Guy on Rocks: Will Andrew Forrest become the King of Nickel?

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Mr ‘Middle of the Road’ Jerome Powell and Joe Biden (who can’t remember what he had for breakfast) have become this column’s new best friend, and I am crediting them with a US$30 rise in the gold price last week to US$1,181.

If anyone knows of any aged care facility vacancies in Washington please call the White House as soon as possible.

We might see further moves this week with consumer confidence, PMI Index, unemployment due on Thursday and non-farm payrolls (consensus figures of 700,000 jobs added) on Friday.

Platinum closed up 1% to US$1,006 with palladium having a strong finish up 5.5% to US$2,342.

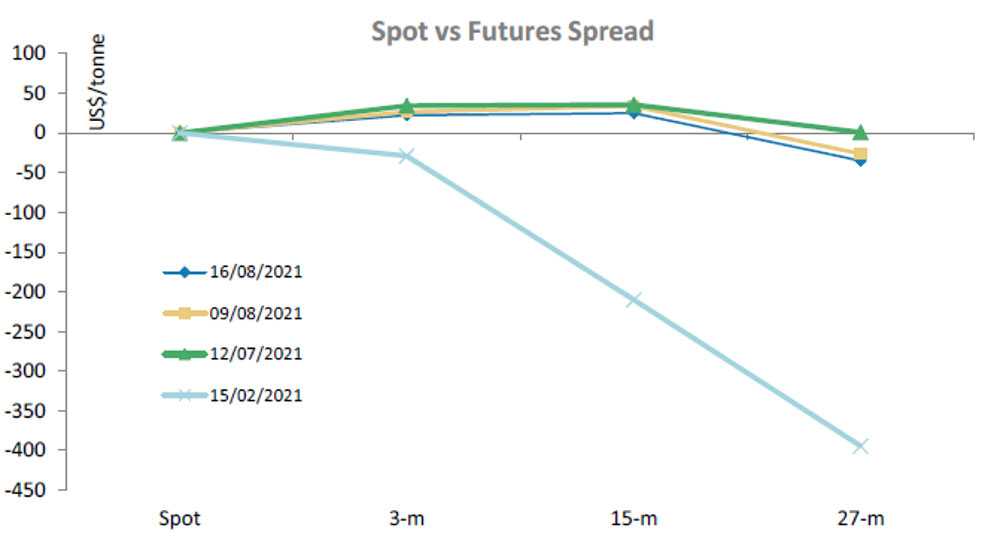

Overall, the week saw a broader rebound in metals with copper also up 17 cents closing at $4.26 with the copper futures market continuing to improve (figure 1). The Baltic Index also pushed higher to close at 4,200.

The overall macro theme of copper continues to look strong with two strikes (Andina, Caserones), a drought (Los Pelambres), and blockades (Las Bambas) highlighting supply concerns.

Furthermore, China’s Malaysian scrap imports have been interrupted for a few weeks and local fabricators have been destocking for months.

