Oil and gas slots right into our clean energy revolution: Who are the ASX plays positioned to take advantage?

Oil and gas players will play a pivotal role to meet projected demand. Pic via Getty Images.

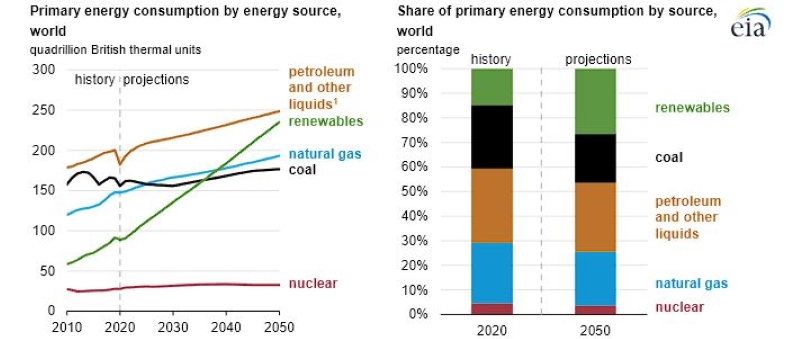

As we transition to cleaner energy production and phase out coal, natural gas has frequently been touted as a viable intermediary solution, as electricity grids worldwide will still foreseeably rely on centralised power grids from constant, baseload energy production.

That, and as a result of the electrification of transportation, appliances, industry and home heating, electricity demand by 2050 is set to grow by a whopping 27%.

“In 2022, 79% of our energy came from fossil fuels,” according to the US Energy Information Agency, and that will fall to just 65% by 2050.

The prevailing concept is that as solar arrays and wind farms continue to proliferate – and when the sun doesn’t shine or the wind dies down – natural gas will be requisite to serve as a substitute baseload energy source for more environmentally detrimental energy sources such as coal, until we implement new tech and decentralise our electricity grids.

For oil, demand increases look to remain on track to grow by 2.2 million barrels per day (mb/d) in 2023 to 101.8 mb/d, led by resurgent Chinese consumption, jet fuel use and petrochemical feedstocks.

Gas demand pressure

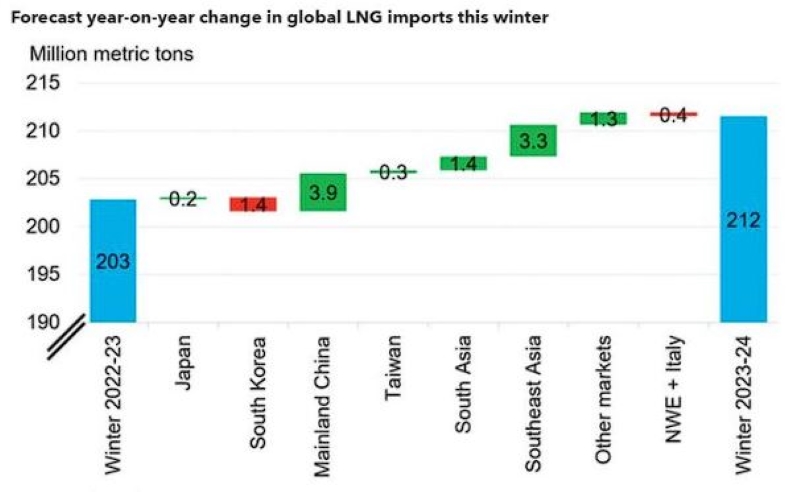

Natural gas is very much in demand at the moment due to lower recent exploration – which some put down to a COVID lag effect reducing exploration and the war in Ukraine shifting supply chains away from Russia.

Chinese government energy arm Sinopec bought more than 30 cargoes of LNG via tender for October to the end of 2024, in order to cover winter demand and boost the supply pool for trading, according to local sources.

Spot prices in Northeast Asia have been steady week on week at $13.50/MMBtu for the third consecutive week, according to Energy Intelligence assessments for deliveries four to eight weeks ahead. Spot LNG prices in Southwest Europe remained stable during the period at $10.50/MMBtu.

