WARNING, SPOILERS AHEAD: Here’s how 2022 ended on the ASX (and it’s far from all bad news)

2022's having a baby! Be sure to join us next season on Stockhead! Via Getty

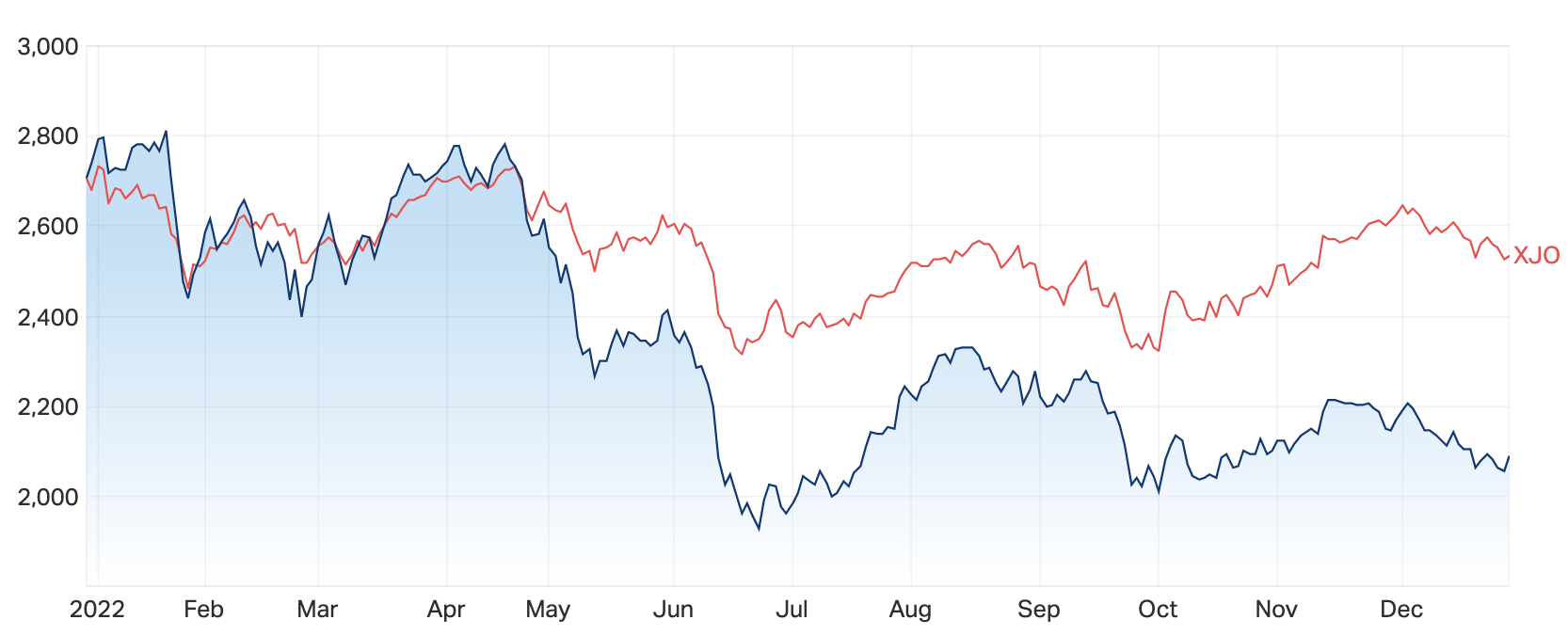

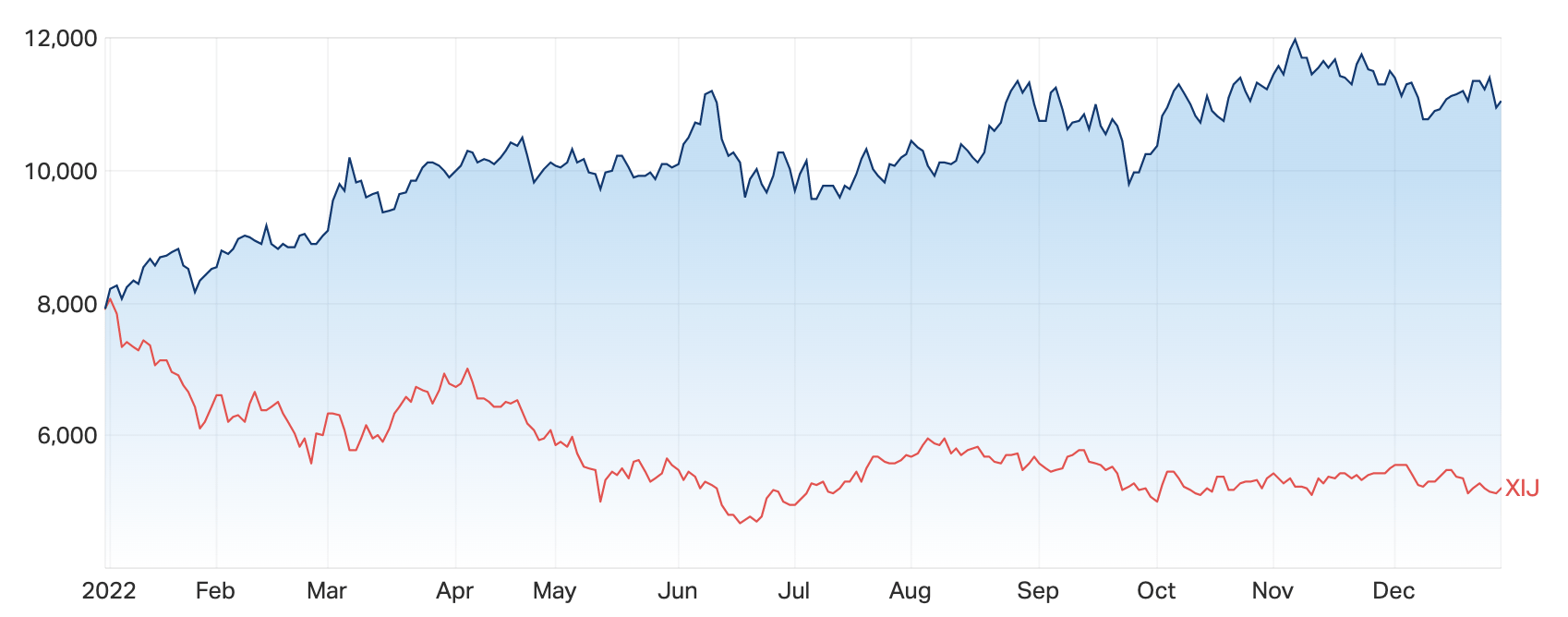

The benchmark for Australia’s micro-cap companies, the S&P/ASX Emerging Companies (XEC) index began 2022 head to head with the top end of town.

Blow for blow, gain for gain. The plucky average gave as good as it got. It was great telly there for a bit.

