Guy on Rocks: Know what’s good for gold? A debauched US dollar

Pic: d3sign / Moment via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

To be good at forecasting precious and base metal prices, you need to have one eye on the global economy and one on supply/demand metrics.

As we move into unprecedented levels of debt (figure 1) in the US (126% of GDP or $229,000 per taxpayer) which compares to a projected 45% in Australia by 30 June 2022, I thought it would be appropriate to seek out some doomesday preppers in the US such as Robert Kiyosaki (author of “Rich Dad, Poor Dad”) whose YouTube interview entitled “The biggest crash in world history” claims that there is no correlation between the US economy and the actions of Powell and Yellen.

Kiyosaki is 74, looks 42, is good friends with Donald Trump and identifies himself as a capitalist rather than a Republican or Democrat. Kiyosaki’s upcoming book, “The Capitalist Manifesto,” due out later this year, claims that the US government is exercising more totalitarian control measures on the populace.

Time to issue this man with Western Australian citizenship.

Where it has all gone wrong, according to Kiyosaki, is that M2 (or money supply) has increased without a corresponding increase in spending. What does all that mean? A pumped-up stock market and real estate sector.

He likens the establishment of the central bank as “90% of communising a nation”. As Vladimir Illyich Lenin pointed out, the best way to destroy a capitalist system is to debauch the currency, so it appears that the Fed is well on the way to achieving this.

So, the biggest “crash of all time”, aside from leading to massive and geopolitical social unrest, may present a good opportunity to buy gold (for saving), silver (for spending) and bullets (for protection), according to Kiyosaki.

A number of economic luminaries have suggested that the Fed Reserve create a one trillion-dollar platinum coin and borrow against it. The US Treasury could mint a $1 trillion platinum coin under commemorative clauses and deposit it at the Federal Reserve, giving the US an extra $1 trillion in funds to cover existing debts and pay bills without raising or suspending the debt ceiling. This would be a “fascist” move according to Kiyosaki.

Clearly the markets didn’t think this was going to happen, with platinum closing around US$971/ounce last week (figure 2).

For those learned southern-Africans among the Stockhead faithful, I thought I would show you a copy of the one hundred trillion-dollar Zimbabwe banknote I purchase in Cape Town back in 2012 for around US$20 (lead image, above).

The devaluation of the currency, among other things, ultimately led to the collapse of the economy. I’m not sure if my North American readers would appreciate a comparison with an African economy, however it did happen in Germany back in the 1930s.

The real question is, could this happen in the US? Looking at the clowns running the Fed at the moment, anything is possible.

In other news gold took a hit mid-week based on comments of Powell, closing at US$1,760/oz up $13 for the week with silver closing at US$22.48/ounce up 15 cents, palladium dipped into the low US$1,700s/oz before closing at US$1,846/ounce down 2.5% for the week and US$500/oz over the last month.

Copper was off 2.5% closing at $4.13/lb (Chinese imports were down 4.5% MoM and 12.4% YoY in September) with Chinese continuing reserve sales of all base metal stocks amid serious domestic economic concerns (e.g., Evergrande), energy supply problems and skyrocketing prices.

