Hydrogen is still on the decarbonisation agenda, here’s where it fits

Hydrogen still has its parts to play in progressing net zero. Pic: Getty Images

- Hydrogen still has a role to play in decarbonisation

- Heavy transport and replacing existing fossil fuel-derived hydrogen are areas for clean hydrogen to lead

- Natural hydrogen capturing investor interest as viable energy sources

Is hydrogen still the “fuel of the future”? Perhaps not as a replacement for fossil fuels as was previously thought, but almost certainly in some sectors where carbon abatement is challenging.

Despite the hopes of major automotive companies such as Toyota – possibly the biggest proponent of hydrogen vehicles – adoption of consumer hydrogen fuel cell (HFC) vehicles has been downright dismal in Australia.

The sales figures are telling. Throughout the entirety of the June 2024 quarter, a grand total of FIVE HFC-powered cars were sold in Australia, barely a blip compared to the 25,353 battery electric vehicles (BEVs) sold during the same period.

Tesla’s popular Model Y and Model 3s alone account for 10,327 of these BEVs sales.

In this space at least, hydrogen has conceded the field without even the pretence of a battle. But there are plenty of areas where it is taking the lead.

Still hope for hydrogen in transport

That’s not to say that hydrogen won’t play a role in the transport sector.

It is still a rich source of energy and addresses issues such as recharging (or refuelling) time, infrastructure and power delivery where BEVs might struggle.

Pure Hydrogen Corporation (ASX:PH2) is a firm believer that HFCs could help medium and heavy transport operators achieve their net zero goals and is already seeing strong interest from government and corporate customers for hydrogen-powered buses, waste collection trucks, prime movers, and refuelling solutions.

In the past couple of months, the company has executed agreements to expand its distribution network with GreenH2 LATAM in November, ETHERO Truck + Energy in October and Riverview International Trucks in July.

It also sold vehicles and supporting infrastructure under agreements such as those with Vietnam ASEAN Hydrogen Club and another party worth ~$10m in late October.

PH2’s Taurus prime mover truck is on trial with PepsiCo and Barwon Water while multiple sales of waste disposal vehicles have been made to major waste recovery companies including JJ Richards and Solo, as well as prominent local governments such as the City of Newcastle.

Development is underway on Stage 1 of its initial hydrogen micro-hub at Archerfield Airport in Queensland as a demonstration plant that will supply nearby commercial customers – including JJ Richards – as well as aviation industry demand.

Industrial uses

Another area where hydrogen can reduce emissions is industries and sectors that can be quickly decarbonised by swapping out a feedstock manufactured using a process with high carbon intensity with the same feedstock made using a low or zero carbon process.

A key example is in the production of ammonia fertiliser, which requires large quantities of hydrogen.

The problem is this hydrogen is currently produced from fossil fuels, producing a significant amount of carbon emissions.

Replacing fossil hydrogen with hydrogen produced using cleaner methods will make an immediate difference to our emissions.

It also remains viable as a store of energy for peaking power plants that run on hydrogen rather than natural gas.

Two options are typically touted as the way to go about doing so.

The first – blue hydrogen – continues to produce hydrogen from fossil fuels but proposes to capture the resulting CO2 and sequester (or inject) it into depleted natural gas reservoirs, a process that’s typically seen as controversial given the paucity of commercial carbon capture and storage projects.

One of the biggest CCS projects – the Gorgon CCS project that seeks to sequester CO2 produced by the Gorgon LNG project offshore Western Australia – is still performing well below capacity.

However, emerging technologies might offer solutions here with Hazer Group (ASX:HZR) already demonstrating its proprietary technology for producing hydrogen and graphite from natural gas using a low-cost, low-emission process at its Commercial Demonstration Plant (CDP) in Munster, Perth.

This has been running continuously for hundreds of hours and avoids concerns about CCS by turning the carbon byproduct into solid graphite that is valuable in its own right.

The other technology is green hydrogen, which uses electrolysers powered by renewable energy to crack water into oxygen and hydrogen, though this route suffers from high costs and poor efficiency.

Natural hydrogen coming to the fore

However, the answer to the question of where to source cleaner hydrogen might lie under our feet.

Natural, gold or white hydrogen is produced by certain geological processes such as when water reacts with certain rocks, deep in the subsurface.

This gas is then trapped in reservoirs akin to those that host oil and gas.