Then, around May, the appetite for the risk/return equation which makes so much of the constituents of the ASX XEC so attractive began to erode, signalling much of what the benchmark ASX/200 and so many other leading global indices would encounter in a few short weeks.

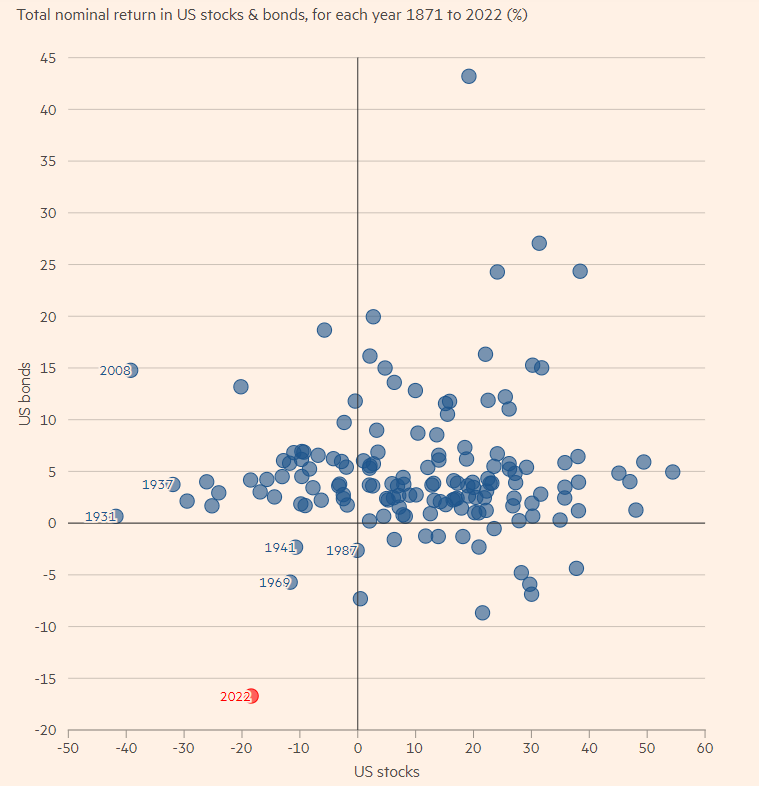

Fast forward to a few hours ago, and according to the new math from the Financial Times, around the world, global equities and bonds lost more than US$30 trillion altogether this year.

