September Crypto Winners: XRP, TSUKA and Terra coins pumped; Evmos and Synthetix didn’t

Confusing: the Cryptoverse's September. (Getty Images)

So, that was the crypto market’s September (aka Septembear). As England’s former Test batsman Paul Collingwood said when Aussie legend Adam Gilchrist retired: “Thank God for that”.

There’s no guarantee October will be any better, but let’s take a look at what performed and didn’t over the past 30 days.

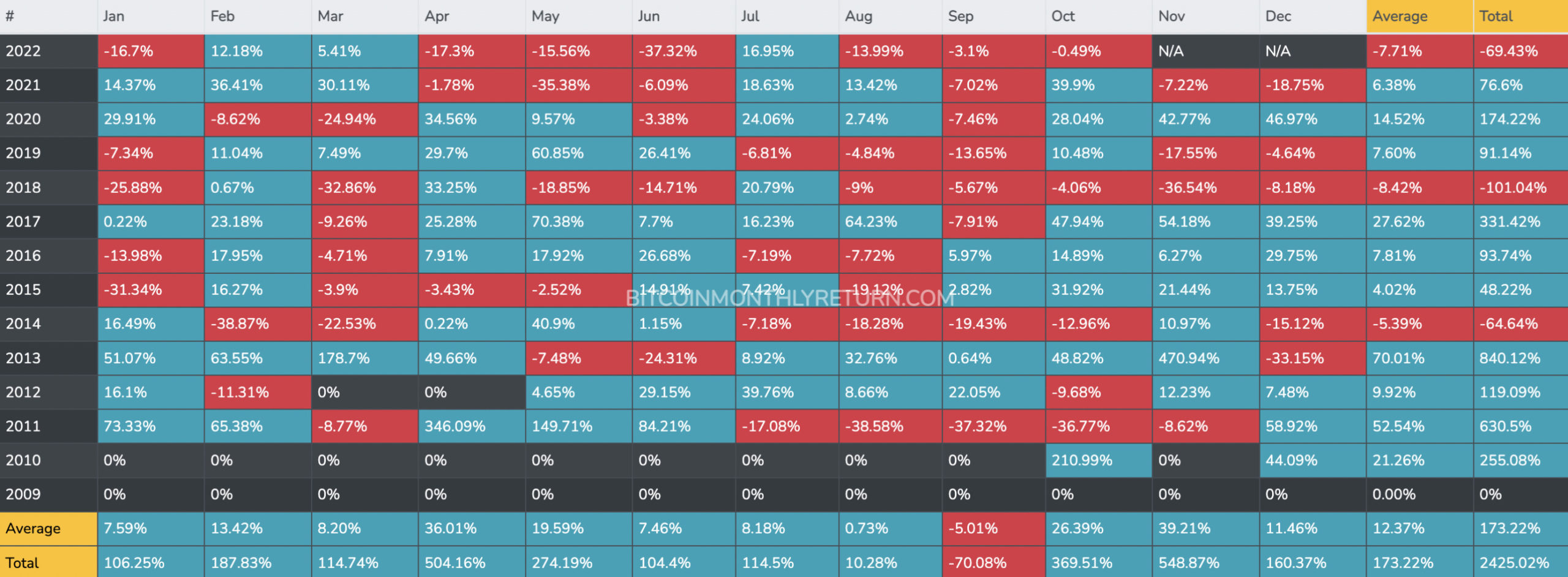

If we’re looking just at Bitcoin as the leading crypto market barometer, September (-3.1%) wasn’t quite as bad as generally feared, as you can see from the Bitcoin monthly returns table below.

Beginning the month at about US$20k, BTC closed it around US$19,300. Not a terrible drop in crypto terms, but there was certainly a lot of choppiness and mixed sentiment in between (see CoinGecko chart below).

October, sometimes referred to as “Uptober” in the cryptosphere, is usually one of the top three months for crypto investors judging by the data. So there’s some hope floating round for the next few weeks – based largely on past performance.

That said, these are obviously pretty extraordinary times for macroeconomics. It’s probably way too much to hope for another 2017 or 2021, but we might offer a small prayer to the fickle crypto portfolio gods that we don’t have a repeat of 2011.

