Guy on Rocks: Forget your hot air, the real winds of change are blowing graphite’s way

A hippie's hair yesterday, torn out after he read 'Guy on Rocks'. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Very Nice

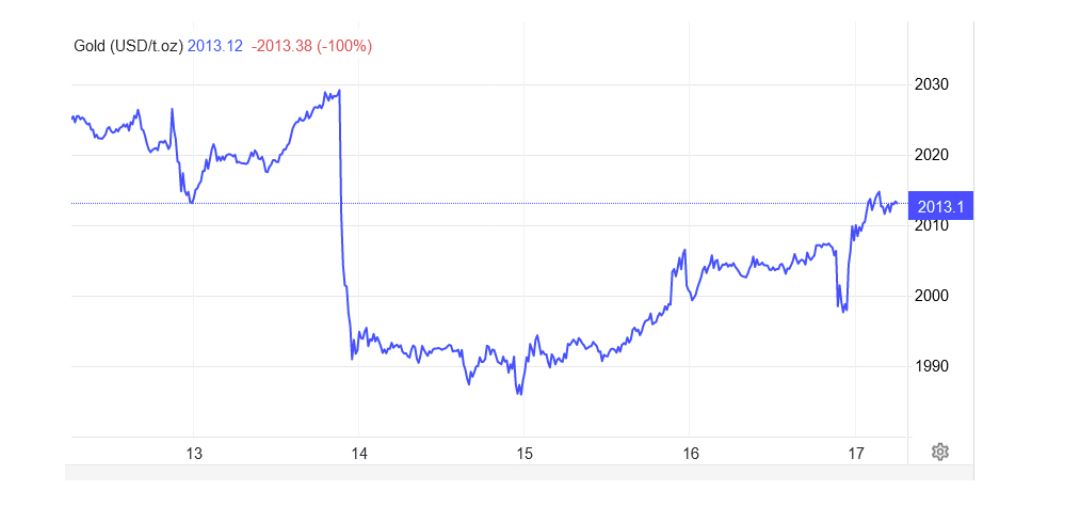

Gold (figure 1) had a volatile week falling from US$2,030/ounce to as low as US$1,991/ounce in just over 1.5 hours after a strong US non-farm payrolls report and higher than expected CPI. January CPI in the US came in last week at 0.30% month-on-month compared to expectations of 0.2% month-on-month. US Bond Yields also rose sharply (figure 2) with the USD again stronger for five out of the last six weeks.

Offsetting the higher-than-expected inflation numbers, retail sales in the US came in weaker than anticipated, falling 0.80% in January as successive interest rate rises start to bite.

The FedWatch is now predicting only a 10% chance of a rate cut in March as Jerome Powell poured cold water on accelerated rate cuts which look more likely around May at a 61% probability.

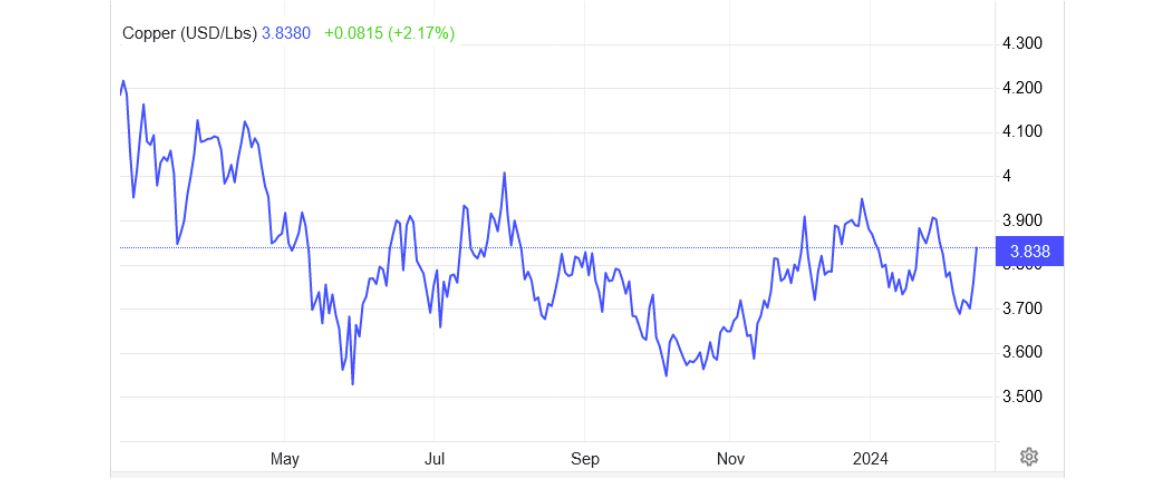

Copper futures (figure 3) rose 14 cents to finish the week at US$3.8/lb after touching three-month-lows of US$3.69/lb on February 9 in response to tepid US retail data which raised prospects of an interest rate cut by the Federal Reserve in the second quarter.

