Guy on Rocks: This platinum group metals stock represents ‘value for money’

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

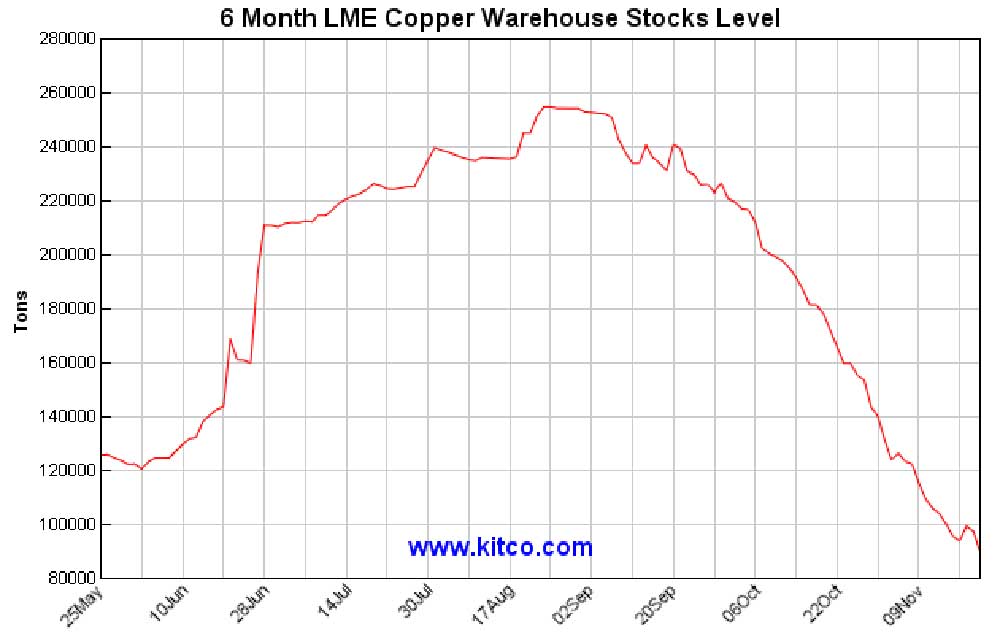

The copper market continues its wild ride with China copper premiums reaching seven-year highs on dwindling stocks (figure 1) and the imposition of a VAT on copper imports.

Copper was trading just above US$4.44/lb at the open on Tuesday.

Copper 3-month backwardation spreads have collapsed down from a record US$0.50 to 0.70 cents however the cash premium in Shanghai is currently US$120/tonne on fears surrounding refined exports going to LME warehouses.

There is no sign of copper volatility abating particularly in the light of rampant inflation.

The slow-moving trainwreck otherwise known as the Federal Reserve continues to calm the nerves of the great unwashed with the reappointment in February 2022 of Chairman Jerome “steady as—it-goes” Powell (who has been doing the job of two men, Laurel and Hardy) to another term.

