Emission Control: BNEF reckons ambitious climate policies will fuel 15-fold global energy storage growth by 2030

More ambitious policies in the US and Europe drive a 13% increase in forecast capacity versus previous estimates. Pic: Getty Images

- Magnis plans to establish a lithium-ion battery Anode Active Material (AAM) manufacturing plant

- First Graphene signs joint development agreement (JDA) with UK-based ZEBCO Heating to develop a heating device using PUREGRAPH graphene

- Two of MPower’s hybrid power clean energy projects in South Australia receive formal Offer to Connect from SA Power Networks

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

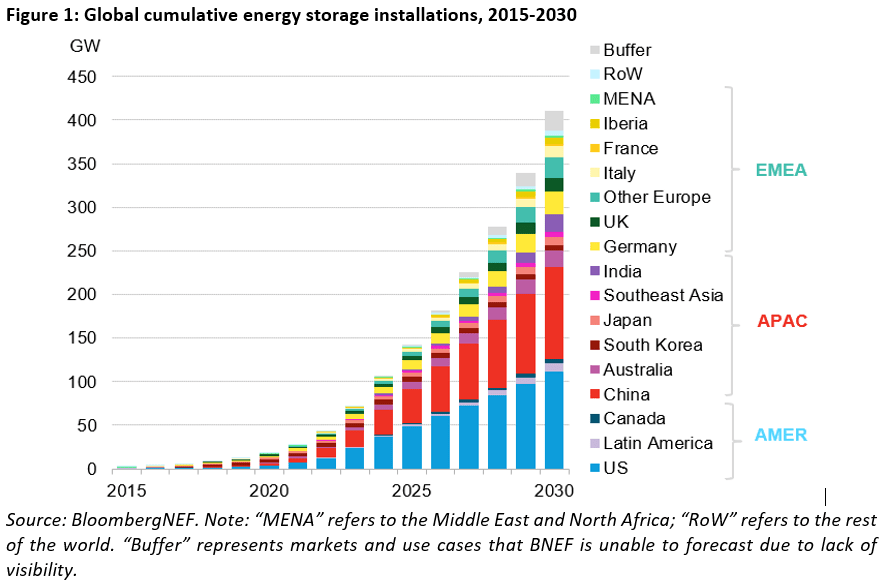

By the end of 2030, energy storage installations around the world will reach a cumulative 411 gigawatts (or 1,194 gigawatt hours) – 15 times the 27GW/56Gwh of storage that was online at the end of 2021, BloombergNEF says – with more ambitious policies in the US and Europe driving a 13% increase in forecast capacity versus previous estimates.

That means an estimated 387GW/1,143GWh of new energy storage capacity will be added globally from 2022 to 2030. That’s more than Japan’s entire power generation capacity in 2020.

The US Inflation Reduction Act, which is expected to inject more than $369 in funding for clean technologies, is anticipated to accelerate the US energy storage market with large volumes of funds allocated to wind, solar and storage tax credits.

According to BloombergNEF, a research provider covering global markets and analysis on trends driving the transition to a lower carbon economy, the US Inflation Act will steer roughly 30GW/111GWh of new energy storage build between 2022 and 2030 with both China and the US remaining the two largest markets, representing over half of global stage installations by the end of the decade.

At the same time, record electricity prices are forcing consumers to consider new forms of energy supply in Europe as Russia’s invasion of Ukraine continues to impact energy storage developments.

The significant utility-scale storage additions expected from 2025 onwards align with the very ambitious renewable targets outlined in the REPowerEU plan and a renewed focus on energy security in the UK, BNEF says.

As the continent ramps up capacity fuelled by the energy crisis, the outlook for the European market is set to see a doubling of energy storage deployments to 2030 from previous BNEF forecasts.

Regionally, Asia Pacific will lead storage build on a megawatt-basis by 2030, with momentum driven by the rapidly scaling market in China, but the Americas will add more capacity on a megawatt-hour basis as storage plants in the US usually have more hours of storage.

The Middle East and Africa are set to lag behind their counterparts.

BNEF’s forecast suggests that the majority of energy storage build by 2030, equivalent to 61% of megawatts, will be to provide so-called energy shifting – in other words, advancing or delaying the time of electricity dispatch.

Co-located renewables-plus-storage projects, in particular solar-plus-storage, are becoming commonplace globally.

Customer-sited batteries – residential, commercial and industrial – are also expected to grow at a steady pace with Germany and Australia the leaders in this space, with sizeable markets in Japan and California too.