The problem according to the Hindsight Experts, is that equities and bonds tumbled together, US bonds having their worst year in literally centuries , while Wall Street stocks have given away about 20% since 365 days ago.

According to The Financial Times your garden variety portfolio made up of circa 60% equities and 40% bonds just had the worst return since 1932. *And I think we all remember what a year that was.

Emerging Companies index (XEC) vs ASX200 (XJO)

XEC: Year that was

- 1 Day +1.72%

- 1 Week -0.18%

- 1 Month -2.60%

- YTD 2023 -23.71%

- 1 Year -22.69%

It was the worst annual performance by the Aussie market since…

2018. Which I seem to recall wasn’t an absolute mess.

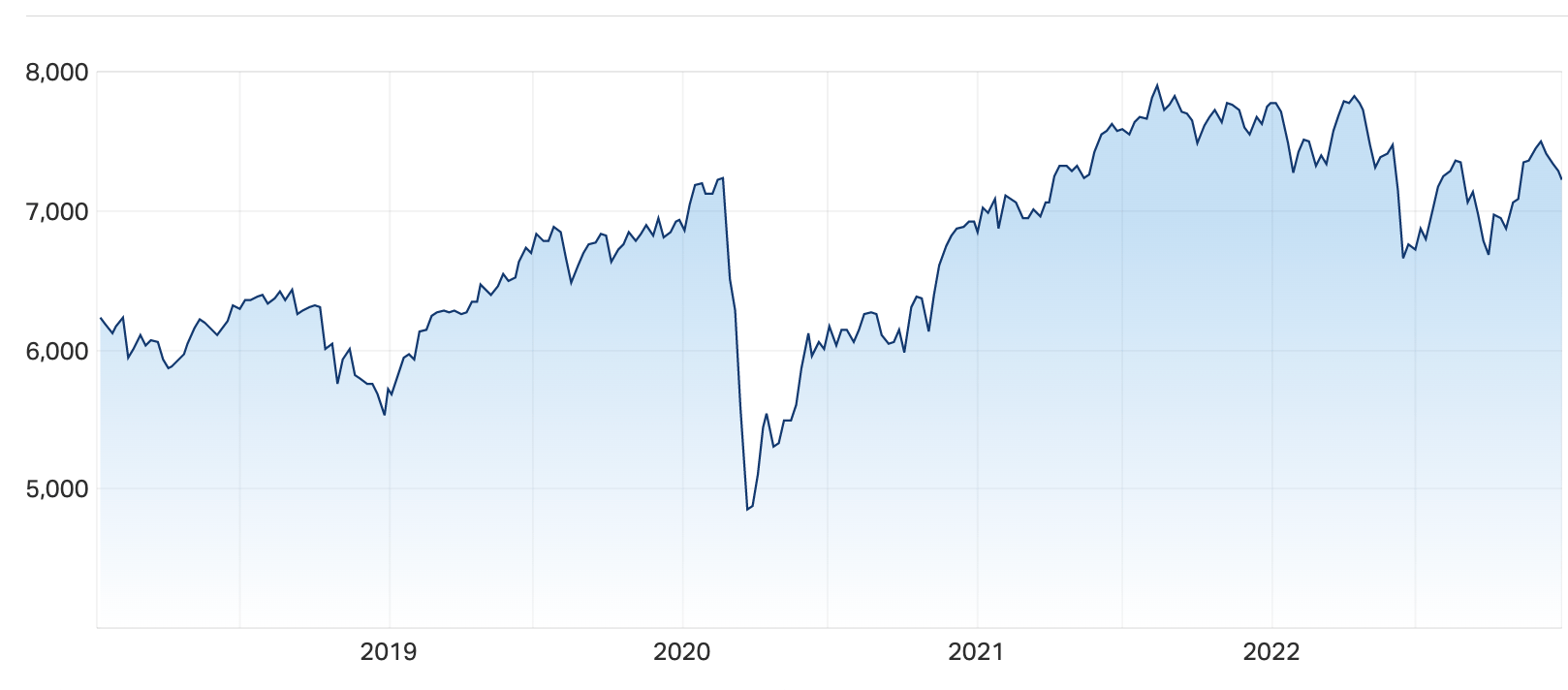

The S&P/ASX 200 (XJO)

