Here’s what has to happen before these ASX small cap hydrogen stocks can become superpower producers

Pic: Rebecca Van Ommen (The Image Bank) via Getty Images.

Hydrogen is all the rage right now as companies plan production across Australia – but whether it’s green (produced via renewables) or blue (produced via fossil fuels) isn’t the biggest issue.

According to Australian Hydrogen Council CEO Dr Fiona Simon, we have all the raw ingredients to be a regional hydrogen superpower, but we need to focus on making hydrogen cost competitive with current fuel sources.

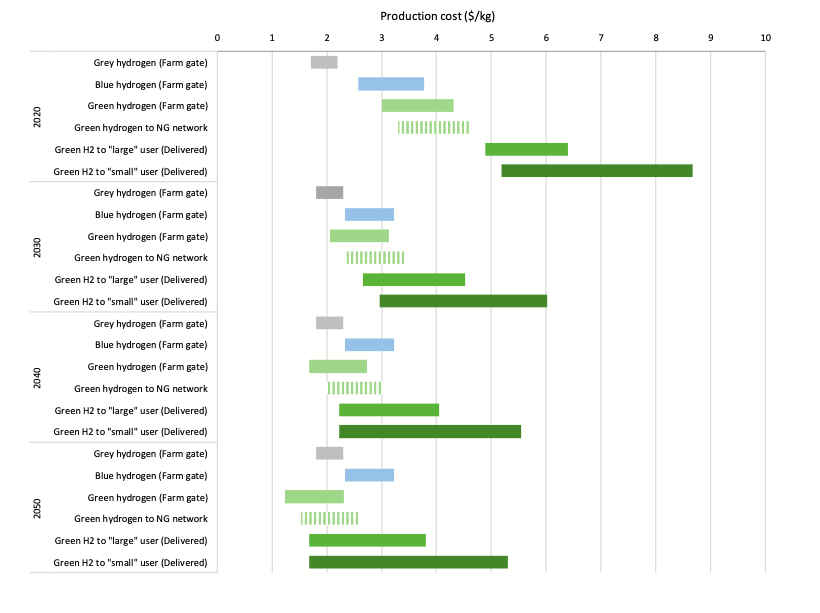

The target hydrogen production price in the National Hydrogen Roadmap of $2-3/kg (excluding storage and transport).

In May the Clean Energy Finance Corporation estimated green hydrogen can be produced for less than $3.90/kg at the “farm gate” but when you add the delivery costs for moving electrons and adding around 20km of pipeline, the delivered cost is closer to $5.82/kg.

To reach the Government’s $2 target costs would have to fall 75% – and that seems unlikely to happen this decade without massive subsidies.

“Hydrogen has huge potential to decarbonise sectors of our economy, but it isn’t commercial at this stage,” Dr Simon said.

“The biggest challenge facing hydrogen is the cost of producing hydrogen.

“We support the Government’s ambition to reach H2 under $2 but we need to work hard to generate hydrogen demand and production simultaneously.”

Dr Simon said we need to get the industry up and running to a place where hydrogen has reached price parity with fossil fuels.

“The cost of electrolysers, the technology required to create hydrogen is forecast to reduce markedly, however Government support is required to bring forward investment in production and demand projects,” she said.

“The actual economic gap for hydrogen to replace fossil fuels varies between applications.

“For example, hydrogen is reasonably close to price parity per unit for equivalent energy value for diesel right now.”

Stronger policy settings needed to value hydrogen

Earlier this year the Federal Government announced more than $300m to build a series of hydrogen hubs around the country.

And last week Energy Minister Angus Taylor and the Morrison Government finally succeeded in getting regulations that would enable the Australian Renewable Energy Agency to invest in carbon capture and storage projects through Federal Parliament – a boon for blue hydrogen players.

Taylor said the Government will invest $20 billion in “new energy technologies by 2030” to drive “at least” $80 billion of public and private investment over the decade.

To put this in perspective, Bloomberg has previously estimated that around US$150 billion of financial support globally would be required before hydrogen can achieve cost parity with natural gas.

Dr Simon said the Government is showing “great enthusiasm and support” for the hydrogen industry but that consistent policies across the states and territories are needed to value hydrogen and create a market.

