OPEC+ (- 2 million barrels a day) = there’s still a whole bunch of upside in oil

Via Getty

It’s not every OPEC+ meeting that can extort an impromptu tweet of fury from this man:

OPEC’s decision to cutback on production is a blatant attempt to increase gas prices at the pump that cannot stand. We must end OPEC’s illegal price-fixing cartel, eliminate military assistance to Saudi Arabia, and move aggressively to renewable energy.

— Bernie Sanders (@SenSanders) October 5, 2022

OPEC+ agreed to slash its production targets for November by 2 million barrels per day. And Senator Sanders is not the only one thinking there’s some cause for concern.

The deep production cuts performed by everyone’s favourite cartel, has many knickers in a knot Stateside and for the rest of us it’s another, slightly harder punch in the gut at the petrol pump.

Unsurprisingly oil prices enjoyed three or four days of straight gains after the announcement and the prices remain toppy in a volatile market.

Oil futures keep rallying and Morgan Stanley et al have the phones out doing the sums after OPEC+ culled production by the biggest volume since the start of the pandemic, circa early 2020.

OPEC+ delivers some 40% of all the oil used around the world on any given day. Now it’s cutting not 1, but 2 million barrels a day. That’s about ~2% of global supply, CBA reckons.

Upside at home

Morningstar senior analyst Mark Taylor thinks investors are still overlooking and undervaluing Australian oil and gas names – while both energy and share prices are high. With growth projects coming online and earnings stability from domestic gas supply also in the post, Taylor still sees upside in a market that’s “underestimating earnings resilience.”

“Yes, the share prices of these companies have already risen strongly, but the earnings outlook remains strong and is still not fully credited by the market, in our opinion. And if we end up with a higher for longer commodity price scenario, things could be better still.”

Morningstar’s fair value estimates assume circa 30% retreat in Brent crude price to a mid-cycle US$60 per barrel by 2024, and 80% plus decline in Asia LNG prices to USD 8.40 per metric million British thermal unit (mmBtu), also by 2024.

“This presumably plays on the mind of investors, and we do forecast mid-cycle earnings retreat from current frothy levels, (particularly for Woodside)… and there has already been considerable commodity price retreat from recent peaks.

“However, this is from unprecedented highs, launched on soaring spot LNG pricing — prices were never going to be sustainable.

“And if measured from normalised levels, earnings for Australian companies will remain very strong, bolstered in no small part by production growth stemming from new development projects, many where construction is already well underway,” Taylor says.

Undestroyed demand

Martijn Rats is Morgan Stanley’s Global Commodities Strategist and he also heads the European Energy team in Equity Research. Speaking on CNBC Martjin is already warning oil prices are not only good to go higher, but are a long, long way from being squeezed by demand destruction.

The US market will be undersupplied by as much as a million barrels a day next year, he said.

Aside from the OPEC cuts, the US strategic reserves are dwindling and Russia will do its own cutting now there’s a looming price cap on Russian oil.

If the Kremlin goes through with that, Rats says, global oil prices will need to retrace numbers like the US$180 a barrel and $190 for diesel prices from the last peak before buyers throw in the towel.

“We are nowhere near prices that cause demand destruction,” Rats told CNBC last week.

The fine print

But before you go big Santos et al, there’s bloody important fine print here:

The reduction in the quota will be applied from November 2022 to December 2023.

But as is the way of being in a cartel where you can make up your own rules, that’s subject to change depending on the outcome of meetings over the coming year – and they’re upping them to every six weeks now, not every six months if you reckon OPEC’s going to take this commercial/political opportunity lying around.

“Just two months ago, OPEC+ decided to increase the production quota by ~100kb/d (~0.1% of global supply), indicating just how quickly market conditions have changed in the eyes of OPEC+, says Vivek Dhar, CBA’s commodity whisperer.

OPEC+ agreed to a 2 million barrels per day cut to their oil production. Importantly the ‘cuts’ are on a quota versus quota basis. Several OPEC+ members had struggled to produce their previous quota anyway (because of underinvestment in oil supply and infrastructure).

