Guy on Rocks: This lucky REE explorer has shanked one straight through the big sticks

Pic: bloodstone, E+/ Via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions:

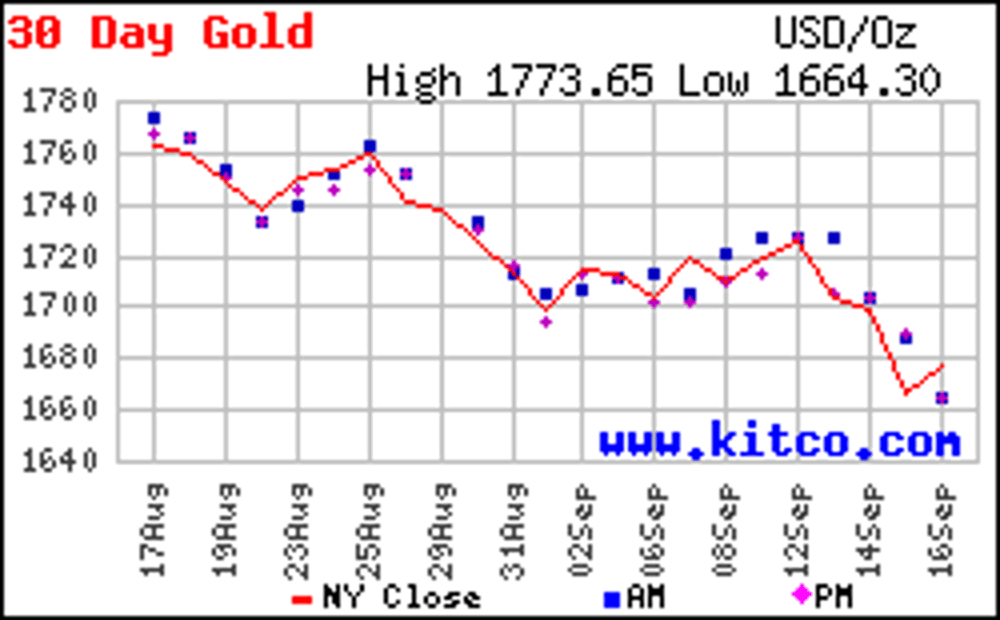

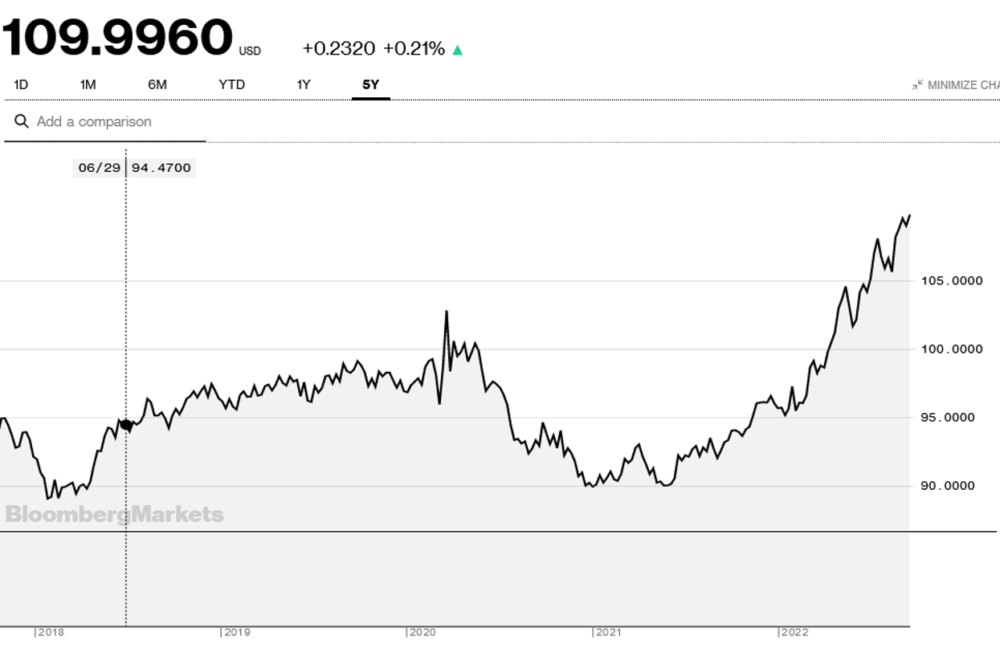

Gold touched US$1,660/oz at the time of writing (figure 1) in response to a surging USD (figure 2) that closed at just under 110.