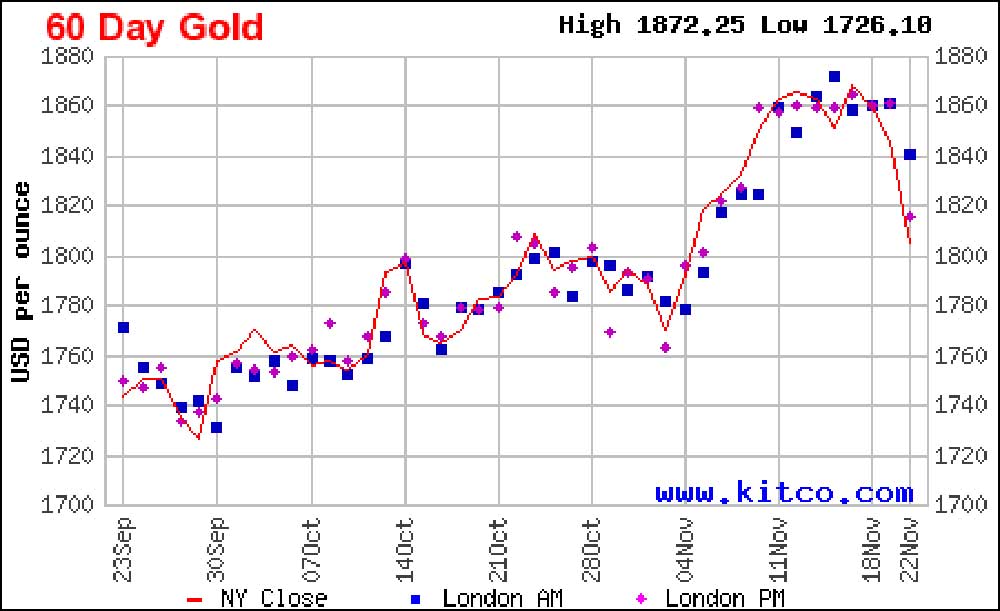

For some reason the broader market saw this as a positive resulting in a sell off in the precious metals sector with gold retreating to US$1,785 (down over US$19/oz in trading on Tuesday) at the time of writing and off from its recent five-month highs of US$1,872/ounce last week. The US dollar hit is highest level since July 2020.

Given Powell has the US economy sailing on an easy monetary trajectory straight into the eye of an inflation hurricane (already at 6.2% a 31-year high), I think his appointment will ultimately be good for gold.

“Now is not the time to raise rates” according to Powell, may as well wait until hyperinflation turns up and maybe he could reconsider his position?

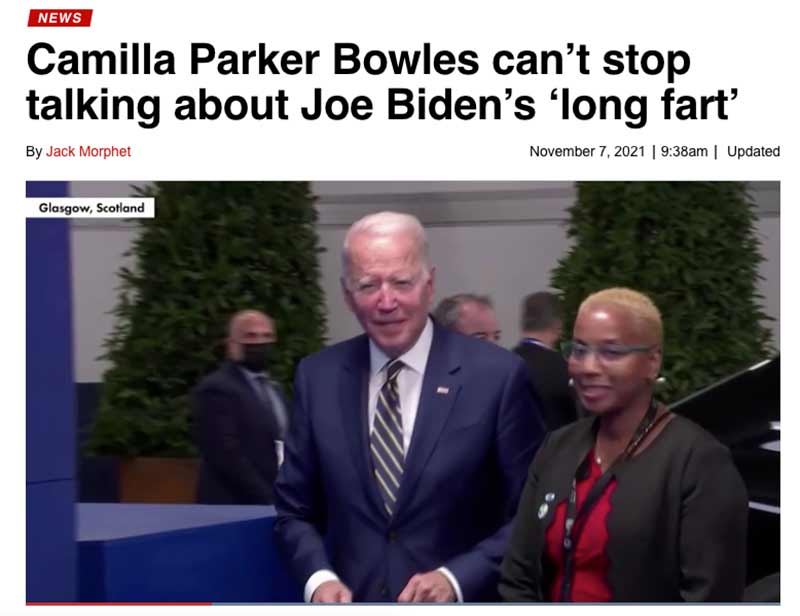

Anyway, I shouldn’t be too harsh on him, at least he hasn’t done a Joe Biden and ripped one off with a member of the Royal Family downwind from the blast…