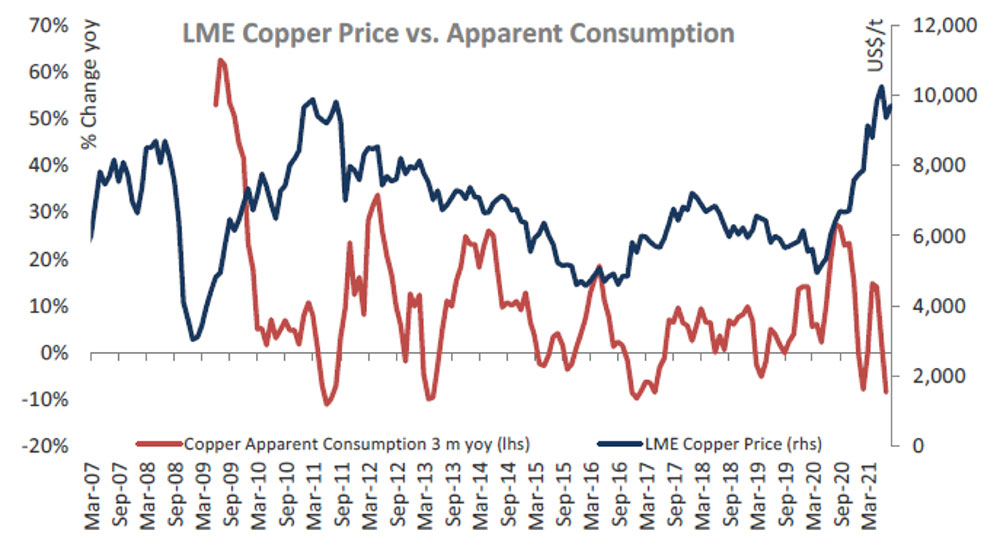

All this has meant limited surplus metal around, with the import arbitrage opening up with China’s spot cathode premium gaining US$58/t over the last 7 days (figure 2).

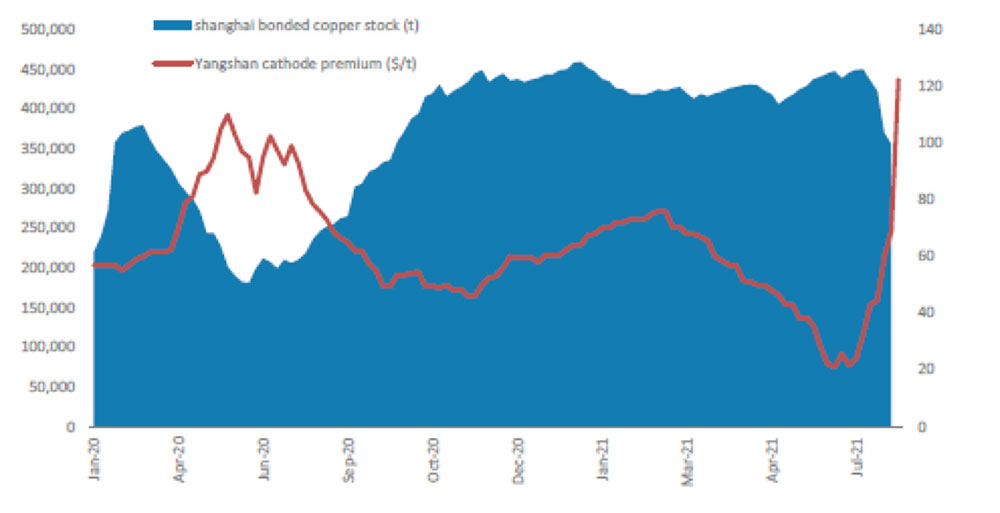

While COVID-19 has put somewhat of a drag on demand and consumption (figure 3) in both automotive and electronics sectors, global inventories remain at only 2 1/2 weeks supply, which is supportive of higher short-medium term copper prices.

Nickel has also seen a number of supply disruptions – Norilsk’s flooding, Koniambo’s extended outage, Sudbury strike, and bad weather in SE Asia.

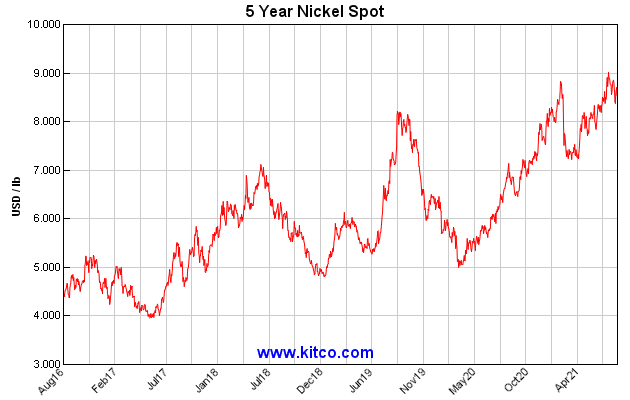

While there is some risk to the reduced output from stainless steel and destocking activities, I anticipate projections that nickel will fall back below US$7.50/lb (from US$8.55/lb) for 4Q 2021 are overly pessimistic (figure 4).

