Guy on Rocks: The dark art of separating China from its rare earths monopoly in 2022

Good luck. Picture: Big Trouble in Little China, 20th Century Fox, 1986

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

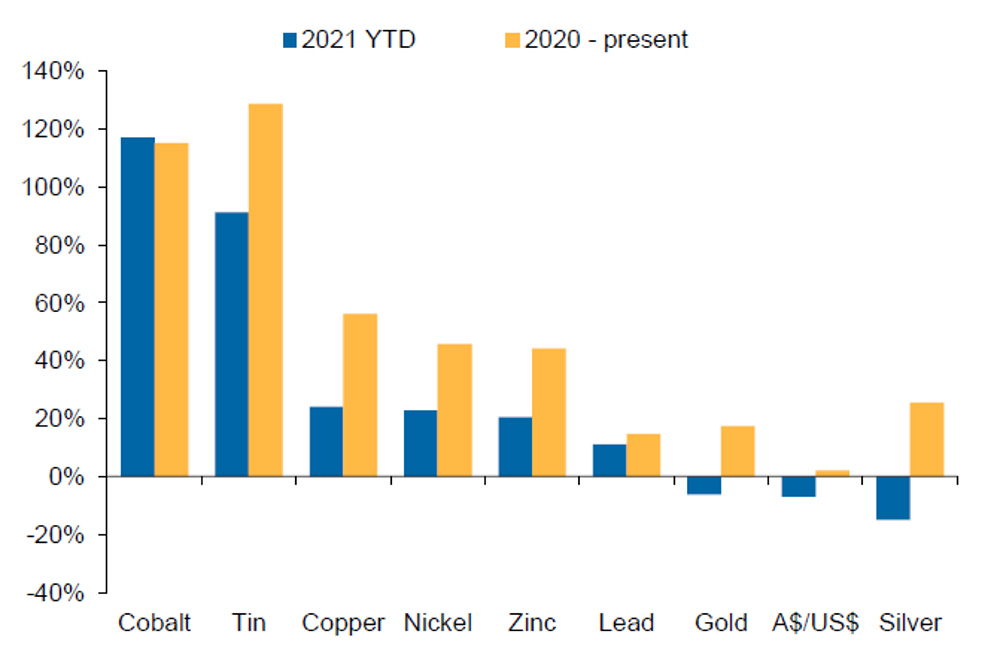

CY 2021 has been a positive year across base metals, and to a lesser extent, precious metals, which is not surprising given the supply-demand metrics of the former with precious metals underperforming in a rising broader market.

Figure 1 shows the strong performance of cobalt and tin this year followed by copper nickel and zinc, a trend that is likely to continue into 2022. The challenge with cobalt and tin of course is exposure via ASX listed vehicles.

Copper has been in the news all year, mostly for the wrong reasons with continual political upheaval in the major producing countries likely to cause ongoing supply disruptions.

Peru is still looking to raise mining taxes by 3-4% according to finance minister Pedro Francke. Prime Minister Oyun-Erdene Luvsannamsrai earlier this week announced that Rio Tinto has agreed to write off Mongolia’s outstanding $2.3 billion debt for its share in the Oyu Tolgoi copper-gold project.

Rio has also agreed to expand the underground development which had been stalled for some time. By my reading that is a quantum change in the project economics from Rio’s perspective and an unhelpful precedent for other operators in developing countries.

One of my favourite picks of 2021 was nickel which had a cracking year.

This is despite Tesla announcing that it intends to shift battery cathode chemistry from nickel (NCM/NCA) to lithium iron phosphate (LFP) for standard range vehicles.