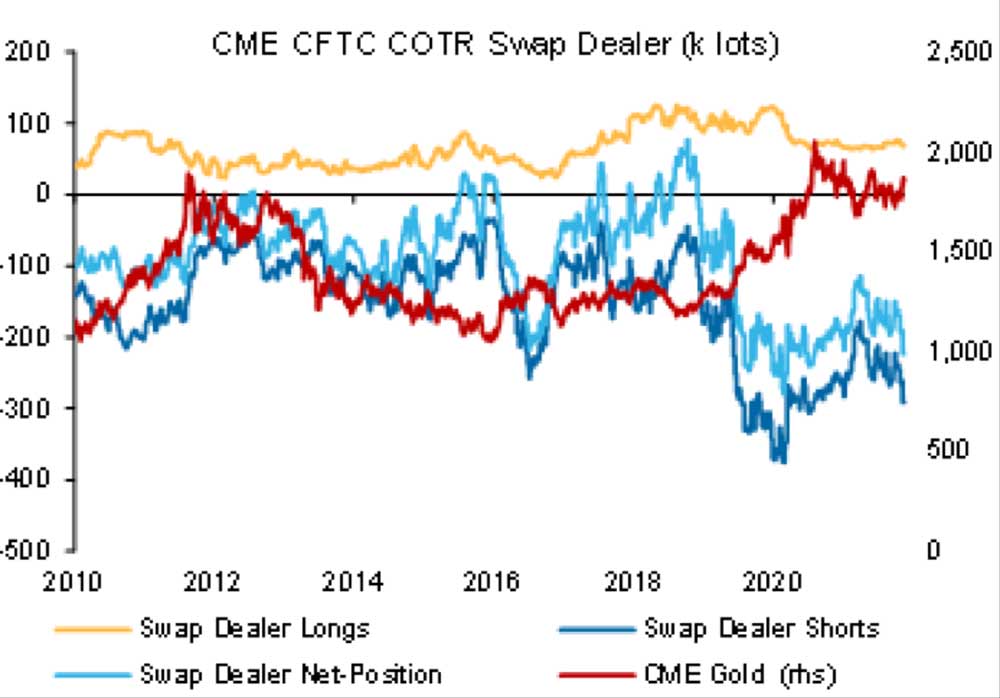

It is clear that (figure 3) the broader market is not convinced that gold’s short to medium term price outlook is positive with Swap Dealer Net positions still in decline.

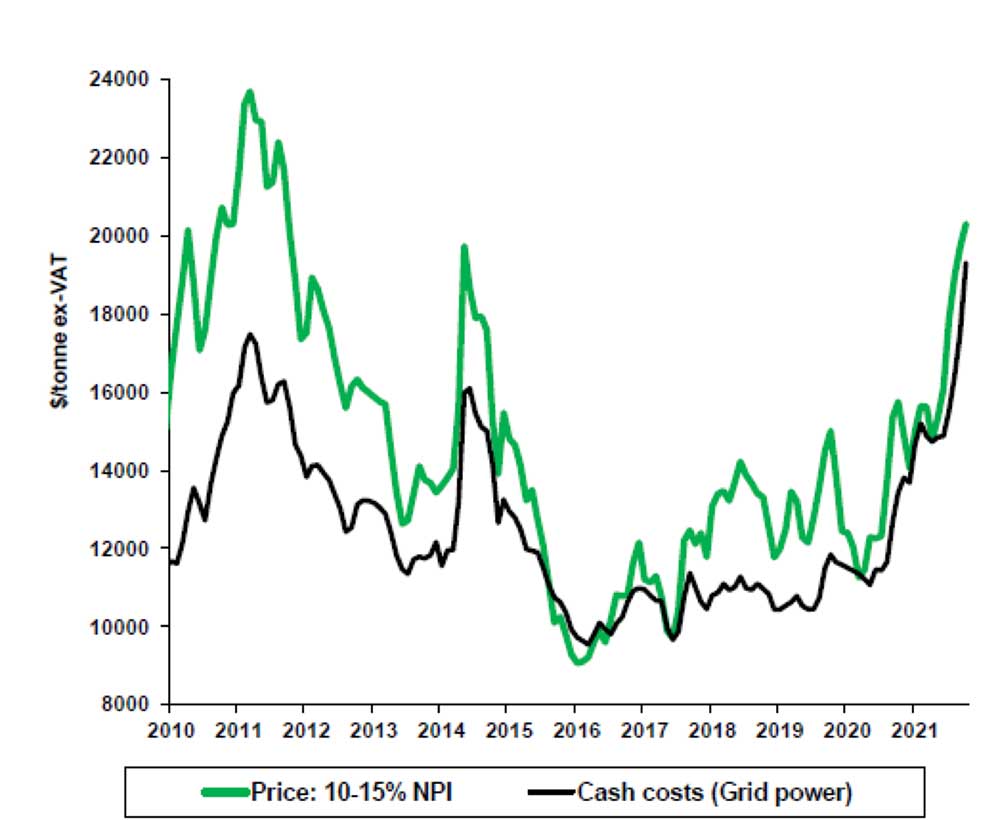

Not surprisingly nickel processing costs have continued rising sharply over 2021 (figure 4), particularly with regard to the energy intensive laterite ores.