Batteries to dominate market until 2030

“With ambition the energy storage market has potential to pick-up incredibly quickly,” Yayoi Sekine, head of energy storage at BNEF, added.

“The nuts and bolts of how energy storage projects will materialise as a result of big policies like the US Inflation Reduction Act still need to be sorted however, companies are already scaling up operations to capture the upside.”

Rapidly evolving battery technology is driving the energy storage market.

Lithium-ion batteries account for the majority of installations at present, but many non-battery technologies are under development, such as compressed air and thermal energy storage.

Nevertheless, BNEF expects batteries to dominate the market at least until the 2030s, in large part due to their price competitiveness, established supply chain and significant track record.

“If new technologies can successfully outcompete lithium-ion, then total energy storage uptake may well be larger,” the company adds.

Here’s how ASX renewable energy companies are tracking:

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | % YEAR | MARKET CAP |

| PH2 | Pure Hydrogen Corp | 0.26 | 6% | -5% | -13% | -2% | $84,895,676 |

| AVL | Aust Vanadium Ltd | 0.036 | 6% | -8% | -22% | 57% | $135,432,871 |

| PRL | Province Resources | 0.091 | 6% | 7% | -9% | -41% | $101,608,410 |

| BSX | Blackstone Ltd | 0.185 | 3% | 3% | -14% | -64% | $85,180,541 |

| LIO | Lion Energy Limited | 0.037 | 3% | 9% | -3% | -21% | $15,339,968 |

| MPR | Mpower Group Limited | 0.0215 | 2% | -2% | -2% | -67% | $6,167,769 |

| CNQ | Clean Teq Water | 0.48 | 2% | -6% | -17% | -27% | $20,993,102 |

| HZR | Hazer Group Limited | 0.54 | 2% | -5% | -19% | -61% | $90,335,184 |

| LIT | Lithium Australia | 0.054 | 2% | -5% | -11% | -51% | $64,641,090 |

| VUL | Vulcan Energy | 6.57 | 2% | -14% | -25% | -43% | $927,379,397 |

| FMG | Fortescue Metals Grp | 17.16 | 1% | -3% | -6% | 23% | $52,311,613,957 |

| CWY | Cleanaway Waste Ltd | 2.67 | 1% | -5% | -8% | -1% | $5,898,900,318 |

| AST | AusNet Services Ltd | 0 | 0% | -100% | -100% | -100% | $9,919,608,019 |

| PV1 | Provaris Energy Ltd | 0.057 | 0% | 6% | -15% | -46% | $31,251,987 |

| GNX | Genex Power Ltd | 0.205 | 0% | -5% | -2% | -7% | $283,961,314 |

| HXG | Hexagon Energy | 0.015 | 0% | -12% | -17% | -81% | $7,693,739 |

| IFT | Infratil Limited | 7.29 | 0% | -3% | -12% | -8% | $5,286,521,194 |

| MEZ | Meridian Energy | 4.13 | 0% | -3% | -9% | -14% | $5,219,391,654 |

| NEW | NEW Energy Solar | 0.985 | 0% | 2% | 7% | 28% | $315,779,166 |

| PGY | Pilot Energy Ltd | 0.018 | 0% | 0% | 6% | -68% | $11,005,881 |

| QEM | QEM Limited | 0.22 | 0% | 5% | -4% | 38% | $29,131,585 |

| SKI | Spark Infrastructure | 0 | 0% | -100% | -100% | -100% | $5,036,718,784 |

| KPO | Kalina Power Limited | 0.017 | 0% | -6% | -15% | -48% | $25,758,328 |

| RNE | Renu Energy Ltd | 0.038 | 0% | 0% | -5% | -19% | $13,853,508 |

| NRZ | Neurizer Ltd | 0.12 | 0% | 0% | -20% | 4% | $126,235,941 |

| TNG | TNG Limited | 0.091 | 0% | 14% | -33% | 14% | $126,346,058 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 0% | 25% | $34,125,795 |

| NMT | Neometals Ltd | 1.03 | 0% | -7% | -32% | 20% | $568,916,903 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | -13% | $12,620,500 |