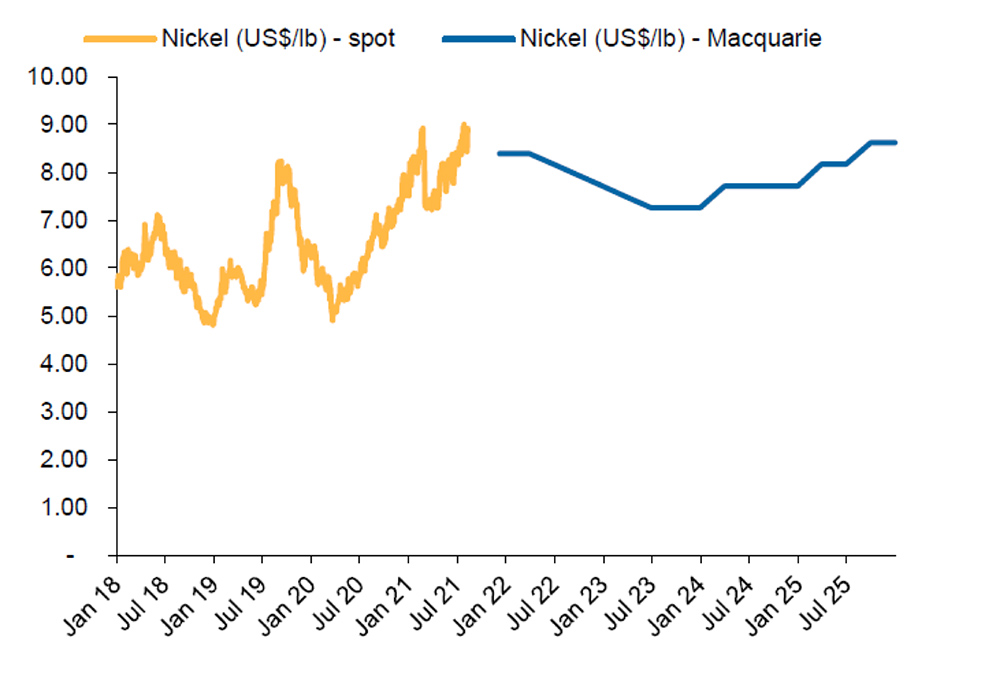

This is likely due to the tightening outlook for nickel, particularly as we approach 2024, however Macquarie Research are still projecting CAGR of 10% of the next 10 years with their long-term nickel price (figure 2) to $17.5k/t (~$8.0/lb) from $13.3k/t ($6.0/lb) partly due to the incentive prices required to turn on the capital-intensive High Pressure Acid Leach (HPAL) plants.

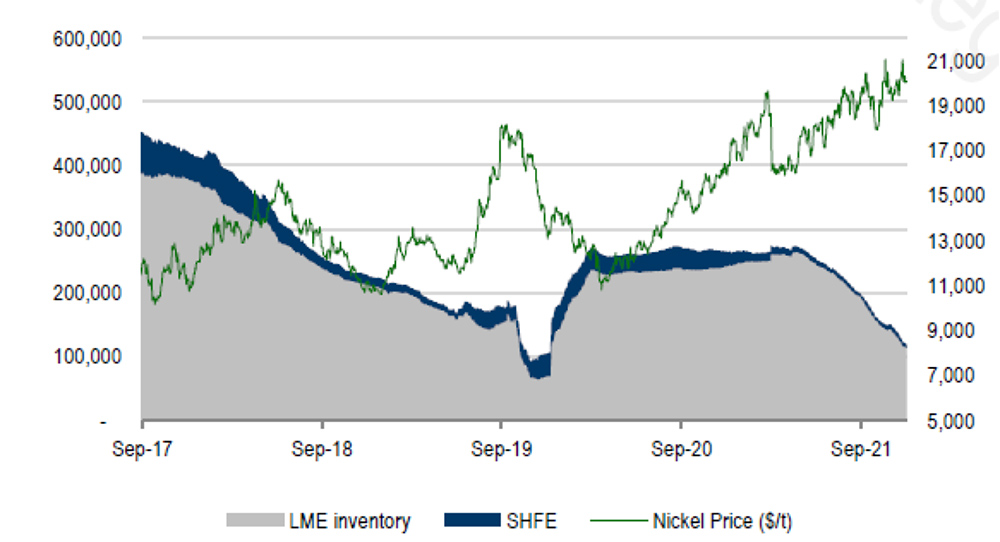

With fundamental tightness in the nickel market, diminishing inventories (LME inventories at two-year lows) (figure 3), nickel pig iron production cuts in China and demand for EV batteries, the stage is set for further bullish moves in the nickel price.

Potential bans/taxes on exports of NPI from Indonesia are also likely to further tighten nickel supply.

The economic drivers in China look a little more positive following the Central Economic Work Conference (CEWC) over 8-10 December.

