Guy on Rocks: Put your pencils down and pay attention to 100 years worth of battery grade material

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

The market seemed a little nonplussed about the pow-wow last week in Jackson Hole, Wyoming, with Jerome Powell commenting that the Federal Reserve has a “long way to go” and that the bank was prepared to “raise interest rates further”.

I think what he was trying to say is that the current round of interest rates weren’t having the desired effect of slowing down the US economy and he has no idea what to do. No surprises here.

Chinese economic data continues to be of concern to the market with property developers Evergrande and Country Garden remaining under severe financial pressure while youth unemployment surged to 21.3%, according to the Australia before Beijing put a lid on any further employment data.

The markets didn’t seem to pay much attention to Powell’s comments last week with the DOW up 247 points on Friday but losing 184 points or 0.53% by Friday close. Gold closed up US$24/ounce to US$1,913/ounce despite a rising US dollar with the DXY closing near a five-month high of 104.13. US 10-year treasuries were flat at 4.24% and volatility as measured by the VIX remains down slightly at 15, just below long-term averages.

Silver was up 22 cents to US$24.21/ounce after a big sell-off the week before while platinum was up US$34/ounce to finish the week at US$946/ounce. Palladium, which continues to be under heavy selling pressure this year, was down US$34 to close at US$1,194/ounce.

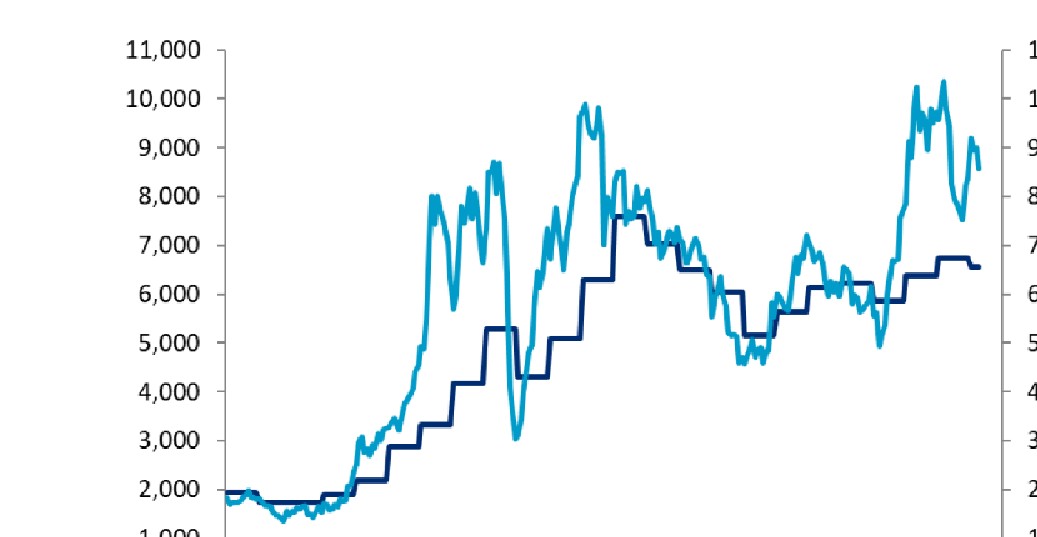

Copper was up 6 cents over the week on short covering and closed at US$3.78/lb. Low inventories are continuing to put a floor on spot prices which have declined just over 7% this calendar year. Near term price projections from investment banks range from US$7,500 to US$8,000/tonne however estimates beyond CY 2025 remain bullish at US$10-US$12,000/tonne.

I think in volatile markets it is useful to look at the marginal cost of production for the 90th percentile of produces which is sitting at around US$6,500/tonne (figure 1).

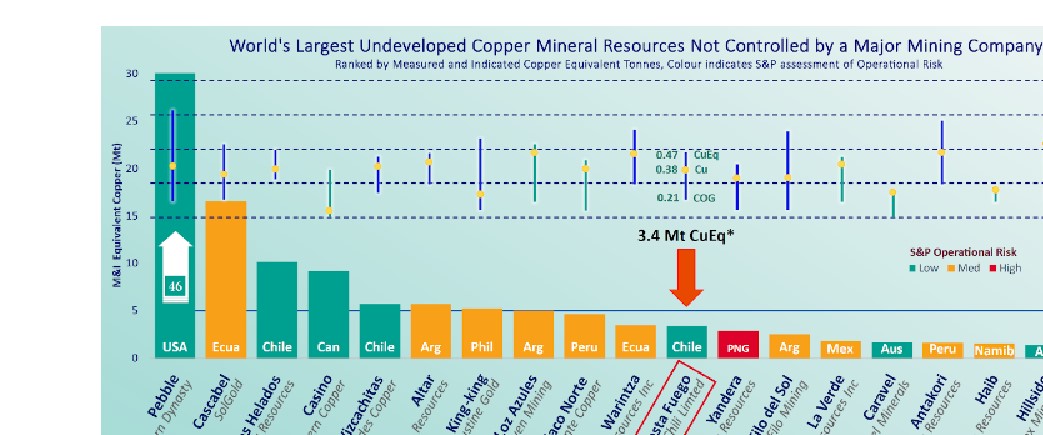

The real issue I have with the majority of new copper projects in the hands of junior-mid tier miners that are scheduled to come online, or are in the development pipeline (figure 2), is that they are mostly low grade porphyry copper+/-gold+/-molybdenum (grades typically ranging from 0.40% to 0.60% copper equivalent) whose incentive prices are likely to be well above US$7,000/tonne given the very high capital intensity and sensitivity of these projects to small movements in exchange rates and spot prices.