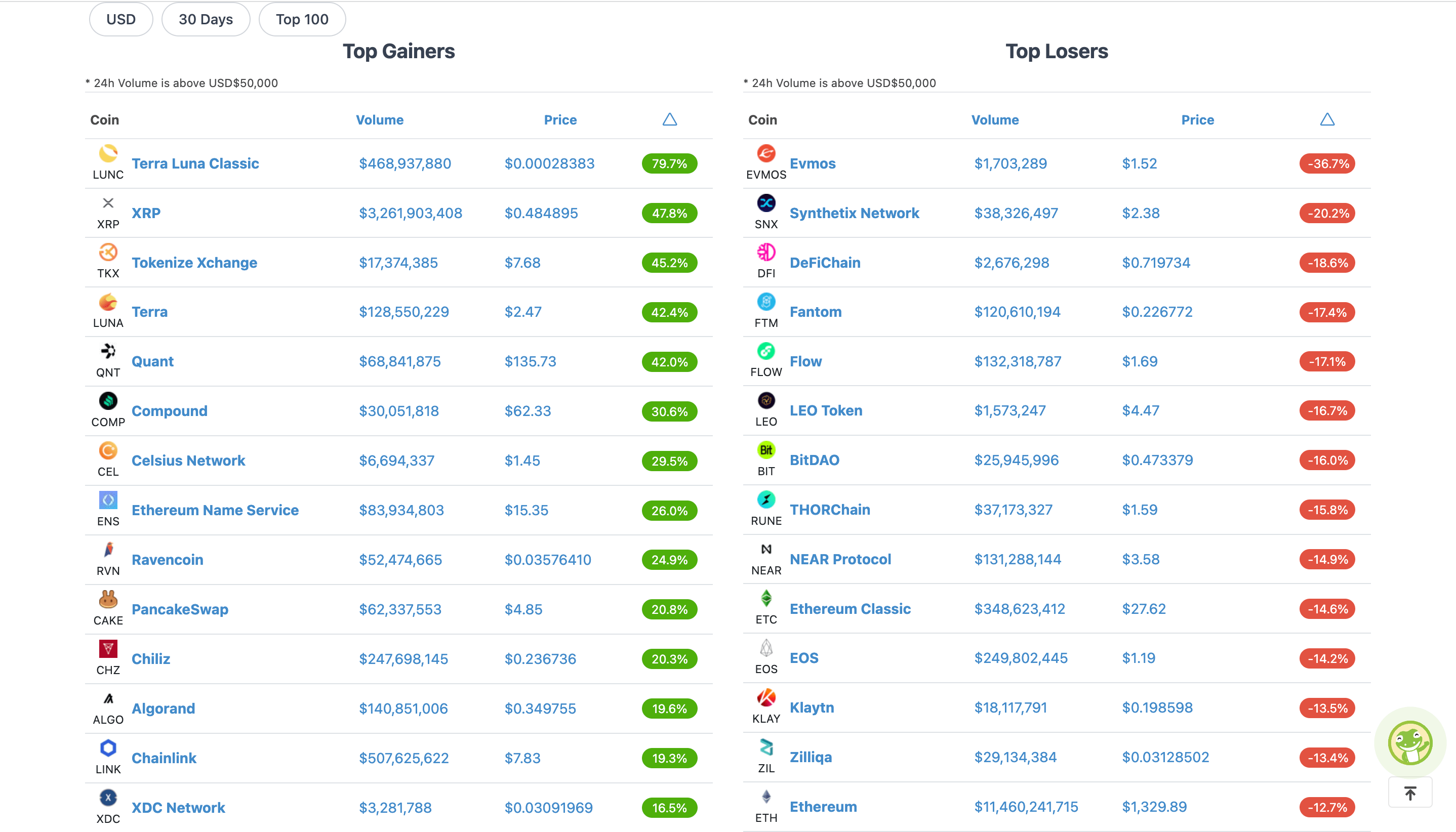

September’s leading gainers and losers in the top 100

Terra firmer (than it was in May)

Terra Luna Classic (LUNC) (+79.7%) led the gains for the month, by a considerable margin.

We’ve occasionally flagged the trading/investing risk on this one, given the controversial recent history of the Terra brand.

Terra (LUNA) (+42.4%) also makes the top gainers’ list, while its founder, Do Kwon, is reportedly wanted by Interpol for apparent violations of South Korea’s Capital Markets Act.

