Peter Strachan: How the experts spot their golden stores of value

Picture: Getty Images

Peter Strachan is a capital markets veteran, resources analyst and lover of the oil and gas game. The brains behind the popular weekly StockAnalysis investment letter, which launched in 2003, Peter has worked in capital markets for over 35 years, and is a qualified metallurgist and geologist.

The gold investment cycle

Holding physical gold has historically been an excellent store of value through the investment cycle.

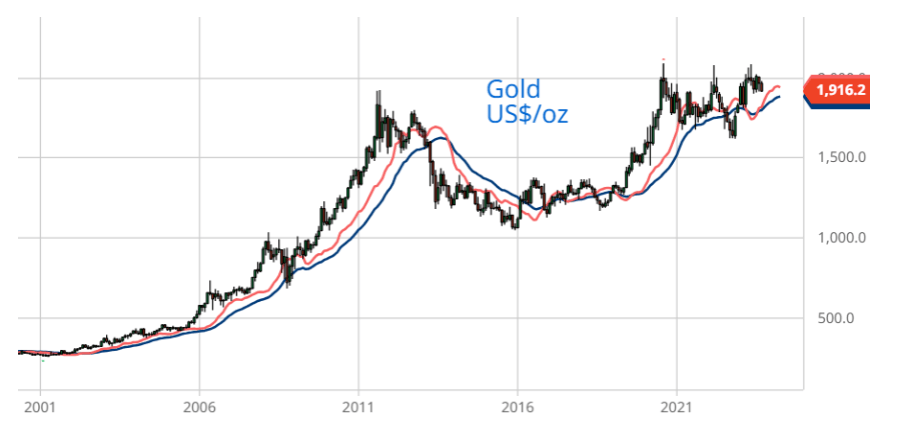

Around 18 years ago, when gold traded at about US$430 or A$560 per ounce, a friend gave me a one-ounce gold coin. Today at a price of A$2,903/oz that coin has outperformed and certainly kept pace with inflation.

Fear and loathing

Interest in gold and gold mining waxes and wanes over long cycles. Investment in gold related exploration and production is often triggered by exploration activity resulting from “nearology” associated with one or more major gold discoveries. A common motivator for gold investment is also fear of an inflationary period that would devalue currency, or a period of low interest rates that reduces the holding cost of a metal that does not generate income to its holder.

While interest in listed gold stocks waned since July 2020, gold held to support bullion backed exchange traded funds (ETFs) has fallen, recently tumbling from ~106 million ounces to 89 million ounces over the past 16 months. However, buying by Central Banks remained strong through June and July of 2023, according to the latest data from the World Gold Council, after purchases of 36.5 million ounces in 2022.

China has been a major gold buyer, supporting speculation that the Chinese government is bolstering its currency the Yuan, so that it can act as a global medium of exchange.

Bell Potter Securities anticipates that as central banks globally, particularly the US Federal Reserve, come to the end of interest rate rising cycles this year, the gold market will enter a period that will be supportive of a rising gold price into 2024.

Discoveries, like De Grey Mining (ASX:DEG) Hemi gold province in Western Australia’s Pilbara region, attract more funding for the company and its neighbours, resulting in more drilling and more discovery, and so the cycle progresses.

Ultimately, discoveries progress to development and production, reducing some speculative appeal as stocks take on debt, reduce exploration spending and begin to be priced on multiples of Reserve ounces, cash flow or earnings. Inevitable development and operating cost overruns and other technical difficulties can lead to a significant reversal of fortune when speculative valuation bubbles are burst. This has been the fate of Red 5 (ASX:RED) , Ora Banda (ASX:OBM) and poli-metal explorer Chalice Gold Mines (ASX:CHN) .

As the investment cycle matures, wages rise, operating costs creep up and finding extra ounces with a drill bit becomes more difficult and expensive leading share prices to stagnate and fall, which is where Australia’s gold industry sits today.

Established producers have been seeking to reduce costs through economies of scale. Buying ounces, often close to existing processing infrastructure, can be cheaper than finding and developing from the ground up. In addition, gaining access to a larger balance sheet, along with scarce skills through friendly or contested mergers and acquisitions becomes a strategic goal.

Merger and acquisition activity can also free up capital as shareholders in acquired targets reinvest down the value chain in the anticipation of repeating a speculative discovery to production cycle.

Newmont’s (NEM:US) recommended offer for $23.5 billion market value Newcrest Mining (ASX:NCM) , could be such a monetising transaction with funds released coming back into the market, looking for opportunities in the gold sector.

Acquisitive Genesis Minerals (ASX:GMD) has acquired laggard company St Barbara (ASX:SBM) Leonora assets while low-cost gold and copper miner Silver Lake Resources (ASX:SLR) acquired a strategic 11.1% stake in Red 5 (ASX:RED), which is finally starting to hit its straps at its KOTH gold redevelopment project.