Chinese nickel pig iron costs are projected to be in the order of US$19,000/t according to Macquarie Strategy (2021) up from around US$11,000/t in early 2020.

Indonesian nickel pig iron costs are also estimated to have risen from US$7,000/t to over $11,000/t over the last rolling 12 months.

This is likely to support the nickel price in the short-medium term (figure 5) which recently broke through US$9.50/lb.

New Ideas

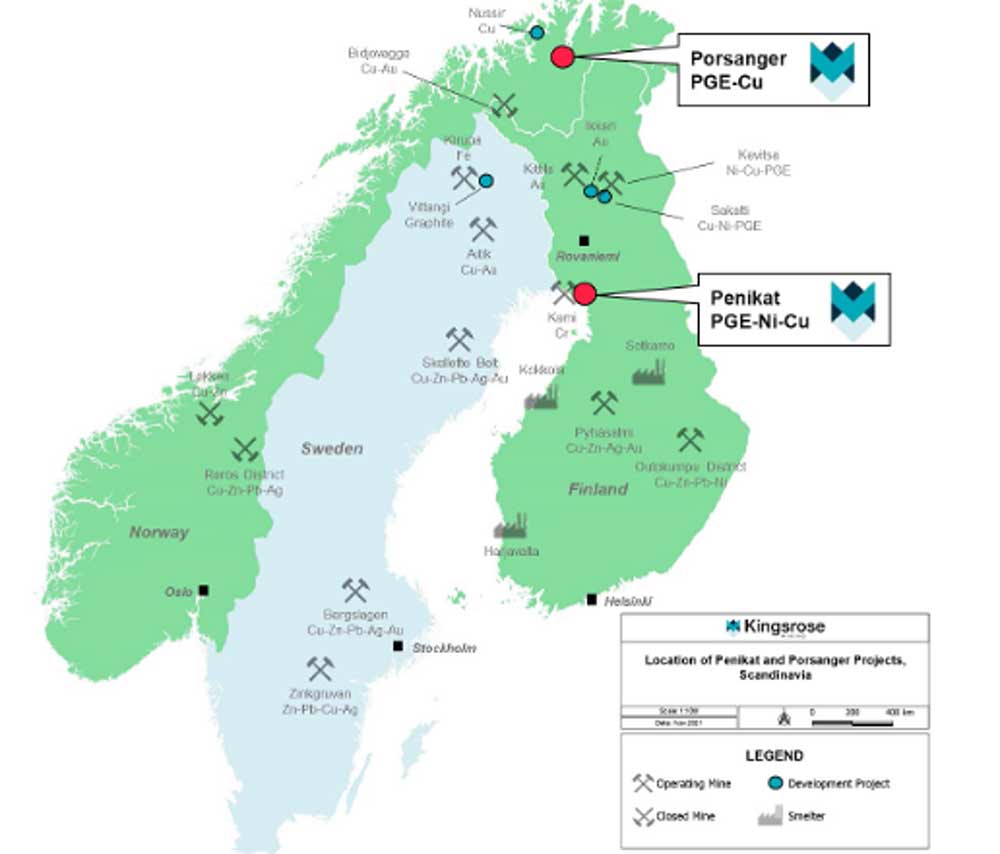

For those of you looking for another PGM play you may want to take a closer look at Kingsrose Mining Ltd (ASX:KRM) (figure 6).