Growth still remains soft in China with deflation unexpectedly rising to a 14-year high with manufacturing PMI’s contracting for the fourth month in a row in January.

According to Trading Economics, Yangshan copper premiums also declined with Chinese copper inventories increasing by over 120% year-to-date to just under 70,000 tonnes.

It appears Mexican President Andrés Manuel López Obrador may have gone right off the reservation after presenting the parliament with proposed constitutional reforms relating to a ban on open-pit on the basis that open-pit mining causes severe environmental damage as well as using excessive water that could otherwise be provided to water-scarce communities.

The Northern Territories’ renewable energy plans are going swimmingly after their farms at Manton Dam, Batchelor and Katherine just south of Darwin were connected to the grid late last year.

Well, knock me down with a feather – they are operating at 25% capacity due to the intermittent nature of the power generation which can trip the system if power output surges during periods of weak demand. Well, they might need to get the PR firm that brought us the CU in the NT campaign back to put a positive spin on this disaster.

Speaking of disasters, Morgan Stanley (Global Lithium, 13 February 2024), in another excellent piece of analysis, have given us their view on where we might find a floor on lithium prices after the China lithium carbonate ex-works (ex-VAT) price plummeted 80% over CY 2024 to US$14,330/t on the back of a +28% year-on-year supply increase headlined by Argentina, Zimbabwe, Mali, China lepidolite, Brazil, Canada and Australia.

Morgan Stanley have revised down their EV numbers due in part to high financing costs, with hybrid sales surging by +72% year-to-date in China and now representing 12% of PV sales.

The 90th percentile of the cost curve for spodumene producers is around US$1,000/t which could pull China lithium carbonate down to around $12,000/t and would see China non-integrated converters just breaking even, suggesting further downside in lithium prices.

With Albemarle recently commenting that current lithium prices do not provide an adequate incentive price for new developments, I anticipate this sentiment will also mean exploration funding for juniors is likely to dry up. That was certainly the sentiment talking to people at last week’s RIU Explorers Conference in Perth.

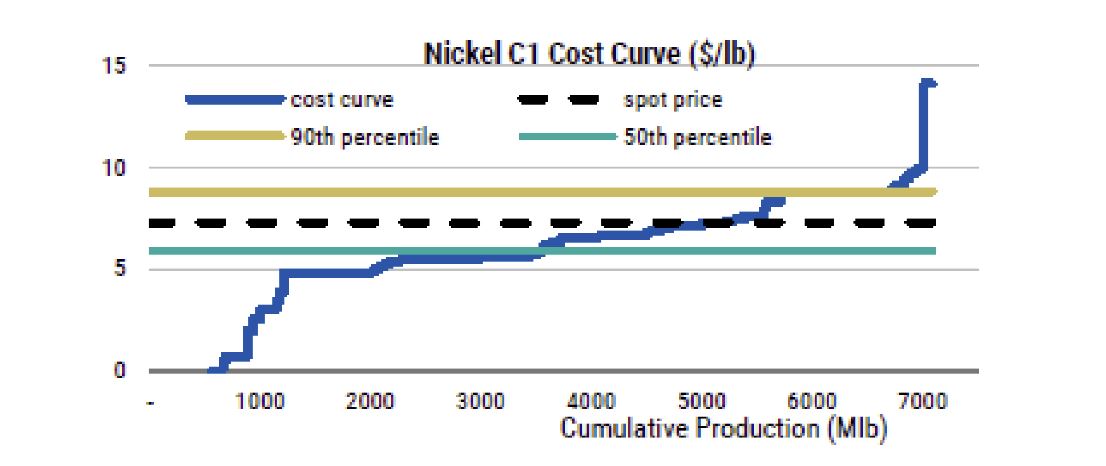

Speaking of pain out there in the metals space, we need to look no further than nickel, one of the worst performing base metals in 2023, falling 45% year-on-year.

With a string of mine shutdowns in Australia and BHP reconsidering the future of Kalgoorlie Nikel Smelter, Morgan Stanley believes we are close to seeing a trough.

According to Morgan Stanley, the nickel price has troughed at the 70th percentile and could shortly rebound.