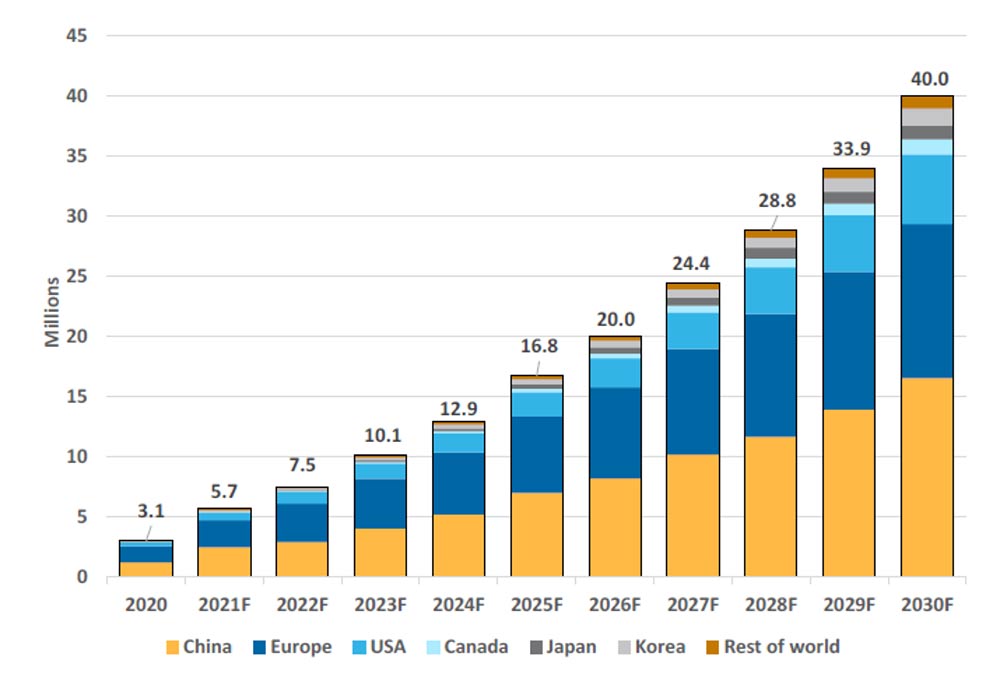

While there are some near term economic headwinds for base metals (or hurricane winds if you take the view of Kiyosaki) the strong projected rise in EV sales (figure 4) is bullish longer term for battery metals.

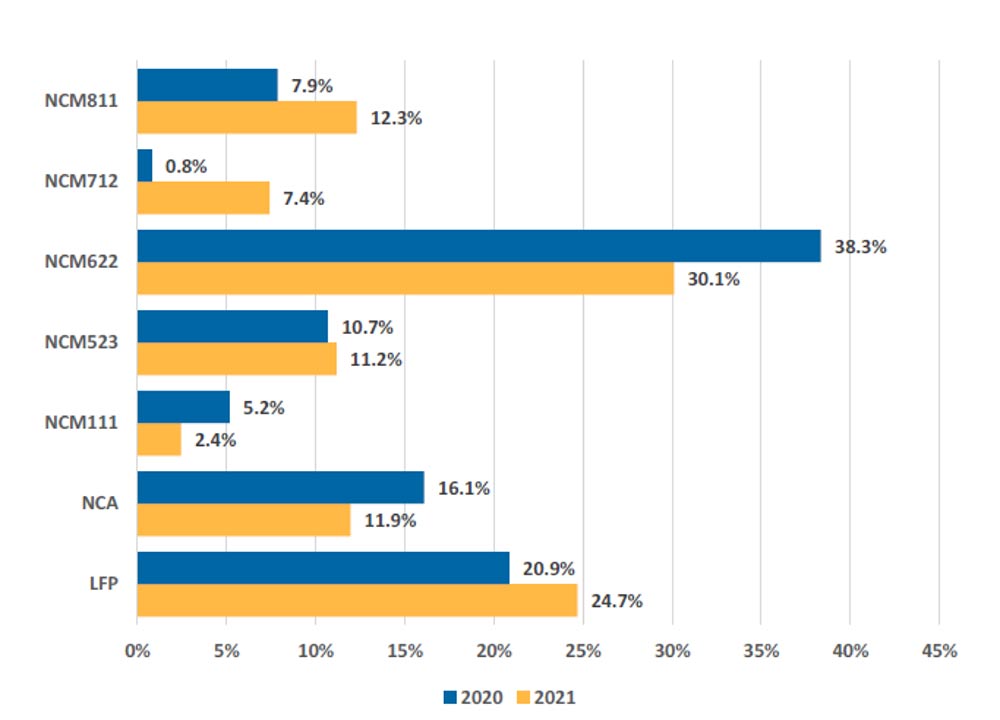

Figure 4 suggests there has been a sharp rise in the share of the high nickel chemistry battery NCM 811 (nickel, cobalt, manganese in ratio of 8:1:1) battery, (7.9% in Jan-May 2020 to 12.3% in Jan-July 2021).

