.

Readers will recall I did work there in the late 1980s but was clearly asleep at the wheel.

The project is ripe for modern exploration techniques and remains open to the north and south (figure 10).

Sweden is one of the more accommodating mining jurisdictions in Europe and this mining district is known to host giant polymetallic deposits.

With zinc trading at US$1.55/lb and the price outlook robust, AQI, at an enterprise value of just under $50 million, represents good exposure to further exploration success as well as an upcoming maiden JORC Resource sometime in 2022.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.