Australia’s top 200 listed companies make up the S&P/ASX 200 (XJO) and that represents some 83% of the entire national equity market (for perspective, some ~2,252 stocks didn’t make the cut), In 2022 the Aussie benchmark index did pretty well compared to some of the other global markets out there – losing 5.45% to 7038.7 points, after ending 2021 at 7444.7. That’s still over the magical 7,000 mark and the market’s total return post a massive year for dividends was just 1.1% lower.

Which shouldn’t cut so deeply after 2021’s fat returns of around 18%.

But add in the steamy inflation at circa 8%, while a roid-raging US dollar – the AUD ended the year around US67.70c. also took a cut from investors’ pockets.

XJO: Year that was

- 1 Day +0.27%

- 1 Week -1.59%

- 1 Month -2.96%

- YTD 2023 -5.45%

- 1 Year -6.32%

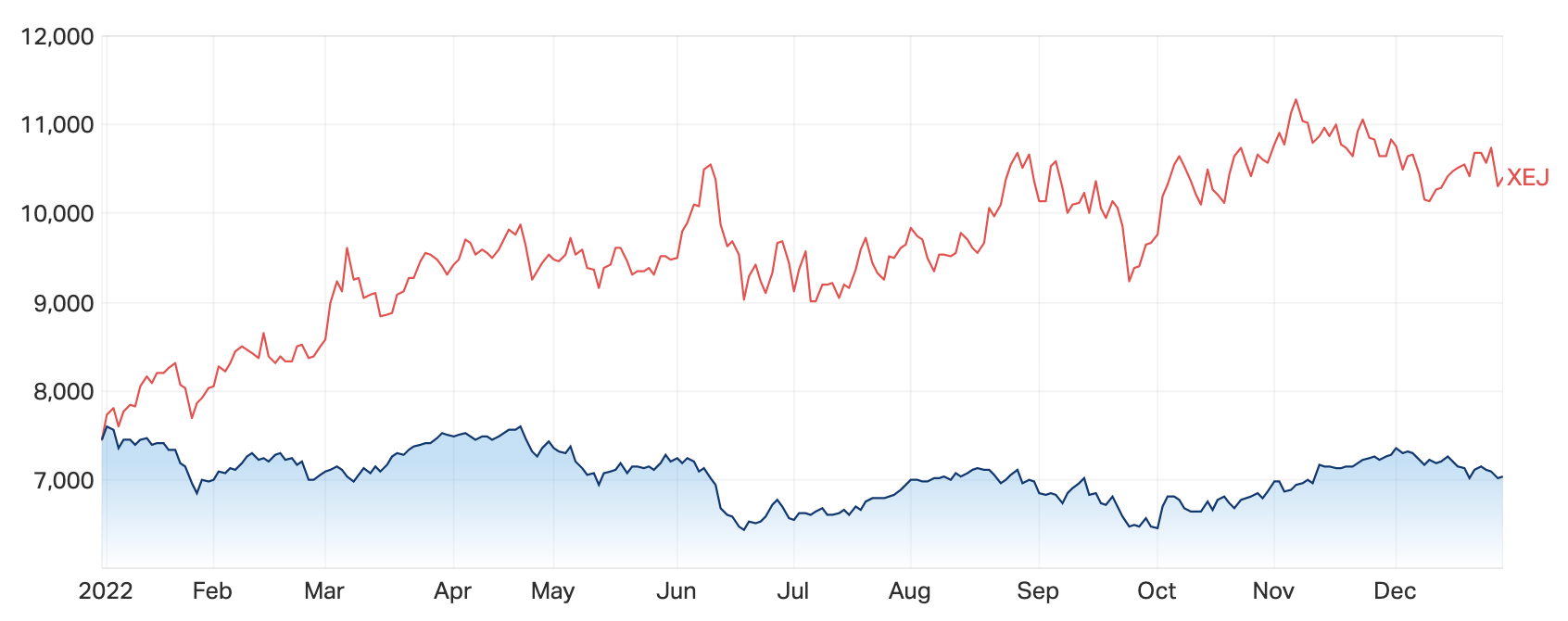

And in 2022 it was energy stocks against the rest.