Also, 50% owner of the low-cost, 350K oz pa Gruyere mine, Gold Road Resources (ASX:GOR) maintains a handy 19.9% ownership of Hemi gold discoverer, De Grey Mining. Long-life, low-cost operations like those in this camp lead Bell Potter Securities to believe that both companies appear to be attractive takeover targets for major gold producers.

Another cause for concern by investors is the overuse of forward gold sales or hedging. Most investors are not looking for dividend income when selecting gold investments! They want pure exposure to the metal and hopefully any capital growth that comes with exploration success.

While lenders may want to see some gold hedging in early days to support repayments, market performance of gold producers with heavy gold hedging puts lead in their saddle bags.

Bell Potter Securities tabulates about A$1bn of hedge losses on the books of 10 gold producers with the worst offenders including Northern Star Resources (ASX:NST) with $263m, Regis Resources (ASX:RRL) with $170m, RED 5 with $145m, Resolute Mining (ASX:RSG) with $172m and Capricorn Metals (ASX:CMM) with $71m. Offsetting hedge losses that investor hate, were three companies identified by Bell Potter that held hedge gains totalling $59 million, including Evolution Mining, West African miner, Perseus Mining (ASX:PRU) and Silver Lake Resources.

Valuation Multiples

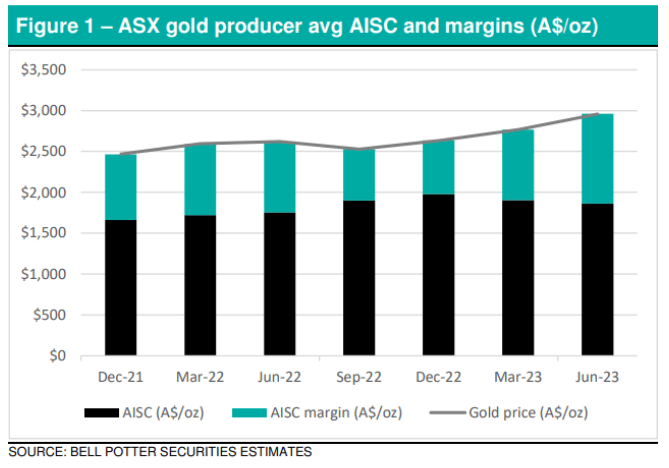

The average AISC for ASX producers runs at around A$1,862/oz within a range of A$1,320 to A$2,200/oz.

Multiples of EV/Resources for gold producers average around A$205/oz but generally ranging from $80-$300/oz while explorers trade on a much lower average of $84/oz.

Trading multiples for EV/Reserve ounces average A$523/oz for producers, roughly equating to net present values per ounce, but ranging from $300 to $800/oz while explorers trade on an average multiple of $399/oz of Reserves.

Stockhead thinks that low-cost gold producers with low debt would be more attractive to gold investors if they held no forward sales of metal.

Target areas

Bell Potter likes Regis Resources as a potential takeover target following receipt of key approvals for its McPhillamys Gold Project in NSW, strong underlying cash flows from its existing Tropicana and Duketon operations and its onerous hedge book being cleared out by the end of FY24.

In a similar vein, $350 million market capitalisation Alkane Resources (ASX:ALK), with cash and liquid assets of $107 million, has a tiger by the tail. The company aims to expand gold production from its Tomingley mine in NSW to 105Koz by 2025 from 70Koz in 2023, with a nine-year mine life on existing Resources. Bell Potter Resources see profit expanding to $55 million pa from 2025, from $42.1m in FY 2023, putting the company on a prospective PER of seven times FY ’25 profit.

Alkane’s big upside potential revolves around massive, low grade porphyry discoveries at its Northern Molong Porphyry Project (NMPP), where the company has defined combined Inferred Mineral Resources of 894Mt grading 0.52g/t AuEq for 14.8Moz AuEq (7.26Moz Au, 1.38Mt Cu). Upgrades of Resources at both the Boda and Kaiser deposits are expected to be available in 2024.

This will be a multi-billion-dollar investment that Alkane can either joint venture or sell, if it isn’t taken over beforehand.

One way to gain access to the speculative end of the exploration market is to leave it to the experts.

Small cap resources fund Lowell Resources Fund (ASX:LRT) has an enviable track record. Over the past eight years, the fund has paid out 100% of its net taxable income as dividends totalling $0.4957 per share while its net tangible asset base has climbed from $0.58 to $1.47 per share.

The fund identifies exploration opportunities across the resource spectrum where the prospects are geologically attractive, risks are manageable, and the management has integrity. Current gold stock interests include West African explorer, Predictive Discovery (ASX:PDI), Carnavale Resources (ASX:CAV), Nth Queensland explorer Pacgold (ASX:PGO), Lefroy Exploration (ASX:LEX), Musgrave Minerals (ASX:MGV) and Saturn Metals (ASX:STN) .

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.