It’s a little confusing, but LUNC is the original Terra LUNA coin, while the one now called LUNA (also known as LUNA2) was created as an airdrop by Kwon as part of a “regeneration” strategy for the Terra ecosystem.

In May we witnessed the implosion of Terra’s LUNA network, in which billions of investor dollars were lost, triggering a domino-like “crypto contagion” effect that brought down or severely damaged several high-profile platforms and crypto-market entities.

Why do these coins continue to see occasional pumpage? Whales might well be having their fun so it’s definitely been an “enter at own risk” trade.

That said, LUNC did have a direct reason for at least part of its recent surge. It could be put down to an announcement from crypto exchange Binance, which is reportedly planning to implement a “burn mechanism to burn all trading fees on LUNC spot and margin trading pairs”. This should effectively cut the token’s supply.

» Binance To Implement Terra Classic (LUNC) Burn Mechanism

Quick thread on what we’re doing and why below.https://t.co/b86RlCGPmv

— CZ 🔶 BNB (@cz_binance) September 26, 2022

The Ripple effect

As for XRP, at the time of writing, it’s up more than 12% over the past 24 hours and close to 50% for the entire of September.

The money transfer network and digital currency was created by Ripple Labs, which is still in the thick of a much-publicised and bitter legal dispute with the US Securities and Exchange Commission. The SEC contends that the initial token sales of XRP in 2018 violated US Securities laws. Ripple strongly disputes this.

A win for the SEC would set a worrying precedent for the vast majority of the crypto industry, especially all projects that engaged in ICO (initial coin offering) token sales. A win for Ripple Labs would be seen as a huge boost – not only for XRP but for crypto in general.

There have been developments in the legal case this month that are potentially seen as favouring Ripple Labs’ chances of a victory. Hence the XRP pumpage. To get the bigger picture, check out our recent articles on the subject here, here and here.

Evmos and Synthetix sink

It can be harder sometimes to pinpoint why certain coins have fared worse than others. Particularly when they appear to be solid projects with solid fundamentals.

Evmos (EVMOS) (-36.7%), for instance, had a banging August, leading the top 100 crypto gains in that month, which was based around excitement for its fee-burning network upgrade that’s all about sustainable growth for the token model.

There’s been nothing to suggest the September Evmos dip has been warranted, so perhaps it’s a case of buyer fatigue or “sell the news”, a la Ethereum and its headline-dominating Merge. Ethereum (ETH), incidentally was also an ultimately double-digit loser in September (-12.7%).

Synthetix (SNX) was another notable September decliner and yet there seems to be a hell of a lot going on with the protocol in terms of DeFi “building” and upgrades.