“The Federal Government’s hydrogen hubs will drive efficiency by collocating different uses for hydrogen near the source of hydrogen production, also reducing the cost of transporting hydrogen,” she said.

“They will help close the investment gap.

“We need to implement policies to close the current investment gap in a range of sectors which could be powered by hydrogen because each has a different combination of production cost, demand and infrastructure needs.

“Consistent policy across states and territories is needed to encourage demand and improve the economics of producing hydrogen.”

Even though the perfect production price point could be some way off, there are still a bunch of stocks on the ASX who are diving headfirst into hydrogen.

Blue Team

Along with its gas projects in Queensland’s Surat Basin and in Botswana, the company has been working throughout the June quarter to develop solutions for conversion to fixed price hydrogen at a lower cost than imported diesel for the transportation industry, submitting a number of proposals to well-known companies with transport fleets.

PH2 has also submitted proposals across Queensland, New South Wales and Victoria to secure four east coast port hydrogen hubs in a JV with Liberty Hydrogen – as well as securing JVs with hydrogen manufacturing and distribution specialists to build pilot plants at the hubs.

The resources/clean energy company is working towards development of its Perdika blue hydrogen project – last month lodging the mine management plan with the NT Government.

Hexagon is confident it will secure government approval to kick off exploration drilling in September.

Along with its traditional oil and gas activities, the company is planning to undertake several feasibility studies – two in the Mid-West region and one in the southwest region of WA as to the viability of blue hydrogen projects.

The studies are all expected to kick off in Q2 FY22.

Green Team

In the June quarter, the company announced it had raised $2.8 million to back its green hydrogen strategy which targets first mover status in production in Australia.

To that end, LIO has appointed Queensland University of Technology (QUT) to assist in locating green hydrogen infrastructure in Queensland and has signed a MOU with Wagner Corporation to pursue green hydrogen, as well as appointing GPA Engineering to undertake a hydrogen production and refuelling concept study.

The part graphite/part hydrogen player is aiming to produce green hydrogen from biogas via its commercial demonstration project which is currently under construction.

Due to cost increase, Covid delays and higher than anticipated engineering requirements to optimise the design, the company now expects a final project cost of $20–$22 million – which is an increase of 17% over previously advised costs and 29% over the original June 2020 FID project budget.

But Hazer says it’s still fully funded to complete the CDP and expects to complete construction by Q4 2021.

The company recently signed a non-binding MoU with French renewables company Total Eren to complete a feasibility study to see if a green hydrogen project of up to 8GW (and equally owned by Total Eren and Province) could be developed in WA.

Global Energy Ventures (ASX:GEV)

The hydrogen shipping developer recently announced plans to complete a feasibility study for its proposed compressed hydrogen shipping model for Province’s proposed HyEnergy project.

Vanadium player QEM has a stake in the hydrogen sector, recently announcing plans to study “green hydrogen opportunities” at its Julia Creek vanadium and oil shale project in Queensland.

Pilot last week also made moves to join the green team, announcing it had engaged key consultants and would soon begin a feasibility study on a wind and solar hydrogen project in WA’s Mid West.

Unlisted (yet) players

H2X Global is a hydrogen vehicle maker focused on bringing zero-emission vehicles to roads.

The company is plotting its course to a major exchange listing and is pushing into new markets in a bid to establish itself as a global premium hydrogen vehicle manufacturer.

The zero carbon commercial green hydrogen producer owns the Arrowsmith hydrogen project in Western Australia and earlier in the year raised almost $10 million through a heavily oversubscribed pre-IPO.

The company raised $2 million via a pre-IPO earlier in the year, with plans to list on the NASDAQ.

Verdant’s proposed green hydrogen plant, Australia’s first scalable hydrogen production plant, will initially deliver 6.5 tonnes per day before being scaled up to 60 tonnes per day by 2024.

The company plans to establish further similar sized hydrogen production plants within Australia.

The company is looking to leverage on its sustainable biomass (in the form of a sawmill business) to produce green hydrogen with a $4m pre-IPO capital raising ahead of its ASX debut later this year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.