The key messages from this top policy-setting meeting include a refocus on economic development as the country spent most of the year battling with demand contraction, supply turbulence and weakening expectations.

As I have previously highlighted, failure to deliver sustainable growth in China is not an option (unless you like peeling spuds in a labour camp) and they have committed to “keep the economy operating within a reasonable range”. All sounds very promising with a target somewhere above 5% for FY 2022.

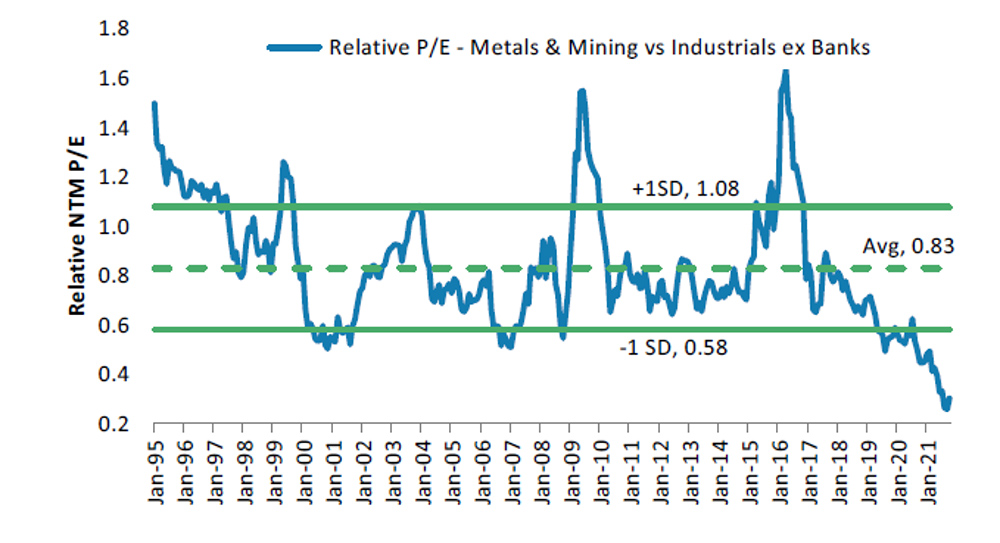

Mining valuations of the larger cap stocks look cheap (figure 4) based on a 12-month forward EV/EBITDA and EV/Rev that is ~2 standard deviations below their long term mean. Interestingly the top end of town is undervalued with juniors mostly overpriced so I will be intrigued to see this gap closed.

Rare earth elements are a poorly understood sector by the market, however the rapid growth in permanent rare earth magnets, which are the primary application for neodymium and praseodymium (NdPr), terbium (Tb) and dysprosium (Dy), is likely to keep this sector in the spotlight.

Macquarie are expecting EV sales to reach over 5.8 million vehicles by 2021 (an 83% increase YoY) and representing 6.5% of total global vehicle sales.

