Scent of an Oily Rag: Traders are still hot for fresh fossil fumes and these ASX energy juniors are just ripening

It's great to smell good. Via Getty

With the ongoing energy crisis keeping gas prices elevated, Australian oil and gas explorers were quick to catch the attention of predatory investors over the last 12 months with exploration (and development) success top of the shopping list.

While some of these gains have been tempered as concerns of a looming recession gather force. It’s fair to say both ends of the market still feature many oil and gas outperformers with still rising stock prices that are apparently impervious to any old headwind.

Not even the crystallisation of a government-led market intervention, (and capped prices are top of that list), are slowing these market darlings down, a decent indicator that energy is going to remain front and centre into 2023.

And why shouldn’t it?

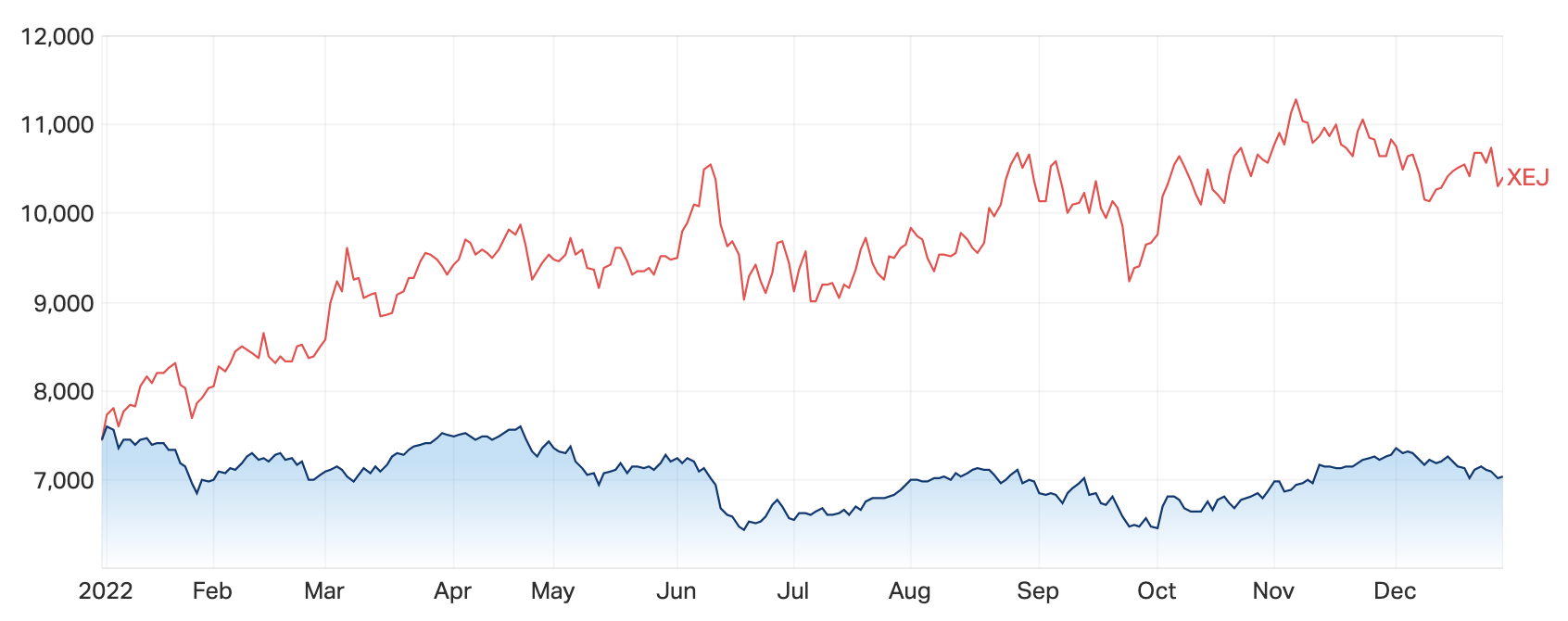

Both around the major global markets and here at home, the Energy Sectors (ours is the ASX/XEJ) pretty much laughed their way through 2022, surrounded by mainly tears and tantrums.

The XEJ is about 40% higher today than it was a year ago.

ASX200 (XJO) vs the ASX Energy Sector (XEJ)

The question this year is probably ‘how high?’

The equation to answer that might be a little more complex in 2023, but at its heart is the same law of supply and demand that’s been driving commerce since Cowry shells were coveted in China, circa 1300BC (I read that in The Scotsman and it stayed with me for some reason BTW and here it still is! ).