They still see pressures on the demand side, with subdued global stainless-steel output and rising LFP market share within EV batteries, however they expect prices to bottom around their Q2 target of US$15,500/t.

Supply cuts so far (and there are sure to be more to follow) amount to around 54kt of mined nickel capacity suspensions, which would reduce our 200kt 2024 surplus by ~30%.

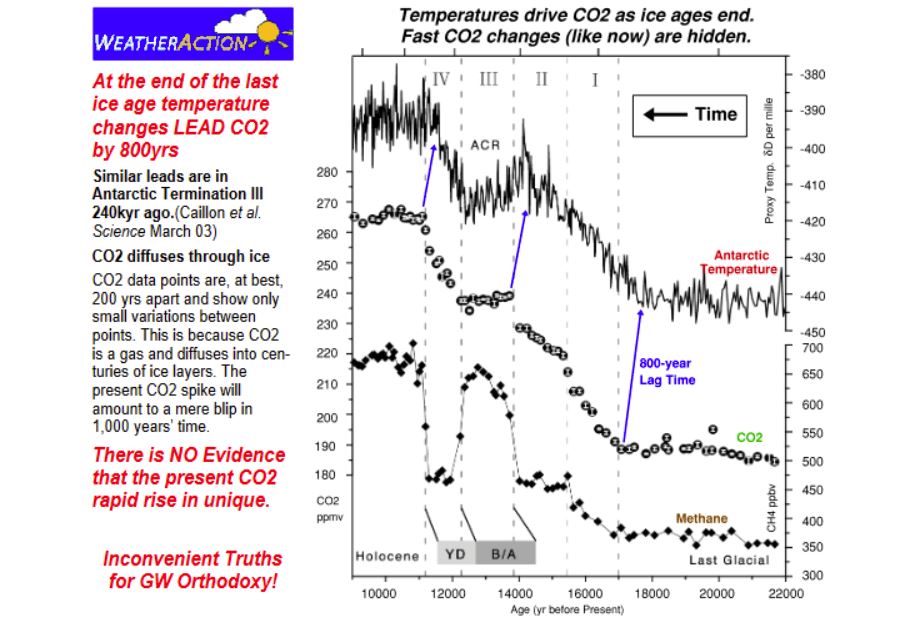

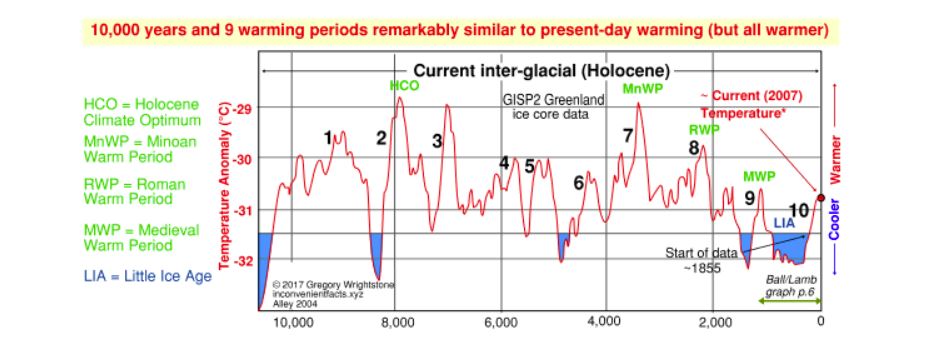

On behalf of the Cigar Social Climate Change Sceptic Committee (“CSCCSC”) I thought I would roll out this little chestnut (figure 5) from Piers Corbyn (2019) who considers that CO2 levels show only minor variations over 200 years intervals which diffuses in ice and is later released, with the present CO2 spike a result of the medieval warming period. He considers it is the temperature that drives CO2 levels not the other way around.

https://www.bundestag.de/resource/blob/666002/21b43e1b155051227ef2981acd52c254/19-16-292-C-Corbyn-data.pdf)

Furthermore, recent warming periods resemble the one we are currently experiencing (figure 6) and are not dissimilar to those experienced over the last 10,000 years.

Of course, the weight of scientific research disagrees with these conclusions because there appears to be funding available (and therefore more scientific papers) for scientific research that support the current CO2 global warming link. As we have seen in the past with Y2K and Weapons of Mass Destruction, the great unwashed (Stockhead faithful excluded of course) are likely to swallow whatever is dished up to them if you keep repeating the message.

I think the real Weapons of Mass Destruction are the current energy policies adopted by the developed world.