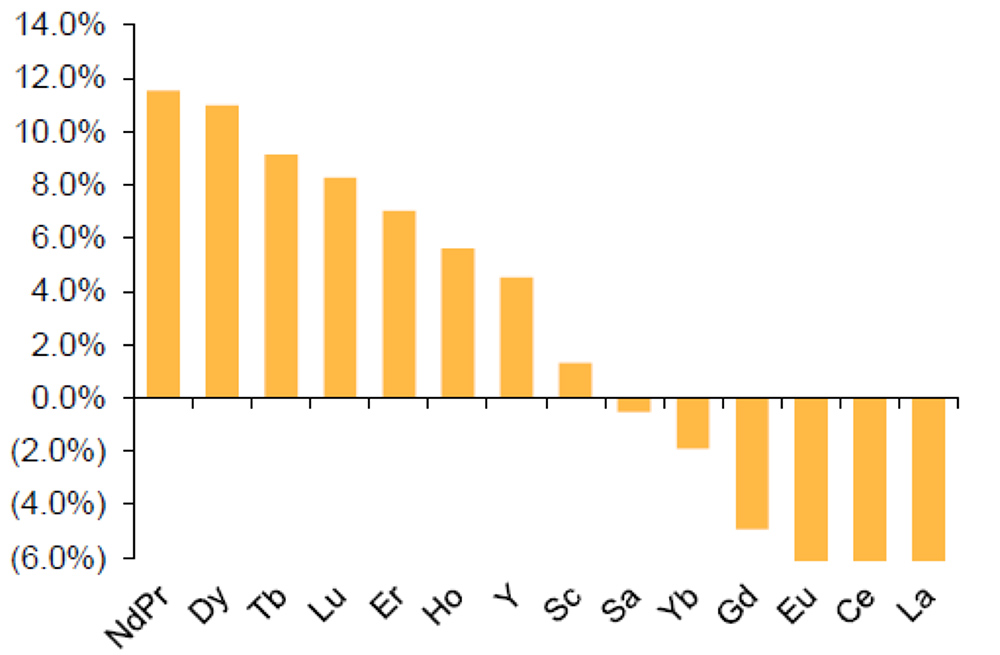

Other additional supply of NdPr, and Tb/Dy, will be required however other rare earths are likely to be oversupplied in the process (figure 5).

Rare earths that are projected to fall in price include europium (Eu), gadolinium (Gd), lanthanum (La) and cerium (Ce). Growing demand for offshore wind turbines, conventional automotive parts, inverter air conditioners, white goods, and electronic consumables are also likely to have a significant influence on REE prices in the short to medium term.

China accounts for around 60% of world supply of rare earths oxides. China also dominates the separation of rare earths, a black art poorly understood by the West.

Restructuring in China has seen supply consolidated into three producers accounting for around 90% of rare earth capacity.

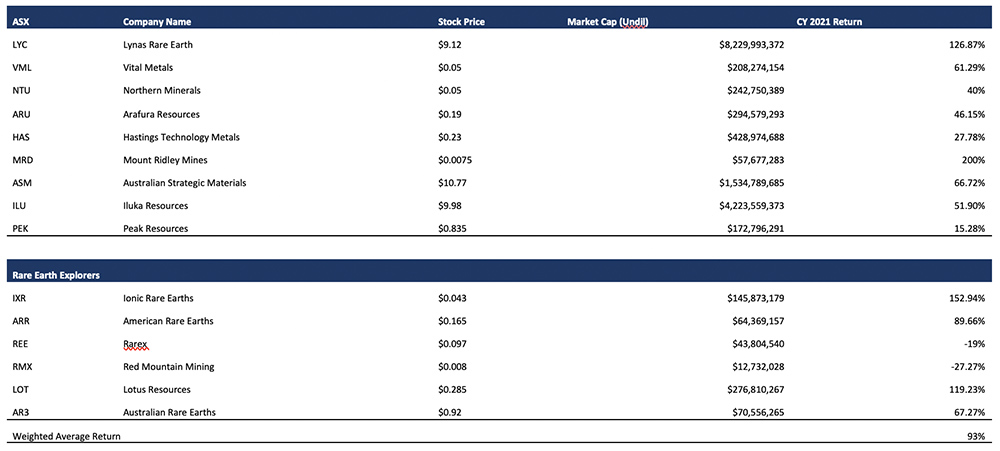

There is an emerging rare earth sector in Australia. The June Stockhead article provides a good overview and the basket (with GGG omitted and MRD included).

The major changes since this Stockhead article was published was the ban on uranium mining in Greenland (hence putting the brakes on the Kvanefjeld development) and the emergence of Mt Ridley Mines (ASX:MRD) as a rare earth explorer in the Eucla Basin (sitting on top of the Albany Fraser Range complex) in southwestern WA (full disclosure – I am director and shareholder of MRD).

The total return for this basket of explorers/developers as set out in table 1 (and excludes Greenland Minerals Ltd (ASX:GGG)) was an impressive 93%.

Company News

The exploration sector as been in full swing with some excellent results coming through.

Tennant Creek (Northern Territory) has been a frustrating place to explore over the last 30 years with explorers chasing narrow vein high grade gold and gold copper mineralisation.

The majority of interest in the Territory was in the Tanami desert where trail-blazer North Flinders Mines, followed by Normandy Mining and then Newmont, had phenomenal success over 40 years, particularly following the discovery of the Callie deposit in the early 1990s (500,000 oz gold/annum).

