Guy on Rocks: Palladium price nears record highs

Pic: Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Despite index and ETF trading data showing weekly investor outflows in the order of $300m, with outflows of around ~$2.3bn over CY 2021, precious metals had a strong finish to the week.

Gold was up almost 2 per cent to $US1,766 ($2,287) an oz, silver rose 1 per cent to $US25.95/ounce and palladium was on a tear – up a staggering 5.6 per cent to $US2,690/oz, only $US65 off its all-time high (figure 2).

Of the $US10bn in outflows this year the majority was attributed to the precious metals sector alone and not surprisingly, based on these figures, money manager positioning remains weak for gold at 2.4x (6 April 2021) compared to the five-year average of 7x. The same can be said for silver and palladium positioning. A sign that precious metals may be about to lift.

Elsewhere, Goldman Sachs/Citi posted bullish reports on copper finishing the week at $US4.20 on the back of positive economic data from China. Iron ore (62 per cent fines) was trading around $US178/tonne on Friday – its highest level since 2011, with premium spreads increasing as the call for emission reductions in China (not sure whether anyone is listening) is seeing more demand for higher grade and lump iron ore.

Speculation remains rife around Bitcoin, with some commentators believing that once the cryptocurrency increases in size, governments will be more inclined to shut it down given they historically control the supply of money.

While economic data appears strong across many of the developed economies, labour shortages appear to be an obvious problem here in the west and also in the US where people are making good money sitting on their cherries taking in Biden dollars. I’ve heard similar stories in Greece, however they are sponsored by Germany so it’s really not an issue for them.

Anyway, they might need to knock down the wall and bring in the Mexicans if Biden’s $US2 trillion infrastructure package gets up in the senate. This includes fixing 20,000 miles of roads and 10,000 bridges. Very bullish for commodities and a big statement from a president that tripped up one flight of stairs three times. If this gives you a headache maybe go and buy some precious metals before the US dollar disappears down the “S’’ bend.

To wrap up my market ructions section I always like to keep one eye (or even two if possible) on large cap mining valuations and valuations relative to other sectors.