In this case, there’s an upper limit to how much oil can be pumped by OPEC nations, with some going so far as to speculate that the cartel has little to no capacity to boost production beyond peak levels seen this year.

Gas has also been a sticking point thanks in part to Russia’s invasion of Ukraine early this year and Russia using its supplies as a crude lever in a bid to deter the European Union from backing Ukraine.

In Australia, domestic gas supplies in the east are looking set to decline due to years of underinvestment and green pressure. Strong demand from buyers of our exported liquefied natural gas have also served to prop up prices.

As such, new exploration success – even hints of that potential, and the prospect of new production have caught investors fancy.

Here are some of the most significant moves for junior oil and gas plays in 2022.

Bass Oil has existing oil production from its operations in the Cooper Basin, South Australia and the Tangai-Sukananti in Indonesia.

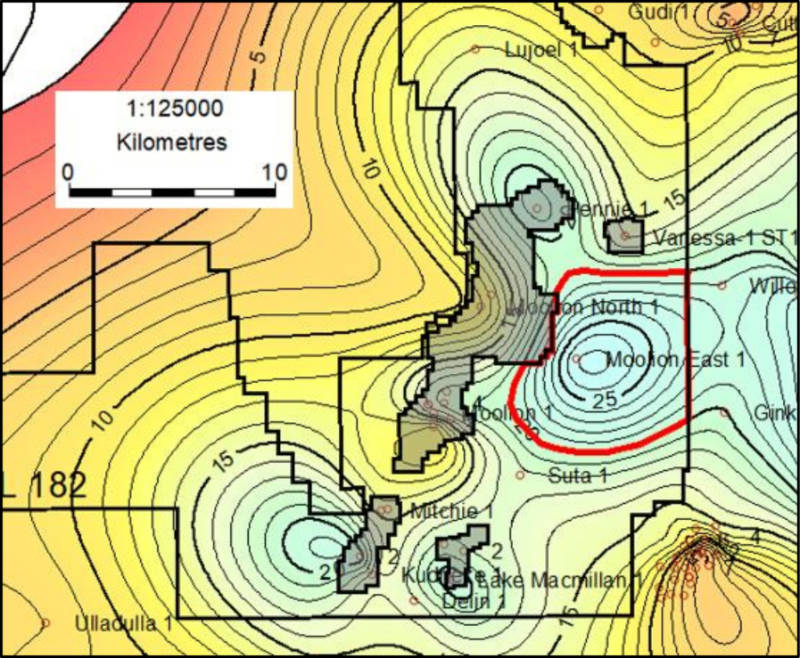

However, the company only really captured market attention when it dropped the bombshell that its PEP 182 permit could host monster in-place gas and condensate/oil resources.

Despite a little typo mixing millions with billions, which was quickly spotted by punters and corrected by the company, the news that the permit in the Cooper Basin could host up to 21 trillion cubic feet of gas and 845 million (not billion) barrels of condensate or oil in deep coals sent shares in the company soaring 153% to 9c.

Shares have since retreated to 6.3c as of early December though this is still a fair chunk higher than the band between 3.4c and 5.1c it has trade at since mid-May 2022.

While the identification of this large potential resource is intriguing to say the least, it does come with a couple of caveats.

First off, in-place estimates are not the same as recoverable reserves being strictly a rough view of how much gas and oil could be contained within the target formation or reservoir.

It is also very much unclear if there’s actually any gas and/or oil present, that will require drilling a well to confirm.

Additionally, the deep gas play is very much a new concept in the Cooper Basin that is being investigated by the likes of Santos (ASX:STO).

That said gas is known to exist in the Permian aged coals of the Toolachee, Epsilon and Patchawarra formations and has flowed at potentially commercial rates after fracture stimulation while Santos’ recent Beanbush 3 horizontal well is adjacent to PEL 182 in the same geological setting and trend in the Patchawarra Trough.

What do you get when you mix data from one of the world’s largest oil companies indicating the presence of a giant gas reservoir and a junior (a minnow in oil and gas parlance) drilling a well into said reservoir and getting signs that there is definitely gas there?

Well, the answer is a 162% increase in share price, which is exactly what Invictus experienced when its first exploration well – Mukuyu-1 – in Zimbabwe encountered fluorescence and elevated gas shows up to 65 times higher than background levels in the Upper Angwa primary target within a structure that Mobil (of ExxonMobil fame) had discovered back in the 1990s.

More gas shows were detected as the well got deeper, which sent shares in the company even higher.

Preliminary wireline logs have provided further evidence that gas is present in multiple zones and as at the time of writing, the company is still awaiting the arrival of a wireline formation testing tool to conduct pressure and fluid sampling to confirm the presence of moveable hydrocarbons.

