Guy on Rocks: Ironbark deal could be beach head in titanic battle for global resources

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Round 1 — US v China

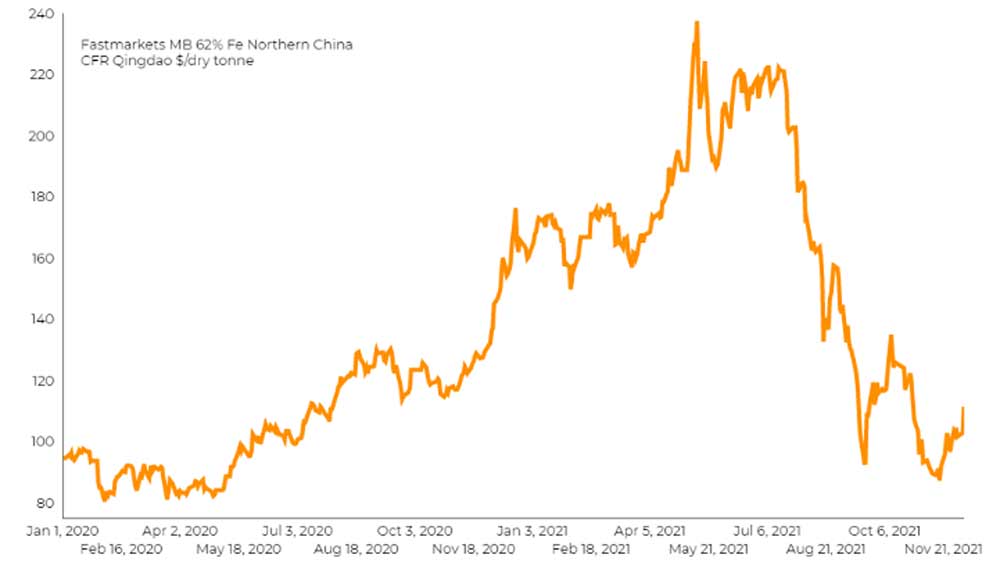

As predicted here last week, iron ore continues to firm, closing around US$111/tonne (62% fines) yesterday (figure 1) as we move into the cyclone season in Australia.

Meanwhile exports from Brazil dropped for the third month in a row to 29 million tonnes in November according to the country’s Ministry for Industry and Trade.

At the same time China, whose medium-term ambition among other things is to increase domestic iron ore production, imported 105 Mt in November compared to 92 Mt in October, representing an increase of 15% MoM, the highest level since July 2020.

Not much happening on the gold front, with COMEX gold sitting at US$1798/ounce at the time of writing.

This is despite a succession of bad economic news including Omnicron COVID-19 presenting risks to US growth and the prospect of a rate hike in June next year (or earlier).

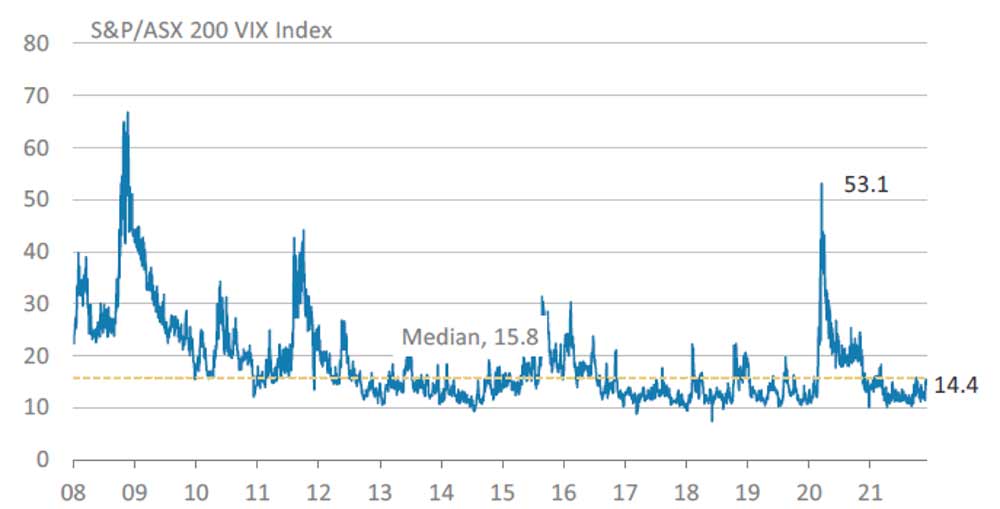

As volatility picked up in November 2021 (figure 2) we saw a “risk off” environment with many of the tech and junior miners being sold down.

The ASX has just under 50 IPOs in the hopper at the moment with mining and energy comprising around 26 of these hopefuls.

The current environment is characterised by overpriced shells and a bevy of junior resources IPOs, mostly recycled moose pasture from the good old days, with recent resources IPOs now largely underwater.