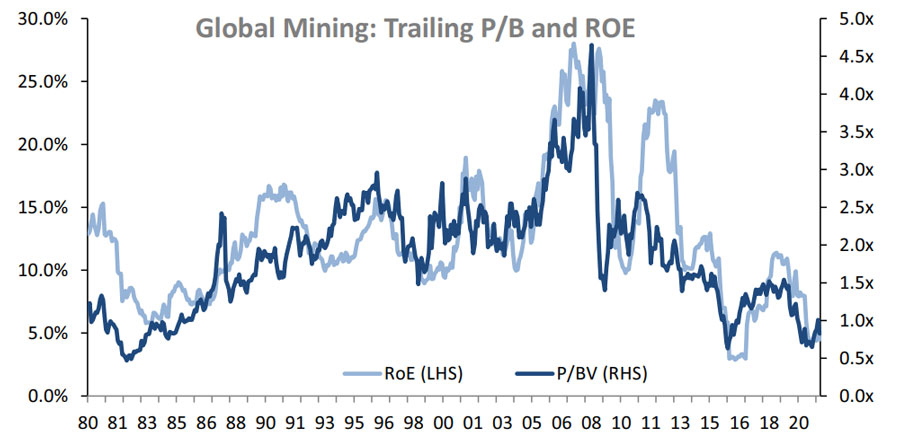

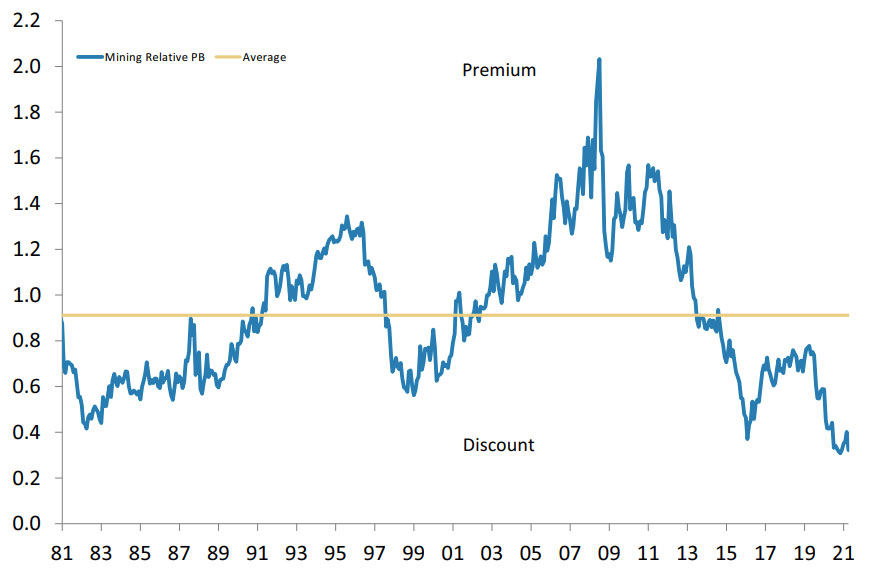

I think the following figures paint some compelling arguments that large cap resource valuations are trading at 1x book value compared to the highs close to 5x in 2007-2008 (figure 3), and the valuation of mining companies relative to the Datastream World Index (figure 4) shows mining companies trading at 40-year lows.

If you believe that large cap valuations often filter down to small to mid-cap companies, then there is good case for a recovery in larger mining company valuations underpinning a junior resources boom for some time to come.

Movers and shakers

Resolute Mining (ASX:RSG) has had the good fortune of having the Bibiani mining licence restored, which was no doubt received with wild enthusiasm by the company.

The only issue now is that the proposed $US105m sale to Chifeng “isn’t recognised” by the Ghanaian government, which is a pity because I thought this old duck had a blue rinse and some lipstick and was looking really special, despite the refractory nature of the ore body.

On the rare occasions I was paying attention studying business I did learn in marketing that a name change can be a good way of re-launching a stale product, so maybe a change to “Bustedarse Gold Project” would help re-launch the project?

Anyway, it is comforting to know that Resolute is “committed to the development of Bibiani and will consider all options to achieve this”. I think pass the parcel is the best option here and get another company to do the heavy lifting. Probably not one of RSG’s best years (figure 5) but it could have been worse.

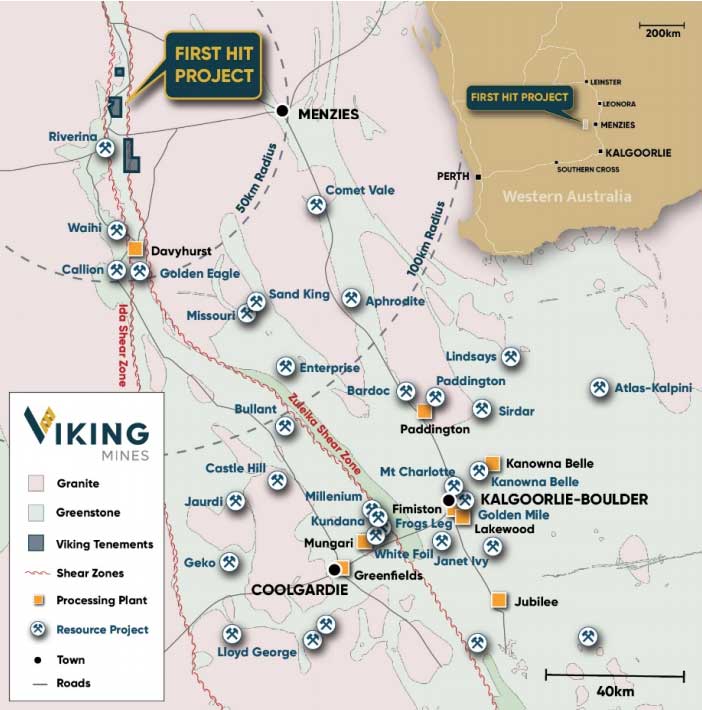

Viking Mines (ASX:VKA) has just completed a $4m capital raising at 3.6c to fund further exploration at its 100 per cent owned First Hit project located 150km northwest of Kalgoorlie (figure 6), covering the highly prospective Ida and Zuleika shears.