So the cut to production, actual versus new quota – do that math, spin in a circle – is closer to 1 million barrels a day.

“That missing million though, expected and confirmed, has had a major role in lifting oil prices 11$ plus from lows about 10 days ago,” says Tobin Gorey at CBA.

“Our estimate assumes that OPEC+ oil producers that are currently below their new output quota will keep output flat, while those that are operating above their new quota will reduce output to stay compliant. ”

Only seven of the 20 OPEC+ members partaking in the OPEC+ accord will be forced to cut oil production from November. And ~88% of the reduction in physical oil supply will come from three members – Saudi Arabia (~39%), Iraq (~27%) and UAE (~22%).

Which is in line with comments by Saudi Energy Minister Abdulaziz bin Salman who said the actual drop in oil supply from the OPEC+ decision will be between 1mb/d and 1.1mb/d.

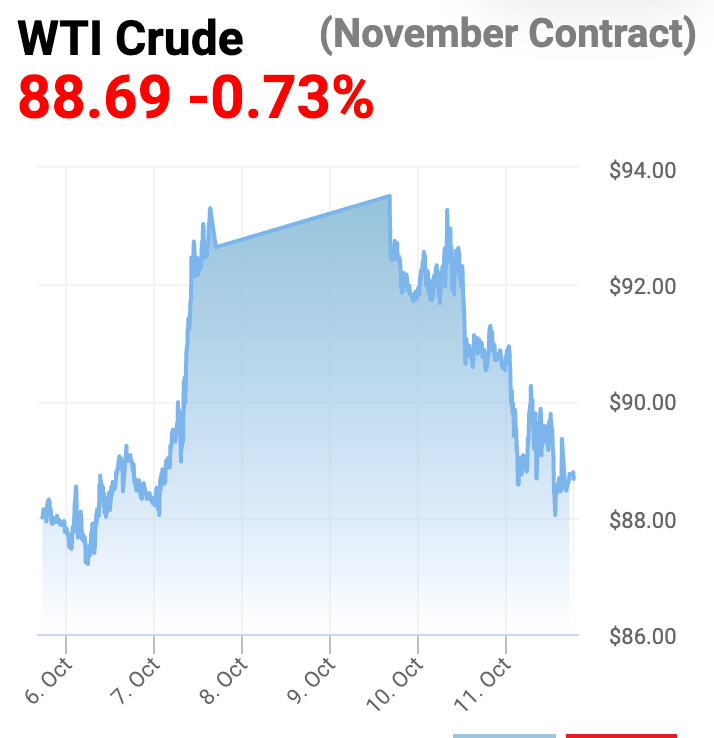

WTI is a volatile hot mess (one week):

The November contract WTI prices rose to $92.35 (+4.43%) on the post-OPEC Friday arvo alone, despite the better-than-expected US jobs report that will most certainly translate into even higher inflation, and as such, further Fed rate hiking.

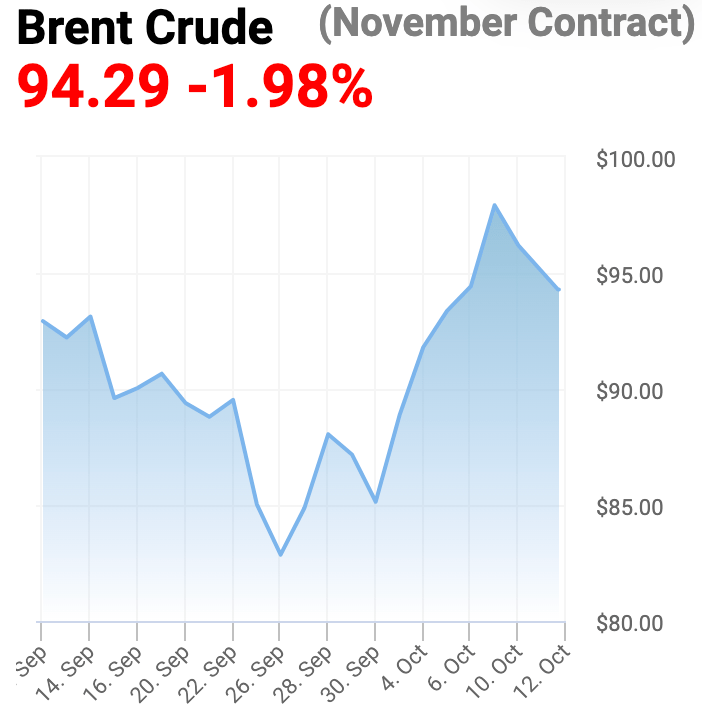

The British one is just as loopy (one month):