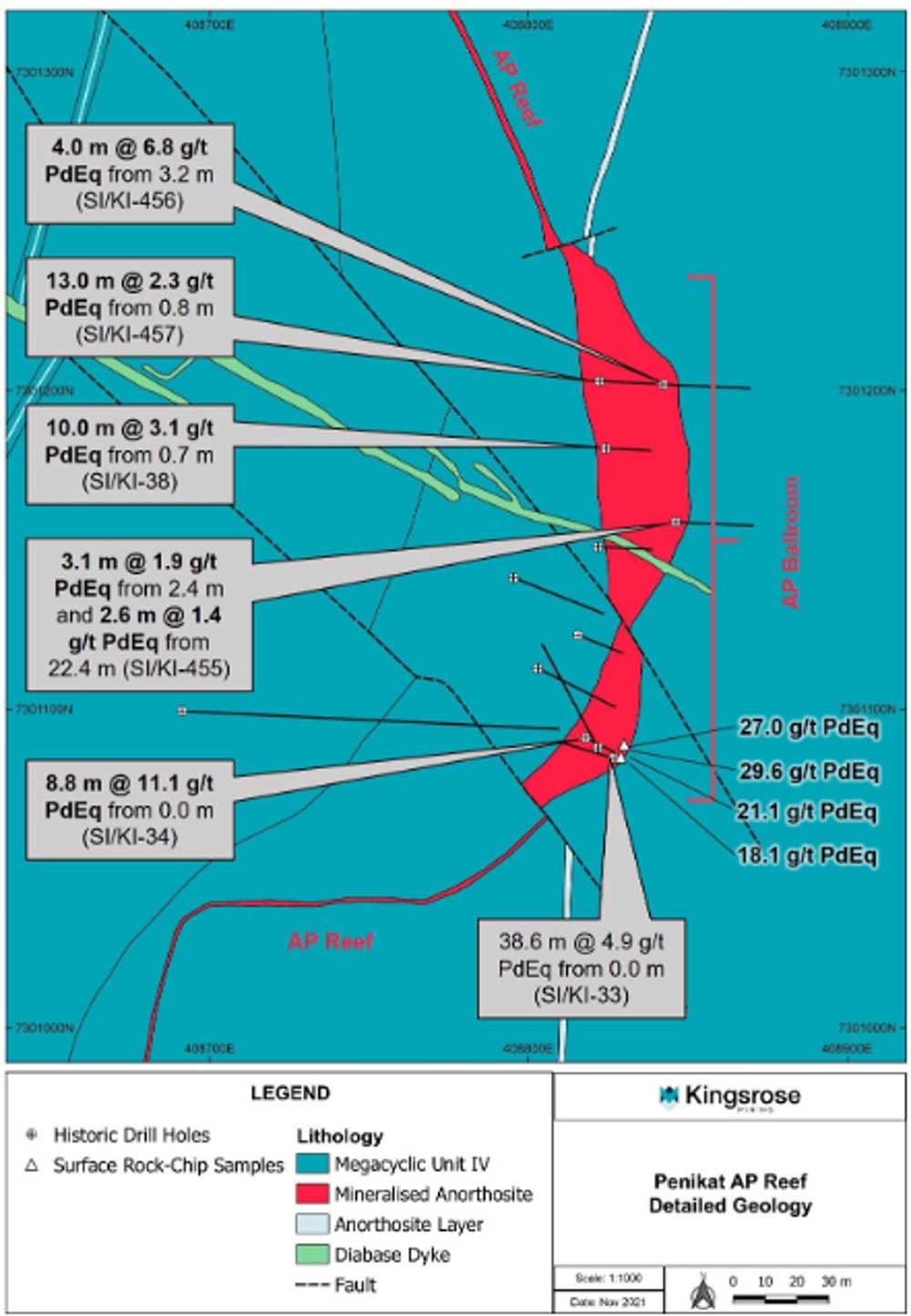

The share price has responded positively to the proposed acquisition of Element 46 earlier in November which has title to the ‘Penikat’ high-grade PGE-nickel-copper-gold deposit hosted within a layered intrusion (figure 7).