Another trend is the strong rise in the cheaper LFP batteries (lithium iron phosphate – containing no nickel or cobalt) (figure 5) increasing from 20.9% to 24.7% over Jan-July 2020 and 2021 respectively. This is mostly driven by China, and I question the stability of these batteries. Despite this, the Tesla Model 3, BYD Han and SAIC GM Wuling are all using LFP. Buyer beware!

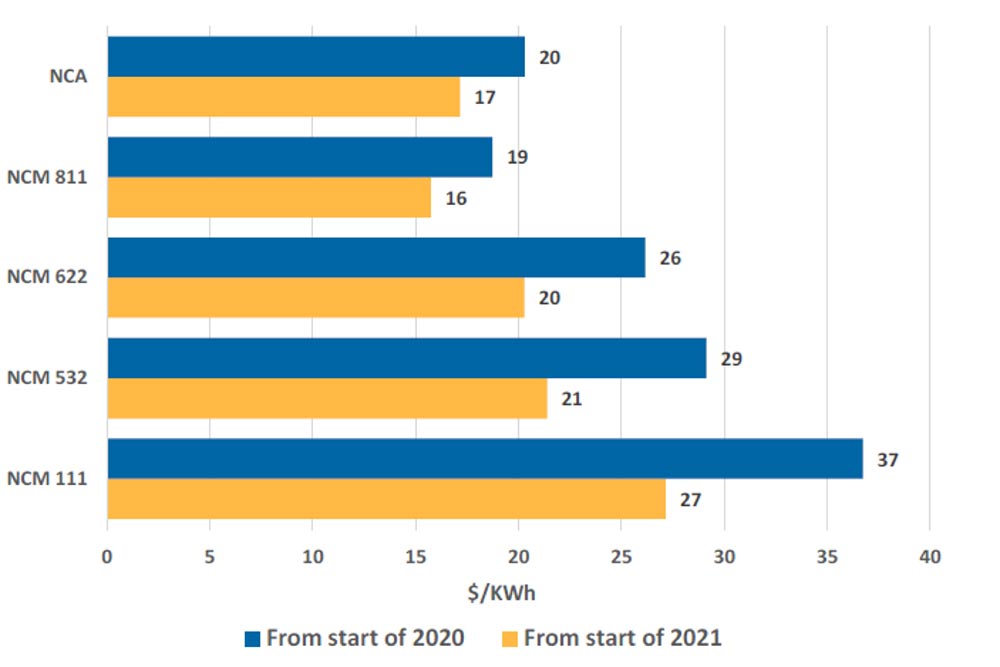

Many commentators are calling for a near term softening of battery metals due to the rising cost pressures as set out in figure 6.

During the third quarter 2021, the average Chinese price of nickel sulphate increased 48% from Q1 2020, with cobalt sulphate prices up 67%, lithium carbonate prices rising 143% and lithium hydroxide prices up 128%.

Company News

Moho Resources'(ASX:MOH) exploration success in the last couple of years has resembled the 2021 Adelaide Crows season.