| EDE | Eden Inv Ltd | 0.0065 | 0% | 8% | -35% | -68% | $17,622,988 |

| CPV | Clearvue Technologie | 0.2 | 0% | -2% | -11% | -31% | $42,408,069 |

| M8S | M8 Sustainable | 0.008 | 0% | 14% | 14% | -70% | $3,927,268 |

| LPE | Locality Planning | 0.061 | 0% | 3% | 5% | -63% | $10,715,793 |

| PV1 | Provaris Energy Ltd | 0.057 | 0% | 6% | -15% | -46% | $31,251,987 |

| DEL | Delorean Corporation | 0.065 | -2% | -2% | -23% | -66% | $14,237,580 |

| RFX | Redflow Limited | 0.035 | -3% | -5% | -22% | -42% | $64,181,638 |

| CXL | Calix Limited | 4.91 | -3% | -19% | -32% | -7% | $817,750,648 |

| ECT | Env Clean Tech Ltd. | 0.016 | -3% | -14% | -14% | 7% | $28,318,153 |

| EGR | Ecograf Limited | 0.315 | -3% | -7% | -20% | -50% | $146,358,374 |

| FHE | Frontier Energy Ltd | 0.46 | -3% | 21% | 19% | 254% | $108,956,761 |

| EOL | Energy One Limited | 4.53 | -4% | -6% | -12% | -24% | $137,843,953 |

| FGR | First Graphene Ltd | 0.105 | -5% | -5% | -16% | -45% | $63,369,365 |

| IRD | Iron Road Ltd | 0.14 | -7% | -13% | -3% | -38% | $119,979,196 |

| PRM | Prominence Energy | 0.0015 | -25% | 0% | -25% | -92% | $4,849,218 |

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | % YEAR | MARKET CAP |

Who’s got news out?

MAGNIS ENERGY TECHNOLOGIES(ASX:MNS)

Magnis plans to establish a lithium-ion battery Anode Active Material (AAM) manufacturing plant utilising high quality and high purity natural graphite feedstock from the Nachu graphite project in Tanzania in the next three to five years.

This downstream AAM production facility will deliver a secured supply of one of the most sustainable and cost-competitive Coated Spherical Graphite (CSPG) anode products in the marketplace for the US and European lithium-ion battery market.

MNS says the processing facility will strengthen the company’s vision of vertically integrating its strategic assets across the lithium-ion battery value chain, as well as meeting the growing supply deficit of critical materials for the broader lithium-ion battery market.

Several locations within the United States are currently being investigated as discussions continue with offtake partners to produce and supply the anode active material.

The demonstration plant will remain the initial focus, which will supply anode active material to OEMS and lithium battery cell manufacturers, followed by the set up of a large-scale CSPG AAM production facility.

FIRST GRAPHENE (ASX:FGR)

A joint development agreement (JDA) has been signed with UK-based ZEBCO Heating to develop a heating device using the company’s PUREGRAPH graphene, which reduces fuel consumption and lowers the nitrogen oxide (NOx) emissions.

It is expected to deliver an efficiency improvement of 20–30% in natural gas usage over current domestic boilers at a time when the European natural gas market faces severe shortages with governments seeking additional supply – in combination with reductions in gas consumption.

Under the JDA, First Graphene and ZEBCO will jointly develop the device, which is suitable for new installations and can be readily retrofitted into existing domestic and commercial heater systems.

ZEBCO has secured an initial £50,000 ($87,000) grant from Innovate UK’s Fast Start Innovation Fund, which will be used to fund feasibility studies and develop a proof-of-concept unit within the next six months.

MPOWER (ASX:MPR)

Two of MPR’s hybrid power clean energy projects in South Australia have received a formal Offer to Connect from SA Power Networks, enabling both sites to take advantage of negative pricing opportunities.

This means MPR will be able to import energy from the grid to charge the batteries at both 5MW solar farms, which are accompanied by DC-coupled 5MW/10MW battery storage capabilities.

It also paves the way for MPower to begin the next phase of development, which is reaching ‘shovel ready’ status – something the company is hoping for in the coming months.

Heading into 2023, MPR CEO Nathan Wise says the company is ready to pursue funding opportunities for the construction of its solar/battery energy projects in SA.

PROVARIS (ASX:PV1)

Provaris has lodged its EPBC Referral with the Australian Federal Government’s Department of Climate Change, Energy, the Environment and Water (DCCEEW) regarding the Tiwi H2 Project on the Tiwi Islands.

The EPBC Referral addressed any potential impacts to Matters of National Environmental Significance, including threated flora and fauna, and migratory and marine species.

A decision is expected within 20 business days on whether the action will require assessment and approval while a 10-day public comment period takes place for the Commonwealth to liaise with the Northern Territory EPA (NT EPA) to ensure their decision-making processes are aligned.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.