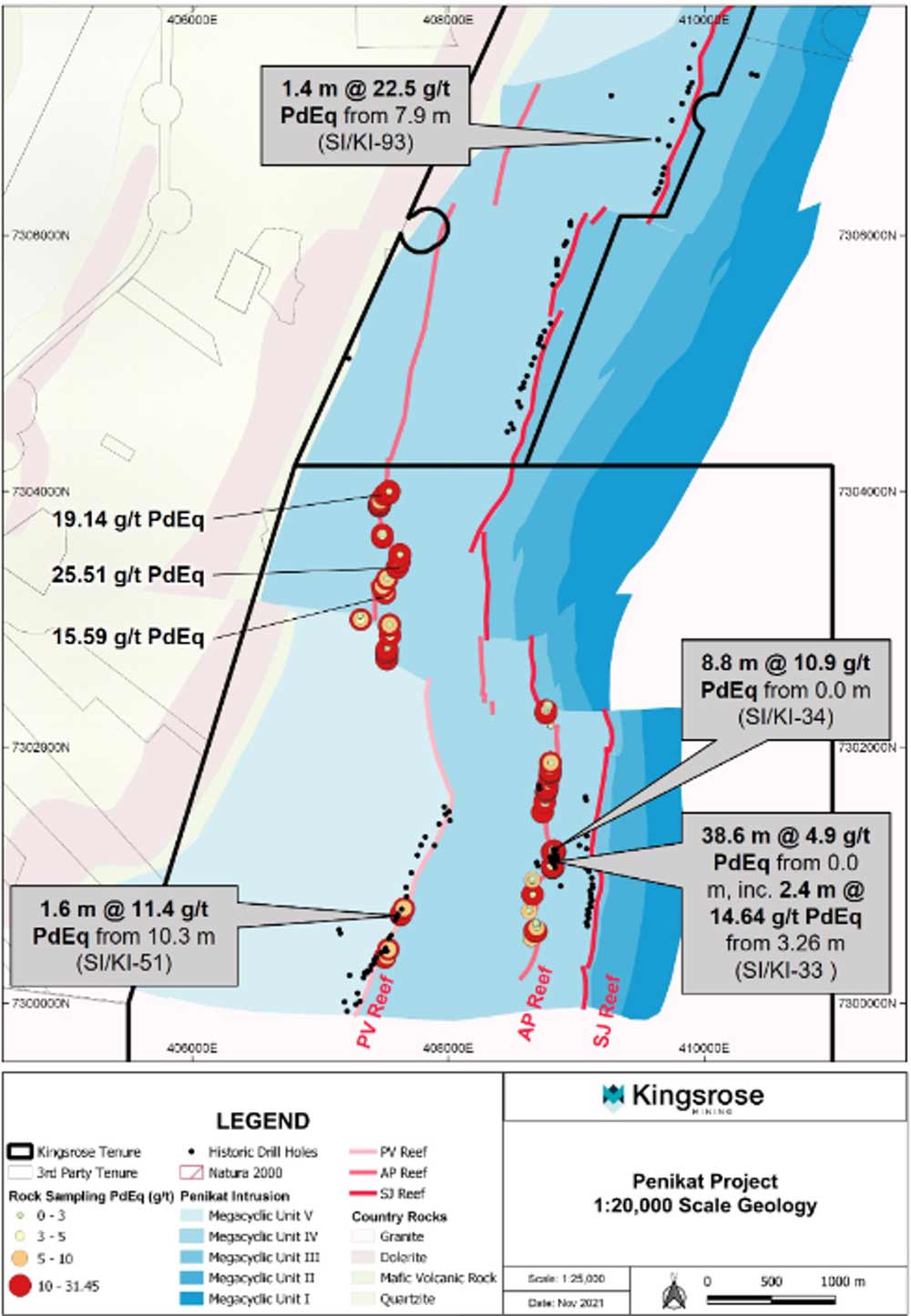

Mineralisation at Penikat is hosted in three outcropping parallel reefs with an apparent strike of approximately 25km with 4,158m of historical drilling that only reached an average depth 43m.

Not surprisingly, the company believes that mineralisation remains open at depth.

The company has identified a number of high-grade targets. Previous drilling suggests widths range from 0.50 to 2m with mineralisation believe to be similar to that found in the Bushveld complex of South Africa.

Better intersections from higher grade “potholes” have included:

- SI/KI-34 with 8m downhole at 10.9g/t PdEq from surface

- SI/KI-33 with 6m downhole at 4.9g/t PdEq from surface.