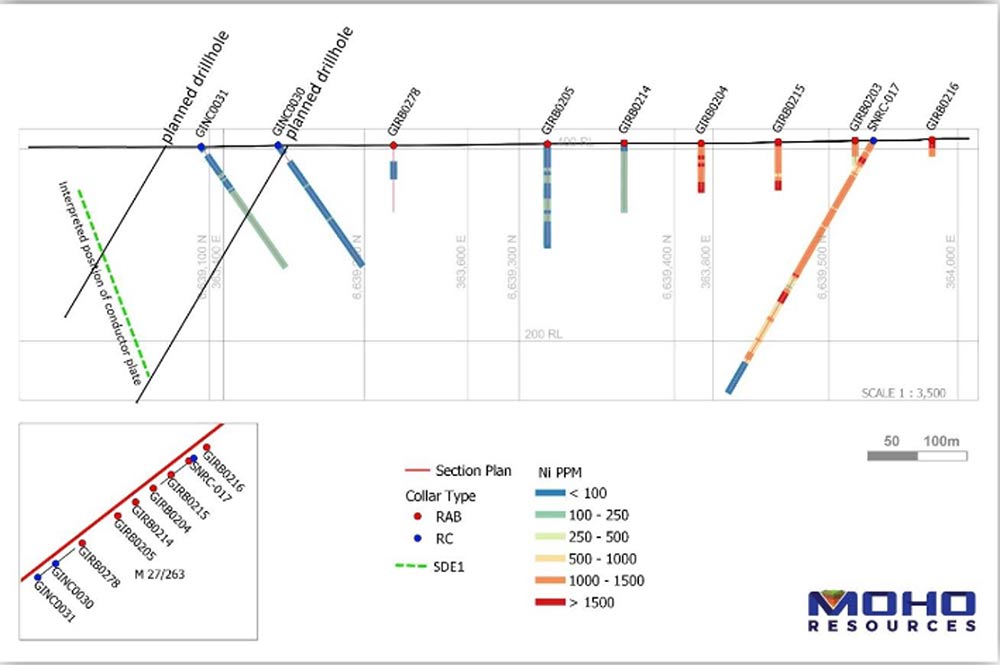

Having said that, it looks like MOH is finally about to drill some interesting nickel sulphide targets at Silver Swan north (Western Australia) in the form of a few sizeable EM conductors.

The Omrah target extends for around 500m at a depth of around 155m (figure 8). There are also a number of magnetic and nickel geochemical anomalies.

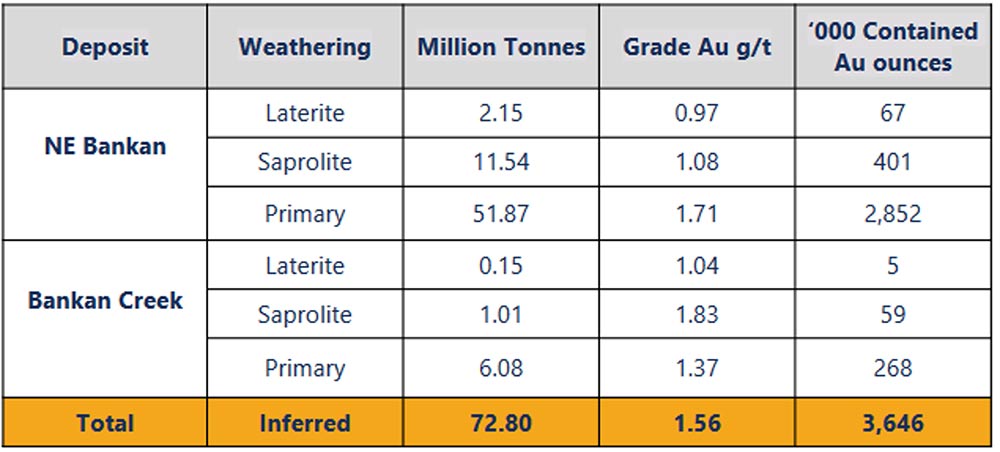

Predictive Discovery Ltd (ASX:PDI) has delivered a solid maiden JORC Resource (table 1) of 72.8Mt @ 1.56g/t gold for 3.646 Moz of gold at Bankan (Guinea).

Importantly, using a higher grade 1g/t Au cut-off, the JORC Resource comes in at 2.82Mt @ 2.82 g/t gold.