Fears of sustained high levels of inflation and concerns of more aggressive rate tightening by the Federal Reserve, who are meeting on 20 September 2022, have driven the USD higher.

The market is now pricing in a 75bps rise, however recent inflation data suggests that could be as high as 100bps.

US 10-year Treasuries are at 11-year highs (3.45%) while 2-year Treasuries are sitting at 3.88% for a 15-year high.

Volatility is also climbing with the VIX also in an upward trend at 27.56. The Stockhead faithful will remember the start of the pandemic (March 2020) when it reached over 65.

Aside from copper, which we always talk about as a bellwether for the global economy, look no further than FedEx Corporation (NSYE:FDX), which has been sold down heavily from US$238/share in mid-August to US$161.02/share as its shipping business shows signs of a sharp downturn.

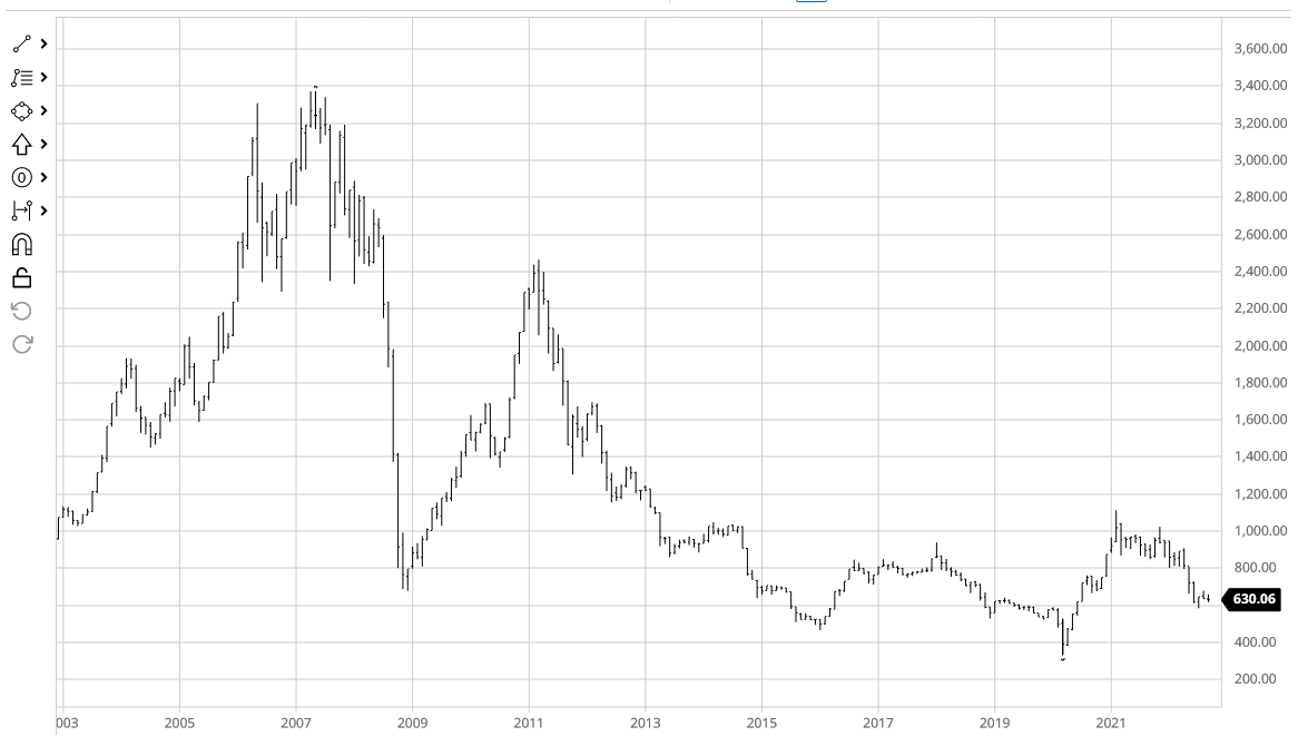

If you need any reminding that things are a little flat out there, the TSX-V in Toronto 9 (or the Ventures exchange as it is otherwise known) has been sold off three of the last four days of trading and closed at 630, down 2.5% for the week (figure 3).

Interestingly, the TSX-V did used to lead the ASX in previous resource cycle upswings however this cycle has seen ASX listed junior companies, particularly those with worthy exploration/development assets, attracting plenty of market attention, good volumes with high valuations in comparison to their Canadian counterparts.

Despite the gloomy economic outlook, copper held up well ending last week at US$3.55/lb but remains in strong backwardation, a sign that the speculators are not bullish on the short to medium term outlook for copper.

Platinum had a very strong week closing up 9% to US$910/oz while palladium lost 2.2% to finish the week at US$2,059/oz.

Energy has had a flat three weeks, possibly a good sign for a reduction in the inflation outlook with Henry Hub US gas prices declining to close at US$8.32MBTU.

Uranium (US$52/lb) and uranium equities have been strong however I anticipate that US$70-80/lb is not far around the corner — a level required to turn on many of those deposits sitting in the middle of the grade-tonnage curve.

Finally, a look at Uncle Joe’s eye-watering Energy Transition bills including the Bipartisan Infrastructure Law of 11/21 and the Inflation Reduction Law (passed in August 2022-note figure 4 refers to Act but this has now been passed into law).

All very positive for uranium (figure 4) with nuclear reactors to receive over US$3 billion in incentives as well as US$6 billion in nuclear credits (i.e., for power generated from nuclear).

Hydrogen is also set to receive over US$9 billion in assistance.

