‘A fantastic asset’: Why Ray Shorrocks joined the board of Alicanto Minerals

Pic: Tyler Stableford / Stone via Getty Images

Special Report: In early August, renowned company maker Ray Shorrocks joined the board of Alicanto Minerals (ASX:AQI). People are already calling this copper-gold explorer ‘Auteco Mark 2’ or ‘Bellevue Mark 3’.

In 2016, tiny explorer Bellevue Gold (ASX:BGL) — then Draig Resources — acquired Bellevue, a historic WA gold project that was very much viewed as ‘old and tired’.

Driving the deal was chairman Ray Shorrocks, an investment banker of 30 years.

Since then, Bellevue has defined 2.2 million ounces (moz) grading 11.3 grams per tonne (g/t) gold — making it one of the fastest and highest-grade gold discoveries in the world.

The company’s share price has exploded since the start of 2017, from 2.2c to over $1 per share.

That’s a gain of about 4,900 per cent.

Shorrocks, whose expertise “is very much focused on exploration”, left the Bellevue board last year as it moved into the development phase.

He then became executive chairman of former vanadium-titanium explorer Auteco Minerals (ASX:AUT), which caught a rocket after buying a historic gold project earlier this year.

The project in question is Pickle Crow, one of Canada’s highest-grade historical gold mines which produced 1.5 million ounces of gold at a grade of 16g/t until 1966.

Auteco is currently up +2000 per cent in 2020.

Shorrocks is also chairman of Galilee Energy (ASX:GLL), and, most recently, Alicanto Minerals.

All of Shorrocks’ companies have a common thread – they own high quality, overlooked assets once held by the majors.

“I live for big companies making stupid decisions,” he says.

“In Bellevue’s case, there was a litany of major companies but the final one was Xstrata, which sold that asset incredibly cheaply when they decided to exit Australia.

“Auteco’s Pickle Crow was the best performing gold mine in Canada between 1935 and 1966. It stopped only because the gold price hit $35/oz – not because it had run out of mineralisation.

“The same applies to Galilee Energy up in Queensland, which was previously owned by AGL.

“That leads me to what attracts me to Alicanto, and why I am so excited about this company.”

Cracking the code at Greater Falun

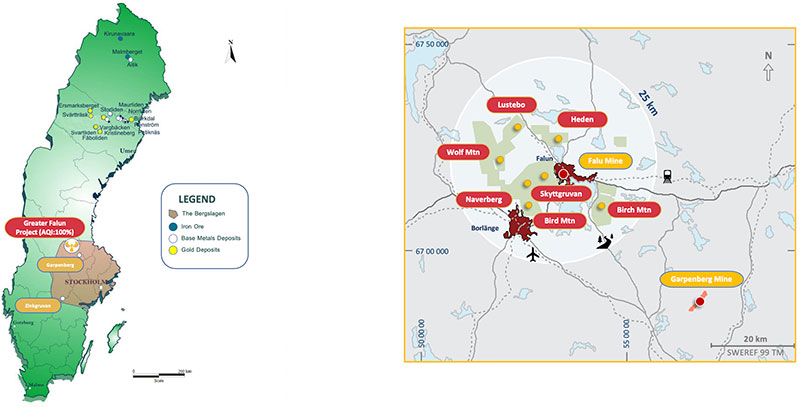

Acquired earlier this year, Alicanto’s Greater Falun project is located in Sweden’s mineral-rich — but historically misunderstood — Bergslagen district.

Close by is the 28-million-tonne Falun deposit, which was mined over 1,000 years at some pretty phenomenal grades until the 1990s.

Like Bellevue, the major miners have overlooked this area because they misunderstood the geology.

When Alicanto first acquired Greater Falun, the company believed that some of the traditional understandings of the region were not 100 per cent accurate.

A common belief was that the large Garpenberg and Falun mines (below right) were standard VMS (Volcanogenic Massive Sulphides):

VMS deposits — rich in base and precious metals like copper, zinc, lead, gold and silver – tend to ‘cluster’ together, which means they can be mined for a long time.

But Alicanto realised they were dealing with something completely different following a very successful drilling campaign at the Wolf Mountain prospect in January/February this year.

“We actually discovered copper skarn mineralisation,” Alicanto managing director Peter George says.

“That blew our socks off — copper skarn mineralisation had never been seen in the Bergslagen, one of the most mineral-rich places on earth.”

These massive Copper-Gold Skarn targets had been completely missed by previous exploration.

“Once we discovered Copper-Gold Skarn at Wolf Mountain earlier this year, we went and pegged a few other prospective areas, and actually found more copper skarn at our Lustebo target and at surface at the Heden target. I’m confident we are going to find it in other areas as well now we know what we are looking for.

This is really what is going to be driving our drilling campaign starting September.”

This upcoming +4,000m campaign is the first focused drilling campaign in the Greater Falun Project, ever.

Alicanto is ‘looking for the big one’

The optionality at Greater Falun Project is fantastic, George says – we are looking for at least 20 million tonnes of high-grade copper-gold skarn to justify a centrally located processing facility.

“We have between 10 and 15 targets now and likely more to come, and each of these targets could be another Falun in their own right,” he says.

“The surface has barely been scratched here.

“Now we are putting together all the pieces of the puzzle – remember, we have only been working on this seriously since January – the whole thing is starting to open up like a Pandoras Box. Very exciting.”

Shorrocks says people are already calling Alicanto ‘Bellevue Mark 3’ or ‘Auteco Mark 2’.

“I guarantee I would not have joined this board if we were chasing 200,000oz deposits,” he says. “We are looking for the high-grade, big tonnage stuff here.

“We have the project, we have size, we are spoilt for choice of targets, and I have the team to make sure it actually happens.

“In my view, Alicanto could be a mining industry ‘unicorn’. Watch this space.”

This story was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.