In simple terms for the Stockhead faithful, the majority of these projects are low grade, require large amounts of capital and are very high risk; hence the requirement for better financial returns which aren’t there for the most part or are marginal in the current climate.

One needs to also factor in cost inflation which has adversely affected many mining studies that have been completed over the last few years.

The other benchmark to look at is the scrap metal marginal source of supply which is sitting below US$2,000 per tonne, however volumes and reliability of supply are an issue here.

The other big issue are the permitting roadblocks that now seem to be as much of an issue in mining friendly jurisdictions such as the US which recently knocked the giant Pebble Mine (JORC Resources of 4.5Bt @ 0.55% copper equivalent) development on the head a few months ago, citing the potential damage to fish and water quality in the event of a catastrophic dam breach, even though this risk was deemed to be very low.

Has anyone thought about asking the fish?

WTI traded down most of the week after a rally on Friday closing at US$80.80/BBL down US$1.20 for the week. Active rigs in the US were down 10 or 17% lower than January this year. US production is currently sitting 12.8 MBOPD representing a post pandemic high and only 400,000 BOPD off an all-time high.

Mickey Fulp (Mercenary Geologist) pointed out an interesting fact last week that subsidies for fossil fuels (oil, gas, coal etc) production hit US$7 trillion, up US$2 trillion year-on-year despite all the talk on climate change. Makes perfect sense given that EV batteries are produced using fossil fuels… because renewable energy is too expensive.

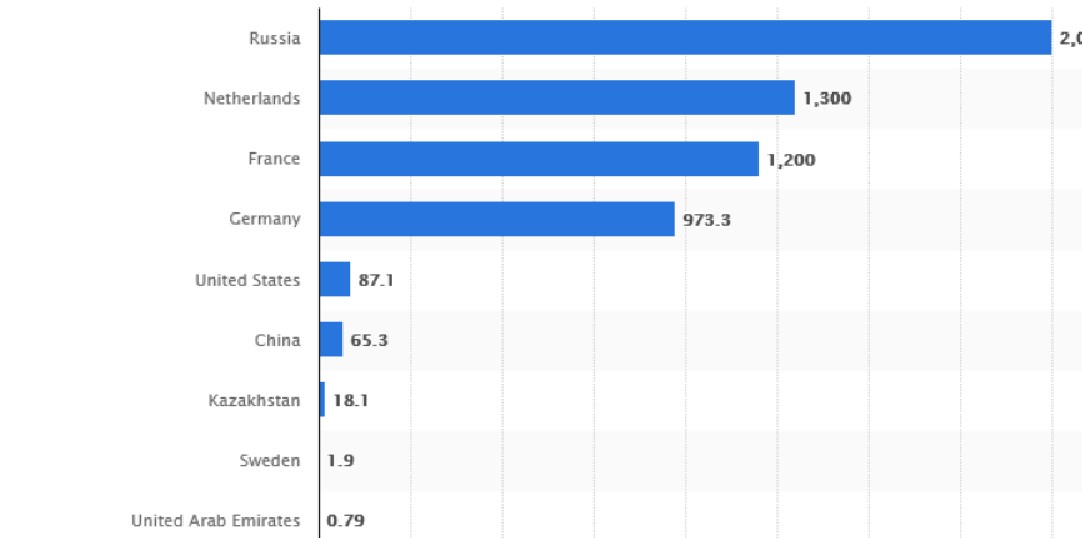

Uranium continues a four-week winning streak finishing the week at US$58.25/lb (figure 3). The conversion of uranium ores to uranium hexafluoride remains a challenge around the globe given the majority of this is undertaken in Russia (over 40% – figure 4). The nuclear security energy pact between US-UK which was recently passed by the US Senate should give the uranium sector a boost providing more incentives and support for uranium producers and downstream processors.

Lithium carbonate prices and equities seemed to be recovering after a drop in China’s lithium futures in July of this year (figure 5).

EV sales around the globe have been mixed with total plug-in sales in the US rising 4.3% month-on-month to while China EVs sold in July declined to 780k, 3.2% lower than 806k units in June. In Europe EV sales were sharply down 26.1% month-on-month to 155k with sales weakness attributed to a phase out of plug-in hybrid vehicle subsidies.

It appears that a vast number of downstream processors in China have tempered stock purchases in light of recent price declines.

Economic news out this week includes non-farm payrolls and PMI (manufacturing and services) on Friday, consumer confidence and preliminary GDP as well as corrected core Personal Consumption Expenditures (PCE).

