FREE WHELAN: In this climate a bear doesn’t just sit in the woods

Experts

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

A note to start that, if not joined already, I am strongly encouraging colleagues and clients to please join our NRL tipping comp! It’s an innovative comp with a little fun as we go. Sometimes you need some time away from the buzz of markets.

Now on with the usual programming.

Hydrogen is first off the list and I put out a hydrogen note a little while ago so I won’t go over it again but there’s been a few discoveries of natural hydrogen around the world, the “big one” being the 200 tonnes per annum discovery in Albania.

There’s always been an issue for my favourite transportation method with the creation of hydrogen and the storage of it.

Having significant quantities flowing freely from the ground does solve a big part of that problem. I prefer to invest in the tech that uses hydrogen as opposed to the parties trying to create it so if the supply is easier than that’s better for the industry gaining ground on the lithium mob.

It’s estimated that 5trn tonnes of hydrogen exists underground and that, according to the project leader at the US Geological Survey, “Most hydrogen is likely inaccessible, but a few per cent recovery would still supply all projected demand — 500mn tonnes a year — for hundreds of years.”

Were this to be the case a number of projects become unsustainable (because alternative sources are more viable) but the positive part is how much cheaper it makes the fuel.

Good things ahead.

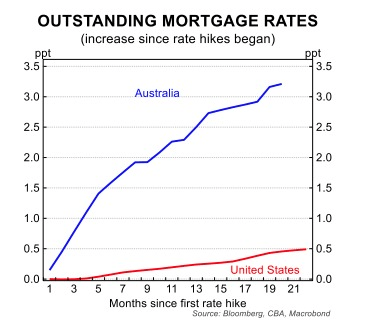

We really are a Tale of Two Countries when it comes to inflationary data and the US. There’s a few reasons why. Ours, particularly in services, is declining quite slowly.

This would be a big one.

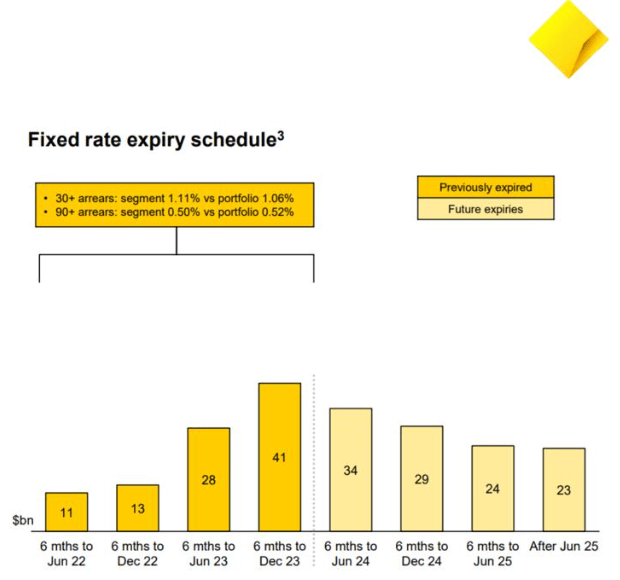

With this still in the pipes. Yes we’ve passed the peak but there’s a fatter tail of loans coming off fixed to variable.

So. Look out!

So no we’re not out of the woods yet and I hold fast that cuts are quicker than expected over 2024. I was right about the margin in the Super Bowl so surely I can be right about this too??!

In that vein and in light of my whole schtick this year of righting classic, usually panicky wrongs that at first glance look shocking but always need to be extrapolated… here’s something that seems like a panic in the US, but isn’t, but which is actually a bit of a worthwhile panic here:

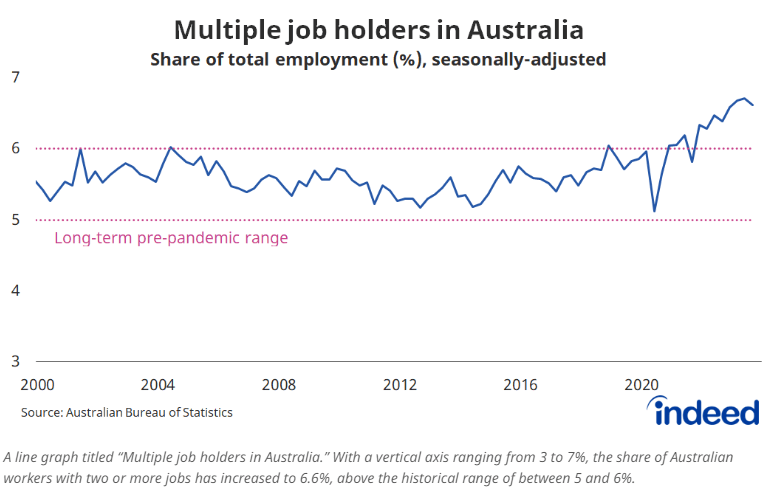

Take the fact that if people are working two jobs it means things are bad, right?

In the US, 5.1% of the labor force is working two, which could be a panic. But, in fact it’s actually below where it was during the sweet economic (but awful fashion) period of the mid to late ’90s.

Now in Australia, we have the percentage of people working two jobs above 6.5%.

Do we have the same healthy situation?

No, we don’t.

I’ve actually seen this data back to the mid ’90s and it’s about 5.4% then.

Things are tight locally but there’s still work and people are working. There’s also levers to pull to ease the squeeze.

Bank reporting continues to show that loan losses are low. People, in this country, find a way forward.

In the US all signs point to a No Landing scenario with an economy booming and a market to match. I’ll go into that in more detail next week.

We do touch on this and more in the latest cut of the podcast where I’m joined by the amazing David Scutt of StoneX group.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.