It is hard to separate Warrego from its West Erregulla partner Strike Energy given the razor sharp focus that investors have for the same gas field.

While the company does have other projects including a majority interest in a producing Spanish solar energy project, the focus is very much on West Erregaulla, and for good reason.

Since drilling the successful West Erregula-2 wells, the joint venture have since drilled three further successful wells that really underscored just how significant a field it looks to be.

Testing of West Erregulla-3 in the middle of the year confirmed the extension of the field to the north and upgrading gross Proved and Probable (2P) Reserves up to 422 petajoules.

And there’s little doubt that this prospectivity was what led to first Strike, then Beach Energy and then Hancock prospecting tipping their hats into the ring to determine who could acquire the company.

Mongolian-focused coal seam gas explorer TMK Energy has been having a tremendously successful year this year with its drill program at the Gurvantes XXXV project.

All five wells drilled by the company intersected gassy coals with desorption samples confirming that the intersected seams contained at least moderate if not high levels of gas.

Taken together, the results were enough for TMK to define a Best Estimate Contingent Resource of 1.2 trillion cubic feet of gas for the project, which is greater than it originally expected.

Additionally, this resource is contained entirely within the Upper Coal Seam due to the company’s success in data gathering and recording good permeability tests.

While only minimal permeability data was returned from the Lower Coal Seam, the results are certainly enough for independent top tier international reserves and resources certifier, Netherland, Sewell & Associates, to tag it with a high estimate (3C) resource of 417 billion cubic feet of gas.

This provides significant potential for a further resource upgrade once adequate permeability and/or pilot production data is available from future drilling campaigns.

It was certainly enough for partner Talon Energy to commit to funding the pilot well program at Gurvantes XXXV to earn a 33.3% stake in the project.

Empire marked this year with the successful fracture stimulation of its Carpentaria-2H well and the drilling of the longest horizontal section in the Beetaloo Basin, Northern Territory.

Carpentaria-2H achieved sustained initial flow rates of 2.6 million standard cubic feet of gas per day over the first 91 hours with minimal decline.

This flow rate was produced from an effective 927m stimulated horizontal length (or 2.8MMscfd per 1,000m), providing the company with materially enhanced confidence that the project can be commercialised.

What this means is that the company’s Carpentaria-3H well, which with a 2,632m horizontal section has the longest horizontal section drilled in the Beetaloo to date, could produce gas at far higher rates.

Fracture stimulation operations were expected to begin in early December 2022 along with drilling of the Carpentaria-4V well.

Whitebark successfully drilled its Rex-4 oil development well in August 2022 and has been carrying out clean-up operations before bringing it into production.

The well was drilled to a total depth of 3,647m while 2,318m of the horizontal section is located within the target Rex Sandstone reservoir.

Clean-up is continuing apace with the oil cut in the recovered fracture stimulation fluid increasing in step with increased flow rates.

Stabilised oil production is expected to be about 300 barrels per day day and 1.4 million standard cubic feet of gas per day.

Ultimate recovery is expected to be about 146,000 barrels of oil and 1.3 billion cubic feet of gas.

Omega recently completed well testing for the Bennett-1 and Bennett-4 wells, each of which were observed to have peak production rates of over 30 barrels of oil per day before stabilising at 15 to 20bpd.

While bringing the Bennett oil field into production will bring some valuable cash flow into the company’s coffers, the real prize it is chasing is the Permian Deep Gas play in Queensland.

The play is aimed at testing a potential multi-trillion cubic feet basin-centred gas play in Queensland’s Surat Basin where previous drilling by BG Group had yielded gas flow rates ranging from 0.1 to 1 million standard cubic feet per day.

While BG’s five wells had all produced gas at varying rates, Omega is hoping to achieve significantly higher flow rates by drilling slimmer wells and fracture stimulating the entire gas column rather than trying to isolate the best gas-bearing sand in the target Kianga Formation.

It expects to start operations in February 2023.

Richard Cottee-chaired State Gas recently started production testing of the Rougemont-2 and Rougemont-3 well pair following successful drilling of two laterals from the latter to intersect with the Rougemont-2 vertical well.

The two laterals – with lengths in excess of 1,000m – provide direct access to about 2,400m of Bandanna coals, a formation under commercial production in nearby Arcadia Valley.

Water levels in both wells will be drawn down slowly to optimise production with initial gas flows not expected to start for several months.

The test is expected to confirm the gas production potential of the Rougemont area within State Gas’ 100%-owned Rolleston-West project in Queensland.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.