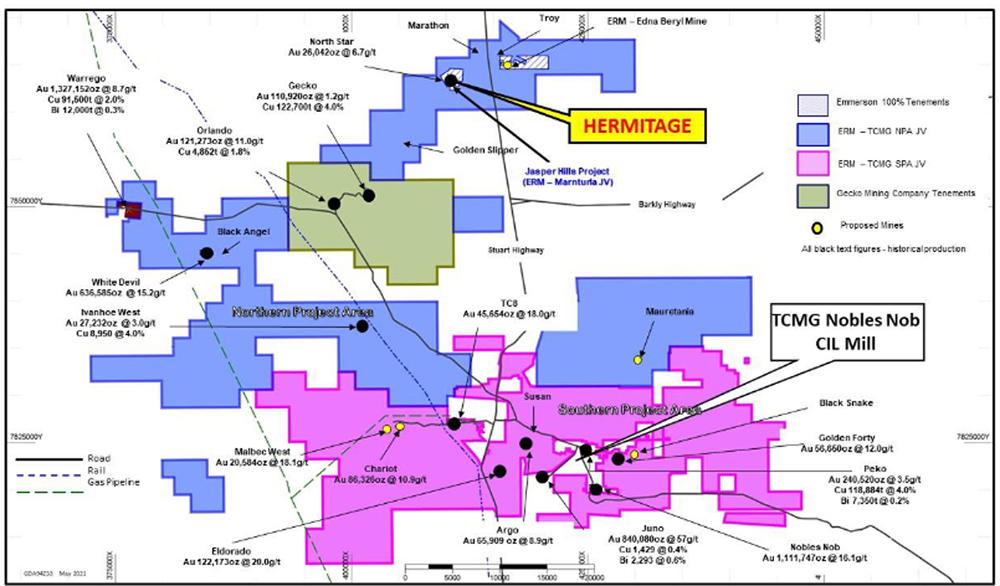

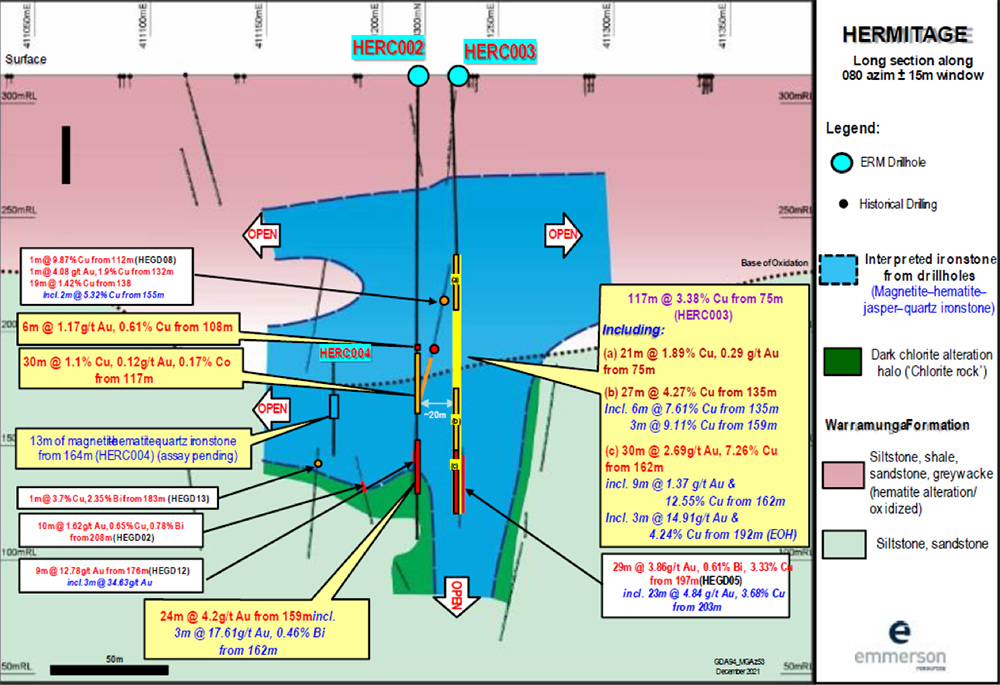

After many years of exploration Emmerson Resources (ASX:ERM) have jagged an impressive diamond drill hole with HERC003 returning 117m downhole @ 3.4% copper at its Cameron River project (earning 80%) – figure 7. Further assays are pending.