Uranium continues to gain traction, finishing the week up 3% to US$33.55/lb mostly likely in response to US$6 billion in tax creditors that received bi-partisan support as part of the US Infrastructure Bill for existing nuclear power plants.

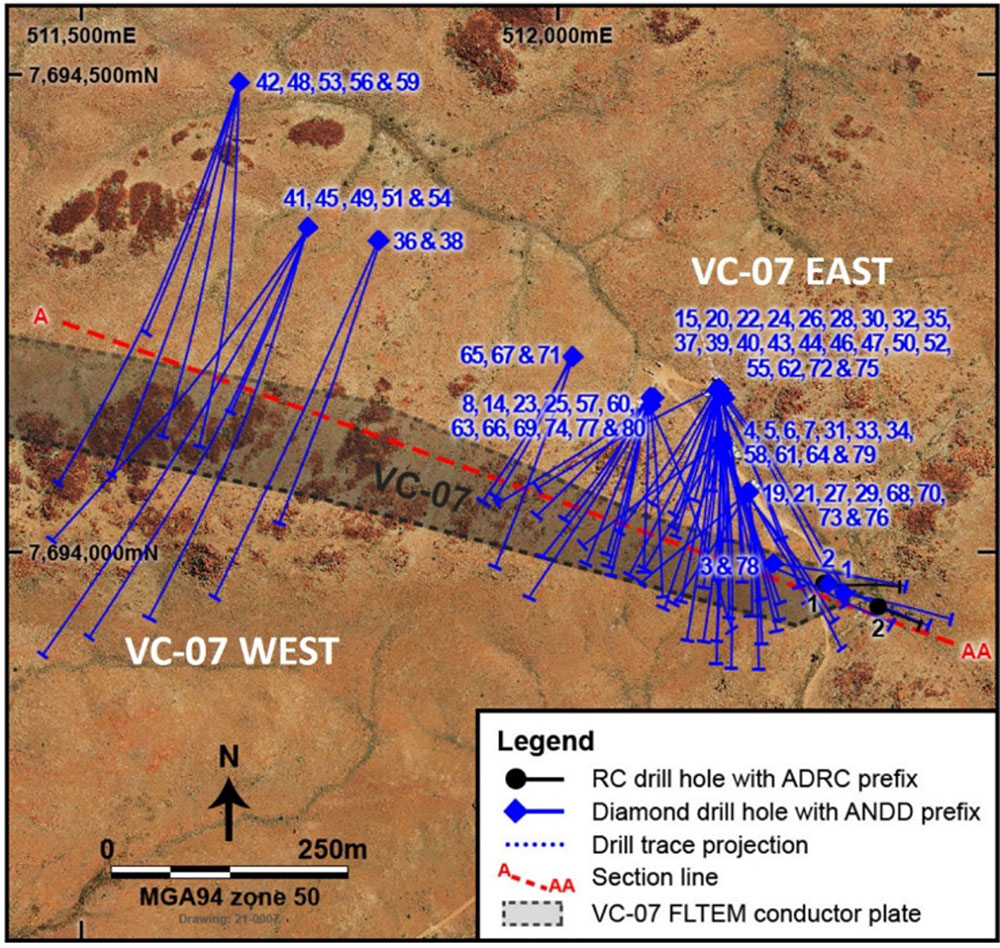

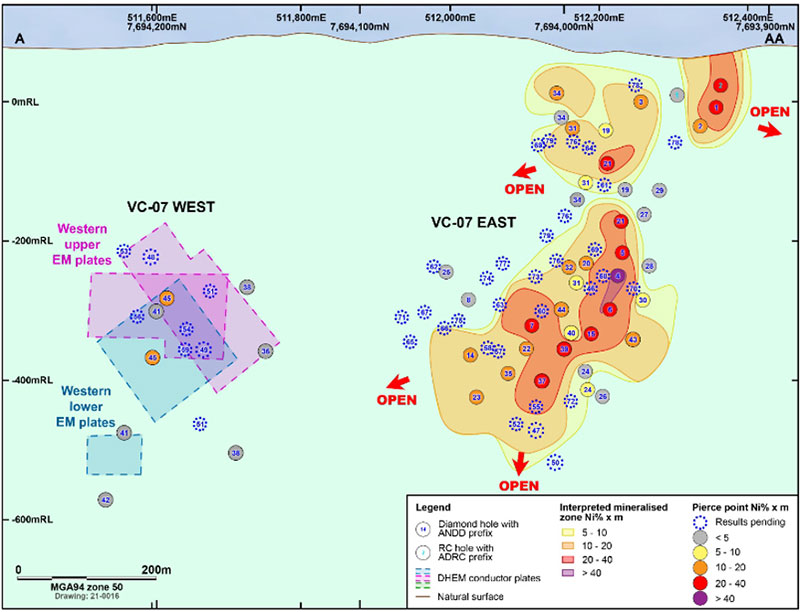

Azure Minerals (ASX:AZS) is almost at the end of its 40,000-metre diamond drilling program at Andover that is aimed at delivering a maiden JORC resource some time in CY 2022.

So far 22 drill holes have intersected massive, semi-massive, matrix and heavily disseminated nickel-copper (Ni-Cu) sulphides at VC-07 East, with better intersections including:

We will have to wait for assays however pXRF does confirm the presence of elevated nickel and copper grades throughout the massive sulphide intercepts.

Mineralisation at VC-07 East now extends for in excess of 400 metres of strike and is mineralised to in excess 500 metres depth and is open for expansion. Not surprisingly the company has decided to extend the drill out till late CY 2021.

The project has an implied value of around $166 million and is held 60% by AZS and 40% Creasy Group.

No doubt there will be some fruitful discussions on Kings Park Road with Mark Creasy coming up, possibly accompanied by a bottle of Henschke Hill of Grace.

Tony, if you are reading this I would go with a 2010 vintage or if you are low on entertainment funds a 2013 or 2014. Anything less, I wouldn’t bother turning up.

I have always thought Lynas Corporation (ASX:LYC) chief executive Amanda Lacaze was a class act with some real ability and intellect.

In an interview with The Australian this weekend she suggested other rare earth developers should think about sharing their facilities rather than building their own downstream infrastructure.

