Emission Control: World’s biggest met coal export terminal wants to get into green hydrogen

Pic: Matthias Kulka / The Image Bank via Getty Images

As the Woodside-BHP deal and the tepid market reaction that followed has shown, investing in energy in 2021 means treading in uncertain waters.

For companies that extract or are heavily leveraged to oil, gas and coal, that might mean hedging on some technologies that may be more valuable in the future as net zero targets grow more ambitious.

Dalrymple Bay Infrastructure (ASX:DBI) seems to be doing just that by commencing a study on producing and exporting green hydrogen from the Dalrymple Bay Coal Terminal in Queensland, the world’s largest coking coal export terminal.

Located at the Port of Hay Point, 38km south of Mackay, DBCT currently waves off met and thermal coal from mines in the Bowen Basin.

DBI, which holds a 50-year lease and 49-year option over the terminal’s operations, is partnering with North Queensland Bulk Ports, Brookfield and Japanese trading giant ITOCHU to assess the feasibility of a green hydrogen plant and export facility.

If feasible it would be a gamble by DBI on the future of steelmaking, in which coking coal is a key reducing agent. Hydrogen is being assessed currently for its potential as an input in so-called ‘green steel’.

““The Dalrymple Bay Terminal at Hay Point is an established export port, known globally for its key role in supporting the global steel supply chain,” DBI CEO Anthony Timbrell said.

“The terminal is ideally placed to develop a green hydrogen facility due to its deep water port, the established Mackay industrial zone, the availability of land and water and position within one of Queensland’s Renewable Energy Zones.”

He added that DBI remains committed to maintaining and expanding infrastructure for its existing coal clients.

“The possible addition of new hydrogen-based products to complement our current export position would see DBT play an even bigger role in the export of key resources to satisfy the world’s demand for steel and low carbon energy sources, such as hydrogen.”

The news came on Wednesday, the same day FMG founder and chairman Andrew Forrest delivered a major keynote speech for a Clean Energy Council event in which he called for a national target for net zero emissions by 2050.

Forrest said the iron ore giant still sees iron ore and steel as essential ingredients for renewable energy infrastructure.

FMG’s new Fortescue Future Industries arm is planning to develop a 50Mtpa green hydrogen business, Forrest said in a manifesto where he criticised the oil and gas industry for sponsoring the concept of ‘clean hydrogen’ not backed by renewable energy.

“That is why the fossil fuel sector has quickly flipped to using a colour code and the new term `clean hydrogen’, this has as much accuracy as ‘clean coal’ or ‘healthy smoking’ — and don’t get me started on the smokescreen of sequestration,” he said.

Dalrymble Bay Infrastructure share price today:

Every tonne counts in climate change fight

The IPCC report came out last week. You’ve probably heard a little bit about it.

It is extremely long and extremely depressing, having been described by UN Secretary General Antonio Guterres as a “Code Red for humanity”.

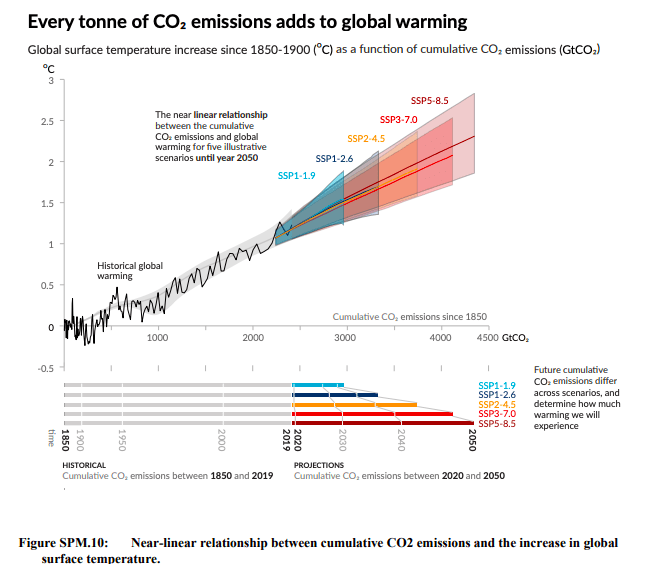

Perhaps the key graph was this one, which illuminates the high certainty IPCC scientists have about the cumulative impact of greenhouse gas emissions.

According to the report we’ve launched in the order of 2390Mt of CO2 into the atmosphere since 1850.

That gives us around 900Mt left to expel to keep global warming to 2C or less to a certainty of around 83%.

It’s a finding that largely renders Scott Morrison’s suggestion that curbing emissions in Australia would do nothing to stop them in China, India, South Africa or any other developing economy largely moot. In the IPCC model, emissions add up, they don’t average out.

Morrison is hardly the most tin-eared member of his government. He seems to be inching towards a net-zero target ahead of the COP26 climate dialogue in Glasgow in November, even if he does have to bring his own Deputy PM Barnaby Joyce kicking and screaming to the negotiating table.

Hazer Group recovers lost gains

Hazer Group (ASX:HZR) fell a couple of months ago on news the test plant for its hydrogen and synthetic graphite project in WA would face coast blowouts.

It has since recovered those losses, with the company aiming to bring its demonstration plant to practical completion by the end of 2021 at a cost of around $20-22 million.

The project, located at Woodman Point in WA, would use biogas and electrical heating to generate 100 tonnes of hydrogen and 380tpa of synthetic graphite with a true graphitic content of 90-95%.

Spun out of research started 15 years ago at the University of WA, Hazer established itself as an early mover in the synthetic graphite and hydrogen spaces when it listed on the ASX in 2015, and has support from the Australian Renewable Energy Agency.

Hazer Group share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.