Not only can this be produced at a low cost using processes matured by the oil and gas sector, it also has very low carbon intensity.

Natural hydrogen found close to the industries that use the gas are especially valuable as they allow their operators to minimise the challenges involved with storing and transporting it.

ASX companies chasing natural hydrogen include HyTerra Limited (ASX:HYT) and Top End Energy (ASX:TEE) , who are both operating in Kansas.

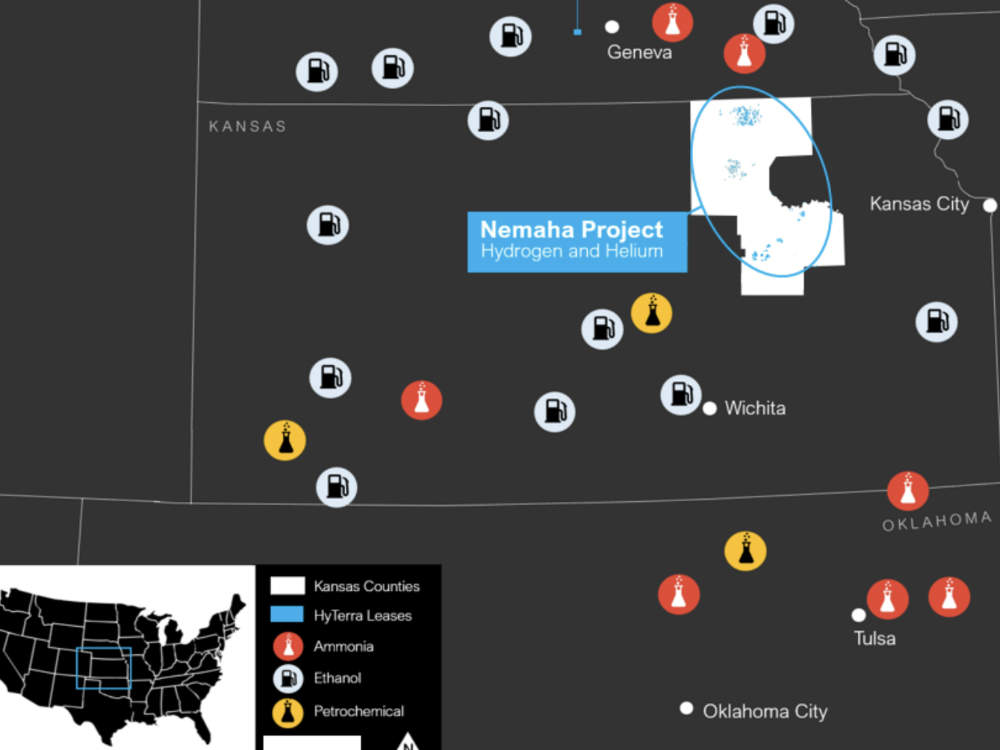

HYT has been busy building up its acreage position at the Nemaha project, which sits in the centre of a major industrial and manufacturing hub between Kansas City and Wichita.

The company recently expanded its landholding by >15% to more than 60,000 acres, giving it plenty of room to expand should its upcoming drill program be successful.

But the best sign that the company is onto something intriguing is Andrew Forrest’s Fortescue (ASX:FMG) making a $21.9m investment to earn a 39.66% stake, which has just been approved by HYT’s shareholders.

Not only is this a clear sign that the big players are interested, it also allowed the company to expand its original two well exploration program into a six well campaign to test a number of geological plays across its acreage.

Historical exploration wells have already confirmed the presence of natural hydrogen and helium, with some returning up to 92% hydrogen and 3% helium.

Newer to the game is Top End, which has just picked up the ~20,000 acre Serpentine project in Marshall, Riley and Washington counties at the heart of the natural hydrogen land rush underway in Kansas.

The Serpentine leases are focused on areas adjacent to recent exploration drilling where leasing is highly competitive.

TEE also benefits from regional access to rail, road, and gas pipelines to enable the delivery of hydrogen feedstock to downstream customers.

In another demonstration of how deeply natural hydrogen has penetrated into the broader market, TEE raised $6m through a strongly support share placement to continue expanding its Kansas lease holding, technical studies, exploration drilling preparation, and explore the potential for expansion to other US states.

At Stockhead, we tell it like it is. While Pure Hydrogen, HyTerra and Top End Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.