We picked this one up in early December and the company has just completed its first round of reverse circulation (5,048m) and diamond drilling (1,648m) with many of the holes appearing to intersect gold mineralisation as predicted by the wireframe modelling.

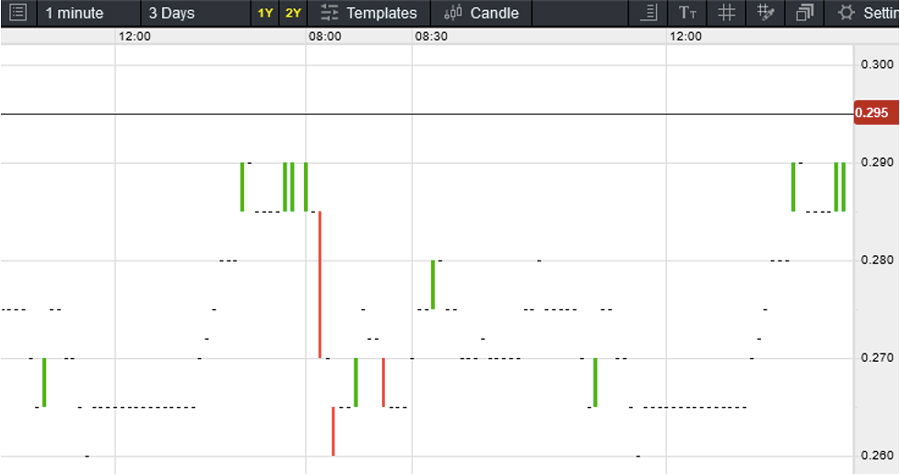

At a market cap of around $35m it’s not cheap but I like the look of the historical grades here, so I am reasonably bullish on the next few months of trading (figure 7).

Despite uranium being down 4 per cent for the week it was encouraging to see the first uranium listing for over a decade, with Athabascan (Canada) focused uranium explorer 92 Energy (ASX:92E), successfully debuting on the ASX last Thursday after gaining 43 per cent to close at 28.5c on heavy volume (figure 8).

The big news last week was the announcement by Regis Resources (ASX:RRL) of its intention to acquire a 30 per cent interest in the Tropicana gold project in Western Australia from IGO (ASX:IGO) for $903m, funded with $300m in debt and a $650m equity raising.

JP Morgan came in with a valuation of around $800m, so the acquisition (assuming the majority of the valuation was an NPV calculation?) looks expensive (and dilutive) so RRL must be banking on plenty of exploration upside or operational efficiencies to justify this premium. I tend to agree with the market response (figure 9).

Hot stocks to watch

Last time I checked we were at the start of a mining boom or “super cycle” as some eastern states analysts like to refer to it as. This is great news as one geologist told me he was relieved that things in the west were “getting back to normal”, which for him was the period 2006 to 2007 when Crystal Champagne (and Porsches) were in short supply.

One of the challenges in the current market is finding inexpensive entries to junior mining stocks, where $20-30m market caps seem to be the “new normal” for any mining company with some moose pasture adjacent to some other recycled moose pasture with nothing on it.