I think this represents a tipping point in the market with new entrants struggling to raise funds (through IPOs) and backdoor listings into overpriced shells, which are diminishing in number, representing a difficult pathway to market.

Something has to give, either the IPOs dry up (and demand increases) or shells drop in value, or both.

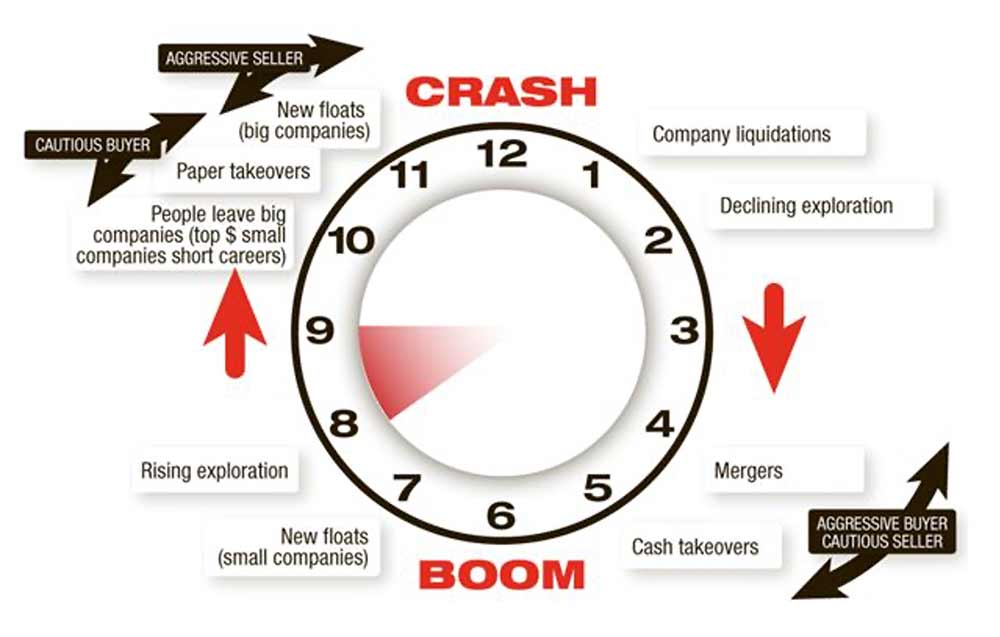

I remember Robin Widdup (formerly at listed resource funds manager Lion Selection Group), talking about his mining clock (figure 3).

His son Hedley has since taken over as chief clock winder.

Only problem was the clock occasionally got stuck or went backwards but, looking at the period 6.00pm to 9.00pm, that could be the current resources market, on its way to a crash.

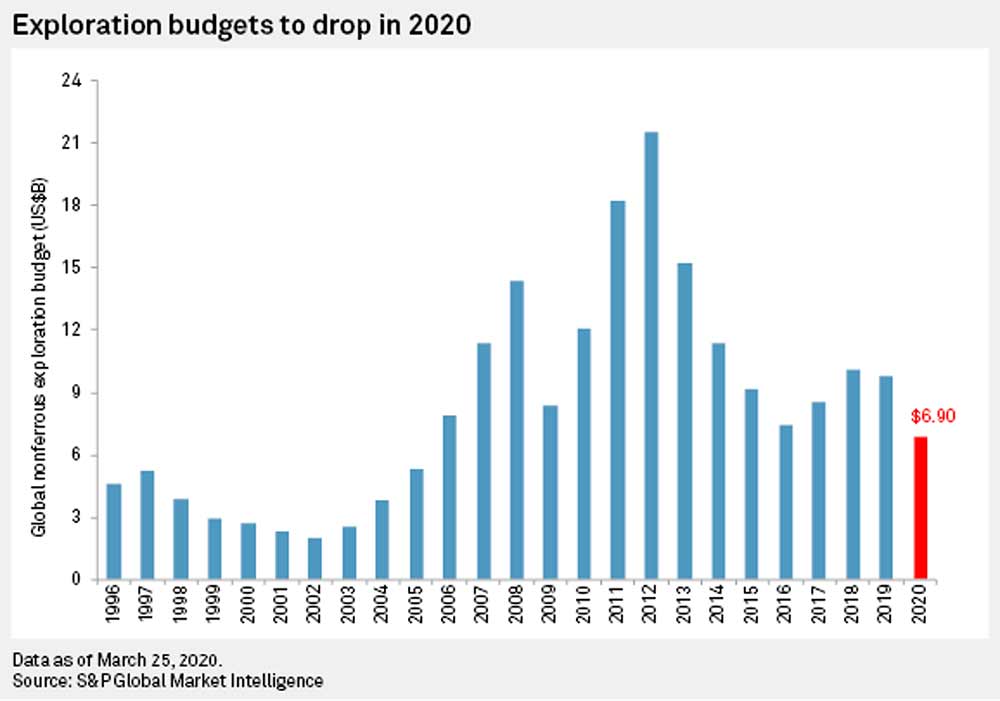

What doesn’t quite tie in with figure 3 is the actual fall in exploration expenditure (figure 4) over recent years due to COVID-19. The cycle, as represented by figure 3, contemplates a period of rising exploration expenditure leading up to a crash.