Oil to remain

A predicted extension of output cuts by Saudi Arabia and Russia through year-end will lock in a sizeable market deficit through 4Q23, as oil finally breached the US$90/bbl mark, something Stockhead’s very own energy expert Bevis Yeo mused over last month.

“Prices moved higher by month-end as fundamentals came to the fore once again and breached $90/bbl for the first time in 10 months after Saudi Arabia and Russia extended voluntary production cuts until the end of 2023,” the September International Energy Agency oil market report said.

To meet this uptick in demand for oil and gas, ASX juniors are making headways to fill the supply gap.

Who’s knocking about with exploration and development?

Hartshead Resources (ASX:HHR) is currently in Phase I of a three-phase development, consisting of five blocks across four existing gas fields in the UK Southern Basin of the North Sea.

Phase 1 comprises the Somerville and Anning gas fields — both of which boast historical production, multiple well penetrations, 3D seismic coverage and combined remaining 2C resources of 324Bcf.

Hartshead is nearing a Final Investment Decision (FID) on the development and aims to achieve first gas in 2024.

Off the coast of Indonesia, Conrad Asia Energy (ASX:CRD) has operating interests in the 413Bcf Mako gas field, where development costs sit at a fairly comfortable US$275m against a projected ~$2.4bn in revenue after royalties to the Indonesian government.

The company also has interests in the Meulaboh and Singkil PSCs offshore of Indonesia’s Aceh Province that have combined 2C Contingent Resources of 214Bcf of gas – 161Bcf of which is attributed to Conrad.

Over to Mongolia and Jade Gas (ASX:JGH) has just completed a 2D seismic survey of its Red Lake 246Bcf contingent resource area in the south Gobi desert.

Results are being processed as the company finalises planning for an upcoming pilot lateral well drilling program.

Closer to home, Queensland Pacific Metals (ASX:QPM) is progressing its waste gas collection project, which consists of the Northern Hub and the Southern Hub.

The Southern Hub includes its recently acquired Moranbah project and all associated gas processing and compression infrastructure, while the Northern Hub, (~40km north of Moranbah), is ideally situated in a part of QLD’s Northern Bowen Basin that is known to contain high volumes of gas.

QPM’s future plans include new infrastructure development in the Northern Hub to collect additional waste gas and significantly grow production.

Just next door, Omega Oil & Gas (ASX:OMA) plans to accelerate the commercialisation pathway for its deep gas assets Canyon-1 and Canyon-2 in QLD, which were drilled to the Permian tight gas play in the Southern Taroom Trough within the prolific Bowen Basin.

It recently brought in $21m via an over-subscribed institutional raise to re-enter Canyon-1 and is working on demonstrating commercial gas flow rates.

Turning attention back overseas, Europe-focused ADX Energy (ASX:ADX) has oil and gas projects in Austria, Romania and Italy, with a focus on implementing low-carbon tech.

In Austria, it’s fast-tracking its near-term Anshof oil discovery and drilling the world-class Welchau gas prospect.

In Western Romania, ADX operates the Parta exploration permit and the Iecea Mare production permit via a 49.2% equity interest in Danube Petroleum. It’s also overseeing the Nilde oil field redevelopment off the coast of Italy.

Focused on both gas and renewables, Botala Energy (ASX:BTE) is producing coal bed methane (CBM) from its 70%-owned Serowe project in a high-grade CBM region of Botswana.

Recently, Botala and JV partner Pure Hydrogen produced sustainable gas flow from the local coals at the Serowe-3.1 well.

CEO Kris Martinick spoke to Stockhead earlier this week, saying company’s focus is to also integrate solar energy and battery solutions to complement its gas production.

“We’re trying to be as green as we can be – we want to do both gas and renewables and find solutions to put back into the Botswanian community,” Martinick said.

“We’re kicking off our commercial sustainable production pilot program at the moment to make these things happen and are excited about our near-term future.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.