Inflationary forces

Brian Gould, Head of Trading at Capital.com’s Australian HQ says the oil price could not be more politically sensitive right now, as higher prices would only further fuel consumer price inflation globally.

“WTI crude prices drifted from highs above US$122 in June to as little as US$77 in late September, trading around US$15 above the 52-week floor of US$62.50. This trend could potentially not continue following OPEC’s overnight decision to cut production by two million barrels.”

“Oil producers have benefited greatly from the price rises that occurred at the beginning of the Ukrainian conflict, and they’ll be looking to regain those elevated US$85+ price levels, which they hadn’t experienced since 2014.

“Russia’s treasury would also be a beneficiary, as a higher price would boost revenues from sales, where China and India continue to import just under two million barrels per day, taking advantage of deals and discounts as Western nations turn their back on Russian oil and gas.

“Currently, we’re seeing renewed interest in our crude oil CFDs as speculators try to get ahead of a potential supply squeeze. With decent buying support around the US$80 mark, this could be a popular trade for investors on our platform looking to take advantage of a supply squeeze.”

Sanctifighting

The EU meanwhile has decided on an eighth round of sanctions, all signed and sealed and on the way to piss off Putin. This latest package will effectively ban the from providing shipping and insurance services for Russian oil unless the oil is priced under a level set by a coalition of G7 nations and other countries including support for a price cap on Russian oil.

It will ultimately allow Russian oil to flow outside of the EU to mostly developing economies so long as the oil price cap is adhered to.

Vivek says the previous round of sanctions threatened a much larger cut to Russian exports via a ban on insurance – potentially leading to a price spike in the next few months:

Russia has responded by saying that they won’t sell oil to any countries adopting such a cap and are willing to ‘cut production by as much as needed’. The Russian threat means global oil markets are still facing the risk of significant supply disruptions over the next 6 months. We still forecast Brent futures will average $US100/bbl in Q4 2022, but anticipate a significant amount of volatility as markets now assess the impacts of EU sanctions on Russian supply, Russia’s subsequent response and global growth concerns.

Geopoliticking

Because on the other side of the Atlantic, it’s all about the clique within the cartel: A big Saudi-Russo love-in. Russian President V Putin’s invasion of Ukraine hasn’t stopped Riyadh from buddying up with today’s top tyrant to put a little pressure back on the US administration.

“The President is disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin’s invasion of Ukraine,” National Security Advisor Jake Sullivan and National Economic Council director Brian Deese said in a statement.

“At a time when maintaining a global supply of energy is of paramount importance, this decision will have the most negative impact on lower- and middle-income countries that are already reeling from elevated energy prices,” they added.

But of course, by “lower- and middle-income countries” the US means the US and other major Western powers like the oft-berated Germans, who, despite warning one another over many years, in many ways keep themselves reliant not just on oil, but the good oil largely sucked out of the territory run by despots and tyrants whose interests as we’re seeing right now, are most changeable.