I still think the junior end is a little overcooked, however metal supply issues could well slow the coming of midnight.

In the interim, I have decided to take some guidance from Jim Morrison: “I don’t know what’s gonna happen but I wanna have my kicks before the whole shithouse goes up in flames”.

This translates to “buy on the dip”.

Finally, copper is trading at US$4.36/lb and remains in backwardation with a negative forward curve.

The LME has come under some criticism by a number of commentators (including the Mercenary Geologist, Mickey Fulp and John Gross from the Weekly Copper Journal) who believe that the LME is “opaque” and a lack of disclosure around live and cancelled warrants together with available copper for sale which has remained un-reported since September.

There hasn’t been any good news coming out of Greenland since they stopped clubbing seals and harpooning whales, however it looks like IronBark Zinc Limited (ASX:IBG) has received preliminary approval for a senior debt facility of up to US$657 million from US based Exim bank for their Citronen Project (figure 6) in northern Greenland.

The interest rate, at 2.2% or thereabouts, is attractive, however the devil, as usual, will be in the detail (including coming up with the required equity component).

The company has engaged London based Bacchus Capital to source potential equity investment.

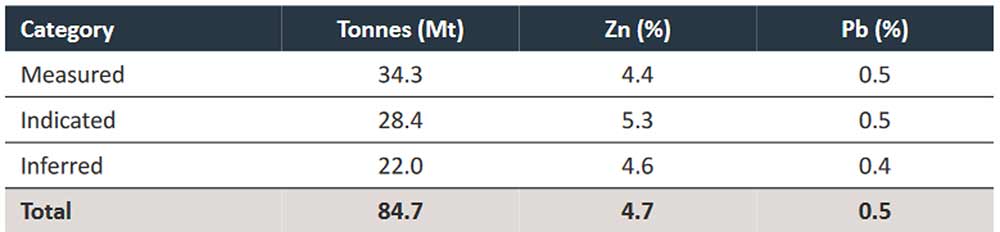

The project has a reserve of 48.8Mt @ 5.1% Zn equiv (4.8% Zn and 0.5% Pb) from a reasonably large resource inventory (table 1).

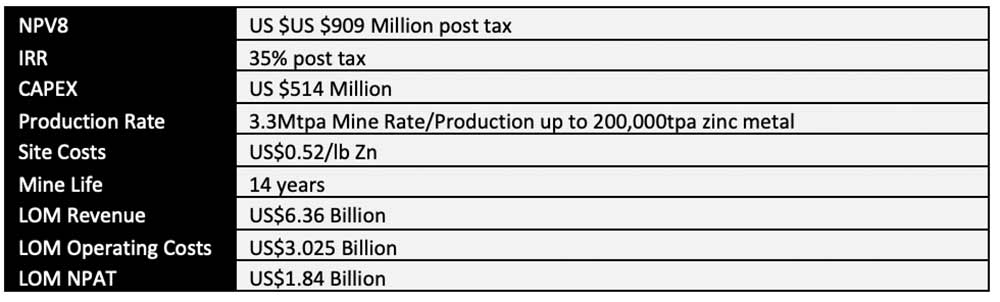

A feasibility study was completed in September 2017 with the financial metrics having improved due to the rise in the zinc price (currently around US$3,300/tonne) – table 2.

What remains unknown is the increase in capital cost due to surging input and energy prices. As table 3 shows, the project presents excellent leverage to zinc prices.

I think this is an impressive deal for IBG even though there are a lot of hurdles to get over to satisfy the lenders.

The deal is all the more impressive as this isn’t a particularly high-grade resource and is located in a fairly inhospitable part of Greenland where even polar bears have been seen wearing golden goose jackets in the extreme cold.

Transport can also be limited to riding on floating ice over October through to March. It also goes to show the lengths that the US government will go to in its pursuit of long-term supplies of critical metals such as zinc.

This is the first deal under the US Government’s 402A program design to combat China’s Belt and Road Initiative.

The deal may represent the start of a titanic battle for worldwide resources and Greenland looks like the beach head.

With Greenland Minerals Ltd (ASX:GGG) Kvanefjeld giant rare earth-uranium project gathering dust after the government changed the legislation to ban mining of any ore contained over 100ppm uranium, this deal may well give the country a much-needed shot in the arm with the help of Uncle Sam.

Maybe Greenland is the promised land after all?

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.