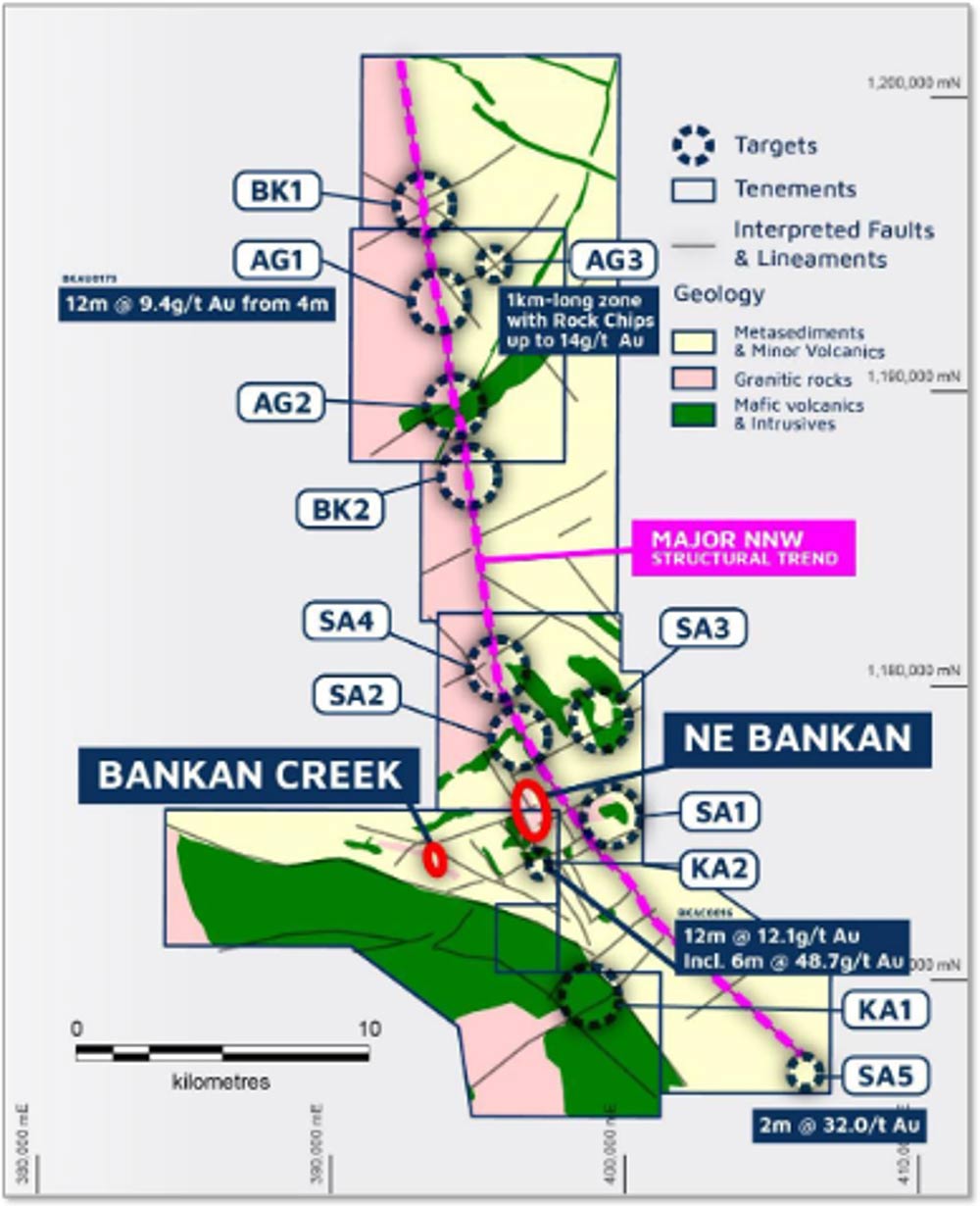

Metallurgical testwork as part of the Scoping Study returned 94-98% recoveries with potential, according to PDI, to substantially increase JORC resources along the 35km long Bankan structure with multiple targets remaining untested (figure 9).

The Stockhead faithful will no doubt being doing handstands as this chestnut was rolled out here around 10-11 cents back in early July this year.

If you are inclined to send a bottle of champagne for this tip then I would find a Perrier Jouet or Crystal acceptable. You could also include a box of Plasencia Alma Fuerte cigars if you are feeling overly generous. Just make sure gifts are under the soft dollar limit of $300 so compliance don’t need to get involved…

New Ideas

As we approach Armageddon and are suitably loaded up with short positions on the market, gold equities and gold bullion, I thought it would be appropriate to start to look for value on the small end of the gold market.

Apart from sporting a year-round tan and being a very capable Masters’ swimmer, Klaus Eckhof has also had a cracking run with African mining companies including Moto Gold Mines Limited (21Moz gold) that was taken out by Randgold in 2009.

So far I haven’t lost money with him yet, so I am going to roll out his latest gig in the jungle being African gold explorer Amani Gold Ltd (ASX:ANL).

While the stock went for a big run on Friday after raising $7 million at $0.001 (together with one for one free attaching options exercisable at $0.0015 on or before 15/1/2024) and with an EV of around $73 million (not including unquoted securities, including 2 billion Performance Rights) I think there is more to come.

