Emission Control: Australia’s transition to a low carbon grid sees record demand in the NEM in ’23

Pic: Getty Images

The National Electricity Market (NEM) is one of the largest interconnected electricity systems in the world, covering around 40,000km of transmission lines and cables for Australia’s east coast and southern states.

It currently supplies around 9m customers and delivers ~80% of all electricity consumption in the country.

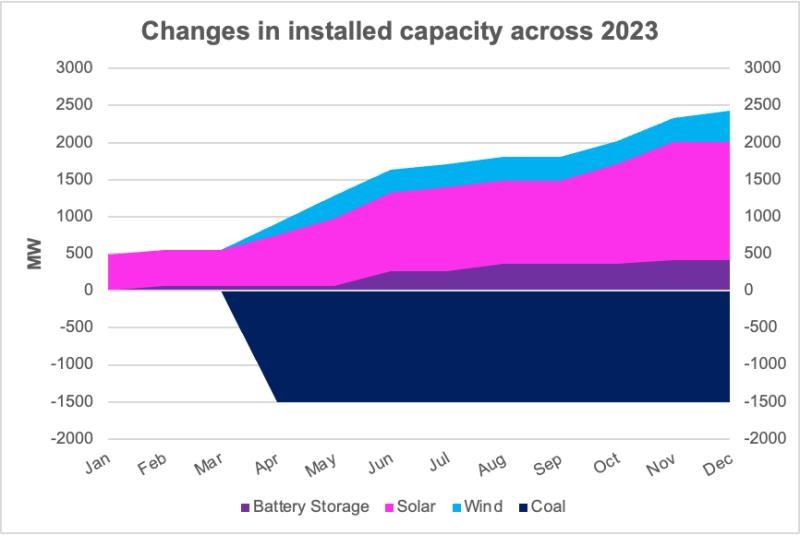

While 2023 marked the beginning of the end of fossil fuels with AGL’s Liddel power station retiring from service in April, it also saw the influx of new renewable capacity in the NEM with 1.6GW of grid scale solar, 0.4Gw of wind and 0.4GW of front of the meter storage.

In fact, renewable energy hit a record 38.6% share in the NEM in 2023, up 3.7% from CY2022 at 34.9%, reflecting a rise of 12% in three years from 26.6% in CY2020.

Renewable penetration also hit a record high, providing 72.1% of generation across the half-hour period from 12pm on 24 October, surpassing the September record of 70%.

About 41% of this generation was provided by the demand side participation of rooftop solar, surpassing black coal as the largest installed capacity by fuel type in Q2 2023.

According to Clean Energy Finance director Tim Buckley, increased renewable energy supply and reduced fossil fuel price gouging is driving down wholesale prices which averaged A$91/MWh in CY2023, -52% year on year.

“This trend has continued, with 4QCY2023 averaging just $64/MWh -41% year on year, and well on its way back down to 2020-2021 levels,” he says via a LinkedIn post.

“This argues really strongly for double digit retail electricity price declines come the default market offer effective 1 July 2024, easing cost of living pressures and inflation, which in turn boosts the potential for slightly lower interest rates over the coming year.”

Australia’s Energy Market Operator (AEMO) is forecasting an additional ~20GW of rooftop solar in the next decade, far outpacing the build out of any other fuel type.

While this presents a threat to system security, market analysts believe the opportunity is huge for behind the meter and front of meter flexibility with grid scale storage, rooftop PV, home batteries and EVs needed to ensure stability and affordability.

Rules for US green hydrogen tax incentives

Latest news out of the green hydrogen space in the US has relieved Australian officials concerned tax credits would divert local capital overseas.

The new rules detailing the requirements to access tax credits for green hydrogen projects under the Biden administration’s Inflation Reduction Act were announced just before Christmas.

To ensure hydrogen actually fights climate change rather than making it worse, the proposal for tax credits is built on ‘three pillars’ – new supply, deliverability and hourly matching – guaranteeing fossil fuels do not provide the additional electricity used to power electrolysers.

Under the Treasury Department’s proposed ‘45V tax credits’, hydrogen producers must secure clean electricity from new energy sources from day one and phase in hourly matching rules in 2028 without exempting pre-existing projects.

ASX green energy news

Provaris enters MOU on green hydrogen supply to Germany

Provaris Energy (ASX:PV1) is developing a portfolio of integrated green hydrogen projects for the regional trade of Asia and Europe by leveraging its compressed hydrogen bulk storage and carrier.

In August 2022, Provaris Norway AS was established to advance the development of regional hydrogen supply in Europe, positioning the Nordics as a first mover and leader in green energy export projects.

Now the company has entered into a non-binding MoU with international energy company Uniper Global Commodities SE to evaluate the supply of green hydrogen into Germany, using PV1’s compressed hydrogen H2Neo carriers.

“Provaris continues to gain the attention of industrial users in Germany due to an increased understanding of the benefits of compression that include a focus on capital and energy efficiency,” PV1 managing director and CEO Martin Carolan says.

Provaris share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.