WA’s energy rule changes are making Frontier’s Waroona project more attractive than ever

Looking good: Frontier’s Waroona project has a greater long-term revenue outlook under WA’s energy policy changes. Pic: Getty Images

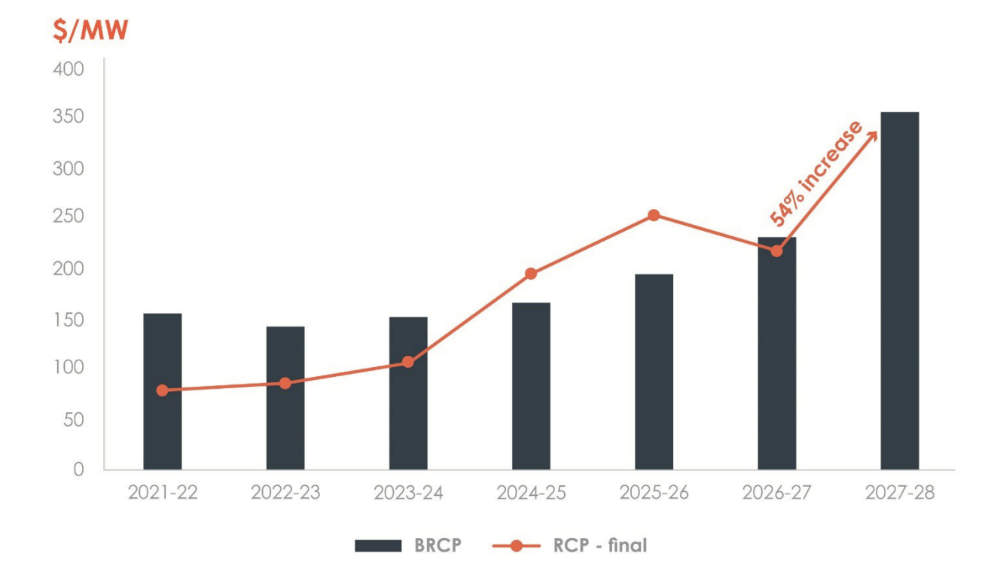

- Big 54% jump in WA’s draft Benchmark Reserve Capacity Price to $354,000/MW expected to boost Waroona project economics

- Introduction of floor price pegged to 50% of the BRCP in WEM Investment Certainty Review adds revenue confidence

- Changes to be included in updated DFS for Frontier Energy’s Waroona project due for release in early December

Special Report: Upcoming changes to WA’s energy policy and framework are expected to deliver marked improvements to the economics of Frontier Energy’s Waroona renewable energy project.

Topping the list is the state’s Economic Regulatory Authority releasing a draft determination setting the Benchmark Reserve Capacity Price (BRCP) for the 2027/28 capacity year under the Reserve Capacity Mechanism (RCM) at $354,000 per megawatt, a massive 54% higher than the 2026/27 price of $230,000/MW.

The RCM is a uniquely WA mechanism that provides payments to electricity generators that can supply energy during peak demand periods, an opportunity that Frontier Energy (ASX:FHE) can tap into thanks to the integrated 4.5 hour duration 88MW/360MWh lithium-ion phosphate (LFP) battery that forms part of its Stage one Waroona development.

It was designed to ensure that there is adequate generation capacity available to meet forecast peak electricity demand and represents an additional payment on top of regular energy sales and other potential revenue streams such as carbon credits and the Frequency Co-optimised Essential System Services.

All electricity generation and electricity storage facilities that become certified are allocated capacity credits based on the size of their generation capacity and will continue to receive payments in future years as long as they meet their obligations regardless of energy source.

While the BRCP, which is set two years in advance each year, was historically based on the cost to build and connect a gas power station, it was changed this year to the cost to build and connect a 200MW/800MWh lithium-ion four-hour battery energy storage system.

The final RCP for any energy generation period is set following an assessment of whether there is a surplus or deficit in capacity to meet the peak demand period.

Once this is done, the Australian Energy Market Operator assigns certified reserve capacity status to new projects that satisfy the required criteria set out in the Wholesale Electricity Market (WEM) rules.

Improved price certainty

Energy Policy WA’s release of the final WEM Investment Certainty Review is also expected to deliver a greater degree of revenue certainty by setting the minimum capacity floor price at 50% of the BRCP (rather than the current zero price floor).

It also grants a 10-year capacity price guarantee option for firming capacity and new technologies while finalising arrangements for the implementation of the RCM review in time for its commencement in the 2025 Reserve Capacity Cycle.

The latter is designed to make the South-West Integrated System (SWIS) – the state’s main electricity network – attractive for new renewable energy and storage investments.

FHE says the changes will have a positive impact on the forecast reserve capacity revenues, and improve the bankability of its Waroona project by providing a floor for reserve capacity prices.

As an example, it noted that based on the latest BRCP and the project’s 88MW capacity, the Waroona project would be able to access minimum reserve capacity payments of $15.5m for the 2027/28 year.

Stronger economics

In early December, FHE expects to release an updated definitive feasibility study for its Stage One Waroona renewable energy project that combines a 120MWdc (megawatts of direct current) solar facility with the integrated battery.

This will incorporate the latest changes along with updated energy price forecasts and reduced capital costs on key equipment items.

“Reserve capacity is a unique revenue stream only available to generators in Western Australia. We believe this payment is a key reason why the economics of our project are stronger in comparison to similar projects on the east coast of Australia,” chief executive officer Adam Kiley said.

“We strongly support the proposed changes resulting from the final WEM Investment Certainty Review outcomes. The current changes are a great start, most notably the new floor price (50% of the BRCP), which further strengthens the long-term economics of our project.

“It was also pleasing to see such a large increase in the draft determination of the Benchmark Reserve Capacity Price for 2027/28 of $354,000/MW, which together with the introduction of a floor price mechanism, will support project financing discussions.”

The company had noted in October that it had started discussions regarding multiple non-dilutive funding options including bonds, equipment-supplier financing and even a sale and leaseback arrangement in relation to the company’s extensive landholdings.

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.