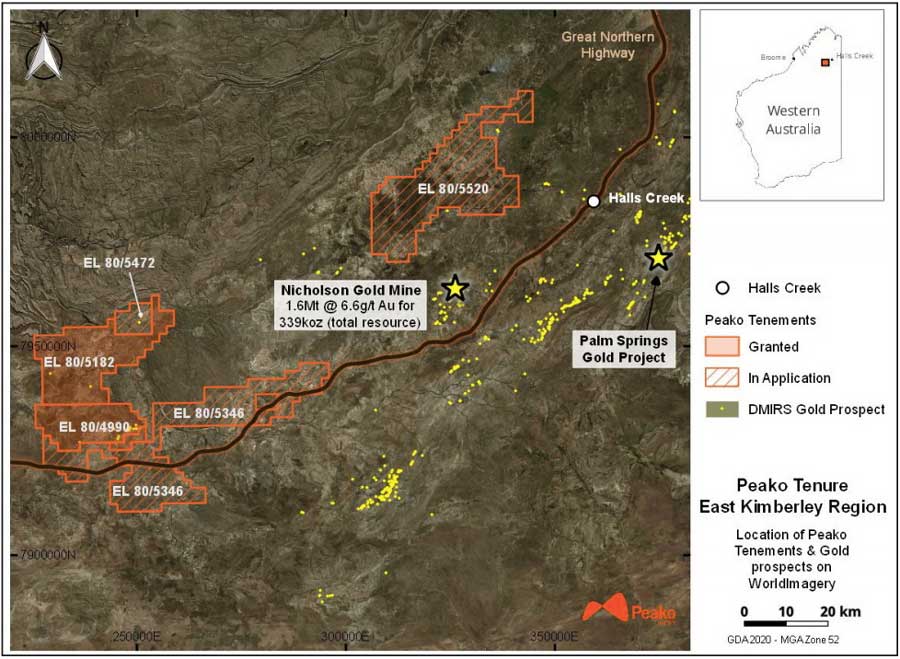

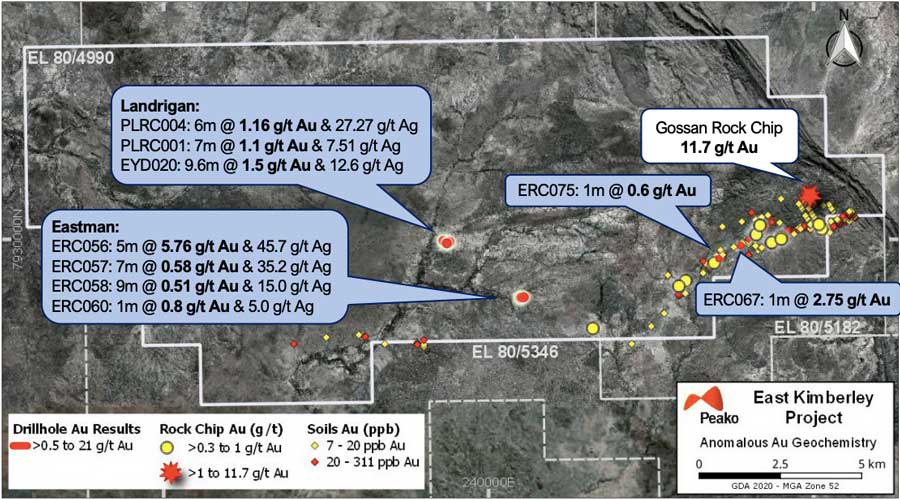

A colleague of mine (whose motto is “false hope is better than no hope”) alerted me to Peako Limited (ASX:PKO), which has a market capitalisation just under $6m, about $1m in cash and is led by Dr Darryl Clark, an experienced geologist with over 26 years’ experience throughout Australia, Central Asia and South East Asia.

Twenty-nine targets on the company’s Eastman tenement package (East Kimberley, Western Australia) are due to be tested in May with around 6,000m of aircore drilling looking for multiple deposit styles including a number of gold geochemical targets, VTEM and magnetic targets as well as alteration targets identified from satellite spectral analyses.

Peako claims that gold prospectivity was overlooked in favour of base metal exploration by previous explorers, so let’s hope the company is right.

Its 2019 campaign (figure 12) had some pretty good hits, so while this is an early stage play it’s not bad value in the current climate.

Protecting ones’ downside is important in the highly unlikely event that the mining boom falters, not that that has ever happened before…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.