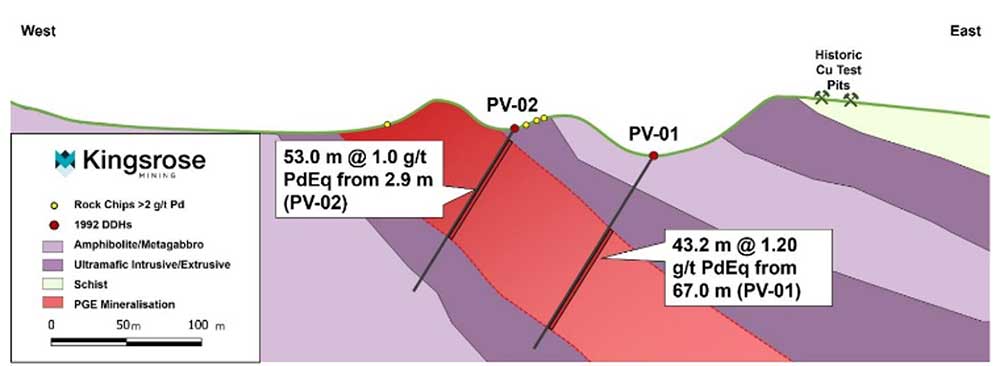

The Porsanger Project is another focus of exploration in 2022 with 50km2 of licences covering the Krasjok Greenstone Belt, and PGE-copper mineralisation analogous to Anglo American’s Sakatti nickel-copper-PGE deposit.

Previous drilling into outcropping magmatic sulphide PGE-copper mineralisation has returned a number of encouraging intersections including PV-01 with 43.2m at 1.2 g/t PdEq (0.9 g/t Pd, 0.4 g/t Pt, 0.1 % Cu) from 67m downhole. (figure 9)

High-grade copper mineralisation over 10km of strike length has also been outlined from rock sampling (Figure 10).

The company also recently announced (24th November 2021) results from re-assaying of core not previously assayed for PGMs with some impressive numbers.

SI/KI-456 and SI/KI-457 (figure 11) were not assayed historically for PGE with resampling returning some impressive grades and extending near surface mineralisation by 20m to the north, supporting the model that mineralisation remains open along strike.

I think the grades and dimensions of Penikat are quite compelling as to the enterprise value at just under $30 million this does actually represent value for money.

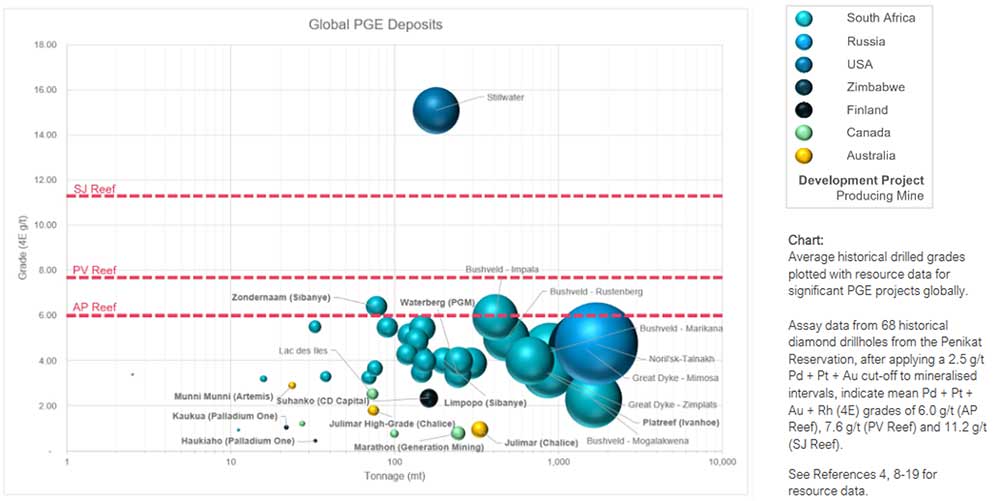

I note in their recent presentation a plot of global PGE deposits interestingly showing Julimar (Chalice Mining ASX:CHN) near the bottom of the pile (from a grade perspective) (figure 12).

I think CHN have outlined an interesting and very large resource but even the higher-grade core of 74Mt @ 1.8g/t 3E, 0.22% Ni, 0.21% Cu, 0.021% Co (~1.0% NiEq or ~2.8g/t PdEq) is not high grade as such and does have a significant strip component.

It has been a great ride but I would venture to say the market capitalisation has gone a little over the top at $3.4 billion (for basically an in-ground resource of 3.3Mt of Nickel equivalent) and is either factoring in very large Net Present Value or significant exploration upside or possibly both.

Time will tell but I think higher-grade core of mineralisation is needed to make Julimar work — hopefully exploration will find additional near surface, higher grade mineralisation along strike.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.