Emission Control: Australia’s most coal dependant state now halfway to achieving 2030 renewable energy target

Pic: Getty Images

Queensland may historically be Australia’s biggest coal producer, but the Palaszczuk Government has wasted no time in bucking the trend as the state inches closer to beating its own renewable-generated target of 50% by 2030.

The increase in renewable energy uptake has meant Queensland’s renewable energy supply has increased by more than 20% in just one year, and by more than 250% in eight years.

Energy minister Mick de Brenni says more than 25% of Queensland’s energy supply is currently powered by renewables with 22GW of new wind and solar, and another 12GW of batteries and pumped hydro projects earmarked for construction by 2035 as part of a$62bn investment plan over the next decade.

That plan includes the phased development of 12 renewable energy zones (REZs) across three regions, which aim to deliver the right mix of renewable energy technologies to the grid.

But Queensland’s emission reduction goals still pale in comparison to that of South Australia, which is aiming for net 100% renewables by 2030, and Victoria with its plans for 95% renewables by 2035.

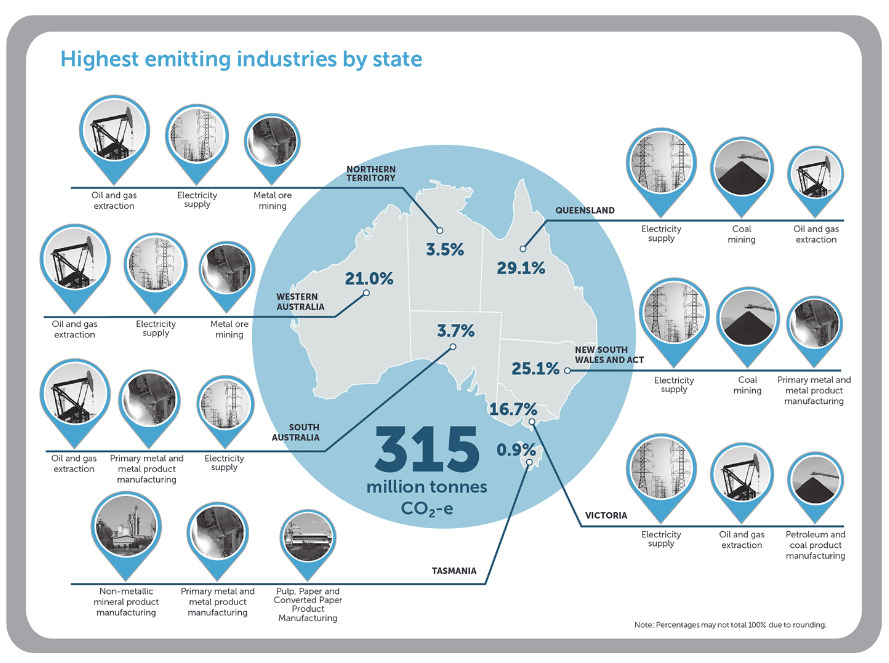

According to the Clean Energy Regulator, the Sunshine State started out as the largest polluter in the country, so while the percentage reduction change is lower than its peers, the overall impact is still significant and probably not all that far away from other states.

De Brenni is convinced once renewables dominate the wholesale electricity market, Australia will see long term reductions in wholesale power prices, with the CSIRO’s most recent GenCost Report reaffirming that renewables are the cheapest form of energy.

But there’s an interesting debate playing out with some commentators claiming that the report only shows that wind and solar are the cheapest option because they do not include the cost of transmission lines, storage and other firming requirements.

They also claim that this is backed by CSIRO chief energy economist Paul Graham as saying that all existing generation, storage and transmission capacity up to 2030 is treated as sunk costs as they are not relevant to new builds and that the cumulative costs of all investments are addressed under the AEMO’s Integrated System Plan (ISP).

However, the same commentators pointed out that ISP does not appear to include an estimate of the cumulative costs of renewable energy investments either, a claim that the AEMO has vehemently denied.

The energy agency noted in a statement that its ISP is a ‘whole of system’ based on rigorous economic modelling and engineering analysis that models all costs including generation, storage and transmission.

It reiterated that new renewables with new transmission – firmed with hydro, batteries and gas – is the lowest cost way to supply electricity to Australian homes and businesses as coal-fired generation is retired.

ASX stocks playing their part in reducing emissions

While Queensland charges ahead with renewables, every little contribution helps with companies across Australia playing their part in reducing emissions.

Australian Vanadium (ASX:AVL) recently signed an agreement with Western Australia’s regional energy provider, Horizon Power, for the purchase, installation and commissioning of a vanadium flow battery (VFB) for a long duration storage plant in Kununurra.

The use of long duration energy storage, in the form of VFBs, could assist Horizon Power to accelerate the decarbonisation of its energy network, which covers 2.3 million square kilometres.

With the use of AVL’s 220kWh battery, which is capable of delivering up to 78kW of power, Horizon Power hopes to increase understanding of how this technology can provide long periods of 100% renewable energy supply across remote energy systems in Western Australia.

The up-front cost may be higher, but vanadium batteries last more than 20 years, are easy to recycle, can survive harsh conditions, support peak energy demand, and require no other minerals.

Meanwhile, Provaris (ASX:PV1) continues to progress the Early Works program for its Tiwi H2 green hydrogen project on the Tiwi Islands, Northern Territory.

The company has completed the Design Feasibility Report, advancing solar farm and transmission system to a 30% level of concept design.

Tiwi H2 is now expected to have peak hydrogen capacity of 90,000tpa while submission of the Environmental Impact Statement is planned to be submitted in early 2024.

Draft project and land agreements have also been submitted to the Tiwi Land Council, together with a proposed community benefits package.

And Westgold Resources (ASX:WGX) has completed the commissioning of its first of four new hybrid power facilities across its Western Australian operations.

According to WGX, the new 17.9MW facility at Tuckabianna has replaced the existing diesel fired power station, delivering a reduction of around 15kt of CO2 equivalent emissions and 10m litres of annual diesel fuel consumption.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.