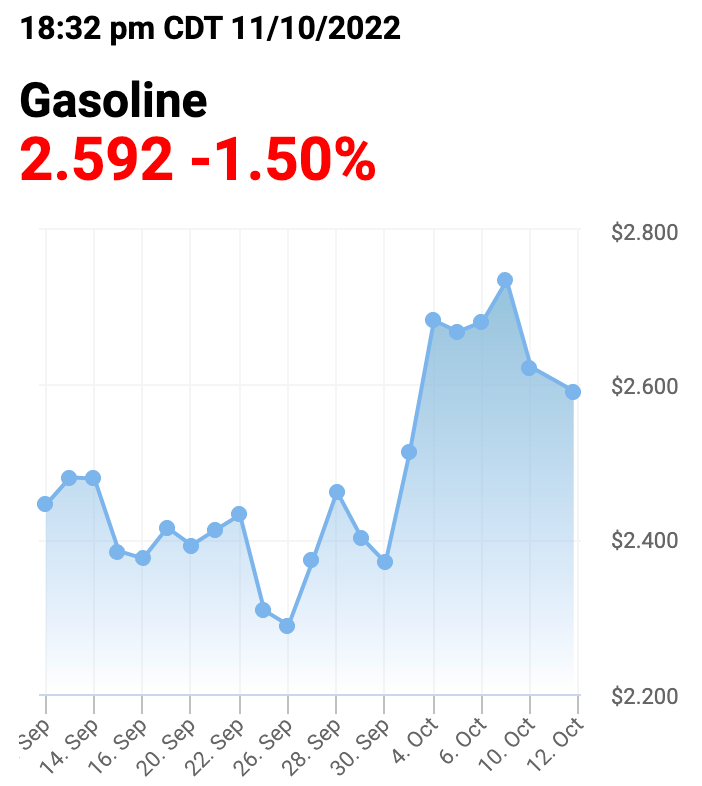

In the States it all comes down to this anyway:

The OPEC+ decision and the downstream impacts it’s about to have, highlight a policy blindspot for the US that begins with big cars and ends every decade or so in tears and recriminations.

The US Department of Energy has already booked another 10 million barrels for the market via America’s Strategic Petroleum Reserve in an attempt to offset the incoming price rises at the bowser, but only highlight the pressure those reserves are now under.

Gasoline prices in the States also began to rise again on Friday, averaging $3.891 per gallon across the nation, up 9.4 cents on the week and 12.7 cents month over month. A year ago today, gasoline prices in the United States were $3.244 per gallon. The hike in the price of WTI, EIA reports of increased gasoline demand last week, falling gasoline inventories, and refinery outages across the United States are all behind the rising gasoline prices.