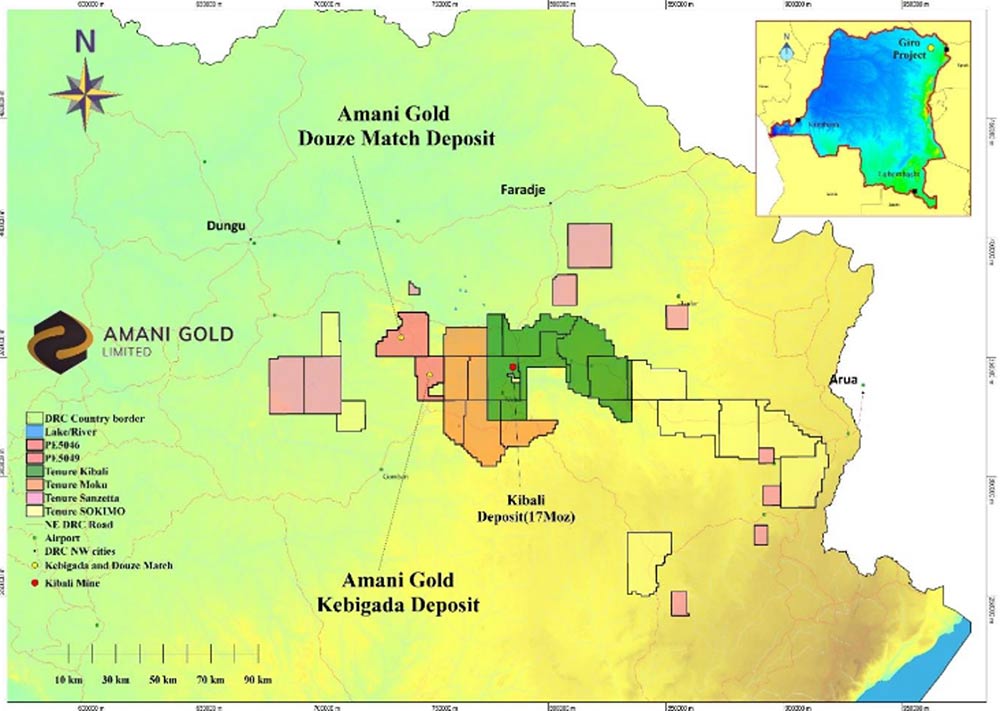

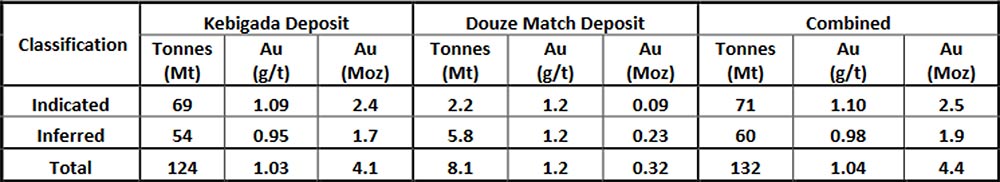

ANL is also starting life with combined Inferred and Indicated JORC Resources at its Giro Gold Project (figure 11) of 132Mt @ 1.04g/t Au (table 2).

Giro covers 497km² of the highly prospective Kilo-Moto Belt in the DRC which also incorporates Randgold’s 17 million-ounce Kibali group of deposits situated within 35km of Giro. The Kibali Gold Project is currently producing in excess of 600,000oz gold per annum.

The tenement has seen both alluvial and primary mining by artisanal miners.

The recently completed placement will fund an infill diamond drill program at Kebigada to further define the Central Kebigada Ore Body.

Drilling will also target the Eastern Kebigada Ore Body which has seen limited drilling despite previous RC holes returning impressive results including GRRC204 with 89m @ 1.58g/t Au from 8m downhole.

The company is also looking to accelerate development/commercialisation options for the project including a desktop study in relation to the Kebigada Deposit as well as a consideration of potential business development and corporate opportunities. I think this stock would fit well in any doomsday prepper’s portfolio…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.