New ideas: E-Metals, a red hot rare earths play

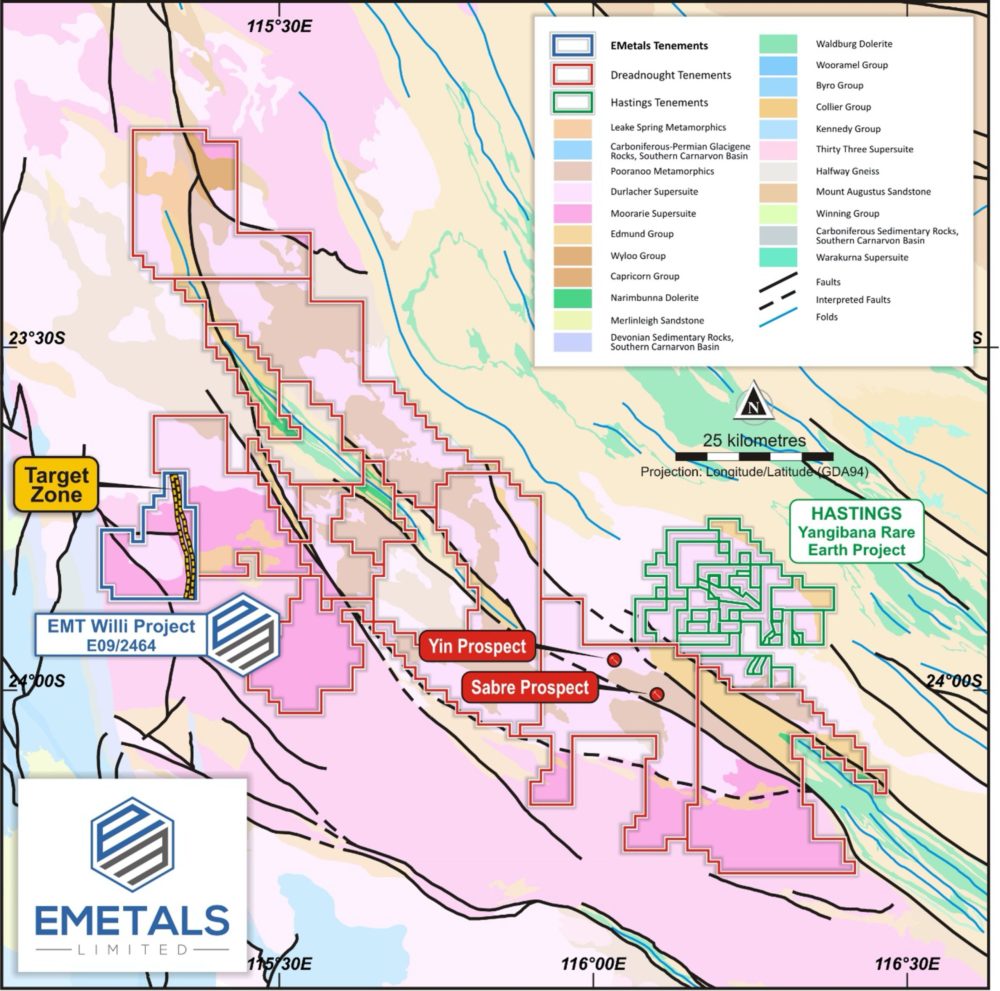

Looks like E-Metals Limited (ASX:EMT) (figure 5) may have kicked one through the middle off the side of the boot as it finds its 100% owned Willi Creek project (E09/2464) near some of the hottest rare earth explorers on the ASX.

More specifically the excitement is around the identification of 50 square kilometres of highly radiometric granites. In fact, EMT consider the granites at Willi Well to be one of the most radiometric in the Gascoyne region which bodes well for the occurrence of rare earth mineralisation.

Willi Creek (figure 6) is situated approximately 70km west of Yangibana containing JORC Reserves of 10.34Mt @ 1.22% TREO and 0.43% Nd+Pr held by Hastings Technology Metals (ASX:HAS).

HAS raised $110 million a few weeks ago (7 September 2022) in a two tranche placement at $4.40/share to accelerate the development of Yangibana. HAS closed Friday at $4.20/share valuing the aspiring producer of around 3,400 tonnes of Nd/Pr per annum (representing approximately 90% of revenue) at around $420 million.

So why is the market getting excited about EMT?

Willi Well hosts the same aged granites (Durlacher Supersuite) as Yangibana (figure 6) and Dreadnought Resources (ASX:DRE), and is also crosscut north-south by a series of dykes, sills and veins that is coincident with over 20km of north-south-striking regional structures are interpreted to crosscut the Moorarie Suite meta granite gneiss (figure 7).

Pegmatites and other veins including aplites and porphyritic dykes between 2 and 10m wide are believed to exist in the eastern part of the granitoid complexes (figure 5) where extensive areas of white rocks have been observed in outcrop.

This is potentially a favourable setting for REE-enriched metasomatic phases concentrating anomalous REE in the granites.

The company is planning to commence surface reconnaissance exploration following a heritage survey in October with plans to follow up (subject to results) with reconnaissance aircore and RAB drilling.

As part of the company’s renewed focus, rock licker and former HAS geologist Simon Cohell has been appointed as technical consultant to lead the charge.

The region is certainly hotting up with explorers in the region such as the aforementioned Dreadnought at a market capitalisation of $360 million and Lanthanein Resources (ASX:LNR) at $52 million.

LNR are due to follow up on high-grade rock chip results from its Lyons project which included a number of assays up to 1.5-2% total rare earths.

At an enterprise value of $13 million and with over $4.0 million in cash, the next six months could be transformative if EMT can jag some decent rare earth results on its Willi Well tenement.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.