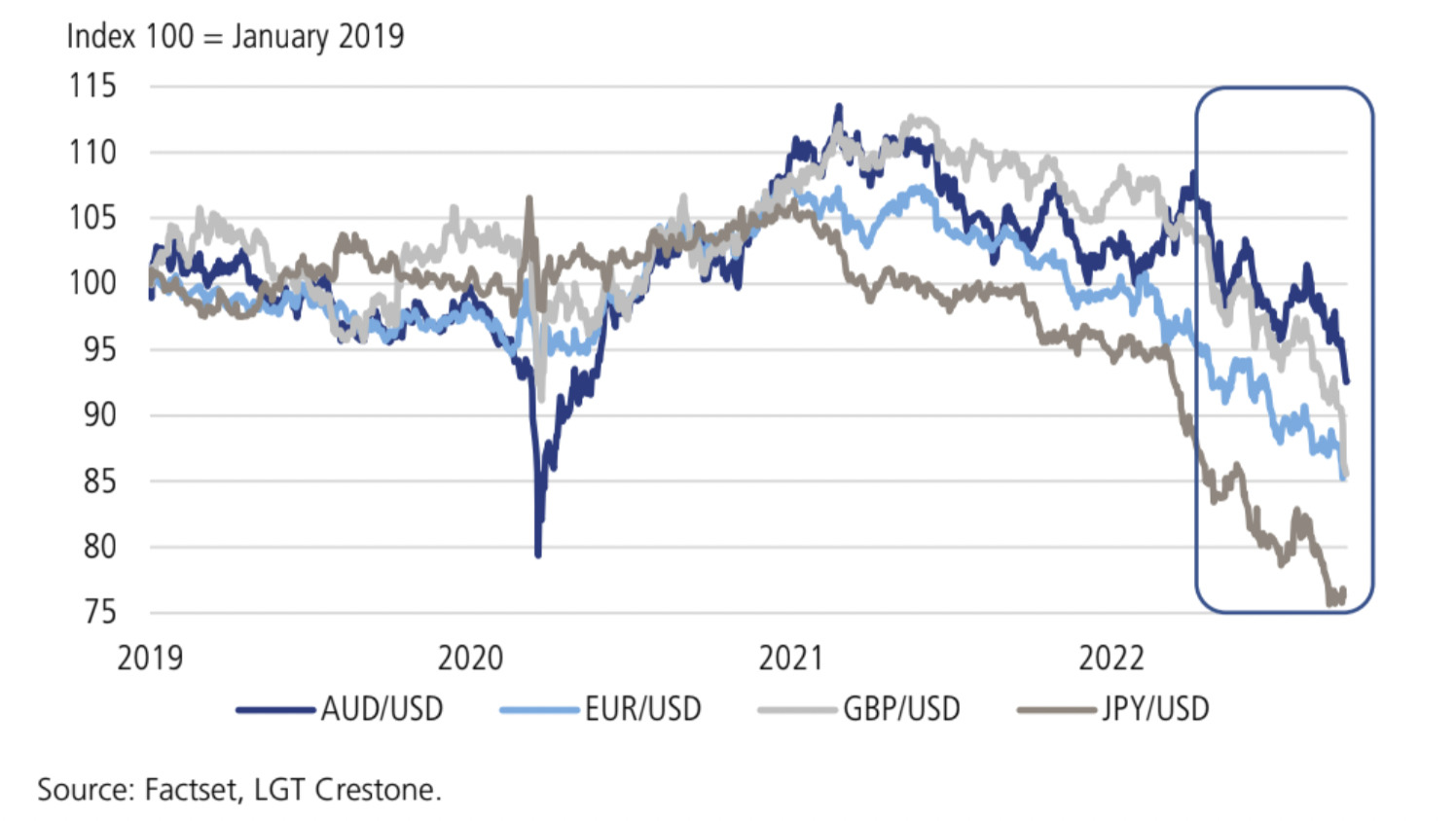

Currencies – This way lies madness:

Not only does cash buy 7% less than it did a year ago, the recent crazy currency volatility – and by that we mean steroidal USD strength – has been wreaking havoc of late for the rest of us.

Via Crestone

Via Crestone

Tobin says the greenback did recover some lost ground midweek, and the AUD is subsequently “exploring lower levels.”

“Currency markets are still processing the RBA’s signal that interest rates are likely to peak at substantially lower levels in Australia than elsewhere. But again the Aussie boomeranged back to where it started.”