ASX200 (XJO) vs the ASX Energy Sector (XEJ)

XEJ: Year that was

- 1 Day +0.89%

- 1 Week -2.72%

- 1 Month -2.36%

- YTD 2023 +39.71%

- 1 Year +38.55%

Meantime around the world as on the ASX, fossil fuels have boomed and the local Energy Sector has surged.

Of the energy companies among the ASX 200 the big names like Santos (ASX:STO) and Whitehaven (ASX:WHC) have collectively climbed an average of around 39% (according to my sums).

That compares quite favourably with the ASX Tech index (XTX), which is down circa 35% – as is usually the way of growth stocks when the the central banks start tightening the screws – fell with a velocity tech stocks felt the world over.

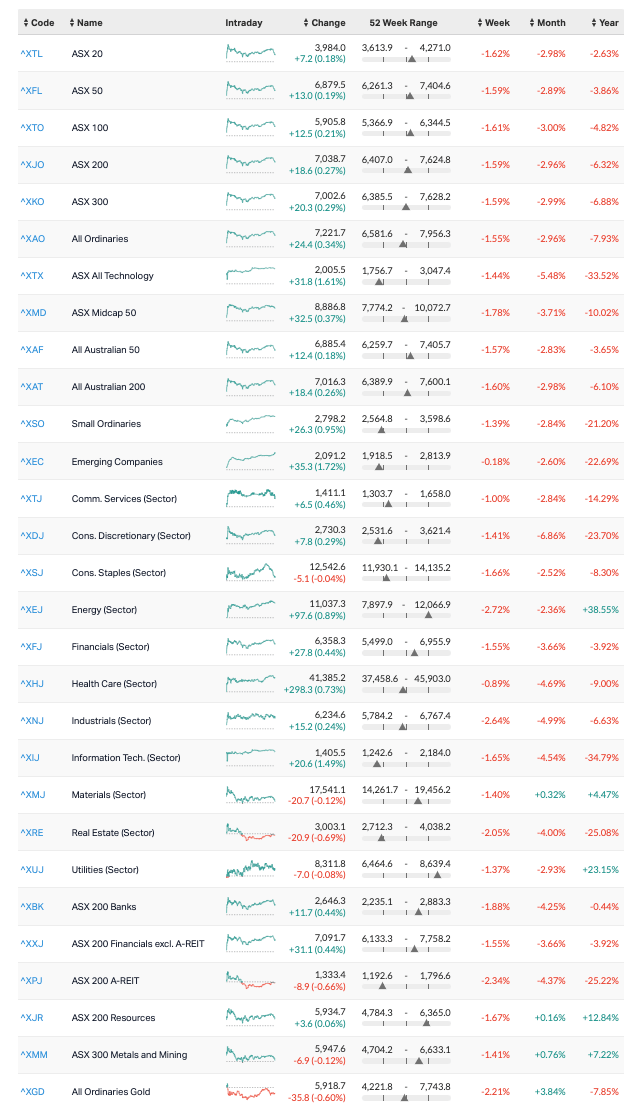

This is how EVERYONE ended on the ASX by sector

ASX Energy Index vs ASX Tech Index

One more thought before leaving you in peace and the company of friends and family.

Aside from the emergence of a global pandemic, another war in Europe, the calamaty of natural; disasters from pakistan to the ongoing famine in the east of Africa, 2020 and 2021 — were years of outrageous plenty for investors.

In new York the S&P 500 jumped 17% (2020) and 28% (in 2021).

Since the end of 2019, the American broader market is still about 18% fatter.

At home, our S&P All Ords is down about 9% this year, but over the last 5 years, it’s still ahead by 16%.

All Ordinaries (XAO) (5 years)

Chin up.

And Happy New Year!

*1932 off the top of my head – worst year of the terrific depression (US jobless at 25%, many live in cars and Hooverville’s (shanty) towns). Mahatma Gandhi got arrested by the poms for agitating for peace, went on a monster hunger strike, And Al Capone was done for income tax evasion, by Kevin Costner.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.