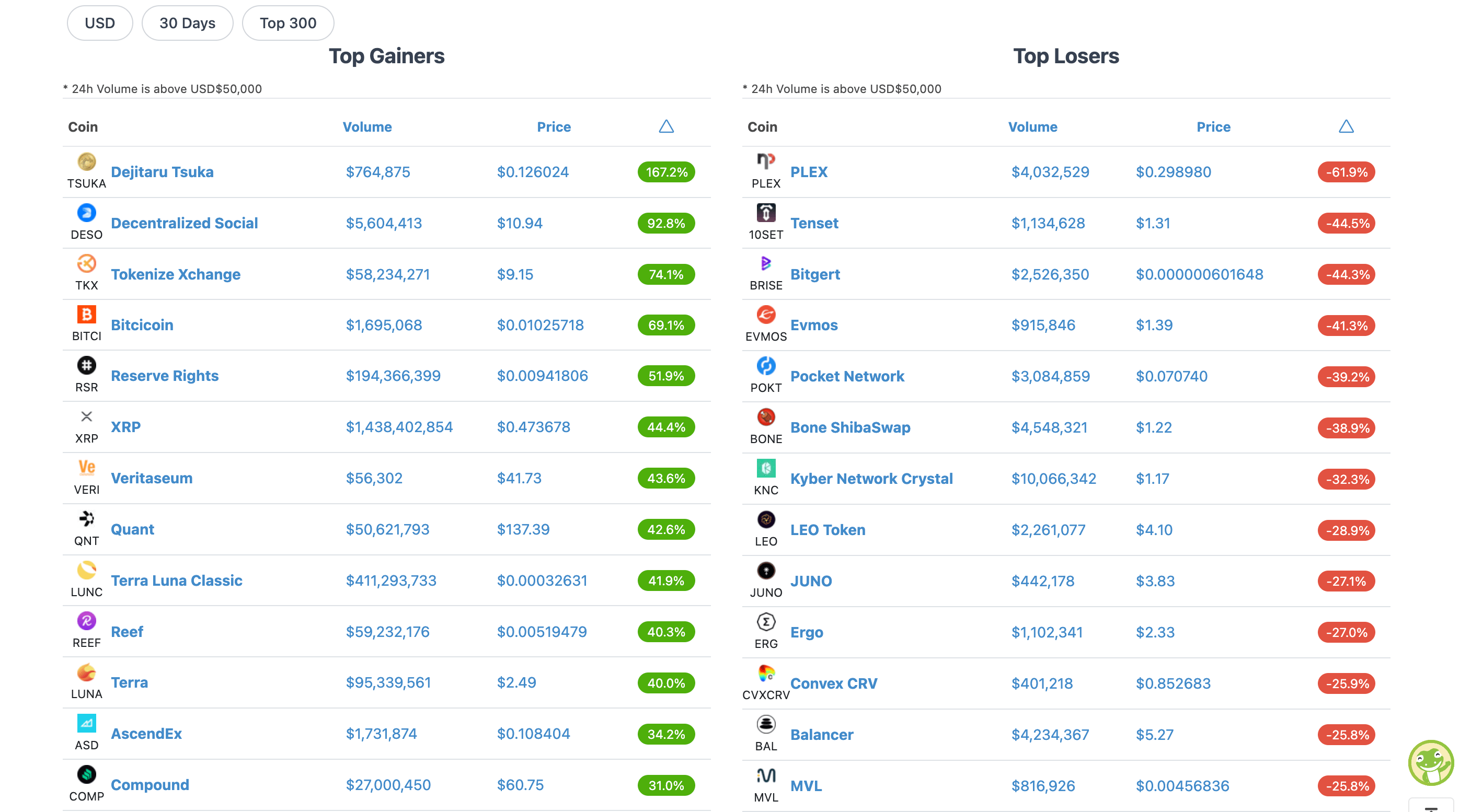

Top 10 gainers and losers in the top 300: What’s TSUKA?

Lastly, zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

What the fungible is Dejitaru Tsuka (TSUKA)? Admittedly it’s flown under Coinhead’s radar, but it’s pumped more than 167% over the past 30 days or so.

A quick glance tells us it’s a “meme coin” ERC-20 (Ethereum-based) token. And according to The Daily HODL website, it’s rumoured to have been created by “Ryoshi” – the same developer behind Dogecoin’s main canine-coin competitor, Shiba Inu (SHIB).

Considering Shiba Inu’s history of absolutely outsized stupendous gains (in its earlier days), then perhaps it’s little wonder this one has had a bit of a pump on the back of another, older narrative.

Per CoinGecko stats, SHIB is presently up 19,838,473.6% from its near-inception low back in 2020. TSUKA is, at the time of writing, up 883% from its all-time-low about two months ago.

What does it do, and what’s its point? That doesn’t seem easy to answer.

“Dejitaru Tsuka touts itself as a decentralized community centered around meditation, reflection and research,” wrote The Daily HODL.

The Dejitaru Tsuka dragon is the “harbinger of abundance and wealth”, according to the meme coin’s website, which cites Japanese lore.

https://twitter.com/Dejitaru_Tsuka/status/1574427387923730432

Righto. In any case, we might keep a bit of a non-financially advised eye on it. Meme coins can sometimes be a bit of leading indicator for crypto-market hype and frothiness.

Overall, though, despite a somewhat tepid September for crypto price action, it still very much feels like the year of living even more dangerously than usual for risk markets.

There’s been the odd talk of it on Crypto Twitter here and there, but we wouldn’t bet too heavily on the Fed making a surprise pivot before the end of the year to start up the money printer once again.

That said, the UK just announced they’re doing exactly that amid crazy inflation levels there, so who da hell knows what these central bankers are actually thinking and planning.

investing in 2022:pic.twitter.com/vuo990sUj1

— LilMoonLambo (@LilMoonLambo) September 29, 2022

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.