And you heard it here first, a new and much more deadly environment hazard has arrived being politicians lying prostrate on the pavement in the middle of the night. I believe this is worthy of some academic research…

New Ideas

An enthusiastic bunch of delegates at the Vertical Events RIU Explorers conference in Fremantle last week who, for the most part, were looking a little battered and bruised after the recent sell down in risk assets.

One company that has been quietly going about its business is Sarytogan Graphite (ASX:SGA) (figure 7) which was listed on ASX by the luminaries at Inyati Capital and RM Corporate Finance back in 2022.

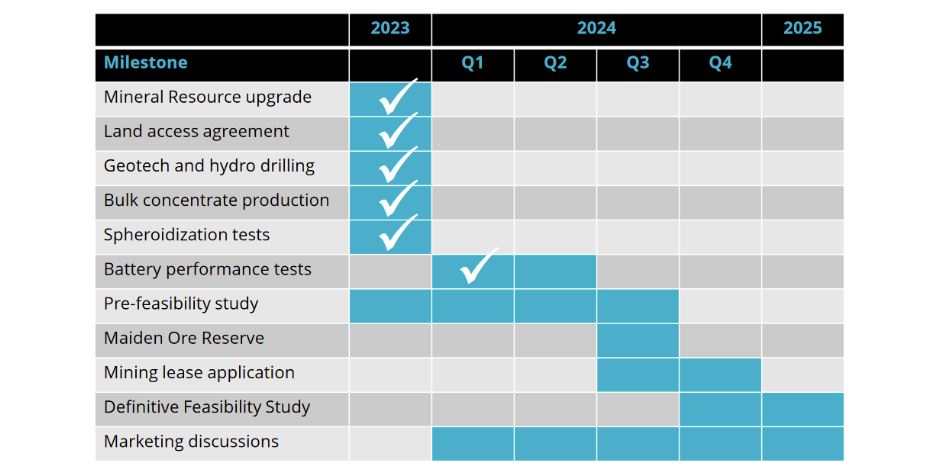

The Company appears to have hit all their milestones (figure 8) including;

- JORC Resource increase from 209Mt @28.5% TGC (containing 60Mt of graphite) to 228Mt @ 28.9Mt (66mt of contained graphite).

- Achieved purity levels exceeding 99.95% (returning 99.998%) and more recently;

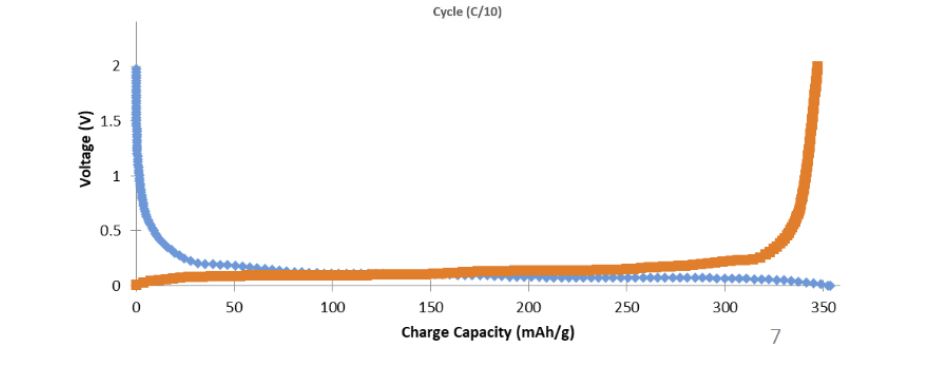

- Batteries have demonstrated reversible capacities ranging from 342 to 347 mAh/g across the six batteries tested (Figure 9) which are superior to many synthetic graphite products used in electric vehicle batteries (returning specific capacities of 330 to 345 mAh/g).

Syrah commences Active Anode Material (AAM) production at its 11.25ktpa Vidalia facility in Louisiana, USA.

Export restrictions on the export of graphite from China were imposed back in December 2023. Furthermore, one of the industry leaders Syrah Resources (ASX:SYR) is commencing active anode material production at its Vidalia facility in Louisiana (USA) as well as ramping production back up at its Balama production facility in Mozambique.

It appears the winds of change may well be blowing in the right direction for graphite after a tough couple of years. In addition, the trend away from expensive synthetic graphite and the desire to sell low carbon footprint EVs has turned the focus back on natural graphite.

With excellent logistics, potentially very low mining costs and a giant deposit capable of supplying battery grade graphite, SGA has put itself in a very strong position ahead of the anticipated pre-feasibility study due in 3rd Quarter 2024.

At a market capitalisation of around $30 million, SGA presents tremendous leverage as it moves into the development phase.

As that great ambassador to Kazakhstan would say “very nice”.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.