LYC is proposing to build a cracking and leaching plant in Kalgoorlie (WA). Given most (if not almost all) processing of rare earths takes place in China, having a fragmented rare earth processing industry is probably not the answer and with LYC’s status as the only major non-Chinese producer of rare earth oxides she has a good point.

Iluka Resources (ASX:ILU) is exporting heavy rare earth concentrates from Eneabba (WA) and is finalising a feasibility study due for completion in 2022 with a positive result likely to see Federal Government support.

Other participants include Australian Strategic Materials (ASX:ASM) that is constructing a metallisation plant in South Korea and Hastings Technology Metals (ASX:HAS) that has commenced construction of its Yangibana rare earths project in the Gascoyne (WA).

The company is planning a hydrometallurgical plant to produce an intermediate concentrate at Onslow.

Andrew Forrest has been around nickel plays for many years now and his latest gig is trying to wrest control, via his vehicle Wyloo Metals, of WA nickel producer Western Areas (ASX:WSA) popping up with 5.3% (WSA, ASX Announcement 20 August 2021).

Wyloo also owns 15% of nickel developer Mincor Resources Ltd (ASX:MCR) as well as having interests in Poseidon Nickel (ASX:POS) and Panoramic Resources (ASX:PAN).

Independence Group (ASX:IGO) is also in the mix having held preliminary discussions with WSA over the preceding weeks.

Wyloo (which holds 37.5% of NOT) is also having a red-hot crack at Canada’s Noront Resources (TSX-V:NOT), which is developing the Eagles Nest Ni-Cu PGM deposit in Ontario, Canada, and recently announced that it did not intend to sell into BHP’s $350m on-market bid for NOT.

