Hexagon Energy acquires hydrogen company

Hexagon Energy Materials has acquired a carbon-free emissions hydrogen energy project. Image: Getty

Special Report: Hexagon Energy Materials is steps closer to its goal of becoming a clean energy company with its agreed takeover of hydrogen company Ebony Energy.

Hexagon’s strategy is to become a predominant clean energy and resource company.

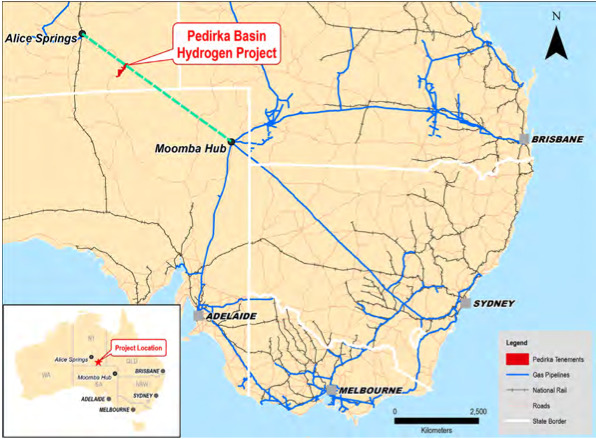

The all-scrip, off-market takeover for unlisted Ebony Energy provides Hexagon Energy Materials (ASX:HXG) with a hydrogen project in the Northern Territory.

Hydrogen is an environmentally friendly, cost effective energy source that has applications in transport, electricity, industry and heating sectors as well as chemical uses.

The global market for hydrogen is expected to grow to $US199bn by 2023 from $US135.5bn in 2018, propelled by high growth markets in Japan, China and Korea, according to experts.

Next steps for Hexagon Energy and its Pedirka project

Ebony Energy’s key asset is its Pedirka project that will use a surface gasification plant to produce ‘blue’ hydrogen from coal for export and domestic markets with zero carbon emissions.

A pre-feasibility study for the Pedirka project is the next step to advance the project.

“The combination with Hexagon provides Ebony Energy shareholders with a perfect platform to progress the Pedirka project,” the company’s chairman Stephen Gerlach said.

“We are confident that the project’s upcoming drilling program and pre-feasibility study will yield excellent results and provide clear direction of the best way forward to become a substantial, zero-emission hydrogen producer.”

Hexagon Energy also has two exploration projects in WA; the Halls Creek gold and base metals project, and the McIntosh graphite, nickel and platinum group metals project.

Hexagon Energy finalises capital raising and share issue

Ebony Energy shareholders will receive 1 Hexagon Energy Materials share for 1.32 of their shares, implying a value of 6c per share for Ebony and its shareholders will represent 23.24 per cent of Hexagon, post-merger.

Current Ebony Energy managing director, Adam Bacon, will join Hexagon’s Chief Commercial Officer, Lianne Grove, to undertake executive management duties and deliver key milestones for the Pedirka project.

At the same time as announcing its acquisition of Ebony Energy, Hexagon has received firm commitments from sophisticated and professional investors to raise $500,000.

Most of the proceeds will pay for the Ebony Energy deal.

The capital raising is through a share placement for 8.7 million shares prices at 5.7c per share, representing a 10 per cent discount to the average, volume-weighted price in the prior 10-day period ending December 16.

This article was developed in collaboration with Hexagon Energy Materials, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.