New Ideas-Sarytogan cracks battery grade purity

Sarytogan Graphite (ASX:SGA) was listed on ASX in July 2022, managed by the luminaries at RM Corporate Finance and Inyati Capital. Full disclosure – both Inyati and RM Corporate Finance received fees and hold shares and options for the role as joint lead managers of the IPO last year.

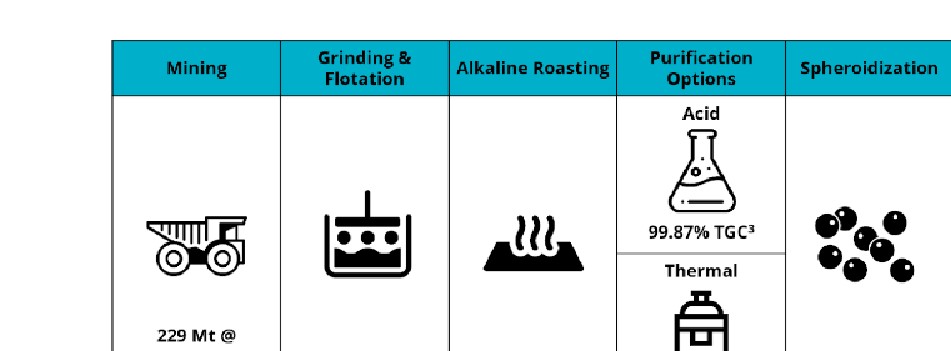

Since that time SGA has hit a number of key milestones including a revised JORC Resource from 209Mt @28.5% TGC (containing 60Mt of graphite) to 228Mt @ 28.9Mt (66mt of contained graphite) with a 55% increase in indicated resources.

While there has never been any question about the resource size (one of the largest deposits of its type in the world) there were some questions being asked in the market about its ability to achieve battery grade graphite specifications (99.95%) with some naysayers believing that while the deposit is one of the largest in the world, it was only good for pencils.

The August 28 announcement however reported that a representative 50g sample of Sarytogan graphite previously treated by flotation and alkaline roasting to 99.70% TGC has now returned a purity of 99.99% which exceeds battery grade specifications (figure 8). A breakthrough result that paves the way for the completion of a Pre-Feasibility Study.

While it is too early to talk about project economics and what the financial metrics will look like on completion of this PFS next year, I believe there are some compelling features around this deposit that give it an excellent chance of being a standout in this sector:

- The sheer size of the deposit and very high grade compared to its peers (figure 9) which has the potential to result in a very long mine life (+100 years) based on reasonable production rates

- The configuration of the high-grade graphite mineralisation should contribute to very low stripping costs (and therefore low mining costs)

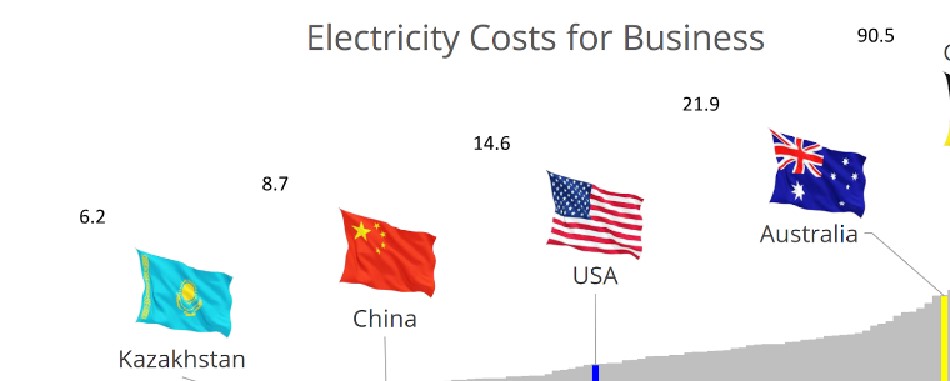

- Low power costs in Kazakhstan at US 6.2 c/kwh compared to other industrialised nations (figure 10)

- Excellent logistics and infrastructure including being located 170km by highway to the large industrial city of Karaganda, 68km from the nearest railway station and 6km from bitumen road to project

- Ability to make battery grade graphite

- A skilled local workforce; and

- Adequate water supply

For those looking at success stories in this sector have a look at Renascor Resources (ASX: RNU). RNU is developing a vertically integrated operation within South Australia consisting of the Siviour Mine on the Eyre Peninsula, concentrator, and a downstream manufacturing facility to produce Purified Spherical Graphite (PSG) via chemical purification for sale to anode makers and use in Li-ion batteries for Electric Vehicles. The current market capitalisation is just under $400 million but not a bad model for SGA to follow.

Plenty of news flow for SGA as the PFS progresses as well as drilling results from the newly discovered Kenesar Project (northern Kazakhstan) where drilling is underway to test various EM conductors.

As that great Ambassador (whose name I am not allowed to mention) from Kazakhstan would say “very nice, very nice, how much?”

Rudi Guiliani, if you are thinking about reaching into your trousers for a second time, pull out a cheque book instead and buy some shares, it is perfectly legal and there is plenty of upside left.

Not even the New York Times will ask any questions…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While Renascor Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.