Andrew Forrest is known as the iron ore king in Australia and my punt is that he will eventually be a consolidator of Australian and/or Canadian nickel developers and producers over the coming years.

As we have seen in the past, he has the muscle and tenacity to pull almost anything off!

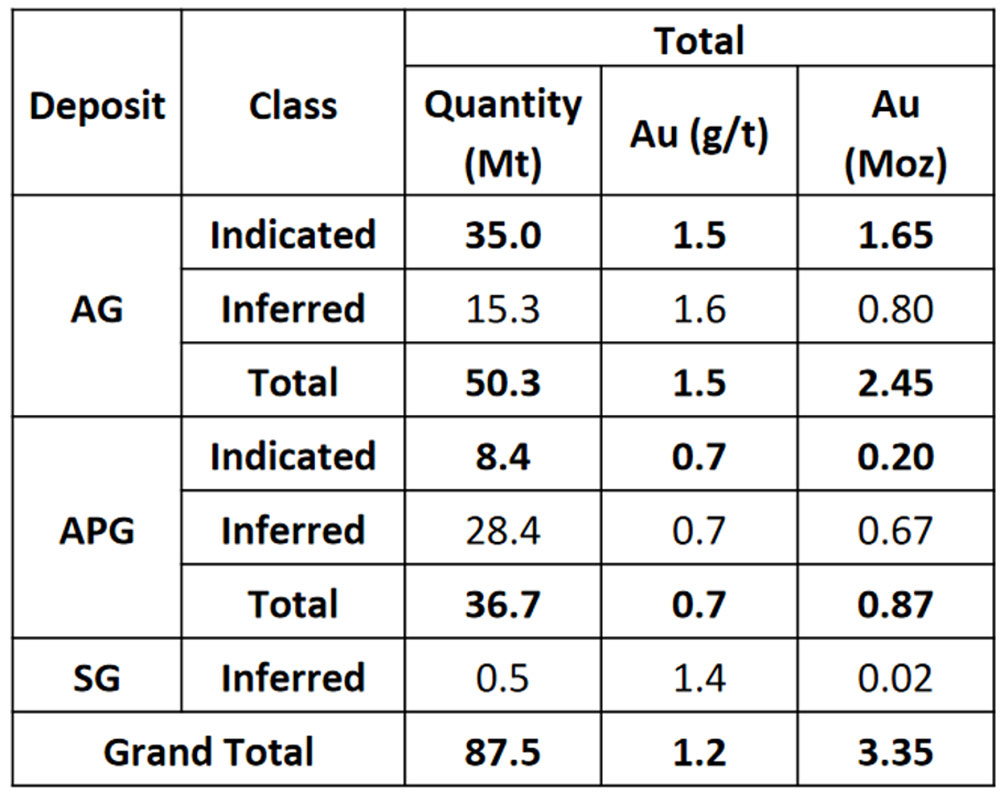

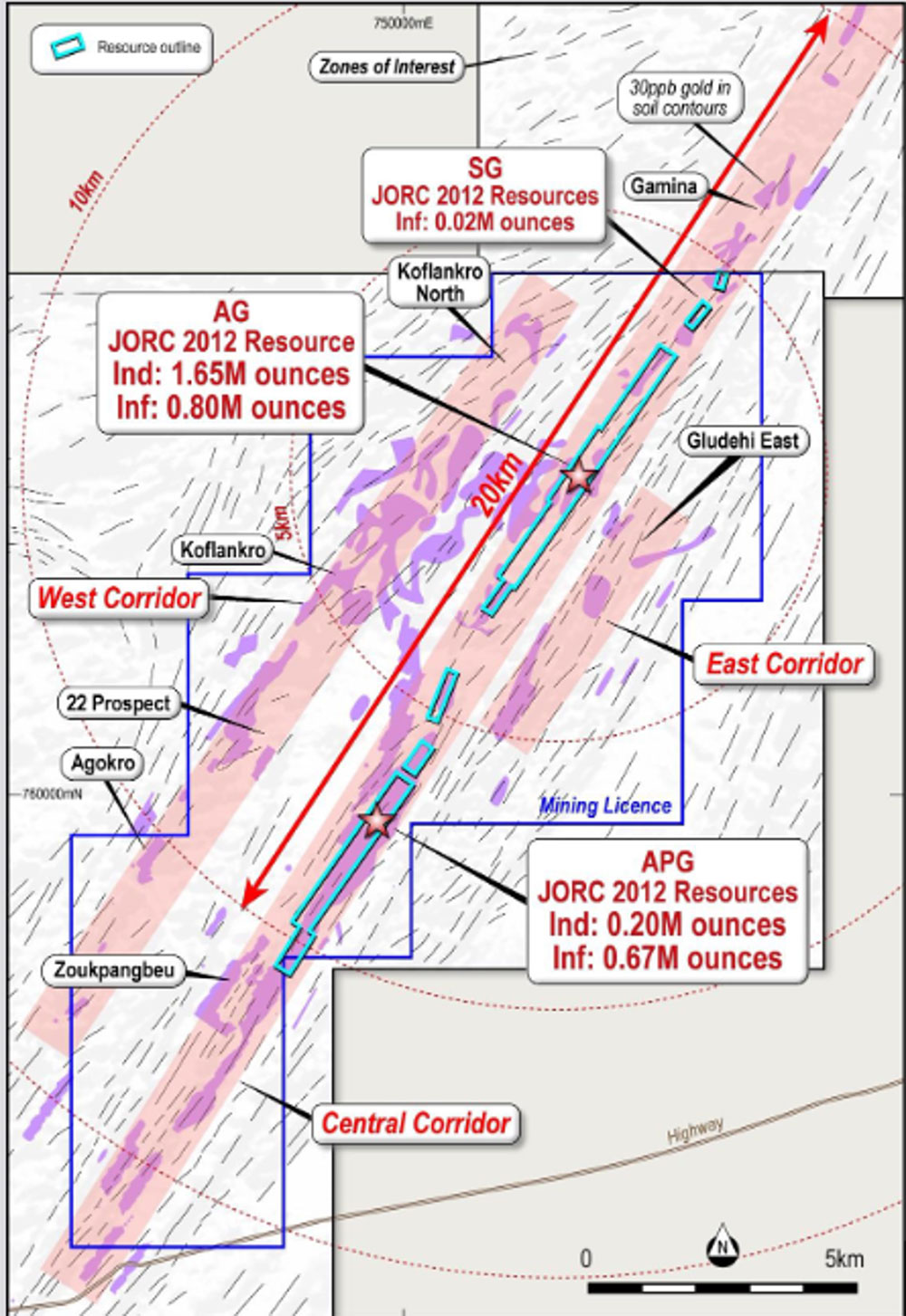

Along with last week’s pick, Navarre Minerals (ASX:NML), Tietto Minerals (ASX:TIE) (figure 9) has been on my watch list for a couple of years.

With gold equities trading at a discount this is another must have in the portfolio.

At an EV of around $100 million, the company boasts a JORC Resource inventory of 3.35 million ounces of gold (table 1) with a Feasibility Study due out sometime this quarter, likely to contemplate a 3.5-4.0Mtpa, 200,000-ounce per annum gold operation.

Planning is also at an advanced stage with an environmental approval secured and a Mining License granted over 120 sqkm.

Six rigs are currently blazing away and likely to deliver another big resource upgrade.

The management team has been bolstered with the appointment of Matt Wilcox as CEO to build a development team.

The driving force is Caigen Wang, a very capable geologist, founder and the current Managing Director of TIE.

The PFS showed a very healthy post-tax NPV5 of around $500 million at an US$1,800 gold price. I’m going to save my powder for another time on this one, suffice to say Canaccord’s price target of 60 cents is very achievable…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.’