This is an impressive intersection (figure 8) by any measure and could, according to the company, point to a high-grade feeder zone at depth.

Another hole, namely HERC004 was drilled to the northwest and intersected 14m of altered ironstone from 164m downhole.

Follow up drilling is planned after the wet season in March-April 2022.

There is further upside at the neighbouring prospect Jasper Hills (also 100% ERM) with a similar geophysical signature which could represent an even larger target.

Access agreements are being progressed for drilling in CY2022. ERM also have a royalty over the Chariot resource (556kt @ 7.8g/t Au for 138.8koz gold) with Small Mines JV partner TCMG looking to establish a processing facility nearby in 2022.

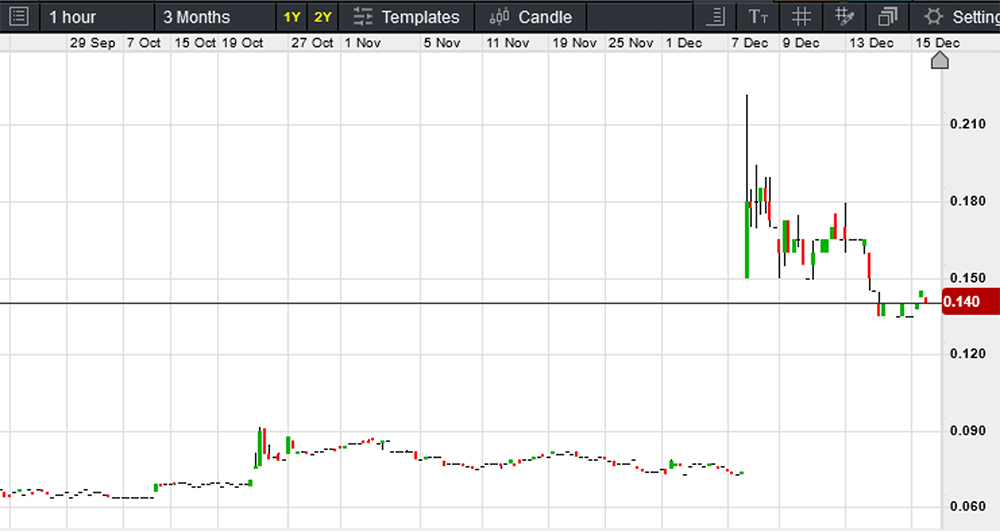

The company ran hard on the back of HERC003 to over 20 cents and is currently sitting around 14 cents equating to a market capitalisation of just under $70 million with approximately $4.0 million in cash for an enterprise value of $66 million.

A capital raising may not be far away given the strong performance of the share price over the last week or so, but it is worth keeping an eye on as it may go quiet prior to the recommencement of exploration in March.

Well done to managing director Rob Bills who has never wavered in his belief on the prospectivity of Tennant Creek.

which is covered by the Exploration (EEJV) and Small Mines (SMJV). Yellow dots are potential small mines and/or remnant resources.

Noting that Emmerson retains 100% of the Jasper Hills, Hermitage, North and Northern Star and Edna Beryl projects. (Source: ERM ASX Announcement, 8 December 2021).

(HERC004) and historical intercepts (HEDGD). Long Section (within 30m wide corridor) of Emmerson drill holes HERC002 and 003. Also note pending assay results (HERC004) and historical intercepts (HEDGD).

New Ideas

I will keep my powder dry for CY 2022 on these two plays as I am aware that the Stockhead faithful may be in an alcohol and cigar-induced fog as we enter the festive season.

RTG Mining (ASX:RTG) and Nexus Minerals (ASX:NXR) will be discussed in more detail in the new year.

RTG have had a major breakthrough through arbitration in with their Philippine partner at the Mobilo project in the Philippines (a cracking project with an excellent set of financial metrics) while NXR are on their way to a +1Moz JORC resource sometime in mid- to late-CY 2022 at their Wallbrook Project.

I hope you have enjoyed the column this year and I have made you all fabulously wealthy.

Just noting that no presents (or other incentives) have been received from the punters but I live in hope.

If it wasn’t for the fun police at Stockhead editing out all the politically correct statements about minority groups, I could have made you all a lot more money…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.