Morningstar’s good oil

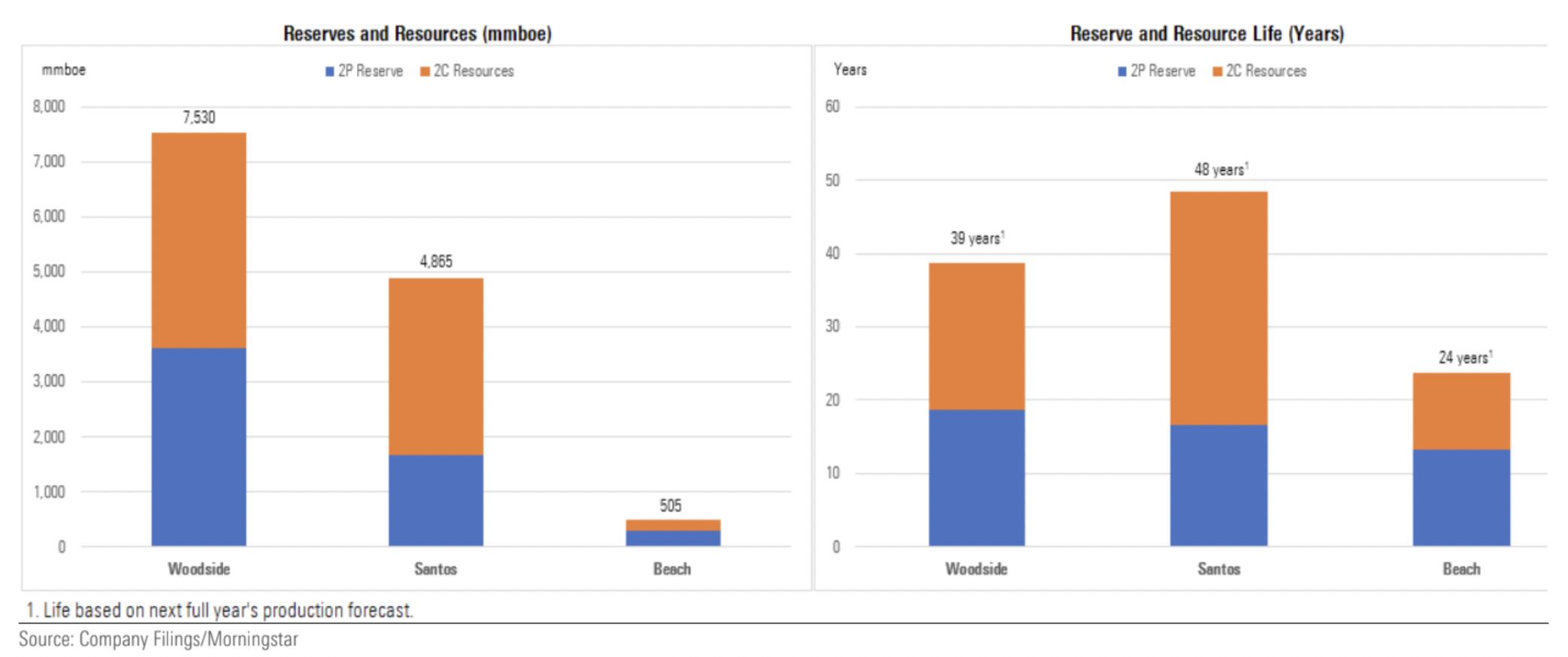

Woodside, Santos, and Beach Energy have all benefited from rising oil and gas prices. However, despite share price appreciation, Morningstar thinks value still exists. And if energy prices remain elevated for longer than expected, value may be even greater. That’s possible given the energy crisis in Europe.

Of the three Australia-based oil and gas producers Morningstar cover, Woodside has the greatest exposure to global prices and has benefited the most from international events.

“For Woodside, only about 20% of production is attributable to domestic gas, where prices are steadier. Beach by contrast has about 60% of production serving the domestic gas market, while Santos sits between those two at about 40%,” Taylor notes.

“Domestic gas has a number of positives, with capital intensity lower than for export gas, and pricing under term contracts with consumer price index escalators.

“But lower margins and shorter field lives mean Beach is potentially more exposed to operating and capital cost inflation with less of the commensurate export pricing upside that Santos and especially Woodside enjoy.”

STO and WPL have longer field life than Beach (reserves and resources)

Mark says:

Santos (ASX:STO) – trades at a near-40% discount to our fair value, the market underpricing for Barossa gas and new oil project growth. Realised prices are below those for Woodside, but margins are comparable.

Santos has longer field life and stronger production growth than peers and a still comfortable balance sheet. Returns were crueled by GLNG cost overruns last decade. But new investments under the watch of CEO Kevin Gallagher have generated attractive returns.

Woodside (ASX:WDS) – shares trade at a circa 25% discount to our fair value, insufficient credit being given for Scarborough/Pluto T2.

Strong realised prices reflect a favourable product mix and comparatively higher spot exposure. Returns on invested capital are tempered by liquid natural gas capital expenditures, including for Scarborough/Pluto T2. But returns should improve upon T2’s start up in 2026.

Beach Energy (ASX:BPT) – is the cheapest of the three, the market too harshly discounting for comparatively shorter field life than peers and lesser export pricing exposure. Realised prices are low versus peers though the gap should narrow as internationally traded prices ease and Beach’s domestic gas contracts become more important.

Short field life dictates material future capital expenditure and risks are somewhat higher in Beach, but the balance sheet is strong with net cash.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.